Variable Interest Rates, a financial concept that impacts borrowers and lenders alike, offer a dynamic approach to interest calculations. Unlike fixed rates, variable interest rates fluctuate based on underlying economic conditions, creating both opportunities and challenges.

When buying a used car, it’s essential to consider the Used Car Loan Rates from different lenders to secure the best deal.

This dynamic nature stems from the connection between variable interest rates and benchmark rates, such as the prime rate or LIBOR. These benchmarks act as indicators of broader market trends, influencing the adjustments made to variable interest rates over time.

If you’re a member of Navy Federal, you may be eligible for competitive rates on auto loans. Explore Navy Federal Auto Loan Rates to see if you can save on your next vehicle purchase.

This means that borrowers and lenders are constantly navigating a landscape where interest rates can rise or fall, creating a need for informed decision-making and risk management.

Variable Interest Rates: Understanding the Fluctuations

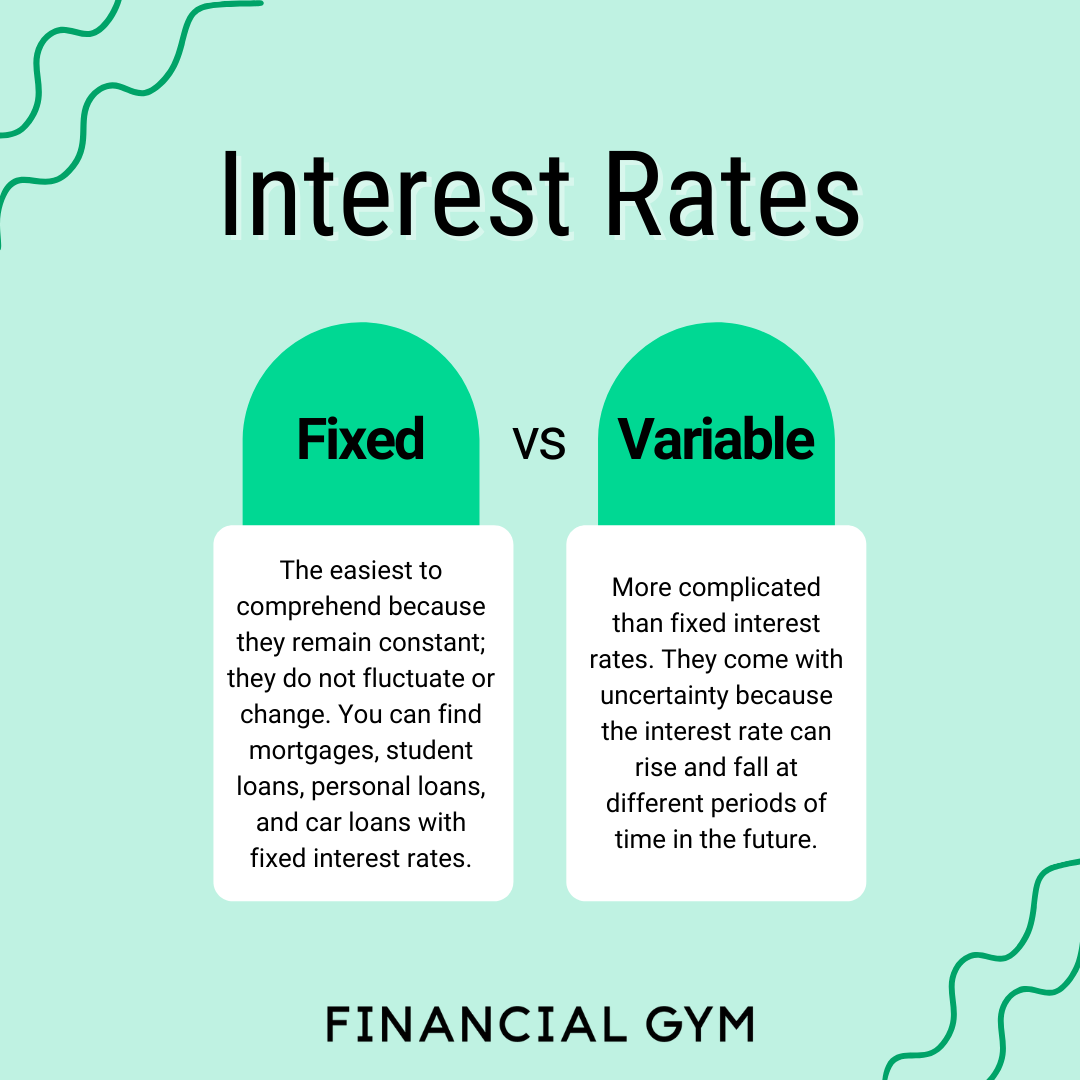

Variable interest rates are a common feature in the financial world, affecting various financial products like mortgages, loans, and credit cards. Understanding how variable interest rates work is crucial for borrowers as they can significantly impact their financial obligations. This article will delve into the concept of variable interest rates, exploring their definition, mechanics, advantages, disadvantages, and strategies for managing associated risks.

Definition and Fundamentals

A variable interest rate is a type of interest rate that fluctuates over time, unlike a fixed interest rate which remains constant for the duration of the loan. The primary characteristic of a variable interest rate is its dynamic nature, meaning it can rise or fall based on changes in underlying market conditions.

The fluctuations of a variable interest rate are driven by several factors, primarily the benchmark interest rate. The benchmark interest rate, often set by central banks or other financial institutions, serves as a reference point for determining variable interest rates.

If you’re in the market for a used car, a Used Car Loan can help you finance your purchase. Shop around for the best rates and terms to find the right deal for you.

As the benchmark interest rate changes, variable interest rates typically follow suit, reflecting the overall cost of borrowing in the market.

How Variable Interest Rates Work

Variable interest rates adjust periodically based on changes in the benchmark interest rate. The frequency of these adjustments can vary depending on the specific terms of the loan agreement. Typically, variable interest rates are tied to a specific benchmark interest rate, such as the prime rate or the London Interbank Offered Rate (LIBOR).

Credit unions often offer competitive rates and personalized service. Explore Credit Union Loans to see if they might be a good fit for your financial needs.

The benchmark interest rate serves as a foundation for calculating the variable interest rate. For example, a loan agreement might state that the variable interest rate is set at the prime rate plus 2%. As the prime rate changes, the variable interest rate will also change accordingly.

Whether you’re looking for a mortgage, auto loan, or personal loan, understanding your options is key. Check out Loan Lenders to find the right fit for your needs.

Variable interest rate products are common in various financial contexts. Mortgages, loans, and credit cards often feature variable interest rates, offering borrowers flexibility and potentially lower initial interest rates compared to fixed-rate products.

When seeking financing, it’s wise to explore different options. Research Bhg Loans and compare them to other lenders to find the best fit for your situation.

Advantages and Disadvantages

Variable interest rates offer both potential benefits and risks for borrowers. On the one hand, variable interest rates can provide lower initial interest rates, leading to lower monthly payments and potential savings in the early stages of the loan term.

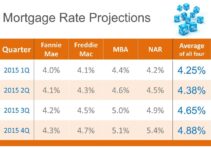

When looking for a mortgage, it’s important to understand current rates. Check out the Va Loan Rates Today to see if you qualify for this beneficial program.

This can be particularly advantageous for borrowers who anticipate a short loan term or expect interest rates to remain low.

Sometimes you need money fast. Same Day Personal Loans can be a lifesaver in those situations, providing quick access to funds when you need them most.

However, the risk associated with variable interest rates lies in their potential to increase over time. If interest rates rise, the borrower’s monthly payments will increase, potentially putting a strain on their budget. This uncertainty can make it challenging for borrowers to plan for the long term, as their future financial obligations might be unpredictable.

Factors Affecting Variable Interest Rates

| Factor | Impact on Variable Interest Rates |

|---|---|

| Inflation | Higher inflation typically leads to higher interest rates, as lenders seek to protect their returns from the erosion of purchasing power. |

| Central Bank Policies | Central banks often adjust interest rates to control inflation and stimulate economic growth. These policies directly influence benchmark interest rates, which in turn affect variable interest rates. |

| Economic Growth | Strong economic growth can lead to increased demand for credit, potentially pushing interest rates higher. Conversely, weak economic growth can lead to lower interest rates as lenders become more cautious. |

| Supply and Demand for Credit | The interplay of supply and demand in the credit market also influences variable interest rates. When demand for credit is high, lenders can charge higher interest rates, while low demand can lead to lower rates. |

For example, imagine a scenario where a central bank raises its benchmark interest rate to curb inflation. This increase in the benchmark rate would likely lead to an upward adjustment in variable interest rates tied to that benchmark, resulting in higher monthly payments for borrowers with variable-rate loans.

Managing Variable Interest Rate Risk

Borrowers can implement various strategies to mitigate the risks associated with variable interest rates. Understanding the terms and conditions of their loan agreement is crucial, particularly the frequency of interest rate adjustments and the potential for rate caps. Interest rate caps can provide protection against excessive rate increases, limiting the potential impact on monthly payments.

Want to add a pool to your backyard? Pool Loans can help make that dream a reality, but remember to factor in the cost of maintenance and upkeep.

Borrowers should also carefully assess their financial situation and risk tolerance before opting for a variable interest rate product. They should consider their ability to handle potential increases in monthly payments and develop a budget that accounts for potential fluctuations in interest rates.

Staying informed about the Current Home Loan Interest Rates can make a big difference in your home buying journey. Keep an eye on those rates to get the best deal.

If a borrower anticipates a long loan term or expects interest rates to rise, a fixed-rate product might be a more prudent choice.

If you need a quick cash injection, a 3000 Loan might be a good option. It can help you cover unexpected expenses or even fund a small project.

Closing Summary: Variable Interest Rate

Understanding the complexities of variable interest rates is crucial for anyone involved in financial transactions. By comprehending the factors that influence these rates, borrowers can make informed decisions about loan products, while lenders can strategically adjust their offerings based on market conditions.

For those looking to purchase a luxury home, understanding Jumbo Mortgage Rates is crucial. These rates often differ from conventional loans.

The dynamic nature of variable interest rates presents both opportunities and challenges, making it a fascinating area of study for individuals seeking to navigate the intricacies of the financial world.

FAQ Insights

What are the main types of variable interest rate structures?

Common variable interest rate structures include prime-based, LIBOR-based, and Treasury-based. Each structure uses a different benchmark rate as its foundation for adjustments.

Homeowners often look to tap into their equity for home improvements or other needs. A Best Heloc can offer a flexible way to access those funds.

How frequently do variable interest rates adjust?

If you need extra financing for a home project, a 2nd Mortgage can provide additional funds, but be sure to understand the terms and potential impact on your overall debt.

The frequency of adjustments can vary depending on the specific loan agreement. Some rates adjust monthly, while others may adjust quarterly or annually.

Can variable interest rates go below the benchmark rate?

While variable interest rates are typically tied to a benchmark rate, they can sometimes go below it, especially in periods of low interest rates.

What are some strategies for mitigating variable interest rate risk?

Understanding the current House Interest Rates is crucial when making a major purchase like a home. Keep an eye on those rates to find the best time to buy.

Strategies include considering a fixed-rate loan, opting for an interest rate cap, or exploring options like a shorter loan term to minimize the impact of potential rate increases.