Best Mortgage Rates 5 Year Fixed: Navigating the world of mortgages can feel overwhelming, especially when trying to find the best 5-year fixed rate. With a 5-year fixed mortgage, you enjoy the peace of mind that comes with knowing your monthly payments will remain consistent for the first five years of your loan.

If you’re in a bind and need money quickly, there are options available. Need Money Fast offers solutions like payday loans and cash advances, but it’s crucial to be aware of the high interest rates and potential risks associated with these types of loans.

This predictability allows you to budget effectively and avoid the uncertainty that can come with variable rates. But finding the right 5-year fixed rate for your individual needs requires research, understanding, and a bit of strategy.

This guide will explore the key factors influencing 5-year fixed mortgage rates, delve into current market trends, and equip you with the knowledge to make informed decisions about your home financing. Whether you’re a first-time homebuyer or a seasoned homeowner looking to refinance, understanding the nuances of 5-year fixed mortgages is crucial to securing the best possible deal.

Looking for a loan that can help you consolidate debt or cover unexpected expenses? Kashable Loans may be a good option for you. They offer competitive rates and flexible repayment terms, making them a convenient choice for borrowers.

Understanding 5-Year Fixed Mortgage Rates

A 5-year fixed-rate mortgage is a popular choice for homebuyers in Canada. It offers predictable monthly payments and stability over the first five years of your mortgage term. The interest rate remains fixed for the entire term, shielding you from fluctuations in the market.

This makes it a good option for those who want to lock in a specific interest rate and avoid the uncertainty of variable rates.

For a more streamlined borrowing experience, consider working with Direct Lenders. They cut out the middleman and handle the entire loan process in-house, which can simplify the application and approval process.

Factors Influencing 5-Year Fixed Mortgage Rates

Several factors influence 5-year fixed mortgage rates, including:

- Bank of Canada Interest Rates:The Bank of Canada’s key interest rate is a major driver of mortgage rates. When the Bank of Canada raises rates, mortgage rates typically follow suit.

- Inflation:High inflation can lead to higher mortgage rates as lenders try to offset the impact of rising prices.

- Market Demand:When demand for mortgages is high, lenders may offer higher rates to attract borrowers.

- Lender’s Risk Assessment:Lenders assess the risk of lending to borrowers based on factors such as credit score, debt-to-income ratio, and down payment. Borrowers with higher risk profiles may be offered higher rates.

Comparing 5-Year Fixed Rates to Other Mortgage Options

5-year fixed-rate mortgages are often compared to variable-rate mortgages. While variable rates can be lower initially, they are subject to change based on market fluctuations. This can lead to unpredictable monthly payments and potential increases in interest costs over the long term.

Need a quick cash infusion? Small Instant Loans can provide you with the funds you need, often within minutes. However, it’s important to be aware of the high interest rates associated with these types of loans.

Fixed-rate mortgages provide stability and predictability, making them a good choice for those who want to avoid surprises.

If you’re purchasing a high-value property, you might need a jumbo loan. Compare Jumbo Loan Rates from different lenders to find the best options for your specific needs. Remember to consider factors like loan terms and fees when making your decision.

Current 5-Year Fixed Mortgage Rates

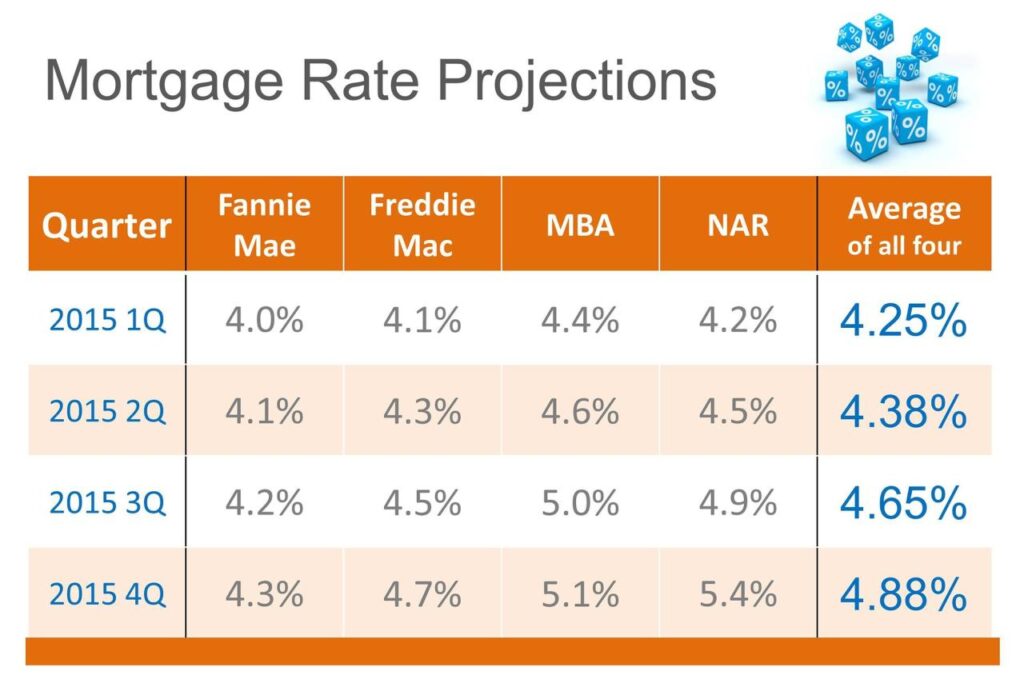

Here is a table of current 5-year fixed mortgage rates from major lenders in Canada. Please note that these rates are subject to change and may vary depending on individual borrower circumstances.

If you’re a member of USAA, you might be interested in their competitive Usaa Mortgage Rates. They offer a range of mortgage options, including conventional and VA loans, and they may have special rates for military members and their families.

| Lender | Rate | APR | Points |

|---|---|---|---|

| TD Bank | 5.25% | 5.30% | 1 |

| RBC Royal Bank | 5.15% | 5.20% | 0.5 |

| CIBC | 5.30% | 5.35% | 1.5 |

| Scotiabank | 5.20% | 5.25% | 1 |

The average 5-year fixed mortgage rate in Canada is currently around 5.20%. This rate has been steadily rising in recent months due to factors such as rising inflation and interest rate hikes by the Bank of Canada.

Purchasing a used car can be a great way to save money. Shop around for the Best Used Car Loan Rates to ensure you’re getting the best deal. Remember to consider the car’s condition and mileage when evaluating your options.

Special Offers and Promotions

Some lenders may offer special promotions or discounts on 5-year fixed mortgage rates. These promotions can include lower rates, reduced closing costs, or cash back bonuses. It’s worth shopping around and comparing offers from different lenders to see what’s available.

Factors Affecting Eligibility and Rates

Lenders consider several factors when assessing mortgage eligibility and determining interest rates.

Securing Car Finance can be a straightforward process. Research different lenders, compare rates and terms, and choose the option that best aligns with your financial situation and car-buying goals.

Key Factors for Eligibility

- Credit Score:A good credit score is essential for securing a mortgage at a competitive rate. Lenders typically prefer borrowers with a credit score of 680 or higher.

- Debt-to-Income Ratio (DTI):Lenders assess your DTI to determine your ability to manage monthly payments. A DTI below 40% is generally considered favorable.

- Down Payment:The size of your down payment influences the amount you need to borrow and the interest rate you’ll be offered. A larger down payment often results in lower rates.

- Employment History:Lenders want to ensure you have a stable income. They may ask for proof of employment and income history.

- Property Type:The type of property you’re buying (e.g., single-family home, condo) can impact your eligibility and rates.

Impact on Rates, Best Mortgage Rates 5 Year Fixed

- Credit Score:Borrowers with higher credit scores are typically offered lower interest rates.

- Debt-to-Income Ratio:A lower DTI usually results in more favorable rates.

- Down Payment:A larger down payment can lead to lower interest rates.

Specific Requirements

Lenders may have specific requirements for 5-year fixed mortgages. For example, some lenders may require a minimum credit score or down payment. It’s important to check with individual lenders for their specific requirements.

Benefits and Drawbacks of a 5-Year Fixed Mortgage: Best Mortgage Rates 5 Year Fixed

5-year fixed-rate mortgages offer several benefits, but it’s important to consider the potential drawbacks as well.

Finding the right Mortgage Lenders can be a challenging task. Be sure to compare rates and fees from multiple lenders before making a decision. Consider factors like loan terms, customer service, and reputation when making your choice.

Advantages

- Predictable Payments:Your monthly mortgage payments remain fixed for the first five years, making budgeting easier.

- Stability:You’re shielded from interest rate fluctuations during the fixed term, providing peace of mind.

- Lower Initial Rates:Fixed rates are often lower than variable rates initially, especially in a rising interest rate environment.

Disadvantages

- Potential for Higher Initial Rates:If interest rates are expected to rise, a fixed-rate mortgage may lock you in at a higher rate than you might get with a variable rate.

- Limited Flexibility:You can’t take advantage of lower interest rates if they fall during the fixed term.

Comparison with Other Mortgage Types

Compared to variable-rate mortgages, 5-year fixed-rate mortgages offer more predictability and stability. However, they may have higher initial rates, especially if interest rates are expected to fall. Ultimately, the best choice for you depends on your individual financial situation and risk tolerance.

When buying a new car, getting the best deal possible is important. Compare rates from different lenders to find the Best Auto Loan Rates. Consider factors like loan terms, interest rates, and fees to make an informed decision.

Finding the Best 5-Year Fixed Mortgage Rate

To find the best 5-year fixed mortgage rate, you need to shop around and compare offers from different lenders. Here’s a step-by-step guide:

Research and Compare

- Check Online Mortgage Rate Comparison Websites:Websites like Ratehub.ca and CanWise Financial allow you to compare rates from multiple lenders.

- Contact Lenders Directly:Reach out to banks, credit unions, and mortgage brokers to get personalized quotes.

- Consider Pre-Approval:Getting pre-approved for a mortgage can give you an idea of your borrowing power and help you negotiate with sellers.

Negotiate a Lower Rate

- Shop Around:Get quotes from multiple lenders and use them to negotiate a better rate.

- Improve Your Credit Score:A higher credit score can lead to lower interest rates.

- Consider a Larger Down Payment:A larger down payment can also help you secure a lower rate.

- Negotiate Points:Points are upfront fees that can reduce your interest rate. Consider whether paying points is financially beneficial for you.

Securing the Best Terms

- Read the Fine Print:Carefully review the mortgage terms and conditions before signing any documents.

- Understand the Fees:Be aware of all fees associated with the mortgage, such as closing costs, appraisal fees, and legal fees.

- Choose the Right Lender:Select a lender that offers competitive rates, good customer service, and flexible terms.

Mortgage Calculators and Tools

Mortgage calculators and online tools can be valuable resources for understanding mortgage costs and comparing rates.

Whether you’re buying a new or used car, securing a Car Loan is a crucial step. Compare rates from different lenders to find the best financing options that fit your budget and needs.

Mortgage Calculators

Mortgage calculators help you estimate your monthly payments, total interest costs, and amortization schedule based on the loan amount, interest rate, and term. They can be helpful for budgeting and planning your finances.

Online Mortgage Tools

Online mortgage tools can provide a comprehensive comparison of rates, lenders, and mortgage options. They can also help you calculate affordability, estimate closing costs, and find pre-approval options.

When you need to borrow money, it’s important to shop around and compare rates from different Lenders. You can find a variety of loan options, from personal loans to mortgages, and it’s essential to choose the right one for your needs.

Recommended Mortgage Calculators and Tools

- Ratehub.ca:A popular mortgage comparison website that offers calculators, tools, and resources for homebuyers.

- CanWise Financial:Another reputable mortgage comparison website with calculators and tools to help you find the best mortgage.

- CMHC Mortgage Calculator:A free online calculator provided by Canada Mortgage and Housing Corporation (CMHC) to estimate mortgage payments.

Financial Considerations and Planning

Before applying for a mortgage, it’s essential to consider your financial situation and create a plan for managing your debt and saving for homeownership.

For veterans and active military personnel, Va Interest Rates can offer significant savings on home loans. These rates are often lower than conventional mortgages, making it a more affordable option for those who qualify.

Budgeting and Financial Planning

- Create a Budget:Track your income and expenses to understand your financial situation and determine how much you can afford to spend on a mortgage.

- Save for a Down Payment:Start saving early for your down payment to minimize the amount you need to borrow.

- Manage Debt:Pay down high-interest debt, such as credit card balances, to improve your credit score and affordability.

Improving Credit Score

- Pay Bills on Time:Timely bill payments are crucial for building a good credit score.

- Reduce Credit Card Usage:Keep your credit card balances low to improve your credit utilization ratio.

- Check Your Credit Report:Review your credit report regularly for errors and to monitor your credit score.

Building a Strong Financial Foundation

- Establish a Savings Plan:Set aside money regularly for emergencies, unexpected expenses, and future financial goals.

- Invest for the Future:Consider investing in a Registered Retirement Savings Plan (RRSP) or Tax-Free Savings Account (TFSA) to build wealth for the long term.

- Seek Financial Advice:Consult with a financial advisor to create a personalized financial plan that meets your needs.

Last Word

Securing the best 5-year fixed mortgage rate involves a combination of understanding market dynamics, researching lenders, and carefully assessing your own financial situation. By following the steps Artikeld in this guide, you can navigate the mortgage landscape with confidence, making informed decisions that lead to a successful homeownership journey.

Remember, the right mortgage is a personalized choice, and the information provided here is intended to guide you towards a solution that aligns with your unique financial goals.

Clarifying Questions

What are the advantages of a 5-year fixed mortgage?

If you’re looking for a personal loan to consolidate debt or cover unexpected expenses, Personify Loans might be a good option. They offer competitive rates and flexible repayment terms, making them a convenient choice for borrowers.

The main advantage of a 5-year fixed mortgage is predictable payments for the first five years. This stability helps you budget effectively and avoid surprises in your monthly expenses. It also provides a sense of security, knowing that your interest rate won’t fluctuate during that period.

How often do 5-year fixed mortgage rates change?

If you’re thinking about buying a home, Chase Home Mortgage can help you get pre-approved and navigate the mortgage process. They offer a range of mortgage products, including fixed-rate and adjustable-rate mortgages, to meet your specific needs.

5-year fixed mortgage rates are generally determined by market conditions and the Bank of Canada’s key interest rate. They tend to fluctuate more frequently than longer-term fixed rates, but they are locked in for the initial five-year period of your mortgage.

Can I break my 5-year fixed mortgage early?

Yes, you can break your 5-year fixed mortgage early, but there are usually penalties associated with doing so. These penalties can be substantial, so it’s important to carefully consider the financial implications before making a decision.

What are the common types of mortgage penalties?

Common mortgage penalties include interest rate differential penalties and administrative fees. The specific penalty amount will depend on your lender and the terms of your mortgage agreement.