Finance Classes Near Me can empower you with the knowledge and skills to manage your money effectively, whether you’re looking to invest, save for retirement, or simply understand the basics of personal finance. This guide will help you navigate the world of finance classes, from identifying your needs to finding the right class for you.

Staying active and engaged is important for seniors, and finding a senior community center near you can provide a great opportunity for socialization, fitness, and learning new skills.

We’ll cover everything from understanding different class types and their target audiences to exploring the benefits of taking finance classes and the potential career paths they can open. We’ll also guide you through the process of finding finance classes in your local area, evaluating class options, and utilizing online learning resources.

If you’re looking for a reliable and fuel-efficient car, the Hyundai Elantra is a great option. You can easily find a Hyundai Elantra near you to test drive and see if it’s the right fit for you.

Understanding Your Needs: Finance Classes Near Me

Navigating the world of finance can be daunting, but taking finance classes can equip you with the knowledge and skills you need to make informed decisions about your money. These classes cater to a diverse range of individuals, from those seeking to manage their personal finances effectively to aspiring financial professionals.

Keeping your pool sparkling clean can be a chore, but finding a reliable swimming pool cleaner near you can make a world of difference. They’ll handle the maintenance, so you can enjoy your pool without the hassle.

Types of Finance Classes

Finance classes come in various formats, each targeting a specific audience and skill level. Here’s a breakdown of some common types:

- Personal Finance:These classes focus on managing personal finances, including budgeting, saving, investing, and debt management. They are ideal for individuals looking to gain control over their finances and achieve financial goals.

- Investing:These classes delve into different investment strategies, asset classes, and risk management. They are suitable for individuals interested in building a portfolio and learning about the stock market, bonds, real estate, and other investment options.

- Business Finance:These classes cover financial concepts relevant to businesses, including financial statements analysis, capital budgeting, and corporate finance. They are beneficial for entrepreneurs, business owners, and aspiring finance professionals.

- Financial Planning:These classes focus on developing financial plans, including retirement planning, college savings, and estate planning. They are helpful for individuals looking to secure their financial future and make informed decisions about their long-term goals.

Benefits of Taking Finance Classes, Finance Classes Near Me

Taking finance classes offers numerous benefits, including:

- Improved Financial Literacy:Finance classes provide a solid foundation in financial concepts, enabling you to make informed decisions about your money.

- Enhanced Financial Management Skills:You’ll learn practical strategies for budgeting, saving, investing, and managing debt, empowering you to take control of your finances.

- Increased Confidence in Financial Decisions:Understanding financial principles gives you the confidence to make sound financial choices, reducing anxiety and stress.

- Career Advancement Opportunities:Finance classes can enhance your career prospects by providing you with the necessary knowledge and skills for finance-related roles.

Career Paths in Finance

A finance education can open doors to various career paths, including:

- Financial Analyst:Analyze financial data, prepare reports, and provide investment recommendations.

- Investment Banker:Assist companies in raising capital through debt or equity offerings.

- Portfolio Manager:Manage investment portfolios for individuals or institutions.

- Financial Advisor:Provide financial advice and guidance to clients.

- Accountant:Record and analyze financial transactions for businesses.

- Economist:Study economic trends and forecast future economic conditions.

Finding the Right Class

Finding the right finance class involves identifying your needs, researching available options, and evaluating the best fit for your goals.

Ready to turn your passion for hair into a career? You can find hair cutting schools near you to learn the skills and techniques needed to become a successful stylist.

Step-by-Step Guide

- Define Your Goals:Determine your learning objectives, whether it’s managing personal finances, pursuing a career in finance, or gaining specific knowledge in a particular area.

- Identify Local Institutions:Research universities, community colleges, professional organizations, and financial institutions that offer finance classes in your area.

- Review Course Catalogs:Explore course descriptions, instructors, schedules, and fees to find classes that align with your interests and learning style.

- Contact Institutions:Reach out to institutions for further information, such as course materials, prerequisites, and registration procedures.

- Compare and Contrast:Evaluate different class options based on factors like course content, instructor experience, location, and cost.

- Enroll in the Best Fit:Choose the class that best meets your needs and learning objectives.

Local Finance Classes

Here’s a sample table showcasing local finance classes, providing information about class name, institution, location, and contact details:

| Class Name | Institution | Location | Contact Information |

|---|---|---|---|

| Personal Finance Essentials | City College | Downtown Campus | (555) 123-4567 |

| Investing for Beginners | State University | Main Campus | (555) 876-5432 |

| Financial Planning for Retirement | Financial Planning Institute | Suburban Office | (555) 987-6543 |

| Introduction to Business Finance | Chamber of Commerce | Business Center | (555) 123-4567 |

Comparing Institutions

When choosing a finance class, consider comparing different institutions based on factors like:

- Reputation and Accreditation:Look for institutions with a strong reputation and accreditation in finance education.

- Faculty Expertise:Ensure instructors have relevant experience and qualifications in finance.

- Course Curriculum:Review course content and learning objectives to ensure they align with your goals.

- Student Support:Inquire about resources and support services available to students, such as tutoring, career counseling, and online learning platforms.

- Cost and Flexibility:Compare tuition fees, class schedules, and payment options to find the best value for your investment.

Evaluating Class Options

Choosing the right finance class is crucial for maximizing your learning experience and achieving your financial goals. Here are key factors to consider when evaluating your options:

Factors to Consider

- Course Content:Ensure the course covers topics relevant to your needs and interests. For example, if you’re interested in personal finance, look for classes that cover budgeting, saving, investing, and debt management.

- Instructor Experience:Choose classes taught by experienced and knowledgeable instructors with a strong track record in finance education.

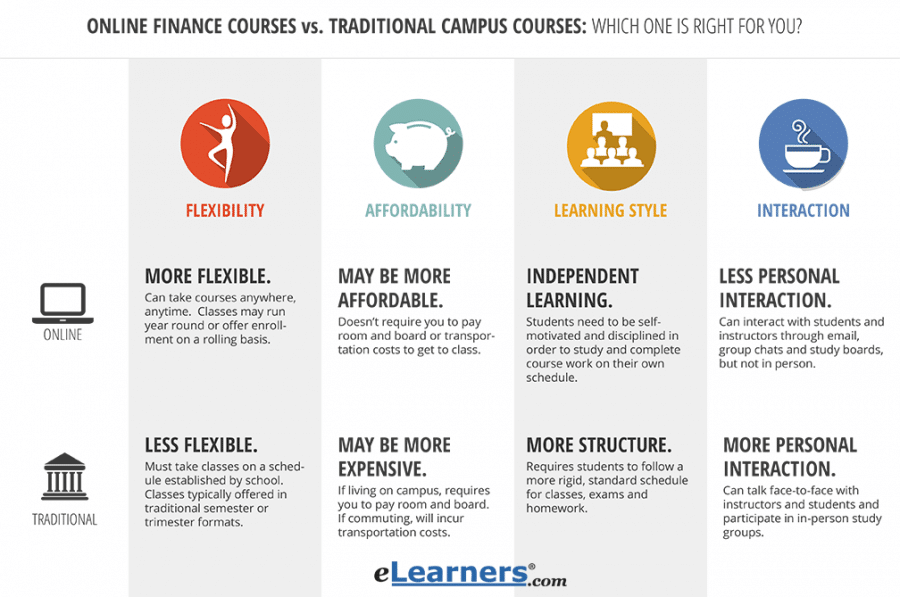

- Learning Style:Consider your preferred learning style, whether it’s lectures, interactive discussions, case studies, or hands-on exercises.

- Class Format:Evaluate whether the class is offered in person, online, or a hybrid format, and choose the option that best suits your schedule and preferences.

- Class Size:Consider the class size and whether it allows for personalized attention from the instructor.

- Location and Accessibility:Choose a class that is conveniently located and accessible to you.

- Cost and Value:Compare tuition fees, course materials, and other expenses to ensure you’re getting good value for your investment.

Aligning Class Objectives with Personal Goals

It’s essential to ensure that the class objectives align with your personal goals. For example, if your goal is to learn about investing, choose a class that focuses on investment strategies, asset classes, and risk management. By aligning class objectives with your personal goals, you can maximize your learning experience and achieve your financial aspirations.

A cracked phone screen can be a real nuisance. Luckily, you can find a phone screen fix near you to get your device back in working order quickly.

Learning Resources

Beyond traditional classroom settings, numerous online resources offer valuable insights into finance, providing flexibility and accessibility for learners of all levels.

Need to visit a Geico office? Finding a Geico location near you is quick and easy, making it convenient to handle your insurance needs.

Online Finance Resources

| Resource Name | Type | Focus Area | Description |

|---|---|---|---|

| Khan Academy | Website, App | Personal Finance, Investing, Business Finance | Offers free courses and videos on a wide range of financial topics, from budgeting and saving to investing and entrepreneurship. |

| Investopedia | Website | Investing, Personal Finance | Provides comprehensive articles, tutorials, and tools for investors of all levels, covering topics like stocks, bonds, mutual funds, and ETFs. |

| Coursera | Course Platform | Personal Finance, Business Finance, Financial Markets | Offers online courses from top universities and institutions, covering topics like financial modeling, investment analysis, and financial management. |

| Mint | App | Personal Finance | Helps users track their spending, budget, and investments in one central location, providing insights into their financial habits. |

Online vs. Traditional Learning

Learning finance online offers several advantages, including:

- Flexibility:Learn at your own pace and schedule, fitting classes into your busy life.

- Accessibility:Access courses from anywhere with an internet connection.

- Affordability:Online courses can be more affordable than traditional classroom settings.

However, traditional classroom settings offer:

- Interactive Learning:Engage with instructors and classmates in real-time, fostering a collaborative learning environment.

- Personalized Attention:Receive direct feedback from instructors and ask questions in person.

- Structured Learning:Follow a set curriculum and schedule, providing a structured learning experience.

Financial Literacy for Everyone

Financial literacy is essential in today’s world, regardless of your career path or financial situation. Understanding basic financial concepts empowers you to make informed decisions about your money, achieve your financial goals, and avoid financial pitfalls.

Relive your favorite music with a collection of classic CDs. You can find a used CDs store near you and discover a treasure trove of musical gems.

Benefits of Financial Literacy

- Improved Financial Well-being:Financial literacy helps you manage your money effectively, reduce debt, and build wealth.

- Increased Financial Security:Understanding financial concepts provides you with the tools to navigate financial challenges and make informed decisions during economic downturns.

- Enhanced Decision-Making:Financial literacy enables you to make informed decisions about your finances, such as saving, investing, and borrowing.

- Reduced Financial Stress:Managing your finances effectively reduces anxiety and stress related to money.

Essential Financial Concepts

Here are some essential financial concepts that everyone should understand:

- Budgeting:Tracking your income and expenses to create a plan for managing your money.

- Saving:Setting aside money for future goals, such as retirement, emergencies, or large purchases.

- Investing:Growing your money over time by putting it into assets like stocks, bonds, or real estate.

- Debt Management:Understanding different types of debt, managing debt responsibly, and avoiding excessive borrowing.

- Credit Scores:Learning how credit scores work, factors that affect them, and strategies for improving your score.

- Insurance:Understanding different types of insurance, such as health, auto, and home insurance, and choosing appropriate coverage.

- Taxes:Understanding basic tax principles, filing your taxes accurately, and maximizing tax benefits.

Wrap-Up

In today’s world, financial literacy is more important than ever. By taking a finance class, you can gain the knowledge and confidence to make informed financial decisions, regardless of your career path. Whether you choose to learn in a traditional classroom setting or online, there are countless resources available to help you achieve your financial goals.

Finding the right incontinence supplies can be a sensitive topic, but you can find a incontinence supply store near you to get the discreet and comfortable products you need.

Clarifying Questions

What are the different types of finance classes available?

Vinyl flooring is a popular choice for its durability and affordability. Finding a reliable vinyl flooring installer near you ensures a professional and long-lasting installation.

Finance classes come in various forms, including personal finance, investing, business finance, and accounting. Each type caters to specific needs and knowledge levels.

Planning a home renovation? You’ll want to find the perfect flooring for your space. Luckily, you can easily discover flooring stores near you to explore a variety of options and get expert advice.

What are the benefits of taking finance classes?

Finance classes offer numerous benefits, including increased financial knowledge, improved money management skills, enhanced career opportunities, and greater financial security.

Craving some delicious Golden Crust pizza? No need to search far and wide, you can easily find a Golden Crust restaurant near you to satisfy your pizza cravings.

How do I find finance classes near me?

You can find finance classes near you by searching online, contacting local community colleges or universities, checking with financial institutions, or attending local events and workshops.

What factors should I consider when choosing a finance class?

When choosing a finance class, consider factors such as the instructor’s experience, the class curriculum, the learning environment, the cost, and the class schedule.

Are online finance classes effective?

Unexpected expenses can pop up, but finding a pay advance near you can help you bridge the gap until your next payday. Just remember to use these services responsibly.

Online finance classes can be effective, offering flexibility and convenience. However, it’s important to choose reputable platforms and ensure the course content is high-quality.

Getting your little one’s hair cut can be a challenge. You can find a kids hair salon near you that specializes in making haircuts fun and comfortable for children.

Looking for a delicious and satisfying sub? You can easily find a subs restaurant near you to grab a quick and tasty lunch or dinner.

Finding the right preschool for your child is a big decision. If you’re looking for a faith-based option, you can find a Christian VPK near you that aligns with your values.