The Roth IRA contribution limit for people over 50 in 2024 offers a valuable opportunity to boost your retirement savings. This “catch-up contribution” provision allows those 50 and older to contribute an additional amount beyond the standard limit, potentially accelerating your retirement nest egg.

The Roth IRA, known for its tax-free withdrawals in retirement, can be particularly advantageous for those in higher tax brackets or who anticipate being in a higher bracket during retirement.

Understanding the eligibility requirements, tax implications, and strategies for maximizing your contributions is crucial. This guide will walk you through the intricacies of Roth IRA contributions for those over 50, empowering you to make informed decisions about your retirement savings.

Roth IRA Contribution Limit for People Over 50 in 2024

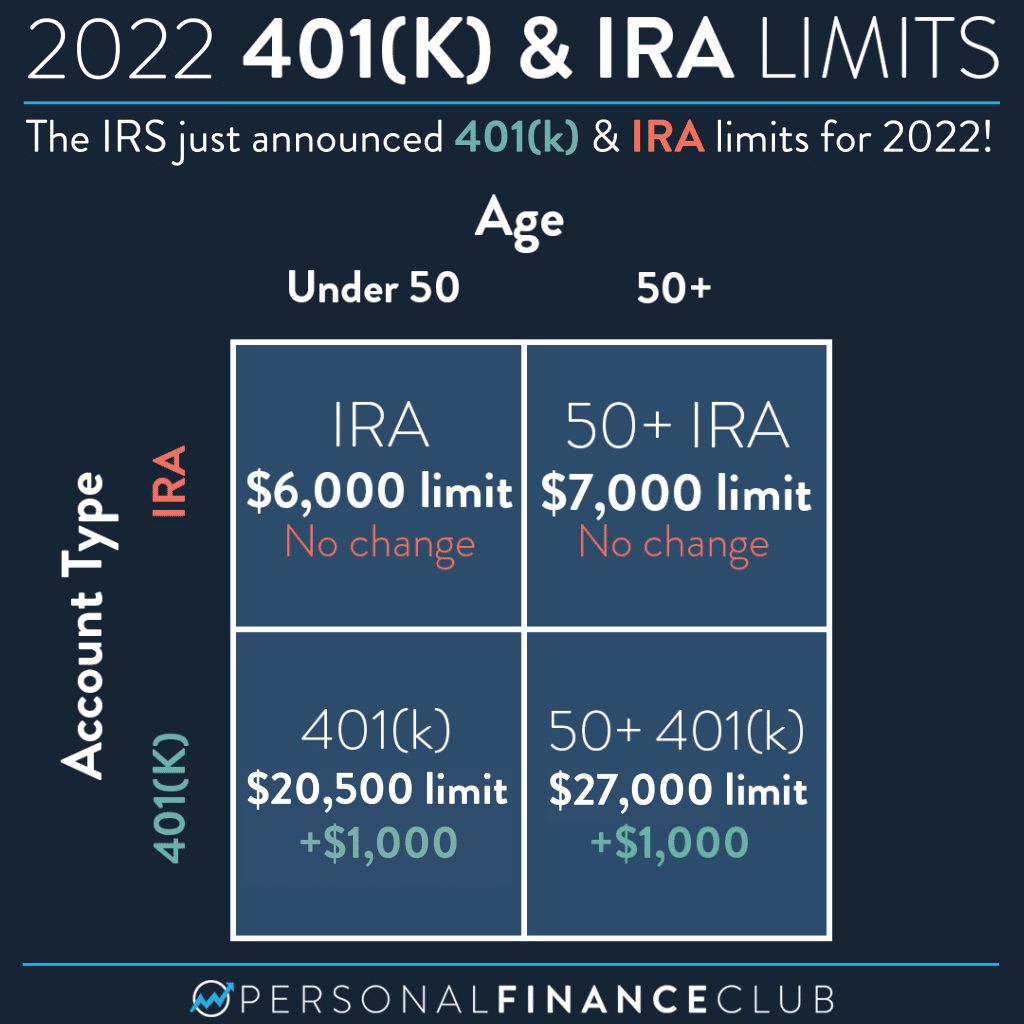

For individuals over 50 in 2024, the Roth IRA contribution limit is $7,500. This means that you can contribute up to $7,500 to your Roth IRA account in 2024, in addition to the standard contribution limit of $6,500. This additional contribution amount is referred to as a “catch-up contribution.”

Catch-Up Contribution

The catch-up contribution provision allows individuals aged 50 and older to contribute an extra amount to their retirement accounts. This is designed to help older workers make up for lost time in saving for retirement. This provision is available for both traditional and Roth IRAs.

Looking for a credit card that rewards your everyday spending? Explore the best credit cards for everyday spending in October 2024 and find the perfect match for your needs.

For 2024, the catch-up contribution limit is $1,000.

Benefits of Contributing to a Roth IRA

Contributing to a Roth IRA offers several benefits, especially for individuals over

When you’re claiming medical expenses, it’s important to know the current mileage rate. The October 2024 mileage rate for medical expenses can help you maximize your deductions.

50. These benefits include

Tax-free withdrawals in retirement

Students have unique tax situations. Use a tax calculator for students in October 2024 to determine your tax liability.

One of the most significant advantages of a Roth IRA is that qualified withdrawals in retirement are tax-free. This means that you won’t have to pay taxes on the money you withdraw from your Roth IRA during retirement.

Potential for tax-free growth

Understanding your tax deductions and credits can help you save money. Try a tax calculator for deductions and credits in October 2024 to see what you qualify for.

The money you contribute to a Roth IRA grows tax-free. This means that you won’t have to pay taxes on the earnings from your investments until you withdraw them in retirement.

Flexibility

Roth IRAs offer flexibility in terms of withdrawals. While you generally need to wait until age 59 1/2 to withdraw contributions without penalty, you can always withdraw your contributions without penalty or tax.

No required minimum distributions

If you’re planning to contribute to a traditional 401k, check out the 401k contribution limits for 2024 for traditional 401k to ensure you’re maximizing your contributions.

Unlike traditional IRAs, there are no required minimum distributions (RMDs) for Roth IRAs. This means that you can keep your money invested in your Roth IRA and continue to grow your savings tax-free for as long as you like.

Don’t miss the tax deadline! Find out when the tax deadline extension for October 2024 is so you can file your taxes on time.

Potential for tax savings

If you expect to be in a higher tax bracket in retirement than you are now, contributing to a Roth IRA can help you save on taxes.

Example:If you expect to be in a higher tax bracket in retirement, contributing to a Roth IRA now can help you save on taxes. Imagine you contribute $7,500 to a Roth IRA in 2024. This money grows tax-free to $15,000 by the time you retire.

If you were to withdraw this $15,000 from a traditional IRA in retirement, you would likely have to pay taxes on it at your higher retirement tax bracket. However, because you contributed to a Roth IRA, you would be able to withdraw the $15,000 tax-free.

Self-employed individuals have unique 401k options. See the 401k contribution limits for 2024 for self-employed to find out how much you can save for retirement.

Eligibility Requirements for Roth IRA Contributions

To contribute to a Roth IRA in 2024, you must meet specific eligibility requirements. These requirements ensure that the Roth IRA program remains fair and accessible to those who need it most.

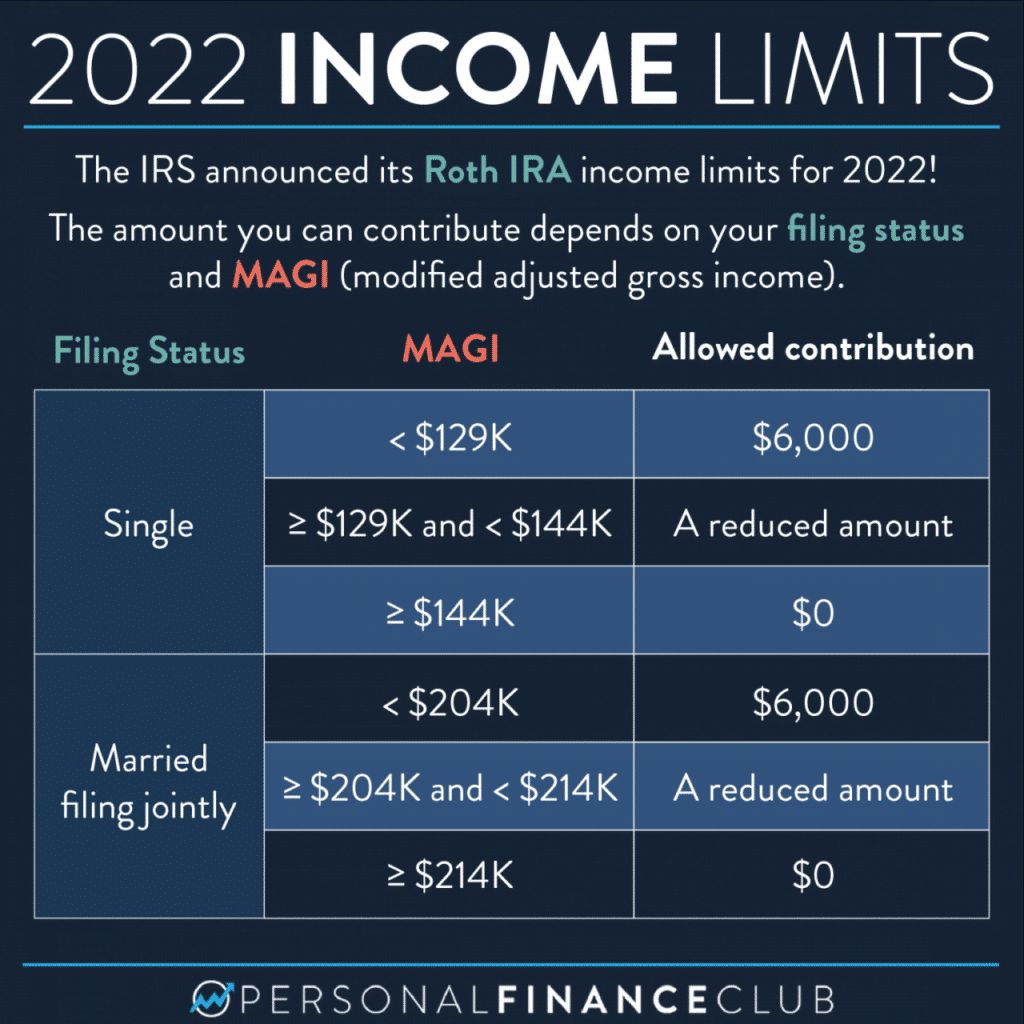

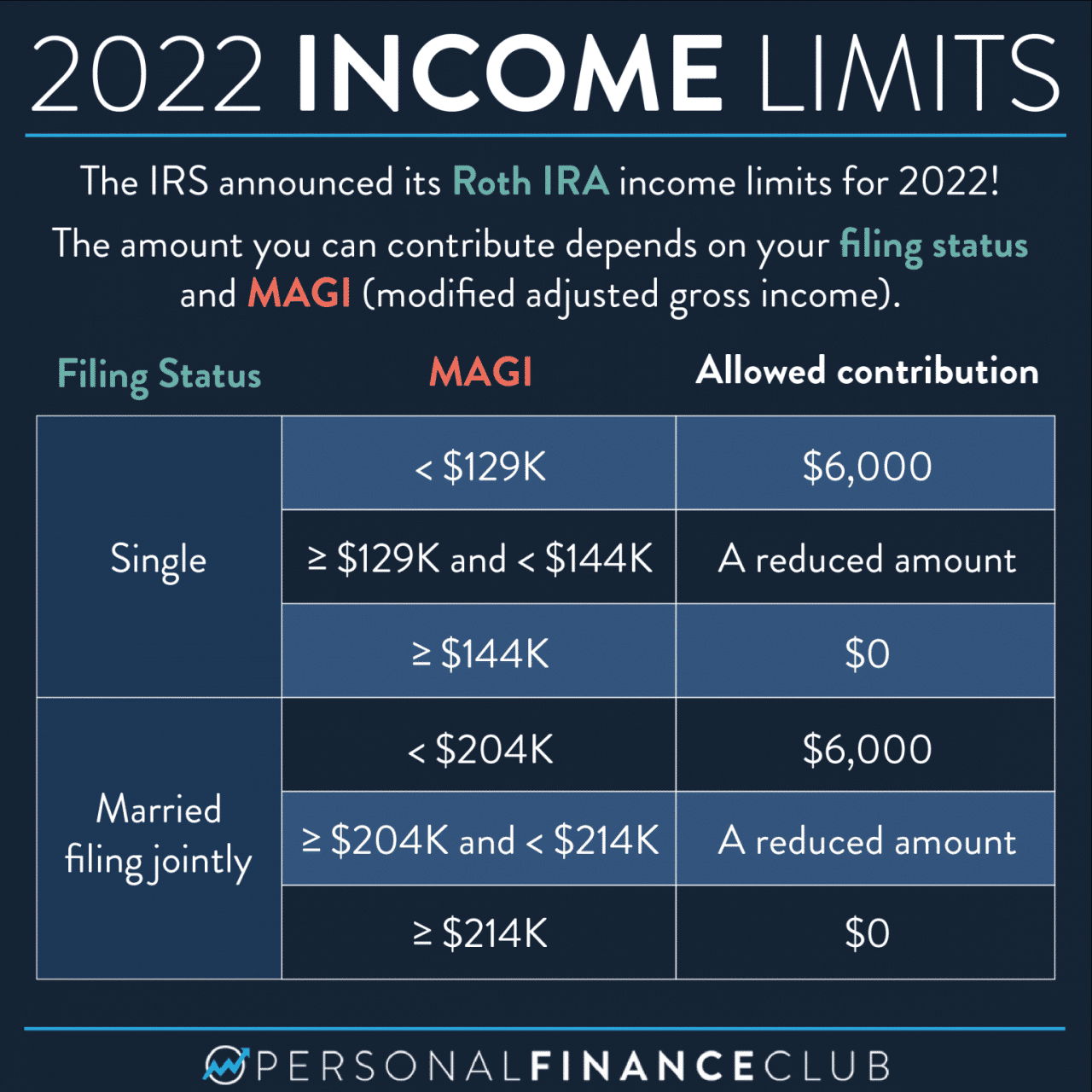

Modified Adjusted Gross Income (MAGI) Limits

The amount you can contribute to a Roth IRA is subject to income limitations, based on your Modified Adjusted Gross Income (MAGI). These limits apply regardless of your age, and exceeding them will prevent you from making contributions to a Roth IRA.

If you’re 50 or older, you can contribute extra to your IRA. Find out if you qualify for a catch-up contribution limit for IRAs in 2024 to boost your retirement savings.

The MAGI limits for Roth IRA contributions in 2024 are as follows:

- Single filers: $153,000 or less

- Married filing jointly: $228,000 or less

- Head of household: $189,000 or less

- Married filing separately: $114,000 or less

Eligibility Requirements for Individuals Over 50

Individuals over 50 have the option to make catch-up contributions to their Roth IRA, allowing them to contribute an additional amount on top of the regular contribution limit. This allows older individuals to contribute more to their retirement savings and potentially catch up on any missed contributions.

Maximize your retirement savings by contributing to your 401k. Learn about the 401k contribution limits for 2024 to make sure you’re saving as much as possible.

In 2024, individuals over 50 can contribute an additional $1,000 to their Roth IRA, bringing the total contribution limit to $7,500.

If you’re married filing separately, your tax bracket will differ from those filing jointly. See the tax brackets for married filing separately in 2024 to determine your tax liability.

Tax Implications of Roth IRA Contributions

Contributing to a Roth IRA in 2024 offers distinct tax advantages, making it an attractive retirement savings option, especially for individuals over 50. Unlike traditional IRAs, where contributions are tax-deductible, Roth IRA contributions are made with after-tax dollars. However, this unique structure leads to tax-free withdrawals in retirement, making it a potentially lucrative choice for long-term financial planning.

Tax Treatment of Roth IRA Contributions

The tax treatment of Roth IRA contributions is fundamentally different from traditional IRAs. Understanding these distinctions is crucial for making informed retirement planning decisions.

- Roth IRA Contributions:Made with after-tax dollars, meaning you’ve already paid taxes on the money you contribute. This means you won’t receive a tax deduction for your contributions.

- Traditional IRA Contributions:Made with pre-tax dollars, allowing you to deduct contributions from your taxable income. This results in immediate tax savings but leads to taxable withdrawals in retirement.

Tax-Free Withdrawals in Retirement

The most significant advantage of a Roth IRA lies in its tax-free withdrawals in retirement. This means you won’t have to pay any federal income tax on the money you withdraw, including earnings, as long as you meet certain conditions.

- Age 59 1/2:You can withdraw contributions and earnings tax-free after reaching age 59 1/2, provided the account has been open for at least five years.

- Early Withdrawals:While contributions can be withdrawn at any time without penalty, withdrawals of earnings before age 59 1/2 are generally subject to a 10% penalty, plus taxes. However, exceptions exist for certain situations, such as first-time home purchases, education expenses, and medical expenses.

The amount you can contribute to your 401k may depend on your age. The 401k contribution limits for 2024 by age can help you understand what you can save for retirement.

Tax Advantages for Individuals Over 50

For individuals over 50, Roth IRA contributions offer unique tax advantages. These benefits can significantly impact your retirement planning strategy.

Wondering how much you can contribute to your traditional IRA in 2024? Find the answer with the information on traditional IRA contribution limits for 2024.

- Catch-Up Contributions:Individuals aged 50 and over can make additional “catch-up” contributions to their Roth IRAs, increasing their retirement savings potential. In 2024, the catch-up contribution limit is $1,000, meaning you can contribute up to $7,500 in total.

- Tax-Free Growth:As your Roth IRA investments grow, the earnings accumulate tax-free. This tax-free growth can be substantial over time, particularly for individuals with long investment horizons.

- Tax-Free Income in Retirement:By choosing a Roth IRA, you can potentially reduce your taxable income in retirement, potentially lowering your tax liability and maximizing your after-tax income.

Strategies for Maximizing Roth IRA Contributions

Maximizing your Roth IRA contributions can be a powerful strategy for building a secure retirement, especially if you’re over

50. This is because you can contribute more than younger individuals and benefit from tax-free growth on your investments. Here’s a step-by-step guide to help you maximize your Roth IRA contributions in 2024

Determining Your Contribution Limit

The contribution limit for Roth IRAs in 2024 is $7,500 for individuals under 50 and $15,000 for individuals over 50. To determine your maximum contribution, you should consider your income level, as there are income limitations for Roth IRA contributions.

Understanding your tax bracket is crucial for effective financial planning. Check out the tax brackets for 2024 in the United States to see how your income will be taxed.

If your modified adjusted gross income (MAGI) exceeds certain thresholds, you may not be able to contribute to a Roth IRA or your contribution may be limited.

If you’re over 50, you may be able to contribute more to your Roth IRA. Check the Roth IRA contribution limits for 2024 over 50 to see your options.

Prioritizing Roth IRA Contributions

Once you’ve determined your contribution limit, it’s essential to prioritize Roth IRA contributions. If you’re unsure where to start, consider following these steps:

- Assess Your Financial Situation:Start by evaluating your current financial situation, including your income, expenses, and outstanding debts.

- Establish Emergency Fund:Ensure you have a healthy emergency fund to cover unexpected expenses. This fund should be at least three to six months’ worth of living expenses.

- Pay Down High-Interest Debt:If you have high-interest debt, such as credit card debt, consider paying it down before contributing to a Roth IRA. This is because the interest you pay on high-interest debt can outweigh the potential growth of your Roth IRA investments.

- Maximize Employer-Sponsored Retirement Plans:If your employer offers a 401(k) or similar plan, take advantage of any employer matching contributions. This is free money that can significantly boost your retirement savings.

- Contribute to Roth IRA:Once you’ve addressed these priorities, you can start contributing to your Roth IRA.

Comparing Roth IRA Contribution Strategies

There are several strategies you can use to maximize your Roth IRA contributions, and the best strategy for you will depend on your income level and retirement goals.

Strategies for High-Income Earners

High-income earners may find it challenging to contribute the full amount to a Roth IRA due to income limitations. In this case, consider these strategies:

- Backdoor Roth IRA:A backdoor Roth IRA involves contributing to a traditional IRA and then converting it to a Roth IRA. This strategy allows high-income earners to bypass the income limitations for Roth IRA contributions.

- Mega Backdoor Roth IRA:This strategy involves contributing to a 401(k) plan with a Roth option. You can then convert the after-tax contributions to a Roth IRA, bypassing the Roth IRA income limits.

Strategies for Lower-Income Earners

Lower-income earners may find it easier to contribute to a Roth IRA, as there are no income limitations for contributions. Consider these strategies:

- Maximize Contributions:Contribute the full amount allowed for your age, taking advantage of the higher contribution limit for individuals over 50. This will maximize your tax-free growth potential.

- Consider a Roth IRA Conversion:If you have a traditional IRA, you may consider converting it to a Roth IRA. This can be beneficial if you expect your tax bracket to be lower in retirement.

Impact of Maximizing Roth IRA Contributions on Retirement Planning

Maximizing your Roth IRA contributions can have a significant impact on your overall retirement planning. Here are some of the potential benefits:

- Tax-Free Growth:Your Roth IRA investments grow tax-free, meaning you won’t have to pay taxes on your withdrawals in retirement. This can significantly increase your retirement savings.

- Flexibility in Retirement:With a Roth IRA, you have more flexibility in retirement. You can withdraw your contributions at any time, tax-free and penalty-free. You can also withdraw your earnings tax-free after age 59 1/2.

- Estate Planning Benefits:Roth IRAs can be a valuable tool for estate planning. Your beneficiaries will inherit your Roth IRA tax-free, making it a tax-efficient way to transfer wealth.

Resources for Further Information

It can be overwhelming to sift through all the information available about Roth IRAs, especially when considering the specific rules for those over 50. Luckily, there are many reputable resources available to help you navigate this process.This section will provide a list of trusted websites and organizations that offer comprehensive information about Roth IRAs and contribution limits.

Additionally, we will create a table with links to relevant government agencies and financial institutions that provide guidance on Roth IRA contributions. Lastly, we will organize a list of helpful resources for individuals over 50 seeking to understand Roth IRA contribution rules and strategies.

Government Agencies and Financial Institutions, Roth IRA contribution limit for people over 50 in 2024

These organizations provide official guidance and regulations regarding Roth IRAs.

Are you a small business owner looking to maximize your retirement savings? The 401k contribution limits for 2024 for small business owners are higher than ever, allowing you to contribute a significant portion of your income to your retirement plan.

| Organization | Website | Description |

|---|---|---|

| Internal Revenue Service (IRS) | https://www.irs.gov/ | The IRS website is the primary source for information on tax laws and regulations, including Roth IRA contribution limits. |

| U.S. Department of the Treasury | https://www.treasury.gov/ | The Treasury Department oversees the IRS and provides general information about financial regulations. |

| Financial Industry Regulatory Authority (FINRA) | https://www.finra.org/ | FINRA is a self-regulatory organization for the securities industry and offers resources on investing and retirement planning. |

| Securities and Exchange Commission (SEC) | https://www.sec.gov/ | The SEC is responsible for protecting investors and ensuring fair markets. Their website offers information on retirement savings and investing. |

Reputable Websites and Organizations

These organizations provide comprehensive information about Roth IRAs and contribution limits, as well as general financial advice.

- The Motley Fool:Offers articles, analysis, and tools for investors of all levels, including information on Roth IRAs.

- Investopedia:A popular website providing financial education and resources, including articles on Roth IRAs and retirement planning.

- Bankrate:Provides financial information and comparisons, including articles on Roth IRAs and retirement savings strategies.

- AARP:Offers resources for individuals over 50, including information on retirement planning and Roth IRAs.

Resources for Individuals Over 50

Here are some additional resources that can be particularly helpful for individuals over 50 seeking to understand Roth IRA contribution rules and strategies:

- Financial advisors:A financial advisor can provide personalized guidance on retirement planning and Roth IRA contributions, taking into account your individual circumstances and goals.

- Retirement planning workshops:Many organizations offer workshops and seminars on retirement planning, including information on Roth IRAs.

- Books and articles:There are many books and articles available on Roth IRAs and retirement planning, offering insights and strategies.

Final Conclusion

Taking advantage of the Roth IRA catch-up contribution for those over 50 can significantly impact your retirement savings. By understanding the rules, eligibility requirements, and strategies, you can make the most of this valuable opportunity. Remember to consult with a financial advisor to determine the best approach for your individual circumstances and retirement goals.

FAQ Guide: Roth IRA Contribution Limit For People Over 50 In 2024

What is the standard Roth IRA contribution limit in 2024?

The standard Roth IRA contribution limit in 2024 is $6,500. Those 50 and older can contribute an additional $1,000 for a total of $7,500.

Can I contribute to a Roth IRA if I have a 401(k)?

Yes, you can contribute to both a Roth IRA and a 401(k) if you meet the eligibility requirements for both.

Are Roth IRA contributions tax deductible?

No, Roth IRA contributions are not tax deductible. However, qualified withdrawals in retirement are tax-free.

What happens if I exceed the Roth IRA contribution limit?

If you exceed the contribution limit, you may be subject to a penalty. It’s essential to stay within the allowed limits.