October 2024 Income Tax Brackets for Qualifying Widow(er) represent a unique set of tax rules designed for surviving spouses who meet specific criteria. This filing status offers a potentially lower tax burden compared to single filing, allowing individuals to benefit from a larger standard deduction and potentially lower tax rates.

Understanding the eligibility requirements and navigating the tax brackets can significantly impact your tax liability, making it crucial to carefully review the information provided.

The Qualifying Widow(er) status allows a surviving spouse to file as if they were married filing jointly for two years following the death of their spouse, provided they meet certain conditions. These conditions include being unmarried and maintaining a household for a dependent child.

The status grants access to the lower tax brackets associated with married filing jointly, potentially resulting in significant tax savings.

Understanding Qualifying Widow(er) Status: October 2024 Income Tax Brackets For Qualifying Widow(er)

The Qualifying Widow(er) filing status is a special tax status that allows a surviving spouse to file as if they were married to their deceased spouse for two years after the spouse’s death. This status offers a more advantageous tax bracket than filing as “single” or “head of household.” This filing status offers significant tax benefits, particularly when compared to other filing statuses.

It’s essential to understand the eligibility criteria and duration of this status to determine if it’s applicable to your situation.

Eligibility Requirements for Qualifying Widow(er) Status

To claim Qualifying Widow(er) status, you must meet the following criteria:

- Your spouse must have passed away in either 2022 or 2023.

- You must have been legally married to your deceased spouse at the time of their death.

- You must not have remarried before the end of the tax year.

- You must have a dependent child living with you for the entire year.

- You must be the child’s primary caregiver.

Duration of Qualifying Widow(er) Status

Qualifying Widow(er) status is only applicable for two years following the year of your spouse’s death. This means that you can file as a Qualifying Widow(er) in the year of your spouse’s death and the following year.

Comparison with Other Filing Statuses

The Qualifying Widow(er) status offers a more favorable tax treatment than other filing statuses, such as single or head of household. It allows you to utilize the same tax brackets as married couples filing jointly, which generally results in lower tax liability.

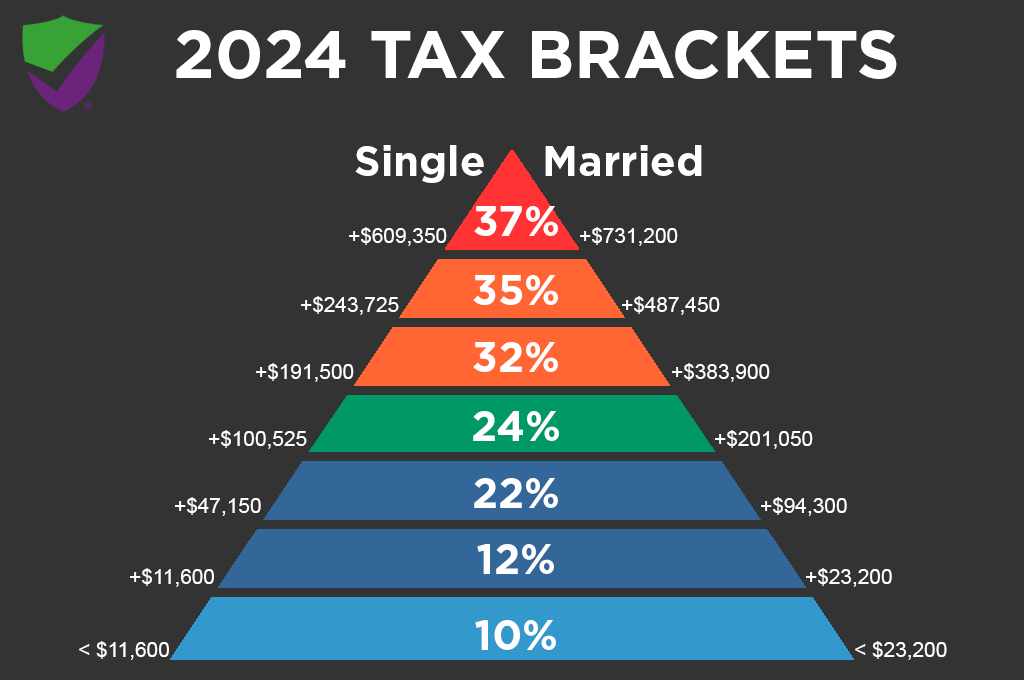

For example, in 2024, the tax rate for the first $21,200 of taxable income for Qualifying Widow(er) status is 10%, similar to the rate for married couples filing jointly. This rate is lower than the 12% rate for single filers and the 10% rate for head of household filers.

2024 Tax Brackets for Qualifying Widow(er)

The Qualifying Widow(er) filing status allows surviving spouses to benefit from lower tax rates for a period of time after the death of their spouse. This filing status offers the same tax advantages as Married Filing Jointly, but with a few key differences.

2024 Tax Brackets for Qualifying Widow(er) Filers

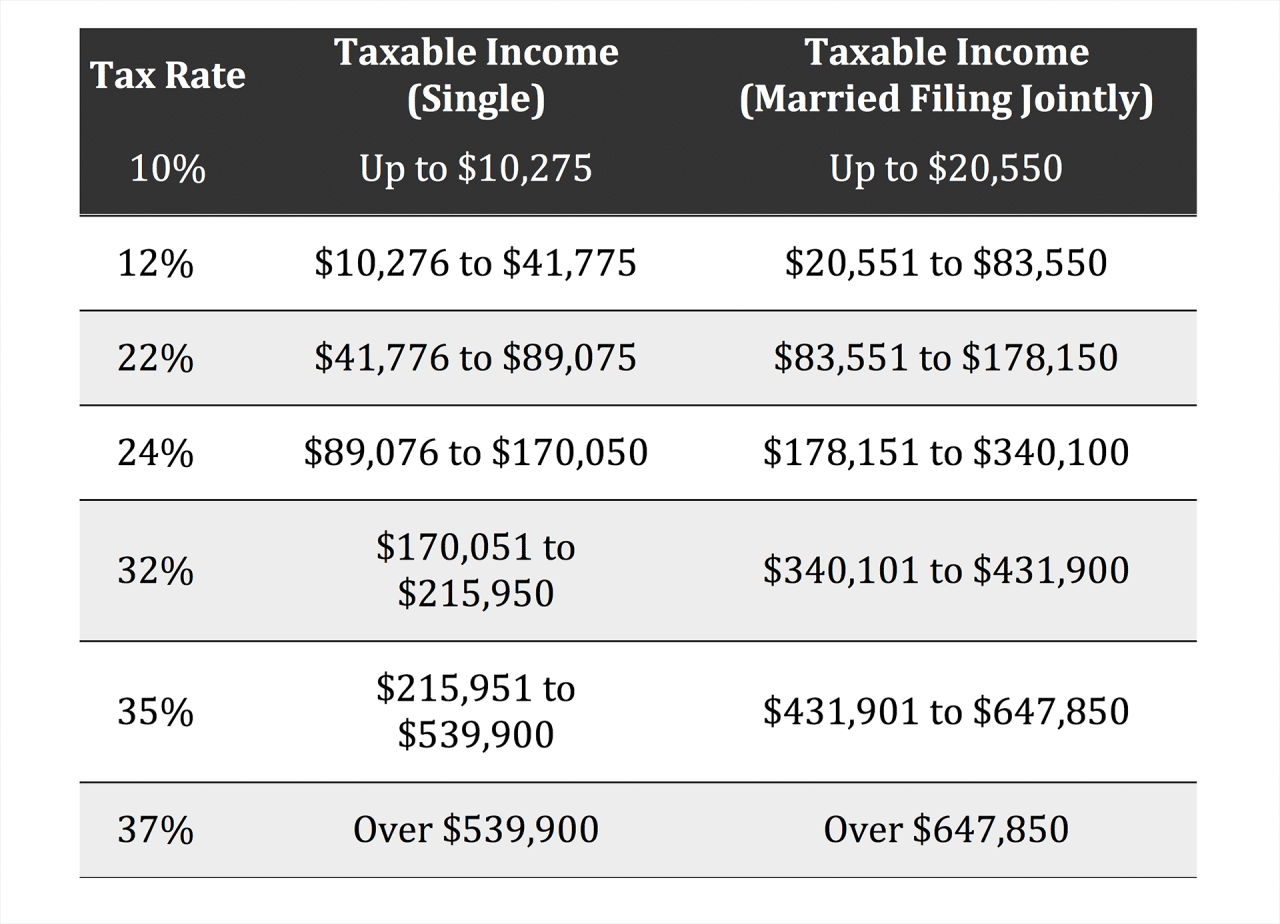

Here is a table outlining the 2024 income tax brackets for Qualifying Widow(er) filers, alongside the corresponding brackets for Single and Married Filing Jointly filers for comparison:

| Income Range | Qualifying Widow(er) Tax Rate | Single Filing Status Tax Rate | Married Filing Jointly Tax Rate |

|---|---|---|---|

$0

|

10% | 10% | 10% |

| $10,951

If you’re participating in a 401(k) plan, you’ll want to know the maximum 401(k) contribution for 2024. This limit can help you plan your retirement savings strategy.

|

12% | 12% | 12% |

$46,276

|

22% | 22% | 22% |

$101,751

|

24% | 24% | 24% |

| $192,151

If you’re married, you might be wondering about the IRA contribution limits for 2024 for married couples. These limits can vary depending on your income and other factors.

|

32% | 32% | 32% |

| $578,126

The 401(k) contribution limits for small business owners in 2024 can be different from those for employees of larger companies. It’s important to understand the specific rules for your situation.

|

35% | 35% | 35% |

| $693,751+ | 37% | 37% | 37% |

For instance, a Qualifying Widow(er) with a taxable income of $75,000 in 2024 would pay $14,395.50 in federal income tax, calculated as follows:

$10,950 x 10% + ($46,275

If you’re a family looking to understand your tax obligations, you might want to use a tax calculator. The tax calculator for families in October 2024 can help you estimate your tax liability and plan accordingly.

- $10,950) x 12% + ($75,000

- $46,275) x 22% = $14,395.50

Standard Deduction for Qualifying Widow(er) Filers in 2024

The standard deduction for Qualifying Widow(er) filers in 2024 is $27,700. This means that a Qualifying Widow(er) filer can deduct $27,700 from their adjusted gross income before calculating their taxable income.

Tax Credits and Deductions

Qualifying widow(er) filers can take advantage of various tax credits and deductions, just like other taxpayers. These benefits can significantly reduce their tax liability. Let’s explore some of the most relevant credits and deductions available in 2024.

Tax Credits

Tax credits are direct reductions in your tax liability. They can be either refundable or nonrefundable. Refundable credits can reduce your tax liability to zero and result in a refund, while nonrefundable credits can only reduce your tax liability to zero.

Here are some notable tax credits that qualifying widow(er) filers can claim:

Earned Income Tax Credit (EITC)

This credit is designed to help low-to-moderate-income working individuals and families. The amount of the credit depends on your income, filing status, and the number of qualifying children you have. The EITC can be a significant source of tax relief for eligible taxpayers.

Child Tax Credit

This credit can be claimed for each qualifying child under the age of 17. The credit amount is $2,000 per qualifying child.

American Opportunity Tax Credit

You might be wondering if you can contribute more than the Roth IRA limit in 2024. The answer is generally no, but there are some exceptions. The Roth IRA contribution limits for 2024 are set by the IRS and are designed to ensure fairness and prevent abuse of the system.

This credit is available for the first four years of post-secondary education. It is a refundable credit that can reduce your tax liability by up to $2,500 per student.

Premium Tax Credit

If you purchased health insurance through the Marketplace, you may be eligible for a premium tax credit to help offset the cost of your premiums. The amount of the credit depends on your income and the cost of your plan.

Tax Deductions

Tax deductions reduce your taxable income, which in turn lowers your tax liability. These deductions are usually based on specific expenses or contributions. Some notable deductions that qualifying widow(er) filers can claim are:

Standard Deduction

Most taxpayers choose to take the standard deduction, which is a set amount that varies based on your filing status.

Itemized Deductions

If you choose to itemize, you can deduct specific expenses, such as medical expenses, state and local taxes, mortgage interest, and charitable contributions.

You might be wondering if you can contribute to your 401(k) after taxes. The contribution limits for after-tax 401(k) contributions in 2024 can vary based on your employer’s plan.

Child Tax Credit

The Child Tax Credit can be claimed as a tax credit or a tax deduction, whichever is more beneficial for the taxpayer.

Student Loan Interest Deduction

If you are paying interest on student loans, you can deduct up to $2,500 of that interest.

Homeownership Deductions

These include deductions for mortgage interest and property taxes.

If you’re over 50, you might be eligible for catch-up contributions to your Roth IRA. The contribution limits for Roth IRAs in 2024 for those over 50 can help you accelerate your retirement savings.

Charitable Contributions

You can deduct charitable contributions, which are gifts made to qualified organizations.

The standard deduction for head of household in 2024 can be a valuable tax break for those who qualify. Understanding your filing status and eligibility for deductions is crucial for tax planning.

Changes in Tax Laws

It’s important to note that tax laws are constantly evolving. The information presented here is based on current legislation and may be subject to change. It’s crucial to consult with a tax professional for the most up-to-date guidance.For 2024, there are no significant changes specifically targeting the Qualifying Widow(er) status.

However, there are some general tax law changes that could indirectly impact your tax liability.

Standard Deduction Increase

The standard deduction amount is adjusted annually for inflation. For 2024, the standard deduction for Qualifying Widow(er) filers is expected to be higher than in previous years. This means that more of your income will be tax-free, potentially lowering your tax liability.

If you’re looking to save for retirement, you might be wondering how much you can contribute to a traditional IRA. The contribution limits for traditional IRAs in 2024 are subject to change, so it’s best to check with the IRS for the most up-to-date information.

The standard deduction for Qualifying Widow(er) filers in 2024 is estimated to be \$20,800.

Tax Rate Changes

The tax brackets and rates are subject to adjustments based on inflation and economic conditions. In 2024, there may be minor changes to the tax brackets and rates. It’s essential to stay informed about these adjustments as they could impact your tax liability.

When it comes to filing your taxes, you might be wondering if you can claim the standard deduction. The standard deduction for 2024 can vary based on your filing status, so it’s important to understand your options.

For example, if the tax brackets are adjusted upward, you might find yourself in a higher tax bracket, leading to a higher tax liability.

Changes to Tax Credits and Deductions

Tax credits and deductions can significantly reduce your tax liability. In 2024, there may be changes to the eligibility criteria, amounts, or phase-out thresholds for various tax credits and deductions. It’s important to research these changes and determine if they impact your tax situation.

The 401(k) contribution limits for 2024 by age can vary, so it’s important to understand the limits that apply to you. This can help you maximize your retirement savings.

For instance, the Child Tax Credit may have adjusted eligibility requirements or a modified phase-out threshold.

The W9 Form October 2024 penalties for non-compliance can be significant, so it’s important to make sure you’re filing your W9 forms correctly. Penalties can include fines and even imprisonment in some cases.

Filing Requirements

As a Qualifying Widow(er), you’ll need to gather specific documents and follow a specific process when filing your taxes. Understanding these requirements is crucial to ensure a smooth and accurate filing.

If you’re driving for business, you might be interested in the mileage rate for October 2024. This rate can help you deduct your business expenses on your taxes.

Documents Required for Filing

To file your taxes as a Qualifying Widow(er) in 2024, you’ll need to gather several essential documents. These documents provide the IRS with the necessary information to calculate your tax liability accurately.

- Social Security Number (SSN): Your SSN is essential for identifying you and your dependents on your tax return. You’ll need your own SSN and the SSNs of any dependents you claim.

- Form W-2: This form summarizes your wages and withholdings from your employer for the year. You’ll receive a separate Form W-2 for each employer you worked for.

- Form 1099: If you received income from sources other than your employer, such as interest, dividends, or freelance work, you’ll receive Form 1099. There are different types of Form 1099, so ensure you have all the relevant ones.

- Form 1095-A: If you obtained health insurance through the Marketplace, you’ll receive this form. It provides information about your health insurance coverage, which you’ll need to claim the Premium Tax Credit.

- Previous Year’s Tax Return: Having a copy of your previous year’s tax return can be helpful in determining your tax liability and identifying any changes in your tax situation.

- Death Certificate of Spouse: To qualify for the Qualifying Widow(er) filing status, you must provide a copy of your deceased spouse’s death certificate.

- Other Relevant Documents: Depending on your individual circumstances, you may need other documents, such as Form 1040-X (Amended U.S. Individual Income Tax Return) or Form 8880 (Credit for Qualified Adoption Expenses).

Steps in Filing Your Taxes

The process of filing your taxes as a Qualifying Widow(er) involves several steps, ensuring you accurately report your income, deductions, and credits.

- Gather Your Documents: Begin by collecting all the necessary documents mentioned earlier. This ensures you have all the information required for accurate filing.

- Choose Your Filing Method: You can file your taxes electronically through tax preparation software or online services, or you can file by mail using paper forms. The IRS encourages electronic filing, which is generally faster and more accurate.

- Complete Your Tax Return: Using the appropriate tax forms, carefully enter all the required information, including your income, deductions, and credits. Ensure you accurately report your Qualifying Widow(er) status and provide all necessary supporting documentation.

- Review Your Return: Before filing, review your tax return thoroughly to ensure accuracy. Double-check your calculations, deductions, and credits to avoid errors. Consider seeking assistance from a tax professional if you’re unsure about any aspect of the process.

- File Your Return: Once you’re satisfied with your tax return, file it electronically or by mail, depending on your chosen method. If filing by mail, ensure you send it by the tax deadline to avoid penalties.

Flowchart Illustrating the Filing Process

The following flowchart provides a visual representation of the steps involved in filing your taxes as a Qualifying Widow(er):[Image description: A flowchart illustrating the process of filing taxes as a Qualifying Widow(er). It begins with “Gather necessary documents,” leading to “Choose filing method.” The flowchart branches out into “File electronically” and “File by mail.” Both paths converge at “Complete tax return,” followed by “Review tax return,” and finally, “File tax return.” The flowchart emphasizes the importance of accuracy and thoroughness throughout the process.]

If you’re a business owner, you’ll want to be aware of the October 2024 tax deadline for businesses. This deadline can vary depending on your business structure, so it’s important to check with your accountant or the IRS to ensure you meet the correct deadline.

Common Mistakes and Solutions

Filing as a Qualifying Widow(er) can offer significant tax benefits, but it’s crucial to avoid common mistakes that could lead to complications or even penalties. This section will highlight frequent errors made by Qualifying Widow(er) filers and provide practical solutions to ensure accurate and compliant tax preparation.

Incorrect Filing Status

The most common mistake is misclassifying your filing status. You must meet specific criteria to file as a Qualifying Widow(er). Failing to meet these requirements can result in penalties and back taxes.

- Requirement:You must have been married to the deceased spouse and have a qualifying child living with you for the entire year. You must also have been the surviving spouse’s main residence for the entire year.

- Solution:Carefully review the IRS requirements for Qualifying Widow(er) status. If you don’t meet all the criteria, you must file as a Single filer or Head of Household. Consulting a tax professional can help ensure you choose the correct filing status.

Incorrectly Claiming Dependent Exemptions

You can claim dependent exemptions for qualifying children, but errors in claiming these exemptions can lead to incorrect deductions.

- Requirement:Qualifying children must meet specific age, relationship, and residency requirements. They must also be financially dependent on you.

- Solution:Ensure you understand the IRS rules for claiming dependent exemptions. Keep thorough records of your children’s income and expenses to support your claims. If you’re unsure about a child’s eligibility, seek guidance from a tax professional.

Overlooking Deductions and Credits, October 2024 income tax brackets for qualifying widow(er)

Qualifying Widow(er) filers are eligible for various deductions and credits, but overlooking these benefits can result in a higher tax liability.

If you’re considering a Roth IRA, you might be interested in the IRA contribution limits for Roth IRAs in 2024. These limits can vary based on your income and other factors.

- Requirement:You must meet the eligibility requirements for each deduction and credit, including income limitations and other conditions.

- Solution:Research available deductions and credits for Qualifying Widow(er) filers, such as the Child Tax Credit, Earned Income Tax Credit, and standard deduction. Consult a tax professional to identify all applicable deductions and credits.

Failing to Keep Proper Records

Maintaining accurate and organized financial records is essential for any taxpayer, especially for Qualifying Widow(er) filers who may be dealing with additional complexities.

- Requirement:You must keep records for at least three years after filing your return or the date of assessment, whichever is later.

- Solution:Organize your financial records, including income statements, receipts, and tax documents. Use a filing system that allows for easy access and retrieval. Consider using accounting software or a dedicated tax filing service to simplify record-keeping.

Not Filing on Time

Missing the filing deadline can lead to penalties and interest charges.

- Requirement:The tax filing deadline is typically April 15th of each year. However, it may be extended in certain circumstances.

- Solution:Mark the filing deadline on your calendar. If you need more time to file, consider requesting an extension from the IRS. Filing an extension doesn’t extend the time to pay your taxes.

Incorrectly Calculating Tax Liability

Errors in calculating your tax liability can lead to overpayment or underpayment of taxes.

- Requirement:You must accurately calculate your taxable income, deductions, and credits to determine your tax liability.

- Solution:Use reputable tax software or consult a tax professional to ensure accurate calculations. Double-check your tax return before submitting it to the IRS.

Last Recap

Understanding the intricacies of the Qualifying Widow(er) filing status, including its eligibility requirements, tax brackets, and applicable deductions, is crucial for maximizing tax benefits and minimizing potential liabilities. By carefully reviewing the information presented and seeking professional guidance when needed, surviving spouses can ensure accurate tax filing and navigate the tax system effectively.

Essential FAQs

How long can I file as a Qualifying Widow(er)?

You can file as a Qualifying Widow(er) for two years following the death of your spouse, provided you meet the eligibility requirements.

What if I remarry during the two-year period?

If you remarry during the two-year period, you can no longer file as a Qualifying Widow(er). You will need to file as single or head of household for the remaining years.

What are the tax implications of claiming Qualifying Widow(er) status?

Claiming Qualifying Widow(er) status can result in a lower tax liability compared to single filing, as you benefit from the lower tax brackets associated with married filing jointly. You also receive a larger standard deduction.

Can I claim Qualifying Widow(er) status if I have a dependent child who is not my biological child?

Yes, you can claim Qualifying Widow(er) status if you have a dependent child who is not your biological child, as long as they meet the requirements for being a dependent.