FHA Loan Interest Rates are a crucial aspect of securing a mortgage through the Federal Housing Administration. These rates, unlike those for conventional mortgages, are influenced by a unique set of factors, including government regulations and the overall economic climate.

In a pinch? Emergency Same Day Loans can provide quick access to funds when you need them most. However, these loans often come with high interest rates, so it’s essential to use them cautiously and only when absolutely necessary.

Understanding how FHA loan interest rates work is essential for any potential borrower seeking to leverage this popular program for homeownership.

FHA loans are known for their flexible eligibility requirements and lower down payment options, making them attractive to first-time homebuyers and those with less-than-perfect credit. However, FHA loan interest rates can fluctuate, impacting the affordability of these loans. By delving into the intricacies of FHA loan interest rate calculations, trends, and comparison with other mortgage options, we can gain valuable insights into navigating the process of securing a mortgage through this government-backed program.

Looking to finance a new car? Knowing the Current Car Loan Rates is essential for making an informed decision. You can find this information online or by contacting various lenders.

FHA Loan Basics

The Federal Housing Administration (FHA) loan program is a government-backed mortgage insurance program designed to make homeownership more accessible to a wider range of borrowers. Established in 1934 during the Great Depression, the FHA’s primary goal was to stabilize the housing market by providing insurance to lenders who issued mortgages to individuals with lower credit scores and down payments.

FHA loans have since become a cornerstone of the American housing market, offering numerous benefits to borrowers.

Check And Go is a company that provides short-term loans, payday loans, and other financial services. They can be a convenient option for those who need quick access to cash, but it’s important to be aware of the potential high interest rates associated with these types of loans.

FHA Loan Eligibility Requirements

To qualify for an FHA loan, borrowers must meet specific eligibility criteria. These requirements are designed to ensure that borrowers have the financial capacity to repay their mortgage obligations. The key eligibility requirements for FHA loans include:

- Credit Score:Borrowers typically need a minimum credit score of 580 to qualify for an FHA loan with a 3.5% down payment. Those with credit scores between 500 and 579 may still be eligible, but they will need a 10% down payment.

Credit unions often offer competitive rates on auto loans, so it’s worth exploring Credit Union Auto Loan options before making a decision. Credit unions typically have lower overhead costs than banks, which can translate to lower interest rates for borrowers.

- Debt-to-Income Ratio (DTI):The DTI is a measure of how much of your monthly income is dedicated to debt payments. FHA loans typically require a DTI of 43% or less.

- Down Payment:FHA loans require a minimum down payment of 3.5% for borrowers with a credit score of 580 or higher. Those with lower credit scores may need to make a 10% down payment.

- Income Verification:Borrowers must provide documentation to verify their income, including pay stubs, tax returns, and bank statements.

- Employment History:Lenders typically require borrowers to have a stable employment history, demonstrating a consistent income stream.

- Property Eligibility:FHA loans are available for various types of properties, including single-family homes, condominiums, townhouses, and manufactured homes. However, there are specific requirements for each property type, including minimum property standards.

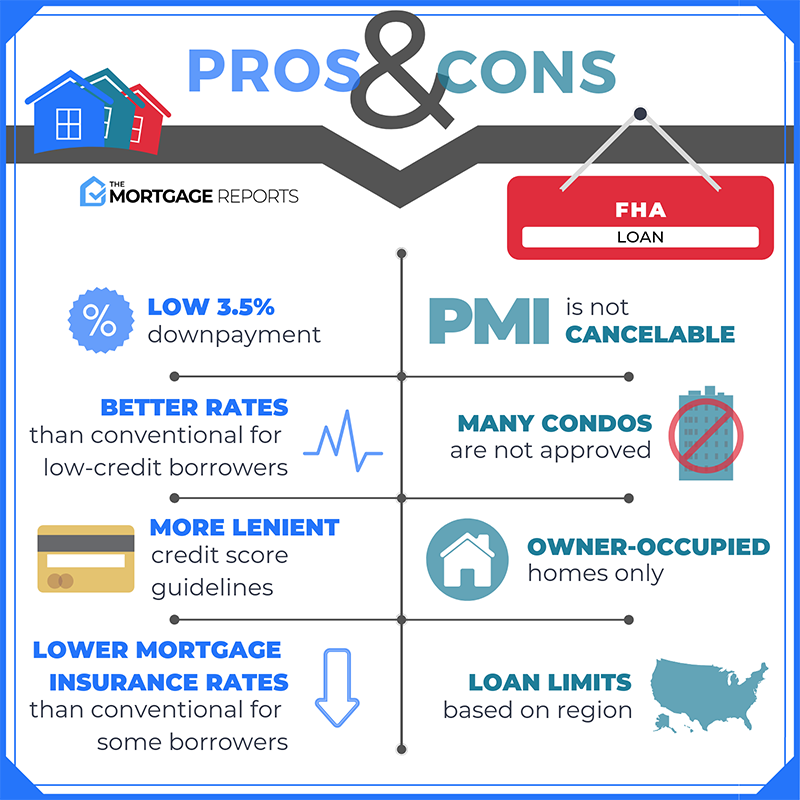

Key Differences Between FHA Loans and Conventional Mortgages

FHA loans differ from conventional mortgages in several key aspects, including:

- Down Payment:FHA loans require a lower down payment than conventional mortgages, making them more accessible to borrowers with limited savings.

- Credit Score Requirements:FHA loans have more lenient credit score requirements than conventional mortgages, making them an option for borrowers with less-than-perfect credit.

- Mortgage Insurance:FHA loans require mortgage insurance, which protects the lender against losses in case of default. This insurance premium is typically paid upfront and as a monthly premium.

- Loan Limits:FHA loans have loan limits that vary by county. These limits are designed to ensure that FHA loans are available for borrowers purchasing homes in various price ranges.

- Closing Costs:FHA loans typically have higher closing costs than conventional mortgages. However, these costs can be financed into the loan, reducing the upfront out-of-pocket expenses.

FHA Loan Interest Rates

FHA loan interest rates are influenced by a variety of factors, including the overall market interest rates, the borrower’s credit score, and the loan term. Understanding these factors is crucial for borrowers seeking to secure the most favorable interest rate on their FHA loan.

Factors Influencing FHA Loan Interest Rates

Several factors contribute to the determination of FHA loan interest rates. These factors are interconnected and can fluctuate over time. Some of the key factors include:

- Market Interest Rates:The Federal Reserve’s monetary policy and overall economic conditions significantly influence market interest rates. When interest rates rise, FHA loan interest rates tend to follow suit.

- Borrower’s Credit Score:A higher credit score generally leads to a lower interest rate. Lenders view borrowers with good credit as less risky and are more likely to offer them favorable terms.

- Loan Term:The length of the loan term also impacts interest rates. Longer loan terms typically have higher interest rates, as borrowers have more time to repay the loan.

- Loan-to-Value (LTV) Ratio:The LTV ratio is the percentage of the home’s value that is being financed. A higher LTV ratio generally results in a higher interest rate, as lenders perceive a greater risk with a larger loan amount.

- Property Location:FHA loan interest rates can vary depending on the property’s location. Certain areas may have higher interest rates due to factors such as property values, risk of default, and competition among lenders.

Comparing Current FHA Loan Interest Rates with Historical Trends

FHA loan interest rates have historically fluctuated in response to changes in the overall market and economic conditions. While current FHA loan interest rates are influenced by current market conditions, comparing them to historical trends can provide valuable insights.

Historically, FHA loan interest rates have tended to be lower than conventional mortgage interest rates, reflecting the government’s goal of making homeownership more affordable. However, the gap between FHA and conventional mortgage rates has narrowed in recent years, as market interest rates have risen.

Planning to buy a home? It’s smart to keep an eye on Current 30 Year Fixed Mortgage Rates. These rates can change frequently, so staying informed can help you secure a competitive rate for your mortgage.

Relationship Between FHA Loan Interest Rates and the Overall Market

FHA loan interest rates are closely tied to the overall market interest rates. When the Federal Reserve raises interest rates, it becomes more expensive for lenders to borrow money, leading to higher FHA loan interest rates. Conversely, when the Federal Reserve lowers interest rates, it becomes cheaper for lenders to borrow money, resulting in lower FHA loan interest rates.

The relationship between FHA loan interest rates and the overall market is dynamic and subject to ongoing fluctuations.

Refinancing your mortgage can be a smart financial move if you’re looking to lower your monthly payments or shorten your loan term. Checking Refi Rates regularly can help you determine if refinancing is right for you.

FHA Loan Interest Rate Calculation

Calculating FHA loan interest rates involves a complex process that considers various factors, including the borrower’s creditworthiness, the loan term, and the prevailing market interest rates. Lenders use sophisticated algorithms and models to determine the final interest rate for each borrower.

An Opps Loan can be a helpful option if you need a short-term loan to cover unexpected expenses. However, it’s crucial to understand the potential high interest rates and repayment terms associated with these types of loans.

Understanding the components that contribute to the final interest rate can help borrowers make informed decisions.

Process for Calculating FHA Loan Interest Rates

The process for calculating FHA loan interest rates typically involves the following steps:

- Credit Score Assessment:Lenders assess the borrower’s credit score to determine their creditworthiness. A higher credit score generally leads to a lower interest rate.

- Debt-to-Income Ratio (DTI) Calculation:Lenders calculate the borrower’s DTI to assess their ability to manage monthly debt payments. A lower DTI generally results in a more favorable interest rate.

- Loan Term Selection:The borrower selects the loan term, which can range from 15 to 30 years. Longer loan terms typically have higher interest rates.

- Market Interest Rate Analysis:Lenders analyze the current market interest rates for FHA loans to determine a competitive rate for the borrower.

- Loan-to-Value (LTV) Ratio Determination:Lenders calculate the LTV ratio to assess the amount of the loan relative to the value of the property. A higher LTV ratio generally results in a higher interest rate.

- Risk Assessment:Lenders assess the borrower’s overall risk profile, including their employment history, income stability, and other factors, to determine an appropriate interest rate.

- Final Interest Rate Calculation:Based on the factors Artikeld above, lenders use sophisticated algorithms to calculate the final interest rate for the borrower. The final interest rate is typically expressed as an annual percentage rate (APR).

Components Contributing to the Final Interest Rate

Several components contribute to the final interest rate for an FHA loan, including:

- Base Interest Rate:This is the underlying interest rate determined by the lender based on current market conditions.

- Credit Score Adjustment:Lenders adjust the base interest rate based on the borrower’s credit score. Borrowers with higher credit scores typically receive lower adjustments, resulting in a lower overall interest rate.

- Loan Term Adjustment:Lenders adjust the base interest rate based on the length of the loan term. Longer loan terms typically have higher adjustments, leading to a higher overall interest rate.

- LTV Ratio Adjustment:Lenders adjust the base interest rate based on the LTV ratio. A higher LTV ratio typically results in a higher adjustment, leading to a higher overall interest rate.

- Mortgage Insurance Premium:The FHA mortgage insurance premium is factored into the overall cost of the loan, which can affect the effective interest rate.

Examples of How Different Factors Impact Interest Rates

To illustrate how different factors can impact FHA loan interest rates, consider the following examples:

- Credit Score:A borrower with a credit score of 740 may receive an interest rate of 4.25%, while a borrower with a credit score of 620 may receive an interest rate of 5.00%.

- Loan Term:A borrower with a 15-year loan term may receive an interest rate of 3.75%, while a borrower with a 30-year loan term may receive an interest rate of 4.50%.

- LTV Ratio:A borrower with a 90% LTV ratio may receive an interest rate of 4.75%, while a borrower with a 80% LTV ratio may receive an interest rate of 4.50%.

FHA Loan Interest Rate Trends

FHA loan interest rates have been subject to fluctuations in recent years, influenced by a combination of economic factors, market conditions, and government policies. Understanding these trends can help borrowers make informed decisions about their mortgage options.

Recent Trends in FHA Loan Interest Rates

In recent years, FHA loan interest rates have generally followed the trends in the overall market interest rates. As the Federal Reserve has gradually raised interest rates to combat inflation, FHA loan interest rates have also increased. However, FHA loan interest rates have typically remained lower than conventional mortgage interest rates, reflecting the government’s goal of making homeownership more affordable.

However, the gap between FHA and conventional mortgage rates has narrowed in recent years, as market interest rates have risen.

Keeping track of Mortgage Rates is essential when you’re looking to buy a home. Rates can fluctuate frequently, so it’s important to stay informed and shop around for the best deals. You can find current mortgage rate information online or by contacting a mortgage lender.

Potential Future Trends and Implications for Borrowers

Predicting future trends in FHA loan interest rates is challenging, as they are influenced by a complex interplay of economic factors, market conditions, and government policies. However, some potential trends to consider include:

- Continued Interest Rate Increases:The Federal Reserve is expected to continue raising interest rates in the near future to combat inflation. This could lead to further increases in FHA loan interest rates.

- Economic Uncertainty:Global economic uncertainty and geopolitical tensions could also impact FHA loan interest rates. Economic downturns or geopolitical instability can lead to increased risk aversion among lenders, potentially resulting in higher interest rates.

- Government Policies:Changes in government policies, such as adjustments to FHA loan limits or mortgage insurance premiums, could also influence FHA loan interest rates.

Impact of Economic Factors on FHA Loan Interest Rates

Economic factors, such as inflation, unemployment, and economic growth, can significantly impact FHA loan interest rates. When inflation is high, the Federal Reserve typically raises interest rates to cool the economy. This can lead to higher FHA loan interest rates, as lenders pass on the higher borrowing costs to borrowers.

A Heloc is a home equity line of credit that allows you to borrow against the equity you’ve built in your home. It can be a flexible way to access funds, but it’s important to understand the terms and conditions before taking out a Heloc.

Conversely, when the economy is weak, the Federal Reserve may lower interest rates to stimulate growth. This can lead to lower FHA loan interest rates, as lenders are able to borrow money at lower costs.

Mr Cooper Mortgage is a well-known mortgage lender that offers a range of services, including refinancing and loan modifications. They can be a good option for homeowners looking to manage their mortgage payments or explore different loan options.

FHA Loan Interest Rate Comparison

Comparing FHA loan interest rates with other mortgage options is crucial for borrowers seeking to secure the most favorable terms. Each type of mortgage has its own advantages and disadvantages, and the best option for a particular borrower depends on their individual circumstances and financial goals.

Comparing FHA Loan Interest Rates with Other Mortgage Options

FHA loans are just one type of mortgage available to borrowers. Other popular mortgage options include:

- Conventional Mortgages:These are the most common type of mortgage, not backed by the government. They typically require a higher down payment and credit score than FHA loans.

- VA Loans:These loans are available to eligible veterans and active-duty military personnel. They offer low interest rates, no down payment requirements, and no mortgage insurance.

- USDA Loans:These loans are designed to help borrowers purchase homes in rural areas. They offer low interest rates and no down payment requirements.

Advantages and Disadvantages of Each Type of Loan, Fha Loan Interest Rate

Each type of mortgage has its own unique advantages and disadvantages. Here’s a comparison of the key features of each type of loan:

| Loan Type | Down Payment | Credit Score Requirements | Interest Rates | Mortgage Insurance | Loan Limits |

|---|---|---|---|---|---|

| FHA Loan | 3.5% or 10% | 580 or higher | Typically lower than conventional loans | Required | Vary by county |

| Conventional Mortgage | 5% or higher | 620 or higher | Typically higher than FHA loans | May be required | No limits |

| VA Loan | No down payment required | Minimum credit score varies | Typically lower than FHA and conventional loans | Not required | No limits |

| USDA Loan | No down payment required | 640 or higher | Typically lower than FHA and conventional loans | Not required | Vary by county |

Strategies for Lowering FHA Loan Interest Rates

While FHA loan interest rates are influenced by factors beyond a borrower’s control, there are strategies that borrowers can employ to potentially lower their interest rates. By taking steps to improve their creditworthiness and shopping around for the best rates, borrowers can increase their chances of securing a more favorable mortgage.

Buying your first home can be an exciting experience! Take advantage of First Time Home Buyer Programs that can offer assistance with down payments, closing costs, or other expenses. These programs can make homeownership more accessible for first-time buyers.

Strategies for Lowering FHA Loan Interest Rates

Here are some strategies that borrowers can use to potentially lower their FHA loan interest rates:

- Improve Credit Score:A higher credit score generally leads to a lower interest rate. Borrowers can improve their credit score by paying their bills on time, reducing their credit utilization, and avoiding new credit applications.

- Reduce Debt-to-Income Ratio (DTI):A lower DTI indicates that a borrower has more financial flexibility. Borrowers can reduce their DTI by paying down existing debts or increasing their income.

- Consider a Shorter Loan Term:A shorter loan term typically results in a lower interest rate, as the lender is exposed to less risk over a shorter period. However, a shorter loan term also means higher monthly payments.

- Shop Around for the Best Rates:Different lenders offer different interest rates. Borrowers should compare rates from multiple lenders to find the most competitive offer.

- Negotiate with the Lender:Once a borrower has received a loan offer, they can negotiate with the lender to try to secure a lower interest rate. This may involve providing additional documentation or making concessions, such as a larger down payment.

Impact of Credit Score, Debt-to-Income Ratio, and Loan Term on Interest Rates

A borrower’s credit score, debt-to-income ratio (DTI), and loan term significantly impact FHA loan interest rates. A higher credit score, lower DTI, and shorter loan term generally lead to lower interest rates, as lenders perceive borrowers with these characteristics as less risky.

Role of Shopping Around for the Best Rates

Shopping around for the best rates is crucial for securing a favorable FHA loan. Different lenders offer different interest rates based on their risk assessments, market conditions, and lending policies. Borrowers should compare rates from multiple lenders to find the most competitive offer.

Online mortgage calculators and comparison websites can be helpful tools for this process.

If you’re planning to invest in commercial real estate, understanding Commercial Mortgage Rates is crucial. These rates can vary depending on factors like loan amount, property type, and borrower’s credit history.

Final Review: Fha Loan Interest Rate

In conclusion, FHA loan interest rates are a dynamic element of the mortgage landscape. By understanding the factors that influence these rates, borrowers can make informed decisions and potentially secure a favorable interest rate. By carefully evaluating the advantages and disadvantages of FHA loans, and by considering the strategies for potentially lowering interest rates, individuals can increase their chances of achieving their homeownership goals.

Essential FAQs

What is the current average FHA loan interest rate?

Current average FHA loan interest rates fluctuate daily. To get the most up-to-date information, consult a reputable mortgage lender or online resources.

Chase Loans offer a range of financial products, including personal loans, mortgages, and credit cards. Their loan options can be a convenient choice for those who already bank with Chase, but it’s always a good idea to compare rates and terms from other lenders as well.

How do FHA loan interest rates compare to conventional mortgages?

FHA loan interest rates are typically slightly higher than conventional mortgage rates. This difference is often attributed to the lower down payment requirements and more flexible eligibility criteria associated with FHA loans.

If you’re looking for a personal loan with competitive rates, Low Interest Personal Loans can be a great option. You can use these loans for various purposes, such as debt consolidation, home improvements, or medical expenses. It’s important to compare different lenders and their rates before making a decision.

What are the benefits of choosing an FHA loan?

FHA loans offer several benefits, including lower down payment requirements, more flexible credit score guidelines, and insurance protection for lenders. However, it’s crucial to consider the potential for higher interest rates and the added cost of mortgage insurance.