Fixed Annuity 2024 presents a compelling opportunity to secure a steady income stream and safeguard your savings from market volatility. This type of annuity offers guaranteed interest rates, providing peace of mind in an uncertain financial landscape. Whether you’re planning for retirement, supplementing your income, or seeking protection against long-term care costs, understanding the nuances of fixed annuities is crucial.

Looking for the best health insurance plan for 2024? We’ve got you covered! Check out our comprehensive guide on Health Insurance Companies 2024 , where you’ll find a breakdown of top providers and plans to suit your needs.

This guide will delve into the core features, benefits, and strategies associated with fixed annuities. We’ll explore current market trends, key considerations for 2024, and real-world applications for achieving your financial goals.

Fixed Annuities: A Comprehensive Guide for 2024

Fixed annuities are a type of insurance product that provides guaranteed income payments for life. They are a popular choice for retirees and others seeking a steady stream of income, particularly those who want to protect their savings from market volatility.

Planning a trip? Find the right travel insurance company to protect your journey. Our guide on Travel Insurance Companies 2024 will help you choose the best fit.

In 2024, fixed annuities continue to offer a range of advantages, but it’s important to understand their features, benefits, and limitations before making an investment decision.

Need temporary coverage? Find the perfect short-term insurance plan in Short Term Insurance 2024. We’ll help you navigate the options and find the right fit.

Fixed Annuity Basics

A fixed annuity is a contract between an individual and an insurance company. The individual invests a lump sum or makes regular payments into the annuity, and in return, the insurance company guarantees a fixed interest rate on the investment.

Traveling abroad? Don’t forget travel health insurance! Get the coverage you need in Travel Health Insurance 2024 and enjoy your trip with peace of mind.

This rate remains constant for the duration of the annuity contract, regardless of market fluctuations.

Protect your valuable camera with the right insurance. Find the best camera insurance plans in Camera Insurance 2024 and keep your gear safe.

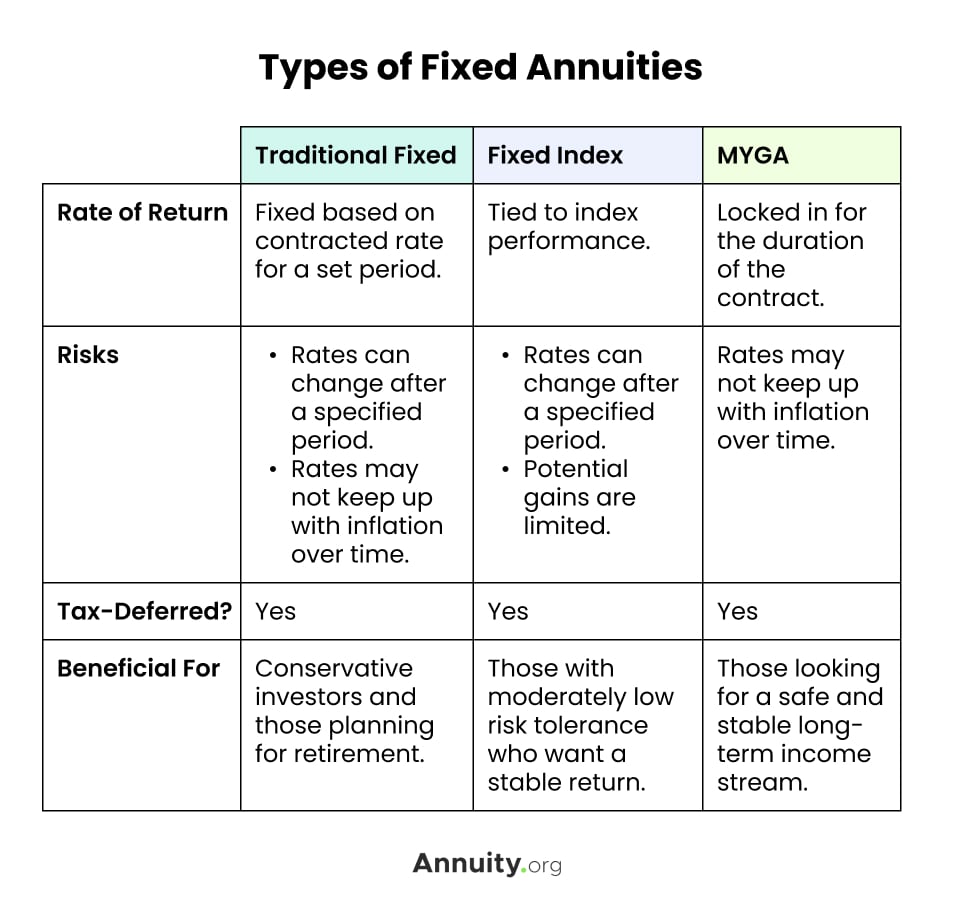

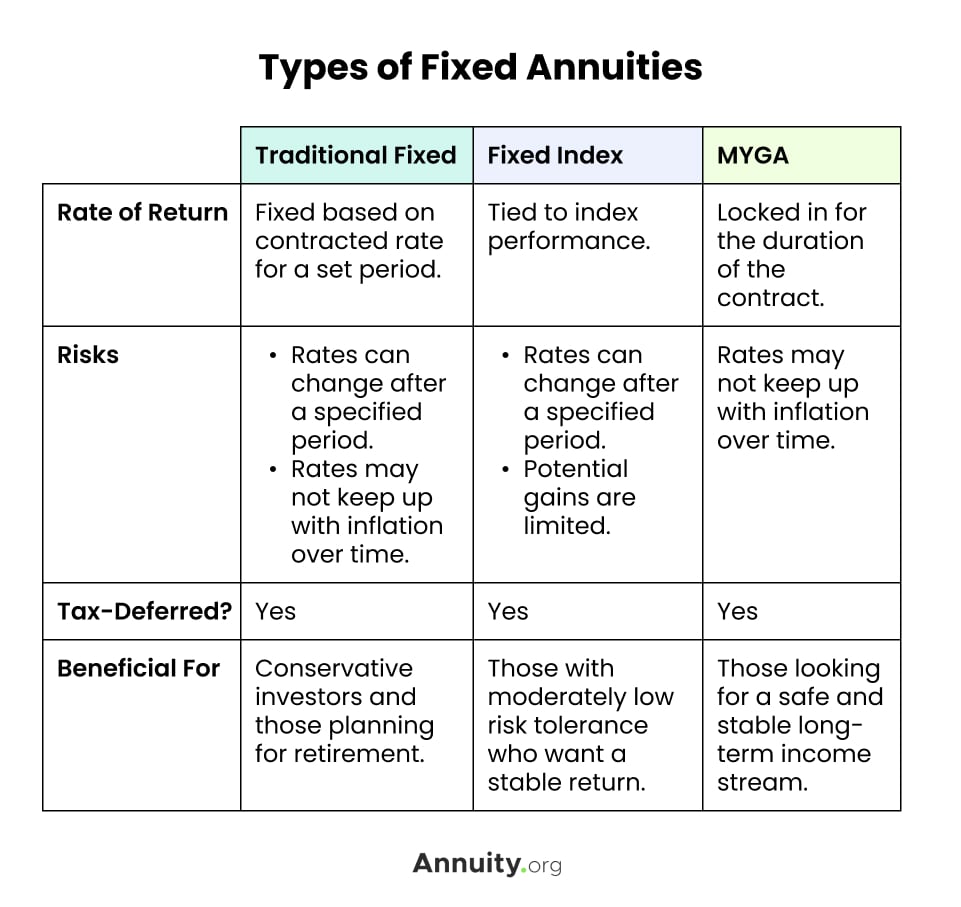

Fixed annuities differ from other types of annuities, such as variable or indexed annuities. Variable annuities invest in mutual funds or other securities, so the returns are not guaranteed and can fluctuate with market performance. Indexed annuities, on the other hand, link their returns to the performance of a specific index, such as the S&P 500, but with some limitations and potential for losses.

Don’t forget about your smile! Explore a wide range of dental plans to keep your teeth healthy and bright in Dental Plans 2024. We’ve got the information you need to make an informed decision.

Fixed annuities offer several advantages, including:

- Guaranteed interest rates: This provides predictable income streams and protects against market volatility.

- Protection against inflation: While fixed annuities don’t directly hedge against inflation, they can be a valuable part of a diversified portfolio that includes other assets that may provide inflation protection.

- Tax-deferred growth: Earnings from fixed annuities are generally not taxed until they are withdrawn, providing tax advantages for long-term growth.

- Potential for longevity protection: Fixed annuities can provide income for life, even if an individual lives longer than expected.

However, fixed annuities also have some disadvantages:

- Lower potential returns: Compared to other investments, fixed annuities typically offer lower potential returns.

- Surrender charges: Many fixed annuities have surrender charges if you withdraw funds before a certain period, which can limit your access to your money.

- Interest rate risk: If interest rates rise after you purchase a fixed annuity, you may miss out on higher returns.

Fixed annuities are most suitable for individuals who:

- Are risk-averse and prioritize guaranteed income.

- Have a long time horizon for their investment.

- Are comfortable with lower potential returns in exchange for guaranteed income.

Fixed Annuity Features and Benefits

Fixed annuities offer a range of features that can provide additional benefits and flexibility. Some common features include:

- Guaranteed interest rates: This is a core feature of fixed annuities, providing a predictable income stream and protection against market volatility. The interest rate is typically fixed for the duration of the annuity contract, which can range from several years to a lifetime.

Cruising the open water? Make sure you’re protected with the right boat insurance. Check out our guide on Boat Insurance 2024 and navigate the waters with peace of mind.

- Death benefits: Many fixed annuities offer death benefits that pay a lump sum to your beneficiary upon your death. This can provide financial security for your loved ones and ensure that your assets are passed on according to your wishes.

Planning a family vacation? Ensure everyone is covered with the right travel insurance. Explore our guide on Family Travel Insurance 2024 and create unforgettable memories without worry.

- Living benefits: Some fixed annuities offer living benefits, which provide additional income payments if you experience a long-term care event or other health issues. This can help cover the costs of care and protect your assets from depletion.

The potential benefits of fixed annuities include:

- Guaranteed income streams: This provides financial security and peace of mind, especially for retirees or those who want a predictable source of income.

- Protection against market volatility: Fixed annuities are not affected by stock market fluctuations, which can be beneficial in uncertain economic times.

- Tax advantages: Earnings from fixed annuities are generally not taxed until they are withdrawn, providing tax advantages for long-term growth.

- Longevity protection: Fixed annuities can provide income for life, even if an individual lives longer than expected. This can be especially important in today’s society, where people are living longer than ever before.

Real-world examples of how fixed annuities can be utilized to address specific financial needs:

- Retirement planning: Fixed annuities can provide a guaranteed income stream to supplement other retirement savings and help cover essential expenses in retirement.

- Income supplementation: Fixed annuities can be used to generate additional income for individuals who are still working but want to supplement their current income.

- Long-term care: Fixed annuities can be used to provide financial protection against the high costs of long-term care. Some fixed annuities offer specific riders designed to address the unique financial challenges of long-term care.

Fixed Annuities in 2024: Current Market Trends and Considerations

The fixed annuity market is constantly evolving, and it’s important to stay informed about current trends and considerations before making an investment decision. Some notable trends in 2024 include:

- Interest rate fluctuations: Interest rates have been rising in recent years, which can impact the interest rates offered on fixed annuities. As interest rates rise, insurance companies may offer higher interest rates on new fixed annuities, but existing fixed annuities may not see an increase in their interest rates.

Travel with confidence knowing you’re protected. Discover the best travel insurance options for your next adventure in Squaremouth Travel Insurance 2024. We’ll help you find the right plan for your trip.

- Product offerings: Insurance companies are constantly developing new fixed annuity products with different features and benefits. It’s important to compare different options and find a product that meets your specific needs and goals.

- Regulatory environment: The regulatory environment for fixed annuities can change, which can impact the availability and features of these products. It’s important to stay informed about any regulatory changes that may affect your fixed annuity.

Economic factors such as inflation and interest rate fluctuations can impact the performance of fixed annuities. Inflation can erode the purchasing power of your income stream over time, while rising interest rates can make fixed annuities less attractive compared to other investments.

It’s important to consider these factors when evaluating fixed annuity options.

Understanding insurance policies can be tricky. Get the information you need in Insurance Policy 2024 and make informed decisions about your coverage.

Key factors to consider when evaluating fixed annuity options in 2024 include:

- Interest rates: Compare the interest rates offered by different insurance companies and consider the current market environment for interest rates.

- Fees: Be aware of any fees associated with the fixed annuity, such as surrender charges, administrative fees, or mortality and expense charges.

- Surrender charges: Understand the surrender charges associated with the fixed annuity and how they may impact your ability to access your funds before a certain period.

- Reputation of the issuing company: Choose an insurance company with a strong financial rating and a good reputation for customer service.

Fixed Annuity Strategies and Applications

There are several different fixed annuity strategies that can be used to meet specific financial goals and risk profiles. Here’s a table comparing different strategies:

| Strategy | Key Features | Benefits | Potential Applications |

|---|---|---|---|

| Single Premium Fixed Annuity | A lump sum payment is made to the annuity, and the insurance company guarantees a fixed interest rate for the duration of the contract. | Guaranteed income stream, protection against market volatility, tax-deferred growth. | Retirement planning, income supplementation, long-term care planning. |

| Deferred Income Fixed Annuity | Payments are made over time, and the annuity starts providing income payments at a later date. | Flexibility to save for retirement or other financial goals, potential for tax-deferred growth. | Retirement planning, saving for a specific event, such as a child’s education. |

| Immediate Income Fixed Annuity | A lump sum payment is made, and the annuity starts providing income payments immediately. | Guaranteed income stream, immediate access to income, potential for longevity protection. | Retirement planning, income supplementation, bridging a financial gap. |

Each strategy can be tailored to address specific financial goals and risk profiles. For example, a single premium fixed annuity might be suitable for someone who wants to secure a guaranteed income stream for retirement, while a deferred income fixed annuity might be a good option for someone who wants to save for a specific event, such as a child’s education.

Fixed Annuities and Retirement Planning

Fixed annuities can play a significant role in retirement planning, providing a guaranteed income stream and protecting against market volatility. They can be a valuable part of a diversified retirement portfolio, alongside other investment vehicles and income sources.

Planning for the future? Final expense insurance can help cover funeral costs and provide peace of mind for your loved ones. Explore your options in Final Expense Insurance 2024.

Fixed annuities can help address several key retirement planning concerns, including:

- Longevity risk: Fixed annuities can provide income for life, even if an individual lives longer than expected. This can help ensure that you have a steady source of income throughout your retirement years.

- Inflation: While fixed annuities don’t directly hedge against inflation, they can be a valuable part of a diversified portfolio that includes other assets that may provide inflation protection.

- Market volatility: Fixed annuities are not affected by stock market fluctuations, which can be beneficial in uncertain economic times. This can provide peace of mind and protect your retirement savings from market downturns.

However, it’s important to consider the advantages and disadvantages of fixed annuities for retirement planning:

- Advantages: Guaranteed income stream, protection against market volatility, tax-deferred growth, longevity protection.

- Disadvantages: Lower potential returns compared to other investments, surrender charges, interest rate risk.

It’s important to carefully consider your financial goals, risk tolerance, and time horizon before deciding if a fixed annuity is right for your retirement planning.

Fixed Annuities and Long-Term Care

Fixed annuities can be a valuable tool for long-term care planning, providing financial protection against the high costs of care. Long-term care can be expensive, and the costs can quickly deplete your savings and assets.

Looking for reliable insurance? Check out Sure Insurance 2024 and explore their range of coverage options to find the right fit for your needs.

Fixed annuities can help address the financial challenges of long-term care in several ways:

- Provide a guaranteed income stream: Fixed annuities can provide a steady stream of income to help cover the costs of long-term care.

- Protect your assets: Fixed annuities can help protect your assets from being depleted by long-term care expenses.

- Offer long-term care riders: Some fixed annuities offer long-term care riders, which provide additional benefits for long-term care expenses. These riders can provide a lump sum payment or a stream of income to help cover the costs of care.

However, it’s important to consider the benefits and limitations of fixed annuities for long-term care planning:

- Benefits: Guaranteed income stream, asset protection, potential for long-term care riders.

- Limitations: Coverage limitations, tax implications, need for comprehensive planning.

It’s important to consult with a financial advisor to determine if a fixed annuity is the right solution for your long-term care planning needs.

Keep your belongings safe and sound with the right renters insurance. Learn more about Aaa Renters Insurance 2024 and find the coverage that gives you peace of mind.

Fixed Annuities and Estate Planning, Fixed Annuity 2024

Fixed annuities can play a role in estate planning, providing death benefits, income streams for beneficiaries, and tax advantages. They can be a valuable tool for ensuring that your assets are passed on according to your wishes and minimizing tax liabilities.

Life insurance is essential, but it doesn’t have to break the bank. Find affordable options in Cheap Life Insurance 2024 and secure your family’s future.

Fixed annuities can offer several benefits for estate planning:

- Death benefits: Many fixed annuities offer death benefits that pay a lump sum to your beneficiary upon your death. This can provide financial security for your loved ones and ensure that your assets are passed on according to your wishes.

- Income streams for beneficiaries: Some fixed annuities offer income streams for beneficiaries, providing a guaranteed source of income after your death.

- Tax advantages: Earnings from fixed annuities are generally not taxed until they are withdrawn, which can provide tax advantages for your beneficiaries.

It’s important to understand the different types of death benefit options available with fixed annuities and their implications for estate planning. Some common options include:

- Lump sum death benefit: This pays a lump sum to your beneficiary upon your death.

- Income stream death benefit: This provides a guaranteed income stream to your beneficiary after your death.

- Joint and survivor death benefit: This provides a guaranteed income stream to your beneficiary after your death, and the income stream continues for the life of your beneficiary.

Fixed annuities can also impact estate taxes. It’s important to consult with an estate planning attorney to determine how to structure your fixed annuity to minimize tax liabilities.

Finding the right health insurance policy can be overwhelming. Our guide to Best Health Insurance Policy 2024 simplifies the process, helping you compare plans and find the perfect fit.

Closing Summary: Fixed Annuity 2024

In today’s volatile market, fixed annuities offer a valuable tool for securing financial stability and achieving long-term financial goals. By understanding the advantages and disadvantages, exploring various strategies, and considering the current market landscape, you can make informed decisions about whether a fixed annuity is the right fit for your individual needs.

Helpful Answers

What are the risks associated with fixed annuities?

While fixed annuities offer guaranteed interest rates, they also come with some risks. These include potential for lower returns compared to other investments, surrender charges for early withdrawal, and the possibility of inflation outpacing interest rates.

How do fixed annuities compare to other types of annuities?

Fixed annuities differ from variable and indexed annuities. Variable annuities offer the potential for higher returns but also carry higher risk due to market fluctuations. Indexed annuities provide a return linked to a market index but with some limitations on growth potential.

What are some factors to consider when choosing a fixed annuity?

When selecting a fixed annuity, factors like interest rates, fees, surrender charges, and the reputation of the issuing company are crucial. It’s essential to compare different options and consult with a financial advisor to make an informed decision.