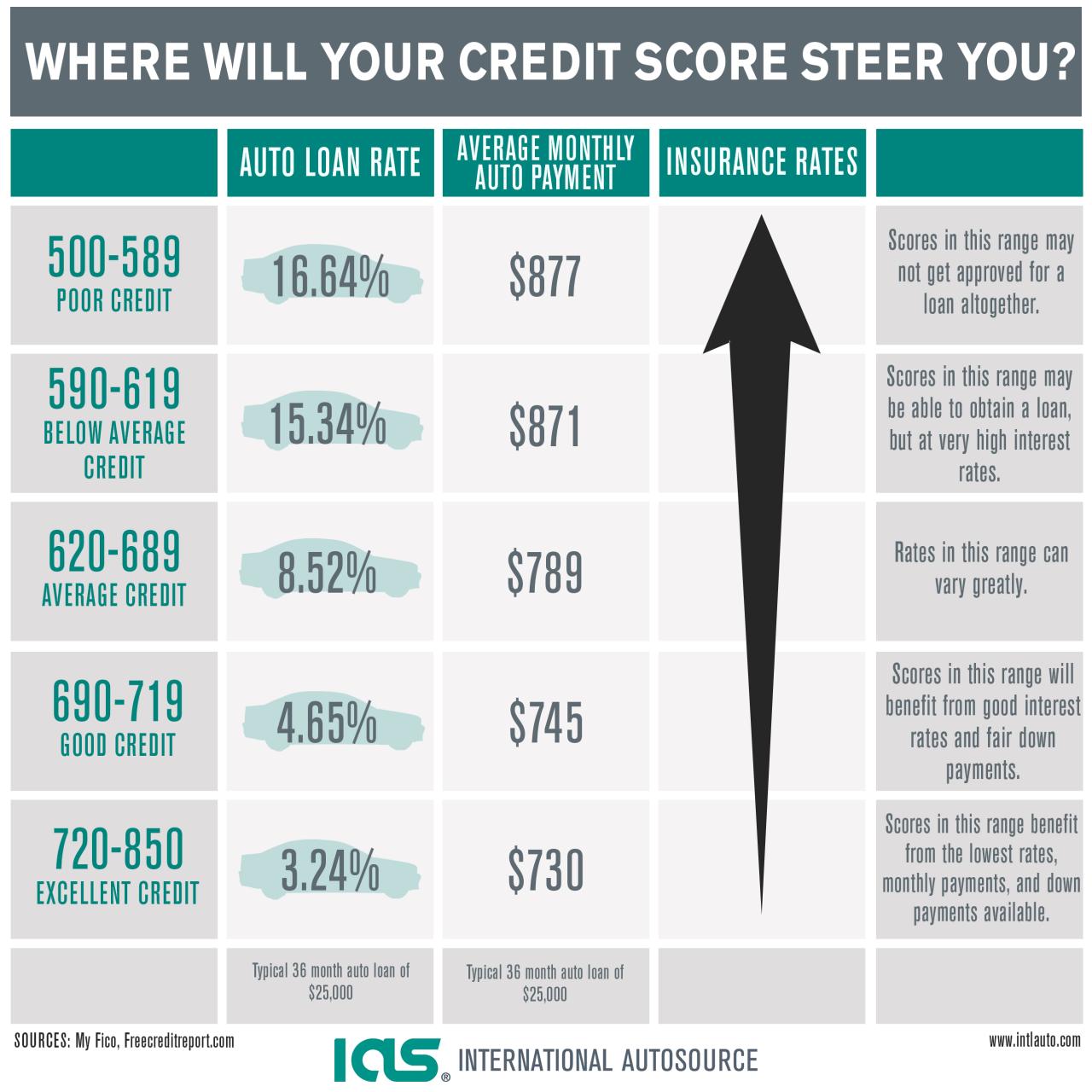

Used Auto Loan Rates are crucial when buying a used car, influencing your monthly payments and overall financing cost. Understanding these rates is essential for making informed decisions and securing a favorable deal.

Home equity lines of credit (HELOCs) can be a flexible way to borrow against your home’s value. Keep an eye on current HELOC rates to see if it’s a suitable option for you.

This guide delves into the intricacies of used car loan rates, exploring factors that influence them, assessing your eligibility, comparing loan options, and navigating the process of finding the best deal. We’ll cover everything from credit score impact to negotiating strategies, equipping you with the knowledge to make informed choices and secure a loan that fits your budget and needs.

Looking for a way to consolidate debt or fund a major purchase? Personal loans online can offer a convenient and potentially lower-interest option compared to credit cards.

Closing Notes: Used Auto Loan Rates

Securing a used car loan involves careful consideration of your financial situation, loan terms, and lender options. By understanding the factors that impact used auto loan rates, assessing your eligibility, and comparing loan offers, you can navigate the financing process with confidence.

Marcus, a division of Goldman Sachs, is known for offering personal loans with competitive rates. Marcus loans might be a good choice for those seeking a reliable lender.

Remember to shop around, negotiate effectively, and carefully review loan documents before signing to ensure a favorable and manageable financing arrangement.

When time is of the essence, fast loans online can provide quick access to funds, but be sure to understand the terms and conditions.

FAQ Compilation

What is the average used car loan interest rate?

Kashable is a relatively new player in the lending space, specializing in loans for specific purposes. Kashable loans could be an option if you have a clear financial goal in mind.

Average used car loan interest rates vary depending on factors like credit score, loan amount, and loan term. However, they typically range from 4% to 10%.

For education-related expenses, federal loans offer a range of programs with potentially lower interest rates and flexible repayment options.

How can I improve my chances of getting a lower interest rate?

Chase Bank offers a variety of financial products, including loans. You can explore their loan options, including Chase loans , to see if they fit your needs.

Improving your credit score, increasing your down payment, and choosing a shorter loan term can all help you secure a lower interest rate.

Finding the right lender can be a challenge. Loan companies vary in terms of interest rates, loan amounts, and eligibility requirements, so it’s crucial to compare options.

What are some common loan fees and charges?

Common loan fees include origination fees, application fees, and prepayment penalties. Make sure to understand all fees before signing a loan agreement.

Need a larger loan for a specific purpose? 20000 loans can be helpful for major expenses like home renovations or medical bills.

What should I do if I can’t afford my loan payments?

Unexpected expenses happen. If you need cash quickly, urgent cash loans can provide a lifeline, though it’s important to be aware of potential high interest rates.

If you’re struggling to make payments, contact your lender as soon as possible. They may be able to offer options like temporary payment deferment or a loan modification.

PenFed Credit Union is known for offering competitive rates on various financial products, including mortgages. PenFed mortgage rates are worth checking if you’re in the market for a home loan.

A line of credit can provide a revolving credit line that you can access as needed, offering flexibility for unexpected expenses or short-term financing.

Looking for a long-term mortgage? 30-year mortgage rates can provide a predictable payment schedule, but keep in mind that you’ll be paying interest for a longer period.

While it’s rare to find loans with absolutely no credit check, online loans with no credit check might be available for those with limited credit history or challenges.

Discover offers a variety of financial products, including home equity loans. Discover home equity loans can be a good option if you’re looking to tap into your home’s equity for a major expense.