Roth IRA contribution limits for 2024 by age are a crucial factor for anyone considering this retirement savings strategy. Understanding these limits and how they might differ based on your age is essential for maximizing your contributions and potential tax-free withdrawals in retirement.

The contribution limits are designed to help individuals save for their future, while also offering tax advantages that can significantly impact your overall financial well-being.

The maximum contribution amount for Roth IRAs in 2024 is $6,500 for individuals under 50 and $7,500 for those 50 and older. This means that if you are under 50, you can contribute up to $6,500 to your Roth IRA in 2024.

However, if you are 50 or older, you can contribute an additional $1,000, bringing your total contribution limit to $7,500. This extra contribution allowance, known as a catch-up contribution, is designed to help older individuals make up for lost time in their retirement savings journey.

Roth IRA Contribution Limits for 2024

For 2024, the maximum amount you can contribute to a Roth IRA is \$7,500. If you’re 50 or older, you can make an additional \$1,500 in “catch-up” contributions, bringing your total contribution limit to \$9,000.

Planning to contribute to an IRA in 2024? You’ll need to know the contribution limits! Learn about the IRA contribution limits for 2024 to make sure you’re within the allowed range.

Contribution Limits by Age

The contribution limit for Roth IRAs is the same for everyone, regardless of age. However, there is a catch-up contribution limit for individuals who are 50 years old or older. This allows them to contribute an additional amount to their Roth IRA each year.

The maximum amount you can contribute to a Roth IRA in 2024 is \$7,500. If you’re 50 or older, you can contribute an additional \$1,500 in “catch-up” contributions, bringing your total contribution limit to \$9,000.

The IRS sets limits on how much you can contribute to your 401k each year. Check out the IRS 401k contribution limit for 2024 to see how much you can save.

Contribution Limits for Individuals and Couples Filing Jointly

The contribution limit for Roth IRAs is the same for individuals and couples filing jointly. However, the amount you can contribute may be affected by your income.

If you’re considering a Roth IRA, it’s important to understand how your income affects your eligibility. Check out the tax brackets for 2024 to see how they might impact your contributions.

The maximum amount you can contribute to a Roth IRA in 2024 is \$7,500. If you’re 50 or older, you can contribute an additional \$1,500 in “catch-up” contributions, bringing your total contribution limit to \$9,000.

Eligibility for Roth IRA Contributions

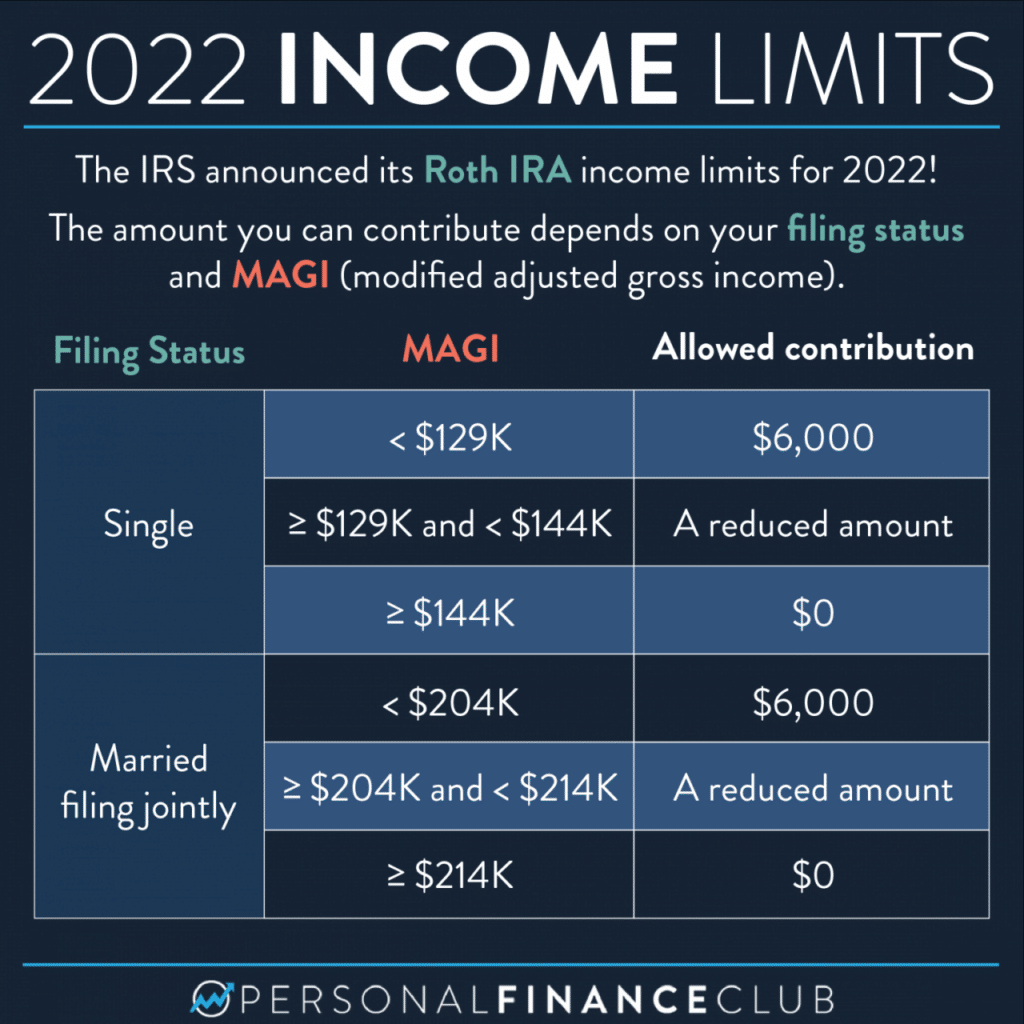

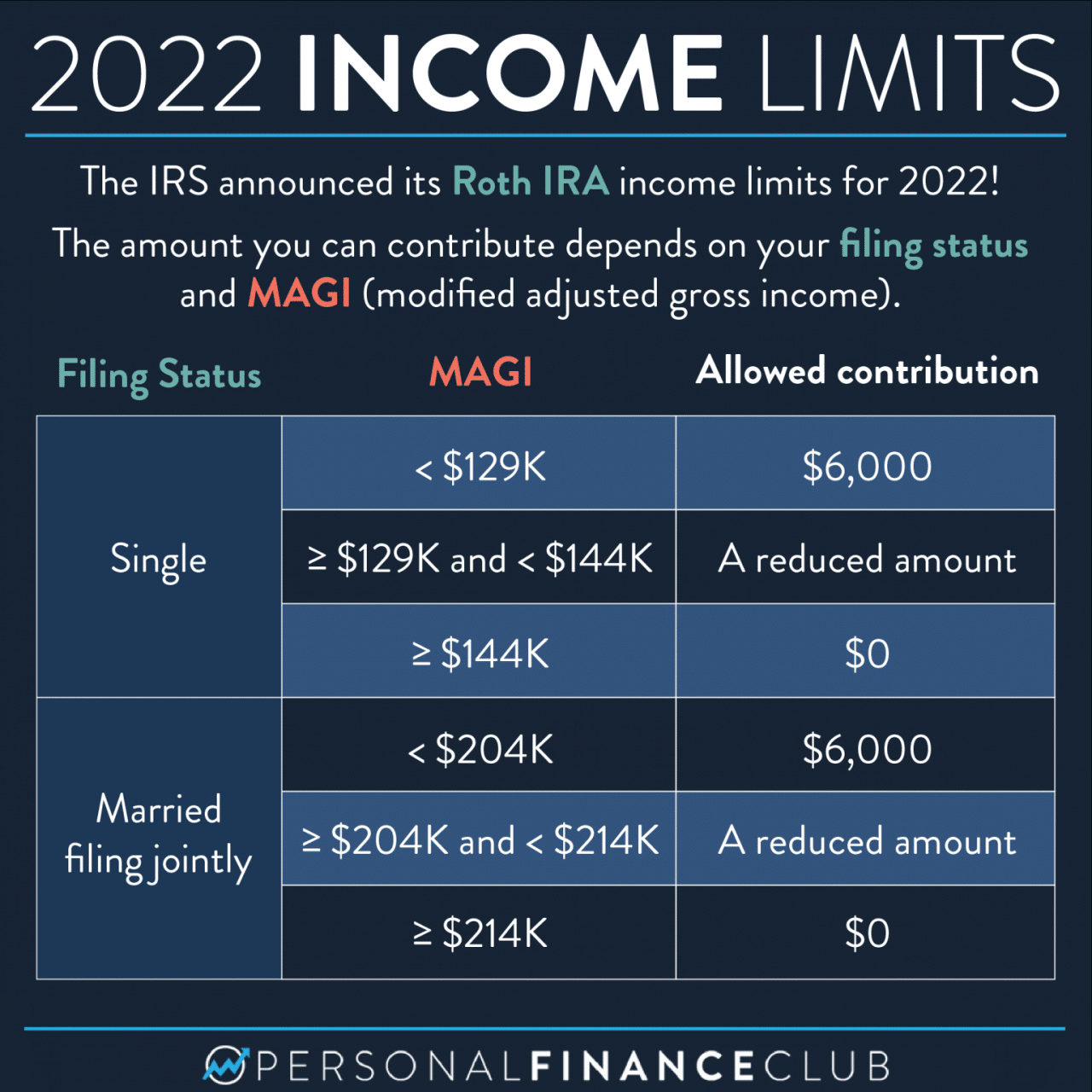

While anyone can open a Roth IRA, not everyone is eligible to contribute to one. The eligibility for Roth IRA contributions is based on your modified adjusted gross income (MAGI), which is your adjusted gross income (AGI) with certain adjustments.

The MAGI thresholds for Roth IRA contributions are based on your filing status and the year you are contributing.

If you’re looking to maximize your retirement savings, you’ll want to know the 401k contribution limits for 2024 based on your income level. These limits can change each year, so it’s good to stay informed.

Income Limitations for Roth IRA Contributions

In 2024, if your MAGI exceeds certain thresholds, you may not be able to contribute to a Roth IRA, or you may only be able to contribute a reduced amount. Here’s how the income limits for Roth IRA contributions work in 2024:

- If your MAGI is below the threshold, you can contribute the full amount to your Roth IRA.

- If your MAGI is above the threshold, you may not be able to contribute to a Roth IRA, or you may only be able to contribute a reduced amount.

- If your MAGI is between the threshold and the phase-out range, you can contribute a reduced amount.

Modified Adjusted Gross Income (MAGI) Thresholds

Here are the MAGI thresholds for Roth IRA contributions in 2024, based on filing status:

| Filing Status | Phase-Out Begins | Phase-Out Ends |

|---|---|---|

| Single Filers | $153,000 | $168,000 |

| Married Filing Jointly | $228,000 | $243,000 |

| Head of Household | $186,000 | $201,000 |

Eligibility Criteria for Different Filing Statuses, Roth IRA contribution limits for 2024 by age

The eligibility criteria for Roth IRA contributions vary based on your filing status.

- Single Filers:If your MAGI is $153,000 or less in 2024, you can contribute the full amount to your Roth IRA. If your MAGI is between $153,000 and $168,000, you can contribute a reduced amount. If your MAGI is over $168,000, you cannot contribute to a Roth IRA.

Looking to contribute to a SIMPLE IRA in 2024? Learn about the IRA contribution limits for SIMPLE IRA in 2024 to make sure you’re within the allowed range.

- Married Filing Jointly:If your MAGI is $228,000 or less in 2024, you can contribute the full amount to your Roth IRA. If your MAGI is between $228,000 and $243,000, you can contribute a reduced amount. If your MAGI is over $243,000, you cannot contribute to a Roth IRA.

Wondering how much you can deduct from your taxes? Learn about the standard deduction for 2024 to maximize your savings.

- Head of Household:If your MAGI is $186,000 or less in 2024, you can contribute the full amount to your Roth IRA. If your MAGI is between $186,000 and $201,000, you can contribute a reduced amount. If your MAGI is over $201,000, you cannot contribute to a Roth IRA.

Benefits of Contributing to a Roth IRA

Contributing to a Roth IRA offers several tax advantages that can significantly benefit your retirement savings. One of the key advantages is that your contributions are made with after-tax dollars, meaning you’ve already paid taxes on the money you contribute.

Wondering if you can contribute to a Roth IRA in 2024? It depends on your income! Check out the Roth IRA income limits for 2024 to see if you qualify.

This allows your investments to grow tax-free, and when you withdraw the money in retirement, it’s completely tax-free.

Tax-Free Distributions in Retirement

A significant benefit of Roth IRA contributions is that qualified distributions in retirement are tax-free. This means you won’t have to pay any taxes on the money you withdraw, unlike traditional IRA distributions, which are taxed as ordinary income.

Running a small business? You might need to file for a tax extension. Check out the tax extension deadline for October 2024 for small businesses to make sure you’re on track.

For example, if you contribute $6,500 to a Roth IRA in 2024 and it grows to $50,000 by the time you retire, you can withdraw the entire $50,000 tax-free.

Comparison with Traditional IRA Contributions

While both Roth and traditional IRAs offer tax benefits, they differ in how taxes are applied. With a traditional IRA, you contribute pre-tax dollars, meaning you get a tax deduction in the year you contribute. However, you’ll need to pay taxes on your withdrawals in retirement.

- Roth IRA:Contributions are made with after-tax dollars, and withdrawals in retirement are tax-free.

- Traditional IRA:Contributions are made with pre-tax dollars, and withdrawals in retirement are taxed as ordinary income.

The choice between a Roth IRA and a traditional IRA depends on your individual circumstances and tax bracket. If you expect to be in a higher tax bracket in retirement than you are now, a Roth IRA may be more beneficial, as you’ll avoid paying taxes on your withdrawals.

Conversely, if you expect to be in a lower tax bracket in retirement, a traditional IRA may be more advantageous.

Catch-Up Contributions for Older Individuals

Individuals aged 50 and older have the opportunity to contribute more to their Roth IRA accounts. This provision allows those nearing retirement to accelerate their savings and potentially increase their retirement nest egg.

Need to track your mileage for business purposes? Find the current mileage rate for October 2024 to ensure your deductions are accurate.

Catch-Up Contribution Limit for 2024

For the 2024 tax year, individuals aged 50 and older can contribute an additional $1,000 to their Roth IRA, on top of the regular contribution limit. This means that individuals aged 50 and over can contribute a total of $7,500 to their Roth IRA in 2024.

Impact of Catch-Up Contributions on Retirement Savings

Catch-up contributions can significantly impact retirement savings. Consider a hypothetical scenario:

A 55-year-old individual starts making catch-up contributions of $1,000 annually for the next 10 years. Assuming an average annual return of 7%, their additional contributions would grow to approximately $15,000 by the time they reach age 65.

This example illustrates how catch-up contributions can provide a substantial boost to retirement savings, especially when combined with consistent contributions throughout the years.

As an independent contractor, you’ll need to fill out a W9 form for your clients. Make sure you’re using the correct form by checking out the W9 form for October 2024 for independent contractors.

Contribution Strategies for Different Age Groups: Roth IRA Contribution Limits For 2024 By Age

As you approach retirement, your contribution strategy should evolve. Younger individuals can benefit from maximizing contributions to take advantage of compound growth, while those closer to retirement may prioritize income security and potentially lower contributions to avoid potential penalties.

Contribution Strategies by Age Group

Here’s a table outlining recommended contribution strategies for different age groups, considering the 2024 contribution limit of $7,500:

| Age Range | Contribution Limit | Recommended Contribution Amount |

|---|---|---|

| 20-30 | $7,500 | $7,500 (Maximize contributions) |

| 30-40 | $7,500 | $7,500 (Maximize contributions) |

| 40-50 | $7,500 | $7,500 (Maximize contributions) |

| 50-60 | $7,500 | $5,000

Want to contribute to a Roth 401k in 2024? Check out the 401k contribution limits for 2024 for Roth 401k to see how much you can save.

|

| 60+ | $7,500 | $0

|

These are just general recommendations, and your specific situation may vary. It’s always best to consult with a financial advisor to determine the best strategy for your individual needs and circumstances.

Roth IRA Contribution Deadline

The deadline for making Roth IRA contributions for the 2024 tax year is typically April 15, 2025. This deadline applies to both traditional and Roth IRAs.However, if you are self-employed or have a deadline extension for filing your taxes, you have until October 15, 2025, to make your Roth IRA contributions for the 2024 tax year.

Missing the Contribution Deadline

Missing the contribution deadline for a Roth IRA can have significant implications for your retirement savings. You will not be able to claim the contribution on your tax return for the relevant tax year, potentially reducing your tax refund or increasing your tax liability.

Don’t forget about your retirement savings! Find out the IRA contribution limits for 2024 so you can plan your contributions accordingly.

Furthermore, the contribution will not be considered part of your Roth IRA until the following year, limiting your potential tax-free growth.

Missed the tax deadline? Don’t panic! You can file an extension, but be aware of the potential penalties for not filing an extension by October 2024.

Late Contributions

If you miss the contribution deadline for a Roth IRA, you have a few options for making late contributions:

- Make the contribution before the extended deadline.This option is only available if you are self-employed or have a deadline extension for filing your taxes. You can make the contribution by the extended deadline of October 15, 2025, and claim it on your tax return for the 2024 tax year.

Filing your taxes as a single filer in 2024? You can take advantage of the standard deduction, but it’s important to know the amount. Find out the standard deduction for single filers in 2024 to ensure you’re getting the most out of your deductions.

- Make the contribution after the extended deadline.If you miss the extended deadline, you can still make the contribution, but it will be considered a contribution for the following tax year. For example, if you miss the deadline for 2024, you can make the contribution in 2025 and it will be considered a contribution for the 2025 tax year.

However, you will not be able to claim the contribution on your 2024 tax return.

It is essential to consult with a financial advisor or tax professional to understand the specific implications of making late contributions to a Roth IRA. They can help you determine the best course of action based on your individual circumstances.

Final Review

Contributing to a Roth IRA offers numerous advantages, including tax-free withdrawals in retirement, the potential for tax-free growth, and flexibility in retirement planning. Understanding the contribution limits and eligibility requirements is key to maximizing your Roth IRA contributions and reaping the benefits of this powerful retirement savings tool.

Key Questions Answered

What is the difference between a Roth IRA and a Traditional IRA?

A Roth IRA is funded with after-tax dollars, meaning you pay taxes on your contributions upfront. In contrast, a Traditional IRA is funded with pre-tax dollars, allowing you to deduct your contributions from your taxable income. However, withdrawals from a Roth IRA are tax-free in retirement, while withdrawals from a Traditional IRA are taxed as income.

Can I contribute to both a Roth IRA and a Traditional IRA in the same year?

Yes, you can contribute to both a Roth IRA and a Traditional IRA in the same year, but there are income limitations for contributing to a Roth IRA. If you exceed the income limits, you may not be eligible to contribute to a Roth IRA, but you can still contribute to a Traditional IRA.

What happens if I contribute more than the maximum Roth IRA contribution limit?

If you contribute more than the maximum Roth IRA contribution limit, you may be subject to penalties. The IRS may assess a 6% penalty on the excess contribution, and you may also have to pay taxes on the excess contribution.

When is the deadline to make Roth IRA contributions for 2024?

The deadline to make Roth IRA contributions for the 2024 tax year is April 15, 2025. However, if you are self-employed, you have until October 15, 2025, to make your contributions.