Navy Federal Mortgage stands as a beacon of financial support for military members and their families. This credit union, renowned for its commitment to service, offers a comprehensive range of mortgage products tailored to the unique needs of those who serve our nation.

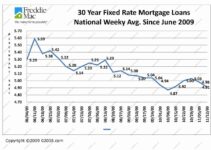

Keeping track of current home interest rates is crucial when planning to buy or refinance a home. Understanding these rates can help you secure the best mortgage deal possible, potentially saving you thousands of dollars over the life of your loan.

From conventional loans to VA financing, Navy Federal provides competitive rates, flexible terms, and personalized guidance to help members achieve their homeownership dreams.

Ascend Loans is a reputable online lender offering various loan products, including personal loans and auto loans. If you’re looking for a loan from a reliable lender, you can explore the options available through Ascend Loans.

Beyond the traditional mortgage offerings, Navy Federal excels in its dedication to military families. Their understanding of the challenges faced by those in active duty and their families translates into programs designed to ease the transition into homeownership. This commitment to military members and their families makes Navy Federal Mortgage a compelling choice for those seeking a trusted and reliable financial partner.

Before you start shopping for a home loan, it’s important to understand your home loan eligibility. Factors like your credit score, income, and debt-to-income ratio can significantly impact your ability to qualify for a mortgage and secure the best terms.

Navy Federal Credit Union Overview

Navy Federal Credit Union is a financial institution that serves the needs of active duty, retired, and former military personnel, as well as their families. Founded in 1933, Navy Federal has grown to become the largest credit union in the United States, boasting over 13 million members and $180 billion in assets.

Getting a new car can be an exciting experience, but it’s essential to find cheap car finance options to keep your monthly payments manageable. Comparing offers from different lenders and considering factors like interest rates and loan terms can help you secure the best deal.

The credit union’s mission is to provide its members with a wide range of financial products and services at competitive rates, while maintaining a strong commitment to financial education and community involvement. Navy Federal is known for its dedication to serving the military community and its commitment to providing exceptional customer service.

Securing the best car loan rates today requires careful research and comparison. Check out online resources and compare offers from different lenders to find the most competitive rates and terms.

Membership and Services, Navy Federal Mortgage

Membership in Navy Federal Credit Union is open to active duty, retired, and former military personnel, as well as their families, Department of Defense civilians, and contractors. Navy Federal offers a comprehensive suite of financial products and services, including:

- Checking and savings accounts

- Credit cards

- Mortgages

- Auto loans

- Personal loans

- Investment products

- Insurance

Unique Benefits for Military Members

Navy Federal Credit Union offers a number of unique benefits to military members and their families, including:

- Lower interest rateson loans and credit cards

- No annual feeson many credit cards

- Dedicated military support, including financial counseling and resources

- Access to exclusive financial products, such as the Military Savings Program

- Strong commitment to serving the military communitythrough charitable donations and volunteer programs

Navy Federal Mortgage Products and Services

Navy Federal Credit Union offers a variety of mortgage products to meet the diverse needs of its members. These products include:

Conventional Loans

Conventional loans are the most common type of mortgage and are not backed by the government. They typically require a larger down payment (usually 20%) and have stricter credit score requirements than government-backed loans. However, they often offer lower interest rates and more flexible loan terms.

A Home Equity Line of Credit (HELOC) can be a helpful financing option, but it’s important to understand HELOC rates before taking out a loan. These rates can vary depending on your credit score, loan amount, and other factors.

FHA Loans

FHA loans are backed by the Federal Housing Administration (FHA) and are designed to make homeownership more accessible to borrowers with lower credit scores and smaller down payments. FHA loans typically require a down payment of 3.5% and have more lenient credit score requirements than conventional loans.

Chase Bank offers a range of personal loan options, including Chase Personal Loans. These loans can be used for various purposes, such as debt consolidation, home improvements, or medical expenses.

VA Loans

VA loans are backed by the Department of Veterans Affairs (VA) and are available to eligible veterans, active duty military personnel, and surviving spouses. VA loans do not require a down payment and often have lower interest rates than conventional loans.

While instant loan approval may seem like a dream come true, it’s important to be realistic about your expectations. While some lenders may offer instant pre-approval , the actual approval process can take longer, depending on the lender and your financial situation.

They also have no private mortgage insurance (PMI) requirements.

Understanding car loan interest rates is crucial when financing a new or used vehicle. These rates can significantly impact your overall loan cost, so comparing offers from different lenders is essential to secure the best deal.

USDA Loans

USDA loans are backed by the U.S. Department of Agriculture (USDA) and are available to borrowers in eligible rural areas. USDA loans are designed to promote homeownership in rural communities and often have lower interest rates and down payment requirements than other mortgage products.

While loans without a credit check may seem appealing, they often come with high interest rates and fees. It’s crucial to carefully consider the potential risks and costs before taking out such a loan.

Additional Mortgage Services

In addition to offering a variety of mortgage products, Navy Federal Credit Union also provides a range of additional mortgage services, including:

- Pre-approval: Pre-approval helps borrowers understand how much they can afford to borrow and makes them more competitive in the housing market.

- Loan processing: Navy Federal’s experienced loan officers handle all aspects of the loan processing, from application to closing.

- Closing assistance: Navy Federal provides guidance and support throughout the closing process, ensuring a smooth and efficient transaction.

Eligibility and Requirements for Navy Federal Mortgages

To be eligible for a Navy Federal mortgage, borrowers must meet certain requirements, including:

Membership Requirements

Borrowers must be members of Navy Federal Credit Union. Membership is open to active duty, retired, and former military personnel, as well as their families, Department of Defense civilians, and contractors.

Looking for a quick and easy way to borrow money? Many online lenders offer short-term loans , which can be a convenient solution for unexpected expenses or financial emergencies. However, be sure to compare interest rates and terms before committing to a loan.

Income Qualifications

Borrowers must have a stable income that meets Navy Federal’s debt-to-income ratio (DTI) requirements. DTI is a measure of how much of your monthly income is used to pay your debts.

If you’re a member of Navy Federal Credit Union and looking to finance a new or used car, you can explore their auto loan options. They often offer competitive rates and flexible terms for members.

Documentation

To apply for a Navy Federal mortgage, borrowers will need to provide the following documentation:

- Credit report

- Income verification (pay stubs, tax returns, etc.)

- Proof of assets (bank statements, investment accounts, etc.)

- Property appraisal

Loan-to-Value Ratios and Debt-to-Income Ratios

Navy Federal uses loan-to-value (LTV) ratios and debt-to-income (DTI) ratios to determine mortgage eligibility. LTV is the ratio of the loan amount to the value of the property. DTI is the ratio of your monthly debt payments to your gross monthly income.

Concluding Remarks

Whether you’re a seasoned veteran or a newly enlisted service member, Navy Federal Mortgage presents an opportunity to achieve financial stability and build a secure future. Their commitment to providing competitive rates, personalized service, and comprehensive resources ensures that members receive the support they need throughout the mortgage process.

By understanding the unique financial needs of military families, Navy Federal Mortgage has become a trusted partner in helping them achieve their homeownership goals.

Finding yourself in a financial bind and needing money quickly can be stressful, especially if you can’t get a loan. If you’re in this situation, there are still options available. You can explore alternative solutions like short-term loans, payday loans, or even seeking help from family or friends.

Clarifying Questions

What is the minimum credit score required for a Navy Federal Mortgage?

While Navy Federal doesn’t publicly disclose a specific minimum credit score requirement, generally, a higher credit score improves your chances of approval and can lead to lower interest rates.

Can I use a VA loan if I’m not currently active duty?

Yes, you may be eligible for a VA loan if you meet certain criteria, including having served at least 90 days of active duty or having a spouse who is currently serving or has passed away while on active duty.

What are the closing costs associated with a Navy Federal Mortgage?

If you’re a member of the Navy Federal Credit Union, you may be eligible for a Navy Federal Personal Loan with competitive rates and flexible terms. These loans can be used for various purposes, such as debt consolidation, home improvements, or medical expenses.

Closing costs can vary depending on the loan amount, property location, and other factors. It’s essential to discuss closing costs with a Navy Federal loan officer to get an accurate estimate.

Does Navy Federal offer mortgage pre-approval?

Yes, Navy Federal offers pre-approval, which can give you a good idea of how much you can borrow and can strengthen your offer when you find a property.

If you have an existing car loan and are looking to lower your monthly payments or reduce your overall interest costs, you may want to consider refinancing your car loan. By shopping around for better rates and terms, you can potentially save a significant amount of money.