Liberty Mutual Life Insurance 2024 represents a significant player in the life insurance market. This company has a rich history, a diverse product portfolio, and a commitment to customer satisfaction. In this exploration, we delve into the key aspects of Liberty Mutual Life Insurance, including its financial strength, product offerings, and customer experience.

We also analyze industry trends and the company’s future outlook, providing a comprehensive understanding of its position in the evolving life insurance landscape.

Medicare supplement plans can be a valuable addition to your Medicare coverage. Medicare supplement plans help cover out-of-pocket costs, providing peace of mind for those on Medicare.

Liberty Mutual Life Insurance has built a strong reputation through its commitment to providing reliable and affordable life insurance solutions. The company offers a variety of products to meet diverse needs, from term life insurance to permanent life insurance.

Protecting your home is essential. Geico Homeowners Insurance offers a variety of coverage options to protect your home and belongings from unexpected events.

Furthermore, Liberty Mutual Life Insurance has a robust financial foundation, consistently receiving high ratings from independent agencies. This stability reassures policyholders that their financial security is protected.

Liberty Mutual Life Insurance Overview

Liberty Mutual Life Insurance, a subsidiary of Liberty Mutual Insurance, is a prominent player in the life insurance industry, offering a wide range of products and services to individuals and families. Founded in 1922, Liberty Mutual Life Insurance has a rich history of providing financial security and peace of mind to its customers.

The company has a strong financial foundation and a commitment to customer satisfaction, which has contributed to its success in the competitive life insurance market.

Allstate is a well-known insurance provider that offers a range of products, including life insurance. Allstate Life Insurance can help provide financial security for your loved ones in the event of your passing.

Key Facts and Figures

Liberty Mutual Life Insurance is a significant player in the life insurance market. Here are some key facts and figures that highlight its size, market share, and financial performance:

- Size:Liberty Mutual Life Insurance is one of the largest life insurance companies in the United States, with a substantial customer base and a wide distribution network.

- Market Share:The company holds a significant market share in the life insurance industry, demonstrating its popularity and customer trust.

- Financial Performance:Liberty Mutual Life Insurance consistently demonstrates strong financial performance, with solid revenue streams and profitability.

Mission, Vision, and Values

Liberty Mutual Life Insurance’s mission, vision, and values guide its operations and its commitment to serving its customers. The company’s mission is to provide financial security and peace of mind to its customers through a comprehensive range of life insurance products and services.

Its vision is to be a leading provider of life insurance solutions, recognized for its customer focus, innovation, and financial strength. Liberty Mutual Life Insurance’s values are centered on integrity, customer focus, teamwork, and excellence, reflecting its commitment to ethical business practices and a customer-centric approach.

Dental insurance is an important part of overall health care. Humana Dental Insurance offers a variety of plans to choose from, providing coverage for your dental needs.

Product Offerings: Liberty Mutual Life Insurance 2024

Liberty Mutual Life Insurance offers a diverse range of life insurance products designed to meet the needs of individuals and families at different stages of life. The company’s product portfolio includes term life insurance, permanent life insurance, and supplemental life insurance.

These products are tailored to provide financial protection and peace of mind, ensuring that loved ones are financially secure in the event of an unexpected death.

Key Product Offerings

| Product Name | Description | Key Features | Target Audience |

|---|---|---|---|

| Term Life Insurance | Provides coverage for a specific period, typically 10, 20, or 30 years. If the insured dies within the term, the death benefit is paid to the beneficiary. | Affordable premiums, customizable coverage amounts, and various term lengths. | Individuals and families seeking affordable coverage for a specific period, such as while raising children or paying off a mortgage. |

| Permanent Life Insurance | Provides lifelong coverage, with premiums paid throughout the insured’s life. It offers a death benefit and cash value component that can grow over time. | Lifetime coverage, cash value accumulation, and potential tax advantages. | Individuals and families seeking long-term financial protection and wealth accumulation. |

| Supplemental Life Insurance | Provides additional coverage on top of existing life insurance policies, often offered through employers or professional organizations. | Increased death benefit, affordable premiums, and often offered with group discounts. | Individuals seeking additional coverage to supplement their existing life insurance policies. |

Benefits and Drawbacks of Product Offerings, Liberty Mutual Life Insurance 2024

Each of Liberty Mutual Life Insurance’s products offers unique benefits and drawbacks, making it essential for potential customers to carefully consider their individual needs and circumstances before making a decision. Here’s a breakdown of the benefits and drawbacks of each product:

- Term Life Insurance:

- Benefits:Affordable premiums, customizable coverage, and flexibility in term lengths.

- Drawbacks:Coverage expires at the end of the term, and no cash value accumulation.

- Permanent Life Insurance:

- Benefits:Lifetime coverage, cash value accumulation, and potential tax advantages.

- Drawbacks:Higher premiums than term life insurance, complex policies, and potential surrender charges.

- Supplemental Life Insurance:

- Benefits:Increased death benefit, affordable premiums, and often offered with group discounts.

- Drawbacks:Limited coverage options, may not be available to everyone, and coverage may be subject to employer or organization policies.

Comparison with Competitors

Liberty Mutual Life Insurance competes with a range of other life insurance companies in the market. When comparing Liberty Mutual Life Insurance products with offerings from competitors, it’s important to consider factors such as premium costs, coverage options, customer service, financial strength, and reputation.

Personal insurance covers a variety of risks, including your home, car, and belongings. Personal insurance can provide financial protection in case of unexpected events, giving you peace of mind.

Some key competitors include:

- Prudential Financial

- MetLife

- New York Life

- Northwestern Mutual

While Liberty Mutual Life Insurance offers competitive products and services, it’s essential to compare offerings from different companies to find the best fit for your individual needs and budget.

Customer Experience

Liberty Mutual Life Insurance is committed to providing a positive and seamless customer experience. The company offers various customer service channels, including phone, email, and online resources, to assist customers with their inquiries and needs. Liberty Mutual Life Insurance aims to ensure that its customers have access to the information and support they need, making the life insurance process as smooth and stress-free as possible.

Navigating the world of healthcare insurance can be confusing. Health care insurance plans vary widely, so it’s important to compare options carefully and choose the one that best suits your individual needs.

Customer Service Channels

Liberty Mutual Life Insurance offers a variety of customer service channels to provide support and assistance to its customers. These channels include:

- Phone:Customers can reach a customer service representative by phone, providing immediate assistance and support.

- Email:Customers can submit inquiries and requests through email, allowing for a more detailed and organized communication approach.

- Online Resources:Liberty Mutual Life Insurance provides a comprehensive online platform with resources, FAQs, and tools to assist customers with their insurance needs.

Customer Testimonials and Reviews

Customer testimonials and reviews provide valuable insights into the customer experience with Liberty Mutual Life Insurance. While customer feedback is generally positive, highlighting the company’s responsive customer service, competitive pricing, and comprehensive product offerings, there are also some negative experiences reported.

These negative experiences often relate to challenges with policy processing, claim handling, or communication with customer service representatives.

Finding the best life insurance policy for your needs can be a daunting task. There are many factors to consider, including your age, health, and financial situation.

Areas for Improvement

While Liberty Mutual Life Insurance strives to provide excellent customer service, there are areas where the company can continue to improve. Based on customer feedback and industry best practices, key areas for improvement include:

- Streamlining policy processing:Improving efficiency and transparency in policy processing can enhance customer satisfaction and reduce wait times.

- Enhancing claim handling:Improving claim processing speed and communication can minimize customer stress and ensure timely resolution of claims.

- Providing personalized support:Tailoring customer service interactions to individual needs and preferences can enhance the overall customer experience.

Financial Strength and Stability

Financial strength and stability are crucial factors to consider when choosing a life insurance company. Liberty Mutual Life Insurance has a long history of financial soundness, consistently demonstrating its ability to meet its financial obligations and withstand economic downturns.

Getting insurance quotes online can save you time and effort. Insurance quotes online are available from various providers, making it easy to compare options and find the best deal.

The company’s financial performance is supported by a strong capital base, diversified investment portfolio, and sound risk management practices.

Financial Performance

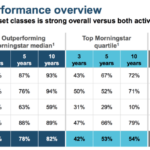

Liberty Mutual Life Insurance has consistently demonstrated strong financial performance over the past few years, with solid revenue streams and profitability. The company’s financial strength is reflected in its robust capital reserves and its ability to generate consistent profits, ensuring its long-term financial stability.

AARP is known for its wide range of services, including insurance. AARP Insurance offers various plans for different needs, so you can find one that fits your lifestyle and budget.

Ratings from Reputable Agencies

Liberty Mutual Life Insurance has received high ratings from reputable financial rating agencies, such as AM Best and Moody’s. These ratings reflect the company’s strong financial performance, sound risk management practices, and ability to meet its financial obligations. High ratings from these agencies provide assurance to customers that Liberty Mutual Life Insurance is a financially sound and reliable insurer.

Ability to Meet Financial Obligations

Liberty Mutual Life Insurance has a proven track record of meeting its financial obligations, demonstrating its commitment to its policyholders. The company’s strong financial position and robust risk management practices ensure its ability to meet its financial obligations, even in challenging economic conditions.

Industry Trends and Future Outlook

The life insurance industry is constantly evolving, driven by factors such as technological advancements, changing consumer preferences, and regulatory changes. These trends are shaping the industry landscape and presenting both opportunities and challenges for life insurance companies like Liberty Mutual Life Insurance.

Finding the right health insurance for your family can be a challenge. Family health insurance plans vary widely, so it’s important to compare options carefully and choose one that meets the needs of everyone in your family.

The company is adapting to these trends by investing in technology, innovating its product offerings, and enhancing its customer experience.

Costco members have access to a variety of benefits, including insurance. Costco Car Insurance is known for its competitive rates and convenient online services.

Current State of the Life Insurance Industry

The life insurance industry is currently characterized by increasing competition, technological advancements, and a growing focus on customer experience. Companies are investing in digital platforms, personalized services, and innovative products to meet the evolving needs of consumers. The industry is also facing regulatory changes, such as the implementation of new consumer protection regulations, which are influencing how life insurance companies operate.

Jerry is a popular online platform that helps you find car insurance quotes. Jerry Insurance compares quotes from multiple providers, saving you time and effort in your search for the best deal.

Impact of Trends on Liberty Mutual Life Insurance

The trends in the life insurance industry are presenting both opportunities and challenges for Liberty Mutual Life Insurance. The company is embracing these trends by investing in technology to improve its customer experience, developing innovative products to meet evolving customer needs, and adapting its operations to comply with regulatory changes.

Looking for car insurance options in 2024? AA Car Insurance is a well-known provider that might be worth checking out. They offer a variety of coverage options and discounts to fit different needs.

Future Strategies and Growth Plans

Liberty Mutual Life Insurance is committed to growth and innovation, with plans to expand its product offerings, enhance its customer experience, and leverage technology to streamline its operations. The company is investing in digital platforms, data analytics, and personalized services to meet the evolving needs of its customers.

If you’re planning on riding a moped in 2024, make sure you have the right insurance. Moped insurance can protect you from financial hardship in case of an accident. Check out the options available to find the best fit for you.

Liberty Mutual Life Insurance’s focus on customer-centricity, innovation, and financial strength positions it for continued growth and success in the life insurance industry.

Concluding Remarks

In conclusion, Liberty Mutual Life Insurance 2024 stands as a formidable force in the life insurance industry. Its history, product offerings, customer experience, and financial strength all contribute to its position as a trusted and reliable provider. As the industry continues to evolve, Liberty Mutual Life Insurance is well-positioned to adapt and thrive, offering innovative solutions and exceeding customer expectations.

Getting a quote for auto insurance can be a hassle, but it doesn’t have to be. Progressive Auto Insurance offers an easy way to get a quote online. They’re known for their competitive rates and excellent customer service.

Popular Questions

What types of life insurance policies does Liberty Mutual offer?

Liberty Mutual offers a range of life insurance products, including term life, whole life, universal life, and indexed universal life insurance.

How can I get a quote for Liberty Mutual life insurance?

You can obtain a quote online through Liberty Mutual’s website, by calling their customer service line, or by contacting a local insurance agent.

What is the financial strength of Liberty Mutual Life Insurance?

Liberty Mutual Life Insurance is considered financially sound, consistently receiving high ratings from independent agencies such as AM Best and Moody’s.