Mortgage Repayments 2024: Navigating the Changing Landscape. As interest rates fluctuate and economic conditions shift, understanding the intricacies of mortgage repayments in 2024 is crucial for homeowners and prospective buyers alike. This year presents a unique set of challenges and opportunities, with factors such as inflation, property values, and government policies playing a significant role in shaping the mortgage landscape.

For those seeking information on 30-year fixed mortgage rates, Interest Rates Today 30 Year Fixed 2024 will provide you with current rates and insights into the 30-year fixed mortgage market.

This guide delves into the key trends impacting mortgage repayments in 2024, providing insights into how these changes affect borrowers and offering strategies for managing repayment obligations effectively. We’ll explore the relationship between interest rates and mortgage payments, analyze the impact of inflation, and examine how property values and government policies influence the overall cost of homeownership.

Mortgage Repayment Trends in 2024

Mortgage repayments are a significant financial commitment for homeowners, and understanding the trends and factors that influence them is crucial for making informed decisions. In 2024, the mortgage landscape is expected to be shaped by several key factors, including rising interest rates, inflation, and evolving government policies.

Rocket Mortgage offers a variety of loan products, including a Home Equity Line of Credit (HELOC). If you’re interested in learning more about their HELOC options for 2024, check out Rocket Mortgage Heloc 2024. This site will provide you with details on eligibility requirements and current rates.

Impact of Rising Interest Rates

Rising interest rates are a major concern for homeowners in 2024. As interest rates increase, the cost of borrowing money goes up, leading to higher monthly mortgage payments. For existing homeowners with fixed-rate mortgages, the impact will be minimal. However, those with adjustable-rate mortgages (ARMs) could experience significant increases in their monthly payments as their interest rates adjust.

A zero-down mortgage can be an attractive option for those who don’t have a large down payment. Zero Down Mortgage 2024 will provide you with information on the different types of zero-down mortgages available and the requirements for qualifying.

Comparison to Previous Years

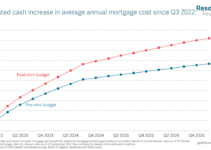

The average mortgage repayment amounts in 2024 are likely to be higher than in previous years due to the rising interest rates. For example, in 2023, the average 30-year fixed-rate mortgage had an interest rate of around 7%, resulting in monthly payments of approximately $1,500 for a $300,000 loan.

Generating leads is essential for mortgage brokers and lenders. Mortgage Leads 2024 can provide you with valuable information on how to effectively generate leads and grow your business in the mortgage industry.

In 2024, with interest rates expected to rise further, the average monthly payment for a similar loan could be closer to $1,700 or more.

Credit unions often offer competitive mortgage rates. Credit Union Mortgage 2024 will give you an overview of current credit union mortgage rates and the benefits of working with a credit union.

Factors Influencing Mortgage Repayment Trends

Several factors can influence mortgage repayment trends in 2024, including:

- Economic conditions:The overall health of the economy, including inflation, unemployment rates, and consumer confidence, can impact mortgage repayment trends.

- Government policies:Changes in government policies related to housing finance, such as tax incentives or regulations, can influence mortgage rates and affordability.

- Housing market conditions:Factors such as supply and demand, property values, and inventory levels can affect mortgage repayment trends.

Factors Affecting Mortgage Repayments

Several key factors play a significant role in determining mortgage repayment amounts.

Interest Rates and Mortgage Repayments

Interest rates have a direct impact on mortgage repayments. The higher the interest rate, the more interest you pay over the life of the loan, resulting in higher monthly payments. For example, a 1% increase in interest rates can significantly increase the total interest paid over the term of the loan, leading to a higher overall cost.

Understanding interest rates is crucial when obtaining a mortgage. Interest Rates Mortgage Rates 2024 will provide you with information on current interest rates and how they affect mortgage rates.

Inflation and Mortgage Repayments

Inflation can indirectly affect mortgage repayments. As inflation rises, the purchasing power of your money decreases, making it more expensive to repay your mortgage. In times of high inflation, lenders may adjust interest rates to compensate for the declining value of money, resulting in higher mortgage payments.

Bank of America is a major lender offering a variety of mortgage products. Boa Mortgage Rates 2024 will provide you with information on current rates and loan options available through Bank of America.

Property Values and Mortgage Repayments

Property values can influence mortgage repayments, particularly for homeowners with adjustable-rate mortgages. When property values rise, homeowners may have the option to refinance their mortgages at lower interest rates, potentially reducing their monthly payments. Conversely, declining property values can make refinancing more difficult and may even lead to negative equity, where the outstanding loan amount exceeds the value of the property.

Government Policies and Mortgage Repayments

Government policies can significantly influence mortgage repayments. For example, changes in tax deductions for mortgage interest or regulations on lending practices can impact the cost of borrowing and the availability of mortgage products.

Strategies for Managing Mortgage Repayments

Managing mortgage repayments effectively is essential for financial stability and achieving long-term financial goals.

The USDA offers a home loan program specifically for those living in rural areas. Usda Home Loan 2024 will provide you with details on eligibility requirements and the benefits of this program.

Budgeting and Managing Mortgage Repayments

Creating a detailed budget that includes your mortgage payment is crucial for managing your finances effectively. This will help you track your income and expenses, ensuring you have enough money to cover your mortgage payment each month. Consider these tips:

- Track your income and expenses:Use a budgeting app or spreadsheet to track your income and expenses regularly.

- Prioritize essential expenses:Ensure you have enough money to cover essential expenses like housing, food, and utilities before allocating funds to discretionary spending.

- Automate payments:Set up automatic payments for your mortgage to avoid late fees and ensure timely payments.

Refinancing or Restructuring Mortgages

Refinancing or restructuring your mortgage can be a good option to lower your monthly payments or shorten the loan term. Refinancing involves replacing your existing mortgage with a new one at a lower interest rate. Restructuring involves changing the terms of your existing mortgage, such as extending the loan term or adjusting the payment schedule.

Making Extra Mortgage Payments

Making extra mortgage payments can significantly reduce the overall loan term and save you money on interest. Even small extra payments can make a big difference over time. You can make extra payments by making a lump sum payment or by increasing your monthly payment amount.

Mortgage Repayment Strategies Comparison, Mortgage Repayments 2024

| Strategy | Benefits | Drawbacks |

|---|---|---|

| Refinancing | Lower interest rate, lower monthly payments, shorter loan term | Closing costs, potential rate lock fees, may not be available if credit score is low |

| Restructuring | Flexibility in payment schedule, lower monthly payments, may be an option for borrowers with limited income | May not be available for all mortgage types, may increase the overall loan term |

| Extra Payments | Reduces loan term, saves on interest, builds equity faster | May require additional cash flow, may not be possible if finances are tight |

Impact of Mortgage Repayments on Personal Finances: Mortgage Repayments 2024

Mortgage repayments have a significant impact on personal finances, affecting cash flow, saving and investing goals, and retirement planning.

Securing a fixed rate home loan can provide peace of mind knowing your monthly payments won’t fluctuate. You can find information on the best fixed rate home loans available in 2024 at Best Fixed Rate Home Loans 2024.

Impact on Cash Flow and Financial Health

Mortgage repayments are a major expense that can significantly impact your cash flow. It’s essential to ensure you have enough income to cover your mortgage payment and other essential expenses while still having some disposable income for savings and other financial goals.

Whether you’re a first-time buyer or looking to refinance, finding the best home loan for your individual needs is crucial. Best Home Loans 2024 can help you compare rates and terms from different lenders, making the process easier.

Impact on Saving and Investing Goals

Mortgage repayments can limit your ability to save and invest. If a large portion of your income goes towards your mortgage payment, you may have less money available to save for retirement, emergencies, or other financial goals. However, owning a home can also be a valuable asset that can appreciate over time, potentially providing you with equity that you can tap into for future needs.

Navigating the mortgage process can be complex. A mortgage advisor can provide valuable guidance and support. Mortgage Advisors 2024 will help you find a qualified advisor in your area who can assist you throughout the mortgage journey.

Impact on Retirement Planning

Mortgage repayments can impact retirement planning in several ways. If you have a significant mortgage debt, you may need to work longer or save more aggressively to reach your retirement goals. Conversely, owning a home free and clear of debt can provide financial security in retirement, allowing you to use your income for leisure and travel or to support family members.

A 10-year mortgage can be a good option for those who want a shorter loan term and lower interest rates. 10 Year Mortgage Rates 2024 will provide you with information on current rates and the benefits of a 10-year mortgage.

Mortgage Repayment Resources and Support

There are various resources and support services available to homeowners facing challenges with mortgage repayments.

Investing in real estate can be a smart financial move. To find out more about investment home loan rates for 2024, visit Investment Home Loan Rates 2024. This site will provide you with insights into current rates and loan options for investment properties.

Government Programs and Initiatives

The government offers several programs and initiatives to assist homeowners with mortgage repayments, including:

- Home Affordable Modification Program (HAMP):This program helps homeowners who are struggling to make their mortgage payments by modifying the terms of their loan.

- Homeowners Assistance Fund (HAF):This program provides financial assistance to homeowners who are at risk of foreclosure due to the COVID-19 pandemic.

- Federal Housing Administration (FHA):The FHA offers mortgage insurance that can help borrowers with lower credit scores qualify for a mortgage.

Financial Institutions and Organizations

Many financial institutions and organizations offer mortgage counseling and support services, including:

- National Foundation for Credit Counseling (NFCC):The NFCC offers free and confidential credit counseling services, including assistance with mortgage repayments.

- Housing and Urban Development (HUD):HUD provides resources and information for homeowners facing foreclosure, including counseling and legal assistance.

- Local housing agencies:Many local housing agencies offer counseling and support services to homeowners in their communities.

Resources for Individuals Facing Challenges

| Resource | Description |

|---|---|

| National Foundation for Credit Counseling (NFCC) | Provides free and confidential credit counseling services, including assistance with mortgage repayments. |

| Housing and Urban Development (HUD) | Offers resources and information for homeowners facing foreclosure, including counseling and legal assistance. |

| Local housing agencies | Provide counseling and support services to homeowners in their communities. |

| Home Affordable Modification Program (HAMP) | Helps homeowners who are struggling to make their mortgage payments by modifying the terms of their loan. |

| Homeowners Assistance Fund (HAF) | Provides financial assistance to homeowners who are at risk of foreclosure due to the COVID-19 pandemic. |

| Federal Housing Administration (FHA) | Offers mortgage insurance that can help borrowers with lower credit scores qualify for a mortgage. |

Last Word

Navigating mortgage repayments in 2024 requires a proactive approach. By understanding the factors influencing repayment obligations and implementing effective strategies, homeowners can navigate the changing landscape and ensure financial stability. From budgeting and refinancing options to exploring government assistance programs, there are various tools available to manage mortgage repayments effectively.

By staying informed and taking control, individuals can make informed decisions that protect their financial well-being and achieve their homeownership goals.

If you’re looking for information on mortgage rates from PNC Bank in 2024, you can find it at Pnc Bank Mortgage Rates 2024. This site will give you an overview of current rates, as well as information on different loan types and terms.

FAQ Resource

What are the main factors influencing mortgage repayments in 2024?

The primary factors influencing mortgage repayments in 2024 include interest rate fluctuations, inflation, property values, and government policies.

How do I know if I should refinance my mortgage?

Consider refinancing if interest rates have dropped significantly, allowing you to secure a lower monthly payment. However, weigh the costs associated with refinancing, such as closing costs, against the potential savings.

What are some tips for budgeting mortgage repayments?

Looking to purchase a home in a rural area? The Usda Rural Housing Loan 2024 program might be a great option for you. This program offers low interest rates and flexible terms, making it easier to achieve the dream of homeownership.

Create a realistic budget that allocates sufficient funds for your mortgage payment. Consider setting up automatic payments to ensure timely repayments and explore options for extra payments to reduce the overall loan term.