Medicare Coverage 2024: Navigating the complexities of healthcare can be daunting, but understanding your Medicare options is essential. This guide provides a comprehensive overview of Medicare benefits, costs, and enrollment processes for 2024, empowering you to make informed decisions about your healthcare coverage.

Securing your family’s future is a top priority. Term Life 2024 offers affordable coverage, providing financial stability for your loved ones in the event of your passing.

Whether you’re new to Medicare or simply seeking updates on the latest changes, this resource offers valuable insights into the different parts of Medicare, including Part A, Part B, Part C, and Part D. We delve into the intricacies of Medicare Advantage plans, prescription drug coverage, and enrollment periods, providing clear explanations and helpful resources to assist you in making the most of your Medicare benefits.

Allstate is a reputable insurance provider known for its home insurance plans. Allstate Home Insurance 2024 offers various coverage options, ensuring your home is protected from unexpected events.

Medicare Coverage Basics in 2024

Medicare is a federal health insurance program for people 65 and older, as well as younger individuals with certain disabilities. In 2024, Medicare continues to provide essential health coverage, but some changes are in effect, impacting benefits and costs. Understanding these changes and the different parts of Medicare is crucial for making informed decisions about your health insurance.

UnitedHealthcare is a prominent provider of Medicare Advantage plans. Unitedhealthcare Medicare Advantage 2024 offers various plan options, providing comprehensive healthcare coverage for Medicare beneficiaries.

Parts of Medicare

Medicare consists of four main parts, each offering distinct coverage:

- Part A (Hospital Insurance):Covers inpatient hospital stays, skilled nursing facility care, hospice care, and some home health services. Most people don’t pay a premium for Part A because they’ve paid Medicare taxes while working.

- Part B (Medical Insurance):Covers doctor’s visits, outpatient care, preventive services, and some medical equipment. You pay a monthly premium for Part B.

- Part C (Medicare Advantage):Offered by private insurance companies, these plans combine Part A, Part B, and often Part D (prescription drug coverage). They may offer additional benefits like vision, dental, and hearing care. You pay a monthly premium for Part C.

- Part D (Prescription Drug Coverage):Covers prescription drugs. You pay a monthly premium and may have a deductible and coinsurance.

Key Changes to Medicare Coverage in 2024

Medicare coverage is subject to annual adjustments. Some key changes for 2024 include:

- Premium increases:The standard monthly premium for Part B is expected to increase, impacting beneficiaries’ out-of-pocket costs.

- Deductible changes:The deductible for Part B may also change, potentially impacting the cost of covered services.

- Drug formulary updates:Medicare Part D plans may update their formularies, which could affect the availability and cost of certain medications.

Medicare Eligibility Criteria for 2024

To be eligible for Medicare in 2024, you must meet specific criteria:

- Age:You must be 65 years or older.

- Citizenship:You must be a U.S. citizen or permanent resident.

- Disability:You may be eligible if you have a disability and have received Social Security disability benefits for at least 24 months.

- End-Stage Renal Disease (ESRD):You may be eligible if you have ESRD and meet other requirements.

Medicare Costs in 2024, Medicare Coverage 2024

Medicare costs can vary based on your individual circumstances and the specific coverage you choose. Key cost components include:

- Premiums:Monthly payments for Part B, Part C, and Part D coverage.

- Deductibles:A fixed amount you pay before Medicare starts covering your costs for certain services.

- Coinsurance:A percentage of the cost of covered services that you pay after you’ve met your deductible.

- Copayments:A fixed amount you pay for specific services, such as doctor’s visits or prescription drugs.

Medicare Advantage Plans in 2024: Medicare Coverage 2024

Medicare Advantage plans are a popular alternative to Original Medicare (Part A and Part B). These plans are offered by private insurance companies and provide comprehensive coverage, often with additional benefits.

Bundling your home and auto insurance can save you money! Home And Auto Insurance 2024 offers comprehensive protection for your most valuable assets, providing peace of mind and potential cost savings.

Types of Medicare Advantage Plans

Medicare Advantage plans come in various types, each with its own set of features and coverage:

- Health Maintenance Organization (HMO):You must choose a primary care physician (PCP) within the plan’s network. Referrals are usually required for specialists.

- Preferred Provider Organization (PPO):You can see any doctor within the plan’s network, but you’ll pay less if you choose a preferred provider. Referrals may not be required.

- Private Fee-for-Service (PFFS):You can see any doctor who accepts the plan, but costs may vary depending on the provider.

- Special Needs Plans (SNPs):Designed for individuals with specific health needs, such as those with chronic conditions or dual eligibility for Medicare and Medicaid.

Benefits and Drawbacks of Medicare Advantage Plans

Medicare Advantage plans offer several potential benefits, but they also have some drawbacks to consider:

- Benefits:

- May offer lower monthly premiums than Original Medicare.

- Often include additional benefits like vision, dental, and hearing care.

- May have lower out-of-pocket costs than Original Medicare.

- Drawbacks:

- May have limited provider networks.

- May require prior authorization for certain services.

- Can be more complex to navigate than Original Medicare.

Factors to Consider When Choosing a Medicare Advantage Plan

When selecting a Medicare Advantage plan, consider these factors:

- Your health needs:Choose a plan that covers the services you need.

- Your budget:Compare monthly premiums, deductibles, and copayments.

- Provider network:Ensure your preferred doctors and hospitals are in the plan’s network.

- Additional benefits:Consider the value of extra benefits like vision, dental, and hearing care.

Key Features of Medicare Advantage Plans for 2024

| Plan Type | Key Features | Benefits | Drawbacks |

|---|---|---|---|

| HMO | Limited provider network, referrals usually required | Potentially lower premiums, may offer additional benefits | Limited provider choice, may require prior authorization for services |

| PPO | Wider provider network, referrals may not be required | More provider choice, may have lower out-of-pocket costs | Premiums may be higher than HMOs |

| PFFS | No network restrictions, costs may vary depending on provider | Most provider choice, potentially lower costs | May have higher out-of-pocket costs, can be complex to navigate |

| SNP | Designed for individuals with specific health needs | Specialized care for chronic conditions or dual eligibility | Limited provider network, may require prior authorization for services |

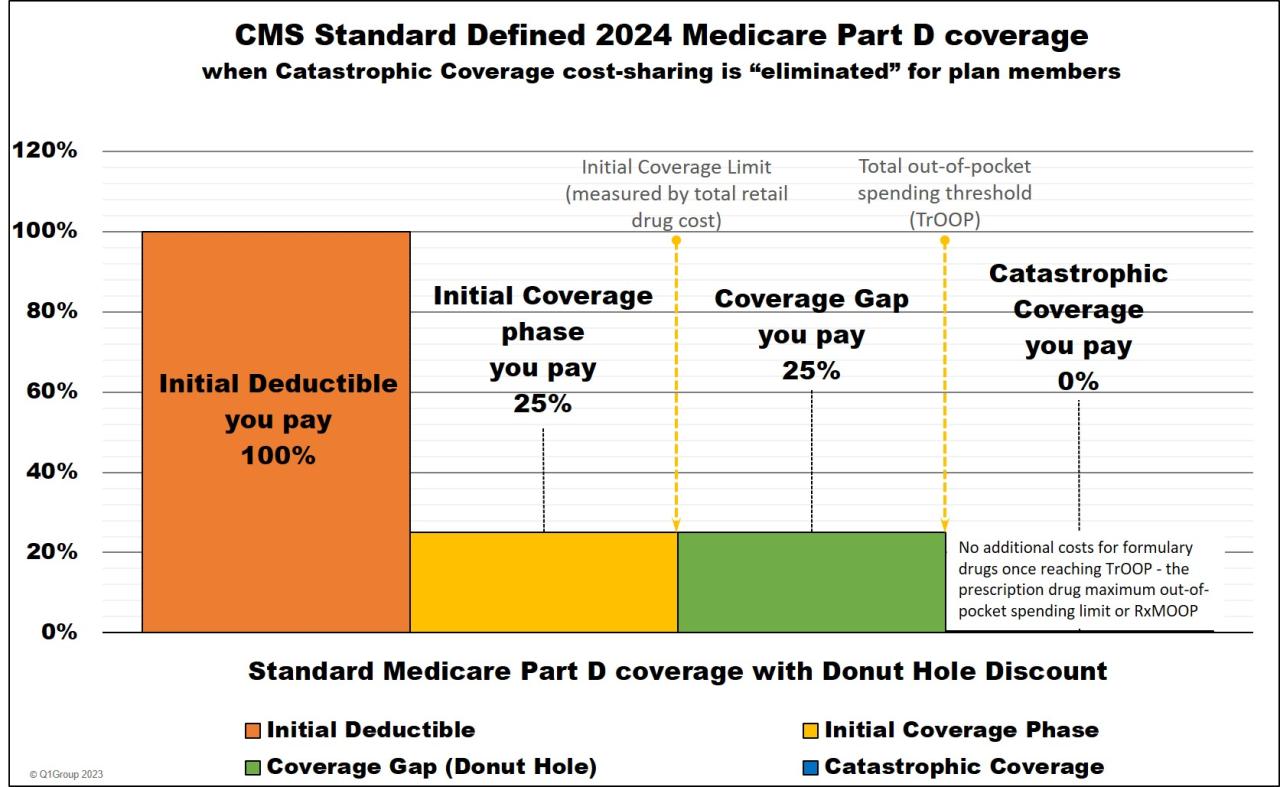

Medicare Prescription Drug Coverage in 2024

Medicare Part D provides prescription drug coverage to eligible beneficiaries. You can choose a standalone Part D plan or enroll in a Medicare Advantage plan that includes Part D coverage.

TennCare is Tennessee’s health insurance program for low-income residents. Tenncare 2024 provides access to quality healthcare, ensuring individuals and families have the coverage they need.

Options for Medicare Prescription Drug Coverage

Medicare offers several options for prescription drug coverage:

- Standalone Part D plans:Offered by private insurance companies, these plans provide prescription drug coverage only.

- Medicare Advantage plans with Part D:Many Medicare Advantage plans include Part D coverage as part of their comprehensive benefits.

Key Factors to Consider When Choosing a Medicare Part D Plan

When selecting a Medicare Part D plan, consider these factors:

- Formulary:The list of drugs covered by the plan. Ensure your medications are included.

- Premium:The monthly cost of the plan.

- Deductible:The amount you pay before the plan starts covering your drug costs.

- Coinsurance:The percentage of the cost of your drugs that you pay after you’ve met your deductible.

- Copayments:Fixed amounts you pay for specific drugs.

Medicare Part D Formulary and Its Impact on Drug Costs

The Medicare Part D formulary is a list of covered drugs. Each plan has its own formulary, and the drugs covered and their costs can vary.

Looking for financial protection in case of accidents? Personal Accident Insurance 2024 provides a safety net, ensuring you and your loved ones are taken care of in the event of an unexpected incident.

- Tiered formularies:Many plans use tiered formularies, which categorize drugs into tiers based on their cost and therapeutic value.

- Drug cost-sharing:You’ll pay different amounts for drugs based on their tier. Lower tiers generally have lower cost-sharing.

- Prior authorization:Some plans may require prior authorization for certain drugs, meaning you’ll need to get approval from your doctor before the plan will cover them.

Costs and Coverage of Different Medicare Part D Plans

| Plan Name | Monthly Premium | Deductible | Coinsurance | Formulary Tier 1 | Formulary Tier 2 | Formulary Tier 3 |

|---|---|---|---|---|---|---|

| Plan A | $25 | $400 | 20% | $10 | $25 | $50 |

| Plan B | $30 | $350 | 15% | $15 | $30 | $45 |

| Plan C | $35 | $300 | 10% | $20 | $35 | $50 |

Wrap-Up

As you navigate the world of Medicare in 2024, remember that you have options. By understanding the different parts of Medicare, the available plans, and the enrollment process, you can confidently choose the coverage that best suits your needs and budget.

Progressive is another leading insurance company offering comprehensive coverage. Progressive Insurance Company 2024 provides a range of insurance products, including auto insurance, tailored to your specific needs.

This guide serves as a starting point, and we encourage you to explore additional resources and seek personalized advice from Medicare professionals to ensure you make informed decisions about your healthcare.

Embarking on a cruise in 2024? Cruise Travel Insurance 2024 is crucial for safeguarding your vacation against unforeseen circumstances, like medical emergencies or cancellations.

General Inquiries

What are the major changes to Medicare coverage in 2024?

Maintaining good oral health is essential, especially as we age. Dental Insurance For Seniors 2024 provides affordable coverage for dental care, helping seniors keep their smiles bright.

While the specific changes to Medicare coverage in 2024 are still being finalized, there are likely to be adjustments to premiums, deductibles, and co-insurance amounts. It’s important to stay informed about these updates as they are announced.

How do I know if I’m eligible for Medicare?

You are generally eligible for Medicare if you are 65 years or older or have certain disabilities. You can also qualify for Medicare if you have End-Stage Renal Disease (ESRD). The Medicare website provides a detailed eligibility checker.

Planning a trip in 2024? Don’t forget to secure your travel insurance! Buy Travel Insurance 2024 to protect yourself from unexpected events, ensuring peace of mind throughout your journey.

What is the difference between Medicare Part A and Part B?

Medicare Part A covers hospital stays, skilled nursing facilities, hospice care, and some home health services. Part B covers doctor’s visits, outpatient care, preventive services, and some medical equipment.

How do I enroll in Medicare?

You can enroll in Medicare during your Initial Enrollment Period, which starts three months before your 65th birthday and ends three months after. There are also Open Enrollment Periods throughout the year for making changes to your Medicare coverage.

MetLife is a well-established insurance company with a wide range of products. Met Life Insurance 2024 offers various insurance solutions, including life insurance, to meet your financial planning needs.

Landlords need adequate insurance protection. Landlord Insurance Quote 2024 helps you find the right coverage, ensuring your investment is safe and secure.

Businesses require specific insurance coverage to protect their operations. Commercial Insurance 2024 provides tailored solutions, safeguarding your business from various risks.

The cost of car insurance can vary depending on factors like location and driving history. Average Car Insurance Cost 2024 provides insights into typical insurance rates, helping you make informed decisions.

Planning for the future is crucial, especially as we age. Life Insurance For Seniors 2024 provides financial security for your loved ones, ensuring their well-being after your passing.