October 2023 Lease Deals offer a unique opportunity to secure attractive deals on new vehicles. With economic conditions influencing lease rates and manufacturers eager to move inventory, savvy car buyers can find exceptional lease terms. This month, automakers are pulling out all the stops with enticing incentives and promotions, making it a prime time to lease a car.

From popular models like the Toyota Camry and Honda Civic to SUVs and trucks, there’s a wide range of vehicles available with competitive lease offers. These deals often include lower monthly payments, reduced down payments, and generous mileage allowances. By taking advantage of these opportunities, you can drive a brand-new car without the hefty upfront cost of purchasing.

Lease vs. Purchase

Choosing between leasing and purchasing a vehicle is a significant financial decision that requires careful consideration. Both options have their advantages and disadvantages, and the best choice for you will depend on your individual needs, financial situation, and driving habits.

This guide will provide a comprehensive overview of the key factors to consider when making this decision.

Looking for a new credit card with great rewards? The Best Credit Cards October 2023 can help you find the perfect card for your spending habits. Compare features and benefits to find the one that suits you best.

Comparing Leasing and Purchasing

Leasing and purchasing a vehicle offer distinct advantages and disadvantages. Understanding these differences can help you make an informed decision that aligns with your financial goals and driving needs.

- Leasingoffers lower monthly payments, access to newer vehicles, less upfront cost, and potentially lower maintenance costs. However, it comes with mileage and wear and tear restrictions, no equity buildup, potential hidden fees, and possible end-of-lease charges.

- Purchasingprovides equity buildup, greater flexibility with modifications and customizations, no mileage restrictions, and the potential for tax benefits. However, it typically involves higher monthly payments, higher upfront cost, and higher maintenance costs. It also involves the risk of depreciation, which can affect the resale value of the vehicle.

October is a great time to snag a new car, with lots of October 2023 Lease Deals popping up. It’s a good time to compare and find the best deal for your needs and budget.

Financial Implications of Leasing

Leasing a vehicle involves a series of financial considerations, including monthly payments, down payments, and end-of-lease options. Understanding these factors can help you determine the overall cost of leasing.

If you’re thinking about getting a new car, you might want to consider a lease. There are some great Best Lease Deals October 2023 available right now, so it’s a good time to shop around and see what’s out there.

- Monthly paymentsare determined by several factors, including the vehicle’s price, interest rates, residual value (the estimated value of the vehicle at the end of the lease term), and the length of the lease term. Lower interest rates and a higher residual value typically result in lower monthly payments.

- Down paymentscan affect the monthly payment and overall cost of the lease. A larger down payment can lower the monthly payment, but it also increases the upfront cost. Conversely, a smaller down payment can reduce the upfront cost but result in higher monthly payments.

Looking to maximize your savings? The Best CD Rates October 2023 can help you find the best option for your needs. It’s worth comparing rates to see which option offers the highest return on your investment.

- End-of-lease optionsinclude returning the vehicle, purchasing it at the residual value, or extending the lease. If the vehicle is returned with excessive mileage or damage, you may be subject to penalties. Purchasing the vehicle at the residual value can be an option if you want to continue driving it after the lease term expires.

Financial Implications of Purchasing

Purchasing a vehicle involves significant financial considerations, including loan terms, depreciation, and maintenance costs. Understanding these factors can help you assess the overall cost of ownership.

- Loan terms, including interest rates, loan terms, and down payment, significantly impact the monthly payment and overall cost of purchasing a vehicle. Lower interest rates, shorter loan terms, and larger down payments typically result in lower monthly payments and overall cost.

- Depreciationrefers to the decline in value of a vehicle over time. The rate of depreciation varies depending on factors such as make, model, mileage, and condition. Understanding depreciation can help you estimate the resale value of the vehicle when you decide to sell or trade it.

- Maintenance costsare typically higher for purchased vehicles than leased vehicles. You are responsible for all maintenance and repairs, including routine maintenance, major repairs, and unexpected breakdowns.

Factors Influencing the Best Choice

Several factors can influence the best choice between leasing and purchasing a vehicle. These factors include driving habits, financial situation, and long-term goals.

- Driving habits, such as mileage needs, driving style, and maintenance habits, can significantly influence the best option. If you drive high mileage or have a demanding driving style, purchasing a vehicle may be more cost-effective in the long run. Conversely, if you drive low mileage and prefer a more relaxed driving style, leasing may be a better choice.

- Financial situation, including credit score, income, and debt levels, can affect the affordability of leasing or purchasing. A good credit score and higher income can qualify you for lower interest rates and better loan terms, making purchasing more affordable. However, if you have limited credit or income, leasing may be a more manageable option.

- Long-term goals, such as future plans to sell or trade the vehicle, desire for equity buildup, and personal financial goals, can influence the best choice. If you plan to sell or trade the vehicle in the near future, leasing may be a better option.

However, if you want to build equity and own the vehicle outright, purchasing is generally a better choice.

7 Tips for Negotiating a Lease Deal

Leasing a car can be a smart financial decision, but it’s essential to negotiate a favorable lease deal to ensure you’re getting the best value for your money. By following these seven tips, you can improve your chances of securing a lease that meets your needs and budget.

Research & Preparation

Thorough research and preparation are crucial before starting lease negotiations. This includes understanding your needs, exploring available options, and comparing lease offers.

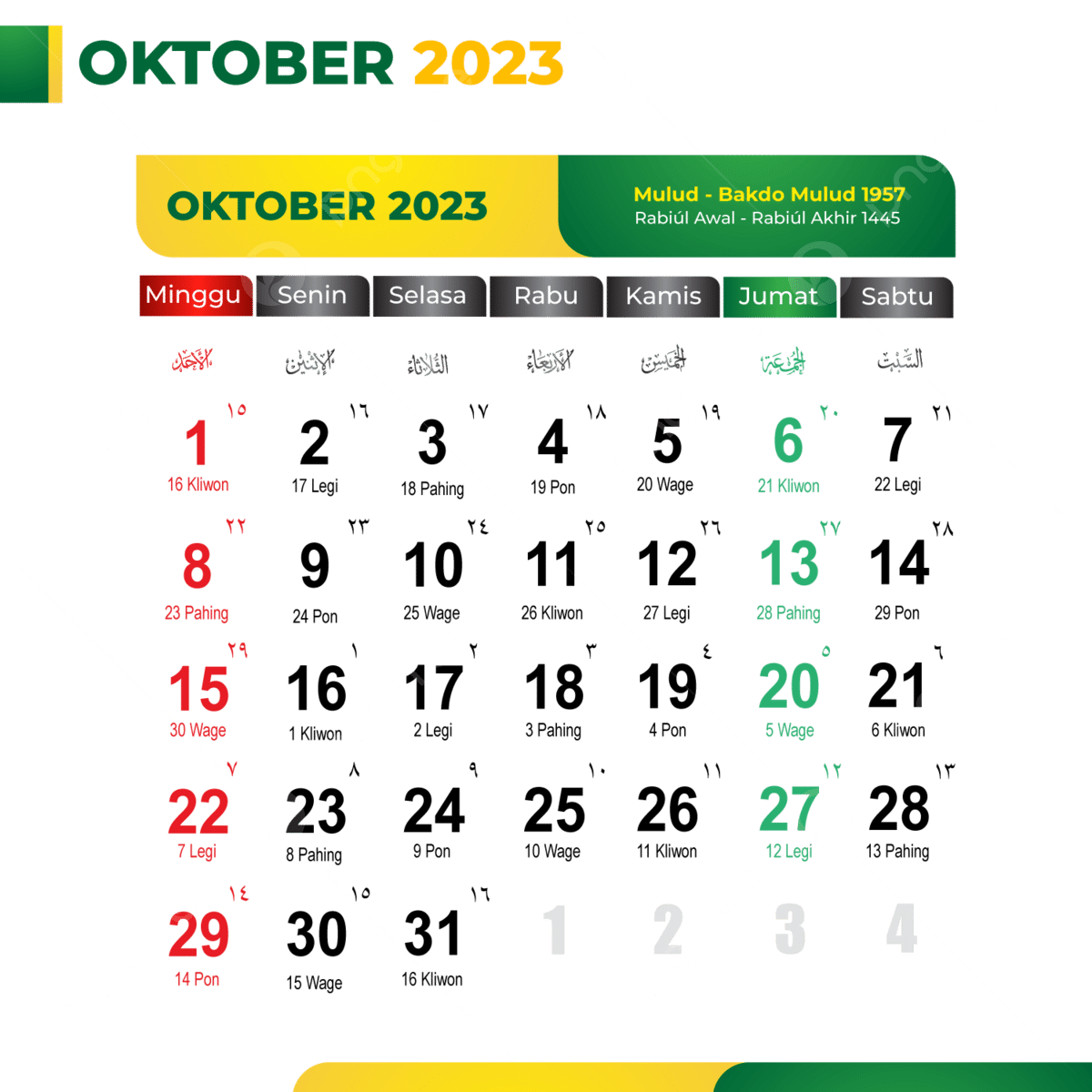

October is here, and with it comes the October 2023 Calendar. Keep track of important dates and deadlines, and make sure you’re organized for the month ahead.

- Identify your needs:Determine the type of vehicle you desire, including its features and your budget. Consider factors such as fuel efficiency, passenger capacity, and safety features.

- Explore available models:Research different makes and models that align with your requirements. Compare specifications, reviews, and pricing to narrow down your choices.

- Compare lease offers:Obtain lease quotes from multiple dealerships to compare terms and incentives. This allows you to identify the best deals and negotiate effectively.

Negotiating Lease Terms

Once you’ve identified your preferred vehicle, it’s time to negotiate the lease terms. This involves discussing monthly payments, lease term, mileage allowance, residual value, and down payment.

- Monthly payment:Aim for a payment that comfortably fits within your budget. Consider your overall financial situation and prioritize affordability.

- Lease term:Choose a term that balances affordability and total lease cost. Shorter terms generally have higher monthly payments but lower overall costs, while longer terms have lower monthly payments but higher overall costs.

- Mileage allowance:Negotiate a sufficient mileage allowance to accommodate your driving needs. If you anticipate driving more than the standard allowance, you may need to pay extra fees.

- Residual value:Understand how the residual value, or the predicted value of the vehicle at the end of the lease, impacts your monthly payments. A higher residual value results in lower monthly payments, but you may have fewer options at lease-end.

- Down payment:Explore options for reducing the down payment or eliminating it entirely. Some dealerships may offer incentives or special financing programs to minimize the upfront cost.

Leveraging Market Conditions & Incentives, October 2023 Lease Deals

The automotive market is constantly changing, and dealerships often offer incentives to attract customers. By understanding these market conditions and leveraging available incentives, you can potentially negotiate a better deal.

Looking for a new car? October is a great time to check out the Best Car Lease Deals October 2023. You might find a great deal on a new ride that fits your style and budget.

- Manufacturer incentives:Inquire about current manufacturer rebates, lease cash, and special financing offers. These incentives can significantly reduce the overall cost of leasing.

- Seasonal promotions:Take advantage of seasonal sales and promotions that dealerships may offer, particularly during holidays or at the end of model years.

- Inventory levels:Negotiate a better deal if dealerships are facing high inventory levels. They may be more willing to negotiate to move vehicles off the lot.

Negotiating Strategies

Effective negotiation involves preparation, confidence, and a willingness to walk away if necessary. By employing these strategies, you can maximize your chances of securing a favorable lease deal.

- Be prepared to walk away:Having a “walk-away” price point in mind helps you avoid overpaying. If the dealership won’t meet your terms, be prepared to walk away and explore other options.

- Emphasize your needs:Clearly articulate your needs and budget to the salesperson. This helps them understand your priorities and tailor the offer accordingly.

- Negotiate in good faith:Be respectful and professional throughout the negotiation process. Avoid aggressive tactics and focus on finding a mutually beneficial agreement.

- Document everything:Keep a record of all conversations, offers, and agreements. This documentation can be helpful if any disputes arise later.

Writing a Lease Agreement

The lease agreement is a legally binding document that Artikels the terms of your lease. Carefully review the agreement before signing to ensure you understand all the details.

- Read the fine print:Carefully review the lease agreement before signing. Pay close attention to fees, penalties, and obligations.

- Understand all terms:Ensure you understand all fees, penalties, and obligations. If anything is unclear, ask for clarification before signing.

- Negotiate any changes:If necessary, request changes to the agreement before signing. This may include adjusting the mileage allowance, lease term, or other terms.

Additional Considerations

Leasing a car involves several considerations beyond the initial negotiation. Understanding these aspects can help you make informed decisions throughout the lease term.

Are you wondering when your taxes are due? Some taxes are due in October, so check out the When Are Taxes Due In October 2023 to make sure you’re on top of your financial responsibilities.

- Lease-end options:Explore options for purchasing the leased vehicle at the end of the term. This may be a good option if you’ve enjoyed the vehicle and want to keep it.

- Early termination:Understand the penalties for ending the lease early. These penalties can be substantial, so consider this factor before making any decisions.

- Maintenance and repairs:Inquire about lease coverage for maintenance and repairs. Some leases may include basic maintenance or a limited warranty, while others may require you to pay for all repairs.

Future Trends in Automotive Leasing

The automotive leasing market is constantly evolving, driven by technological advancements, changing consumer preferences, and economic factors. As we look ahead, several emerging trends are poised to shape the future of leasing, offering both opportunities and challenges for automotive manufacturers, dealerships, and consumers alike.

Electrification’s Impact on Lease Offers

The transition to electric vehicles (EVs) is rapidly gaining momentum, and this shift is having a significant impact on lease offers. EVs offer unique advantages for leasing, including lower operating costs due to reduced fuel expenses and maintenance requirements. As a result, EV lease payments can be more competitive than those for comparable gasoline-powered vehicles.

Unfortunately, the news isn’t all good. Geico Layoffs October 2023 have been announced, impacting many employees. It’s a reminder of the economic challenges facing businesses and individuals alike.

Here are some key aspects of how electrification is shaping lease offers:

- Lower Monthly Payments:EVs often have lower lease payments due to their lower operating costs. This can make leasing an EV more attractive to consumers who are budget-conscious.

- Incentives and Rebates:Governments and manufacturers are offering incentives and rebates to encourage EV adoption. These financial benefits can further reduce lease payments, making EVs even more appealing.

- Battery Life and Residual Value:Battery technology is constantly improving, but the lifespan of EV batteries is still a concern for some consumers. Lease offers may incorporate provisions for battery replacement or performance guarantees to address this issue.

- Charging Infrastructure:The availability of charging infrastructure is crucial for EV adoption. Lease offers may include access to charging networks or home charging installation assistance to alleviate range anxiety.

Subscription Services and the Future of Leasing

Subscription services are transforming various industries, and the automotive sector is no exception. Subscription-based car services offer a flexible alternative to traditional leasing, allowing consumers to access a variety of vehicles on a monthly basis. These services provide a convenient way for consumers to experience different models and brands without the commitment of a long-term lease.

They also offer benefits such as:

- Flexibility and Convenience:Subscription services allow consumers to switch vehicles easily based on their needs and preferences, without the hassle of selling or trading in a car.

- All-Inclusive Pricing:Subscription fees often cover all costs, including insurance, maintenance, and roadside assistance, providing a predictable and transparent monthly expense.

- Access to a Wider Range of Vehicles:Subscription services typically offer a fleet of vehicles from various manufacturers, giving consumers access to a diverse selection.

“Subscription services are expected to gain significant traction in the coming years, as they offer a compelling alternative to traditional car ownership and leasing.”

Industry Analyst Report

The banking industry is facing challenges, and PNC Bank Layoffs October 2023 are a reminder of the economic climate. It’s a good time to review your own finances and make sure you’re prepared for any potential changes.

The Rise of Data-Driven Leasing

The increasing use of data analytics is revolutionizing the automotive leasing industry. By leveraging data insights, leasing companies can:

- Personalize Lease Offers:Data analysis allows leasing companies to tailor lease offers to individual consumer preferences, driving-habits, and financial situations.

- Optimize Residual Values:Data can be used to predict the future value of vehicles, helping leasing companies set accurate residual values and reduce risks.

- Improve Risk Assessment:Data analysis enables leasing companies to assess creditworthiness and predict the likelihood of lease defaults, leading to more informed lending decisions.

- Enhance Customer Service:Data can be used to anticipate customer needs and provide proactive support, improving customer satisfaction and loyalty.

Illustrative Examples of Lease Deals

This section will provide a glimpse into the world of automotive leasing, showcasing examples of lease deals available in October 2023 for different vehicle categories. These examples will help you understand the typical terms, features, and estimated monthly payments associated with leasing.

With the holiday season just around the corner, many people are looking for great deals. If you’re in the market for a new car, you’ll want to check out the Best Lease Deals October 2023. You might be surprised at the savings you can find.

Sedans

Lease deals for sedans often cater to individuals seeking a balance between fuel efficiency, comfort, and affordability. Here is an example of a lease deal for a popular mid-size sedan:

Vehicle:2024 Honda Accord Lease Term:36 months Mileage Allowance:10,000 miles per year Down Payment:$2,000 Monthly Payment:$350 Features:Leather seats, heated front seats, sunroof, Apple CarPlay and Android Auto compatibility.

Investors are always looking for a good dividend, and the Jepi Dividend October 2023 might be worth checking out. See if it aligns with your investment goals and portfolio strategy.

This lease deal offers a competitive monthly payment for a well-equipped sedan, making it an attractive option for those seeking a comfortable and reliable daily driver.

SUVs

SUVs are highly sought after due to their versatility and spacious interiors. Here is an example of a lease deal for a popular compact SUV:

Vehicle:2024 Toyota RAV4 Lease Term:36 months Mileage Allowance:12,000 miles per year Down Payment:$1,500 Monthly Payment:$400 Features:All-wheel drive, advanced safety features, touchscreen infotainment system, heated front seats.

If you need to file your taxes but haven’t gotten around to it yet, don’t worry! The Tax Extension Deadline 2023 gives you a little extra time to get everything sorted out. Just remember, the extension only gives you more time to file, not to pay.

This lease deal provides a balance of affordability and capability, making it suitable for individuals and families seeking a reliable and practical SUV.

Trucks

Trucks are often leased for their towing capacity, durability, and off-road capabilities. Here is an example of a lease deal for a popular full-size pickup truck:

Vehicle:2024 Ford F-150 Lease Term:48 months Mileage Allowance:15,000 miles per year Down Payment:$3,000 Monthly Payment:$550 Features:Powerful engine, towing package, advanced driver-assist features, premium sound system.

This lease deal offers a powerful truck with a generous mileage allowance, suitable for individuals or businesses requiring a robust and capable vehicle.

Do you need a new credit card? The Best Credit Cards October 2023 can help you find the perfect card for your spending habits. Compare features and benefits to find the one that suits you best.

Resources for Finding Lease Deals

Finding the best lease deal requires diligent research and comparison. Fortunately, numerous online resources and tools can assist you in navigating the leasing process and securing favorable terms.

Looking for a good return on your savings? Check out the latest PNC Bank CD Rates October 2023 to see if they fit your financial goals. You might be surprised at the options available.

Website and Online Resources

These websites provide comprehensive information on lease deals, allowing you to compare offers and find the best options for your needs.

- Leasehackr.com:This website specializes in automotive leasing, offering detailed guides, forums, and tools for negotiating lease deals. Leasehackr provides information on lease terms, residual values, and money factors, helping you understand the intricacies of leasing.

- Edmunds.com:Edmunds is a well-known car buying website that also offers a dedicated section for lease deals.

You can browse lease offers by make, model, and location, and use their lease calculator to estimate monthly payments.

- Cars.com:Cars.com provides a comprehensive platform for researching and comparing lease deals. They offer lease offers from various dealerships, allowing you to find the best price in your area.

- LeaseTrader.com:This website specializes in leasing, offering a platform to buy, sell, and trade lease contracts. LeaseTrader can be helpful if you’re looking to get out of a lease early or find a lease deal on a pre-owned vehicle.

- Autotrader.com:Autotrader is a popular online marketplace for new and used cars, including lease deals.

Don’t forget about those taxes! Some Taxes Due October , so make sure you’re prepared to meet your obligations. Late payments can result in penalties, so stay organized and on top of your finances.

You can search for lease offers by make, model, and location, and use their filters to refine your search.

Lease Calculators and Tools

Lease calculators are valuable tools for evaluating lease options and determining affordability. These calculators allow you to adjust various variables, such as down payment, lease term, and mileage allowance, to see how they affect your monthly payments.

- Leasehackr.com:Leasehackr offers a comprehensive lease calculator that allows you to adjust various lease parameters, including money factor, residual value, and lease term. The calculator provides a detailed breakdown of your monthly payments and total lease cost.

- Edmunds.com:Edmunds provides a user-friendly lease calculator that allows you to input vehicle information, lease terms, and financial details to estimate your monthly payments.

- Cars.com:Cars.com offers a simple lease calculator that helps you estimate your monthly payments based on the vehicle’s price, lease term, and down payment.

- Bankrate.com:Bankrate provides a comprehensive lease calculator that allows you to adjust various variables, including interest rate, lease term, and residual value.

The calculator also provides a breakdown of your monthly payments and total lease cost.

Conclusion

This exploration of automotive leasing has highlighted the complexities and nuances involved in this financial decision. From understanding the fundamentals of lease agreements to navigating the intricacies of negotiation and the potential future trends, a comprehensive understanding is crucial to make informed choices.

Key Takeaways

This article has covered a wide range of topics related to automotive leasing, including:

- The fundamental differences between leasing and purchasing a vehicle, emphasizing the unique advantages and disadvantages of each approach.

- Essential tips for negotiating a lease deal, empowering readers to secure the best possible terms and conditions.

- The evolving landscape of automotive leasing, exploring emerging trends and their potential impact on the market.

- Illustrative examples of real-world lease deals, providing practical insights and showcasing the diverse options available.

- Valuable resources for finding the most competitive lease deals, guiding readers towards reputable sources of information.

The Importance of Careful Consideration

Before signing on the dotted line, thorough research and careful consideration are paramount. Overlooking crucial lease terms can lead to unexpected financial burdens and potential legal complications.

Understanding Lease Terms

- Lease term: The duration of the lease agreement, typically ranging from 24 to 60 months.

- Mileage allowance: The maximum number of miles you can drive during the lease term. Exceeding this limit can result in hefty penalties.

- Residual value: The estimated value of the vehicle at the end of the lease term. A higher residual value translates to lower monthly payments.

- Early termination fees: Penalties for ending the lease agreement before the specified term.

- Wear and tear: The lease agreement Artikels acceptable levels of wear and tear on the vehicle. Excessive damage can lead to additional charges.

Resources for Further Information

For in-depth information on lease agreements and tenant rights, explore resources such as:

- National Association of Consumer Advocates (NACA):[https://www.naca.com/](https://www.naca.com/)

- Consumer Reports:[https://www.consumerreports.org/](https://www.consumerreports.org/)

- Your state’s attorney general’s office: [https://www.usa.gov/state-attorney-general](https://www.usa.gov/state-attorney-general)

Taking Charge

By understanding the complexities of automotive leasing and diligently researching the terms of any agreement, you can confidently navigate the process and protect your financial interests. Remember, informed decisions lead to positive outcomes.

Final Thoughts: October 2023 Lease Deals

Leasing a car in October 2023 presents a compelling opportunity to enjoy the benefits of a new vehicle without the financial burden of a traditional purchase. With careful research and negotiation, you can secure a lease deal that meets your budget and driving needs.

Remember to compare offers, understand the terms and conditions, and leverage available incentives to maximize your savings. As the automotive landscape evolves, leasing remains a flexible and affordable option for many car buyers.

Answers to Common Questions

What is the difference between a closed-end and an open-end lease?

A closed-end lease is the most common type of lease. With a closed-end lease, you make monthly payments for a set period of time and then return the vehicle at the end of the lease. You are not responsible for the vehicle’s residual value.

An open-end lease is less common. With an open-end lease, you are responsible for the vehicle’s residual value at the end of the lease. This means you may have to pay additional money if the vehicle’s value is less than the residual value.

What is a money factor?

The money factor is a way of expressing the interest rate on a lease. It is calculated by dividing the annual interest rate by 2,400. For example, a money factor of 0.004 would correspond to an annual interest rate of 9.6%.

How do I negotiate a lease deal?

The best way to negotiate a lease deal is to be well-prepared and informed. Research the lease offers from different dealerships and compare the terms and conditions. Be sure to understand the money factor, the residual value, and the mileage allowance.

You can also try to negotiate a lower monthly payment, a reduced down payment, or a longer lease term.