Annuity Calculator UK 2024 takes center stage, offering a comprehensive guide to understanding and utilizing annuities for your retirement planning. This guide delves into the intricacies of annuities, their various types, and the key factors influencing their rates in 2024.

It equips you with the knowledge and tools to make informed decisions about your retirement income, ensuring a secure and comfortable future.

Pushbullet is a handy tool for transferring files between your phone and computer. Learn how to use Pushbullet to send files from your phone to your computer here.

Annuities are financial products that provide a stream of regular payments, often for life, in exchange for a lump sum payment. They are a popular choice for individuals seeking guaranteed income in retirement, especially those concerned about outliving their savings.

Google Tasks is becoming increasingly integrated with Google Workspace. Read more about the integration of Google Tasks with Google Workspace in 2024 here.

The UK offers a diverse range of annuities, each with its own characteristics and benefits. This guide will explore the different types of annuities, their advantages and disadvantages, and the factors to consider when choosing the right annuity for your needs.

Artificial intelligence is rapidly changing the landscape of Android app development. Learn more about the impact of AI on Android app development in 2024 here.

Introduction to Annuities in the UK

Annuity is a financial product that provides a guaranteed stream of income for life, typically used during retirement. It is a crucial component of retirement planning, as it offers a steady income stream regardless of how long you live. This makes it an attractive option for those who want to ensure they have a reliable source of income during their golden years.

It’s important to understand who is issuing your annuity. You can find more information about annuity issuers in 2024 here.

Types of Annuities

The UK offers various annuity types, each catering to different needs and risk profiles. Some common types include:

- Level Annuities:These offer a fixed monthly income for life, with the amount remaining constant throughout the annuity period. They are suitable for individuals who want a predictable income stream.

- Escalating Annuities:These provide a guaranteed income that increases each year, usually at a predetermined rate. This helps protect against inflation and ensures that the income keeps pace with rising living costs.

- Guaranteed Period Annuities:These offer a guaranteed income stream for a specific period, even if the annuitant passes away before the period ends. This provides peace of mind for those who want to ensure their loved ones receive an income for a certain duration.

Dollify is a popular app for creating custom avatars. You can learn more about the latest version of Dollify and compare it to previous versions here.

- Joint Life Annuities:These provide income for two individuals, typically a couple. The annuity continues until the last surviving member passes away. This is a good option for couples who want to ensure they both have an income throughout their retirement.

Real-Life Scenarios

Annuities can be beneficial in several real-life scenarios:

- Protecting Against Outliving Savings:Annuities provide a guaranteed income for life, helping to prevent individuals from running out of savings during retirement.

- Generating Regular Income:Annuities offer a predictable and reliable income stream, providing financial stability during retirement.

- Passing on Inheritance:Some annuities offer a death benefit, allowing a portion of the annuity to be passed on to beneficiaries upon the annuitant’s death.

Key Factors Affecting Annuity Rates

Annuity rates are influenced by several factors, which can significantly impact the amount of income you receive. These factors include:

Interest Rates

Annuity rates are generally higher when interest rates are higher. This is because insurers can invest the money they receive from annuity purchases at higher rates, allowing them to offer more substantial payouts. Conversely, when interest rates are low, annuity rates tend to be lower.

The Snapdragon processor is known for its performance. Check out the latest performance benchmarks for the Snapdragon processor in 2024 here.

Life Expectancy

Life expectancy plays a crucial role in determining annuity rates. The longer you are expected to live, the lower the annuity rate will be. This is because insurers need to pay out income for a longer period, increasing their risk.

Google Tasks is a great tool for improving productivity. Check out this comprehensive guide to using Google Tasks effectively in 2024 here.

Market Conditions, Annuity Calculator Uk 2024

The overall economic climate and market conditions can also influence annuity rates. During periods of economic uncertainty or market volatility, insurers may offer lower rates to protect themselves against potential losses.

Inflation

Inflation can erode the purchasing power of your annuity income over time. While some annuities offer inflation protection, this usually comes at a higher cost. Therefore, it’s essential to consider the impact of inflation when choosing an annuity.

Annuity products can be complex and it’s important to understand the potential risks involved. Read more about the potential downsides of annuities in 2024 here.

Using an Annuity Calculator

Annuity calculators are valuable tools that can help you estimate your potential annuity income based on your individual circumstances. Here’s how to use one effectively:

Step-by-Step Guide

- Input Your Age:The calculator will use your age to determine your life expectancy, which is a crucial factor in annuity calculations.

- Enter Your Savings:This is the amount of money you plan to use to purchase the annuity. The calculator will use this amount to determine the potential income stream.

- Specify Your Desired Income:Enter the monthly or annual income you wish to receive from the annuity. The calculator will then determine the appropriate annuity type and rate to achieve your desired income.

- Choose an Annuity Type:Select the type of annuity that best suits your needs and risk tolerance. Different annuity types offer varying levels of flexibility, income guarantees, and potential for growth.

- Review the Results:The calculator will provide an estimated annuity income based on your input data. This will help you understand the potential financial benefits of purchasing an annuity.

Scenario Examples

Let’s consider a few scenarios to illustrate how an annuity calculator can be used:

- Scenario 1:A 65-year-old individual with £100,000 in savings wants to receive a guaranteed income of £500 per month. The calculator would determine the appropriate annuity type and rate to achieve this desired income.

- Scenario 2:A couple aged 60 and 62 wants to ensure a combined income of £1,200 per month during retirement. The calculator would help them determine the necessary savings and annuity type to achieve this goal.

Advantages and Disadvantages of Annuities

Annuities offer both advantages and disadvantages. It’s crucial to weigh these factors carefully before making a decision.

Advantages

- Guaranteed Income:Annuities provide a guaranteed income stream for life, ensuring financial security during retirement.

- Protection Against Outliving Savings:Annuities help prevent individuals from running out of savings during their lifetime, as they provide a consistent income stream.

- Inflation Protection:Some annuities offer inflation protection, ensuring that the income stream keeps pace with rising living costs.

- Tax Benefits:In the UK, annuity income is typically taxed as income from savings and investments, which can be beneficial for some individuals.

Disadvantages

- Lack of Flexibility:Once you purchase an annuity, you typically cannot access the underlying capital. This can limit your financial flexibility if you need to access your savings for other purposes.

- Potential for Lower Returns:Annuities may offer lower returns compared to other investment options, such as stocks or bonds. This is because annuities provide a guaranteed income stream, which limits potential growth.

- Fees and Charges:Annuities often come with fees and charges, which can impact your overall returns. It’s essential to understand these costs before purchasing an annuity.

Pros and Cons Table

| Factor | Annuities | Alternative Retirement Options |

|---|---|---|

| Guaranteed Income | Yes | No |

| Protection Against Outliving Savings | Yes | No |

| Flexibility | Limited | High |

| Potential Returns | Lower | Higher |

| Fees and Charges | Yes | Yes |

Choosing the Right Annuity

The type of annuity you choose should align with your individual circumstances and financial goals. There are several types of annuities available in the UK, each with its own features and benefits.

Types of Annuities

- Fixed Annuities:These offer a fixed monthly income for life, with the amount remaining constant throughout the annuity period. They are suitable for individuals who want a predictable income stream and prefer to avoid market volatility.

- Variable Annuities:These offer a variable income stream that fluctuates based on the performance of underlying investments. They provide the potential for higher returns but also come with greater risk. These annuities are more suitable for those with a higher risk tolerance and who are willing to accept some uncertainty in their income stream.

If you’re having trouble with the Glovo app, you can reach out to their customer support team. You can find their contact information here.

- Indexed Annuities:These link the income stream to a specific index, such as the FTSE 100. The income stream may increase or decrease based on the performance of the index. These annuities offer the potential for growth while providing some protection against inflation.

Android app development is constantly evolving. Check out these key trends shaping the industry in 2024 here.

Criteria for Selection

When choosing an annuity, consider the following factors:

- Age and Life Expectancy:Your age and life expectancy will impact the annuity rate you receive. The longer you are expected to live, the lower the annuity rate will be.

- Risk Tolerance:Consider your risk tolerance and investment goals. Fixed annuities offer a guaranteed income stream but may have lower returns, while variable annuities offer the potential for higher returns but come with greater risk.

- Financial Goals:Determine your income needs and financial goals during retirement. This will help you choose an annuity that meets your specific requirements.

Examples of Annuity Types Meeting Specific Needs

- Income Protection:A fixed annuity can provide a guaranteed income stream for life, offering peace of mind and protection against outliving savings.

- Growth Potential:A variable or indexed annuity can offer the potential for higher returns, but it comes with greater risk. These annuities are more suitable for those who are willing to accept some uncertainty in their income stream.

Considerations for Annuity Purchase: Annuity Calculator Uk 2024

Before purchasing an annuity, it’s essential to seek professional financial advice and carefully consider all factors.

Annuity products can be complex and it’s important to understand how they work. Read more about annuities and their relationship to life insurance here.

Seeking Professional Advice

An independent financial advisor can help you understand the complexities of annuities, evaluate different options, and choose the most suitable annuity for your individual circumstances.

If you’re considering becoming a Glovo delivery driver, you might be curious about earnings and tips. Find out more about Glovo driver earnings and tips here.

Factors to Consider When Choosing an Annuity Provider

- Reputation:Choose a reputable annuity provider with a strong track record and positive customer reviews.

- Fees and Charges:Compare the fees and charges associated with different annuity providers to ensure you are getting a competitive deal.

- Customer Service:Consider the provider’s customer service record and ensure they offer responsive and helpful support.

Essential Documents and Information

Before purchasing an annuity, gather the following documents and information:

- Your Financial Statements:This will help you determine your overall financial situation and how much money you can allocate to an annuity purchase.

- Your Investment Goals:Define your investment goals and risk tolerance to ensure the annuity aligns with your overall financial plan.

- Annuity Product Disclosure:Review the annuity product disclosure document to understand the terms and conditions, fees, and charges associated with the annuity.

Final Thoughts

Navigating the world of annuities can be daunting, but this guide has equipped you with the essential knowledge to make informed decisions about your retirement income. By understanding the different types of annuities, the factors influencing their rates, and the advantages and disadvantages of this financial product, you can confidently plan for a secure and comfortable retirement.

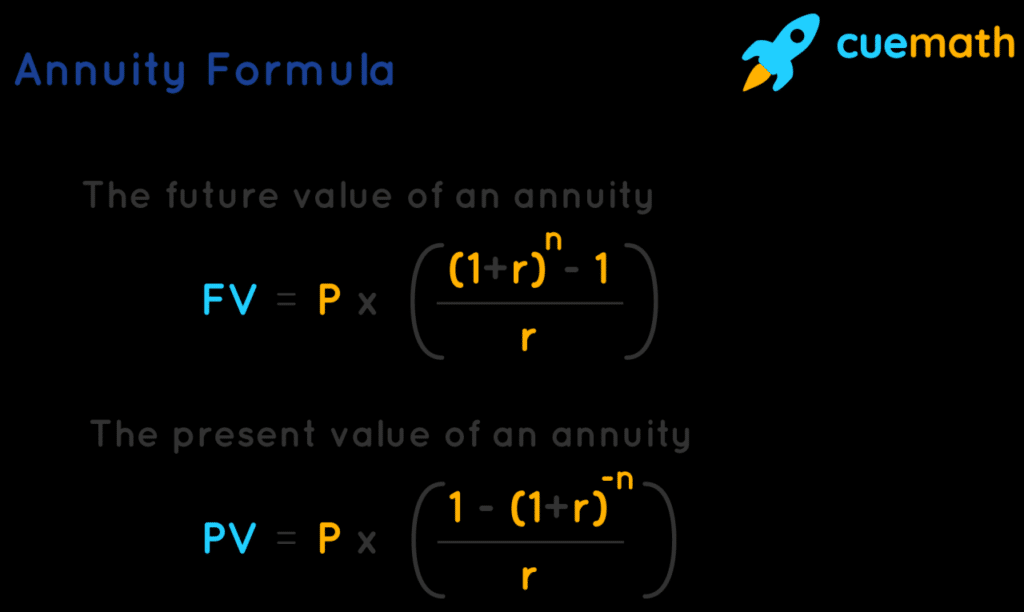

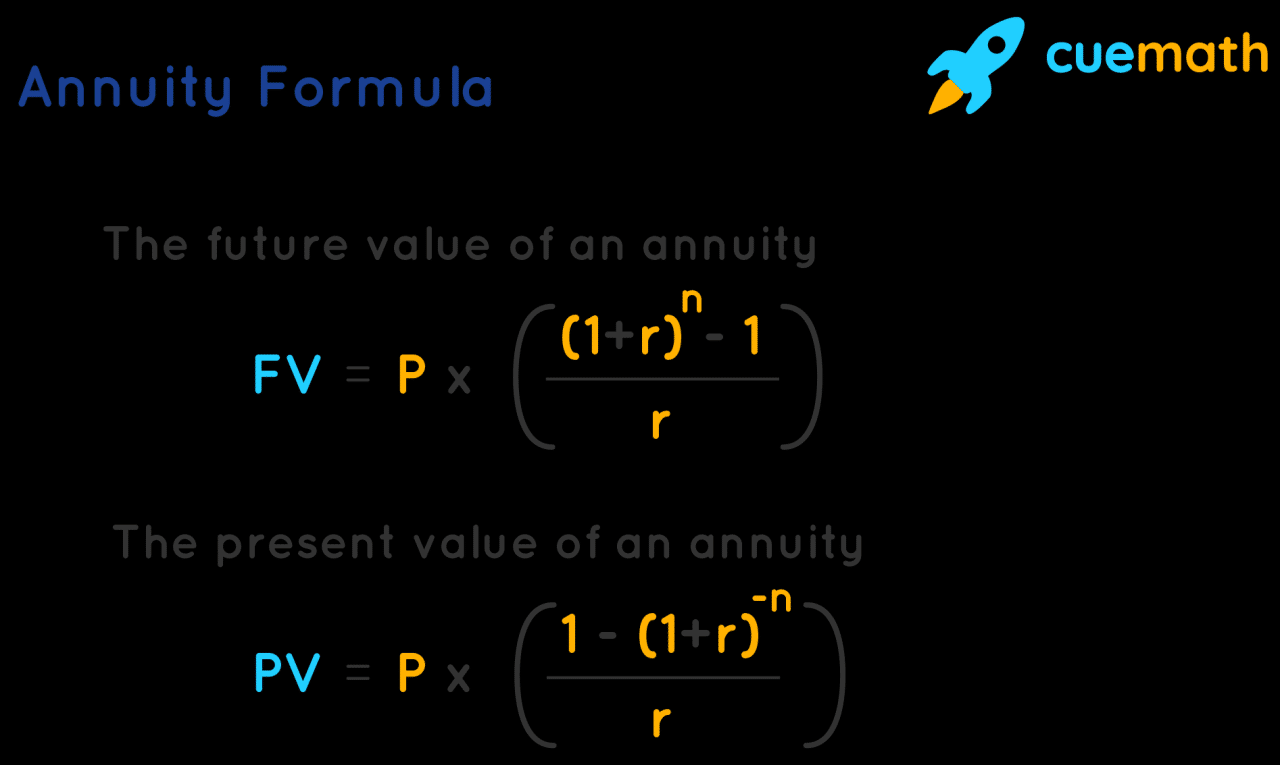

An annuity is essentially a series of regular payments. For more information about annuities and their structure, check out this article here.

Remember, seeking professional financial advice is crucial to tailor your retirement plan to your individual circumstances and goals.

Choosing the right tools is crucial for successful Android app development. Find a list of the top Android app development tools for 2024 here.

Question Bank

How do annuity rates work in the UK?

Google Tasks is getting a number of updates in 2024, including new features and enhancements. You can learn more about the latest changes to Google Tasks here.

Annuity rates in the UK are influenced by factors such as interest rates, life expectancy, and market conditions. Higher interest rates generally lead to higher annuity rates, while longer life expectancies tend to result in lower rates. Market conditions also play a role, with favorable market performance potentially boosting annuity rates.

What is the difference between a fixed and a variable annuity?

A fixed annuity provides a guaranteed, fixed income stream for life, while a variable annuity’s payments fluctuate based on the performance of an underlying investment portfolio. Fixed annuities offer stability and predictability, while variable annuities potentially provide higher returns but carry more risk.

Is it better to buy an annuity or invest my savings?

The decision to buy an annuity or invest your savings depends on your individual circumstances and risk tolerance. Annuities offer guaranteed income, while investments offer the potential for growth but carry more risk. It’s essential to consult with a financial advisor to determine the best approach for your retirement planning.

Can I withdraw my money from an annuity?

The terms of an annuity determine whether you can withdraw your money. Some annuities allow for partial withdrawals, while others are non-withdrawable until a certain age or under specific circumstances. It’s crucial to review the annuity contract carefully before making a decision.