Unsubsidized loans are a common form of financial aid for students pursuing higher education. Unlike subsidized loans, where the government pays the interest while you’re in school, unsubsidized loans accrue interest from the moment they are disbursed. This means that the total amount you owe will grow over time, even while you’re still in school.

This guide will delve into the intricacies of unsubsidized loans, providing a comprehensive understanding of their features, eligibility, and management.

Hard money lenders can be a good option for borrowers who need financing quickly or who have a less-than-perfect credit history. However, these loans typically come with higher interest rates and fees.

Understanding the nuances of unsubsidized loans is crucial for making informed financial decisions. This guide will explore key aspects, including interest accrual, repayment options, and the impact on personal financial planning. By understanding the intricacies of unsubsidized loans, borrowers can make informed decisions about their financial future.

When shopping for a mortgage, it’s important to compare home mortgage rates from multiple lenders. Factors like your credit score, down payment, and the type of loan you’re seeking will all influence the rates you qualify for.

Unsubsidized Loans: A Comprehensive Guide

Unsubsidized loans are a common form of financial assistance for students pursuing higher education. They offer flexibility and accessibility, but it’s crucial to understand their nuances to make informed financial decisions. This guide delves into the ins and outs of unsubsidized loans, covering their basics, eligibility, interest rates, management strategies, and financial implications.

To find the best mortgage rate for your individual situation, you should compare best home loan rates from multiple lenders. Factors such as your credit score, down payment, and loan term will all affect the rate you qualify for.

Unsubsidized Loan Basics

An unsubsidized loan is a type of student loan that is not subsidized by the government. This means that interest accrues on the loan from the moment it is disbursed, regardless of whether the borrower is in school, in grace period, or deferment.

If you have fair credit, you might have a harder time qualifying for a traditional personal loan. But don’t worry, there are still options available to you. Check out personal loans for fair credit to see what’s available.

Unlike subsidized loans, the government does not pay the interest while the borrower is in school or during deferment periods.

If you’re in the market for a new car, you might want to explore your vehicle finance options. There are a variety of lenders who offer car loans, so it’s important to compare rates and terms before making a decision.

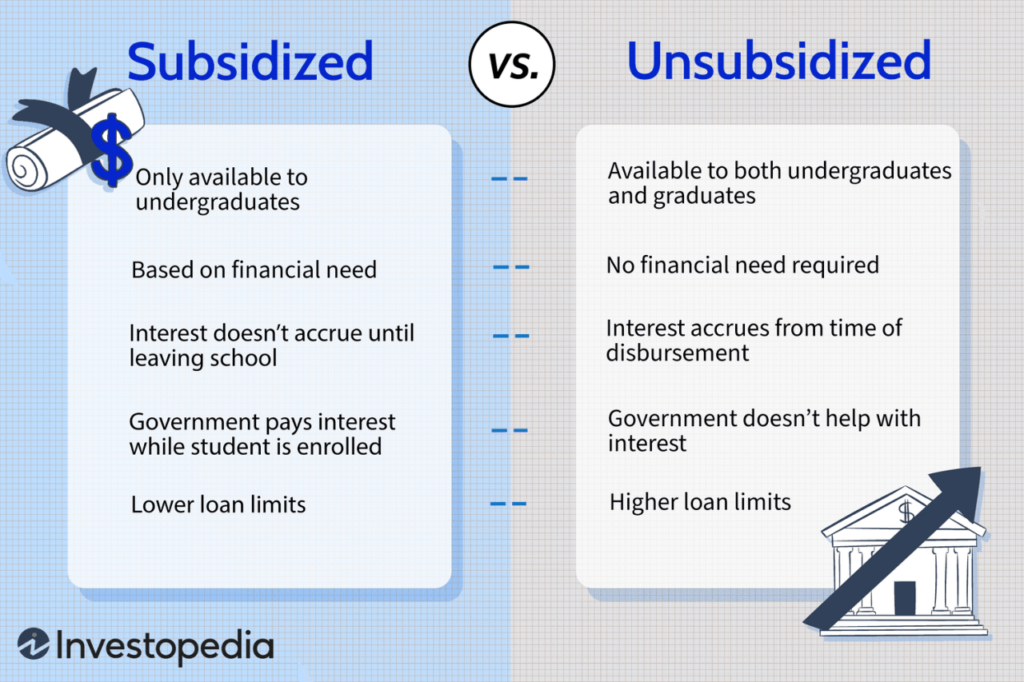

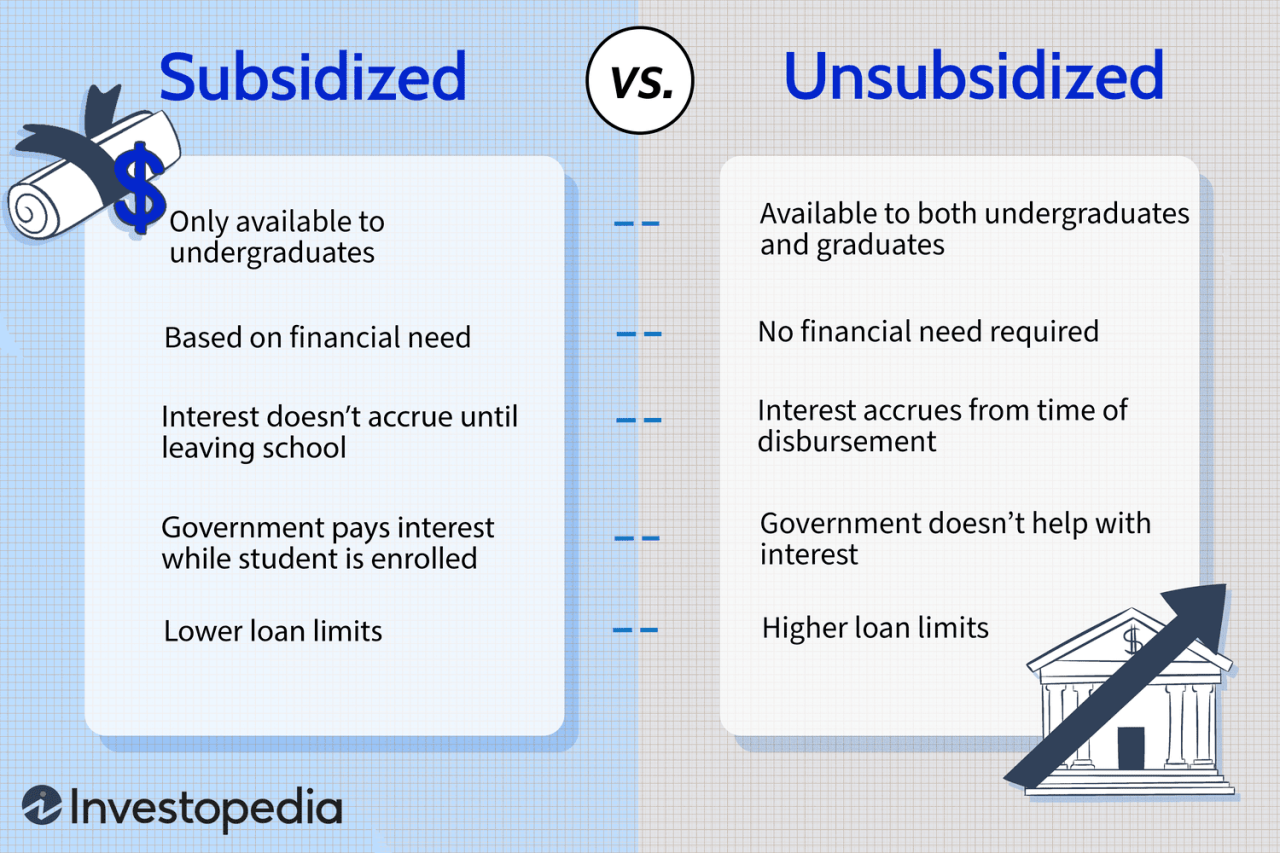

The key difference between subsidized and unsubsidized loans lies in the interest accrual. With subsidized loans, the government covers the interest while the borrower is in school or during deferment periods. In contrast, interest accrues on unsubsidized loans from the time the loan is disbursed, and the borrower is responsible for paying this accumulated interest.

If you’re looking for a fixed-rate mortgage with a shorter term, you might want to consider best mortgage rates 5 year fixed. These mortgages offer a predictable payment schedule and can be a good option for those who plan to stay in their home for a shorter period of time.

Interest accrues on unsubsidized loans in a straightforward manner. The interest rate is applied to the outstanding loan balance, and the interest is added to the principal amount. This compounding effect means that the loan balance grows over time, even if no payments are made.

30 year mortgage rates are generally lower than shorter-term mortgages, but you’ll end up paying more in interest over the life of the loan. It’s important to weigh the pros and cons of different mortgage terms before making a decision.

The longer the loan remains unpaid, the more interest accrues, leading to a larger overall debt.

Capital One Auto is a popular lender for car loans. They offer a variety of loan options to fit different budgets and credit scores. It’s always a good idea to compare rates from multiple lenders before choosing a car loan.

Eligibility and Application Process

To be eligible for an unsubsidized loan, borrowers must meet specific criteria. Generally, they must be:

- A U.S. citizen or eligible non-citizen

- Enrolled at least half-time in an eligible program at an eligible school

- Meeting satisfactory academic progress requirements

- Not in default on any federal student loans

The application process for unsubsidized loans is typically straightforward. Borrowers can apply through the Free Application for Federal Student Aid (FAFSA). The FAFSA collects information about the borrower’s financial situation and educational goals. Based on this information, the Department of Education determines the borrower’s eligibility for various types of financial aid, including unsubsidized loans.

To ensure a smooth application process, borrowers should gather necessary documentation, such as their Social Security number, tax information, and financial aid information from their school. They should also carefully review the FAFSA instructions and seek assistance if needed. The Federal Student Aid website provides comprehensive resources and guidance for completing the application successfully.

Interest Rates and Loan Terms

Interest rates on unsubsidized loans are determined by the federal government and are fixed for the life of the loan. The rates are typically lower than those offered by private lenders, but they can still be significant. The specific interest rate for an unsubsidized loan depends on the loan disbursement date.

Current home loan rates can fluctuate daily, so it’s important to check with lenders regularly to see what’s available. Factors like your credit score, down payment, and the type of loan you’re seeking will all influence the rates you qualify for.

The current interest rates for unsubsidized loans can be found on the Federal Student Aid website.

A Citi Personal Loan can be a good option for consolidating debt or financing a large purchase. These loans offer competitive interest rates and flexible repayment terms.

Unsubsidized loans typically have longer repayment terms than other types of loans, such as personal loans or credit card debt. This can help borrowers manage their monthly payments, but it also means that they will pay more interest over the life of the loan.

If you’re looking to finance a mobile home, you’ll need to find a lender who specializes in mobile home financing. These loans can be a bit more challenging to obtain than traditional home loans, but there are lenders out there who can help.

The standard repayment term for unsubsidized loans is 10 years, but borrowers may have options for longer repayment terms, such as 25 years for certain loan types.

A VA home loan is a type of mortgage that is available to eligible veterans and active-duty military personnel. These loans often have favorable terms, such as no down payment requirement and lower interest rates.

Unsubsidized loans offer several repayment options, including:

- Standard Repayment Plan:This is the most common repayment plan, with a fixed monthly payment over 10 years.

- Graduated Repayment Plan:This plan starts with lower monthly payments that gradually increase over time.

- Extended Repayment Plan:This plan extends the repayment term to up to 25 years, allowing for lower monthly payments.

- Income-Driven Repayment Plans:These plans tie monthly payments to the borrower’s income and family size.

Managing Unsubsidized Loans

Managing unsubsidized loans effectively is crucial to avoid accumulating excessive interest and debt. Here are some tips for managing and repaying unsubsidized loans:

- Track Loan Payments:Keep track of your loan balance, interest rate, and due dates to ensure timely payments.

- Prioritize Repayment:Consider making extra payments or paying down your loan faster to reduce interest charges.

- Explore Repayment Options:Consider switching to a different repayment plan if your current one is not manageable.

- Consolidate Loans:If you have multiple student loans, consider consolidating them into a single loan with a lower interest rate.

Defaulting on an unsubsidized loan can have severe consequences, including:

- Negative Credit Score:Defaulting on a loan can damage your credit score, making it difficult to obtain future loans or credit cards.

- Wage Garnishment:The government can garnish your wages to collect on the loan.

- Tax Refunds Seized:Your tax refunds may be seized to pay off the loan.

To reduce interest costs and accelerate loan repayment, borrowers can consider strategies such as:

- Making Extra Payments:Even small extra payments can significantly reduce the total interest paid over the life of the loan.

- Refinancing:If interest rates have fallen since you took out your loan, refinancing can lower your monthly payments and save you money.

- Consolidating Loans:Combining multiple loans into a single loan with a lower interest rate can simplify repayment and potentially reduce interest costs.

Unsubsidized Loans and Financial Planning

Unsubsidized loans can significantly impact personal financial planning. The monthly loan payments can strain budgets and limit financial flexibility. It’s crucial to consider the long-term implications of taking out unsubsidized loans and to incorporate loan payments into a comprehensive financial plan.

Budgeting and financial literacy are essential when taking out unsubsidized loans. Borrowers should create a realistic budget that accounts for loan payments, other expenses, and potential income fluctuations. They should also develop financial literacy skills to understand the terms of their loans, manage their finances effectively, and make informed financial decisions.

If you’re looking for a short-term loan to help you get through a financial emergency, you might consider best payday loans. These loans are typically small and can be repaid within a few weeks. However, it’s important to be aware of the high interest rates associated with payday loans.

Incorporating loan payments into a comprehensive financial plan involves considering factors such as:

- Income and Expenses:Assess your current and projected income and expenses to determine affordability.

- Financial Goals:Consider your short-term and long-term financial goals, such as saving for a down payment on a house or retirement.

- Risk Tolerance:Evaluate your willingness to take on financial risks and adjust your financial plan accordingly.

Alternatives to Unsubsidized Loans

Unsubsidized loans are not the only financing option for education and other purposes. Several alternatives can provide financial assistance with potentially lower interest rates or more flexible repayment terms. These alternatives include:

- Subsidized Loans:These loans are subsidized by the government, meaning that interest does not accrue while the borrower is in school or during deferment periods.

- Grants:Grants are forms of financial aid that do not need to be repaid.

- Scholarships:Scholarships are awarded based on academic merit, financial need, or other criteria.

- Work-Study Programs:These programs provide students with part-time jobs on campus or in community service organizations.

- Private Loans:Private loans are offered by banks, credit unions, and other lenders, and they often have higher interest rates than federal loans.

When considering an unsubsidized loan, it’s essential to compare its pros and cons with other financing options. Factors to consider include interest rates, repayment terms, eligibility requirements, and potential impact on your financial plan. An unsubsidized loan may be the most suitable option if other financing options are unavailable or if the borrower prefers the flexibility of a fixed interest rate and a longer repayment term.

The interest rates today 30 year fixed are influenced by a number of factors, including the Federal Reserve’s monetary policy and the overall state of the economy. It’s a good idea to shop around for the best rates before committing to a mortgage.

End of Discussion

Navigating the world of unsubsidized loans can be daunting, but with the right knowledge and planning, you can effectively manage your debt and achieve your financial goals. By understanding the key factors, exploring different repayment options, and prioritizing responsible financial practices, you can confidently navigate the path to financial stability.

Remember, informed decisions are the foundation of sound financial management.

FAQ: Unsubsidized Loan

What happens if I don’t make payments on my unsubsidized loan while I’m still in school?

Interest will continue to accrue on your unsubsidized loan, even if you’re still in school. This can lead to a larger overall debt burden when you begin repayment.

Can I consolidate my unsubsidized loan with other types of loans?

Yes, you can consolidate your unsubsidized loan with other federal student loans, such as subsidized loans or PLUS loans. This can simplify your repayment process and potentially lower your monthly payments.

What are the consequences of defaulting on an unsubsidized loan?

Defaulting on an unsubsidized loan can have serious consequences, including damage to your credit score, wage garnishment, and tax refunds being withheld. It’s crucial to make timely payments and explore options if you’re struggling to keep up with your loan obligations.

A lifetime mortgage is a type of loan that allows homeowners to borrow money against the value of their property. This can be a useful option for older homeowners who need access to cash, but it’s important to understand the potential risks before taking out this type of loan.