Am I eligible to contribute to a Roth IRA in 2024? This question is on the minds of many individuals looking to secure their financial future. The Roth IRA, with its potential for tax-free withdrawals in retirement, has become a popular retirement savings vehicle.

But, eligibility for Roth IRA contributions is not universal, and certain income limitations and other factors can impact your ability to contribute.

This guide will delve into the intricacies of Roth IRA eligibility in 2024, providing a comprehensive understanding of the rules and regulations that govern contributions. We’ll explore the modified adjusted gross income (MAGI) limits, the concept of “phase-out,” and other factors that can influence your eligibility.

We’ll also shed light on the benefits of Roth IRAs, including tax-free growth and withdrawals, and discuss the consequences of contributing when ineligible.

Eligibility Requirements for Roth IRA Contributions in 2024

To contribute to a Roth IRA in 2024, you must meet certain eligibility requirements, primarily based on your income. The rules governing Roth IRA contributions are designed to ensure that the benefits of tax-free withdrawals in retirement are primarily available to those with modest incomes.

Modified Adjusted Gross Income (MAGI) Limits

The eligibility for Roth IRA contributions is determined by your Modified Adjusted Gross Income (MAGI), which is your adjusted gross income (AGI) with certain additions and subtractions. If your MAGI exceeds certain limits, you may not be able to contribute to a Roth IRA, or your contributions may be partially limited.

2024 MAGI Limits for Roth IRA Contributions

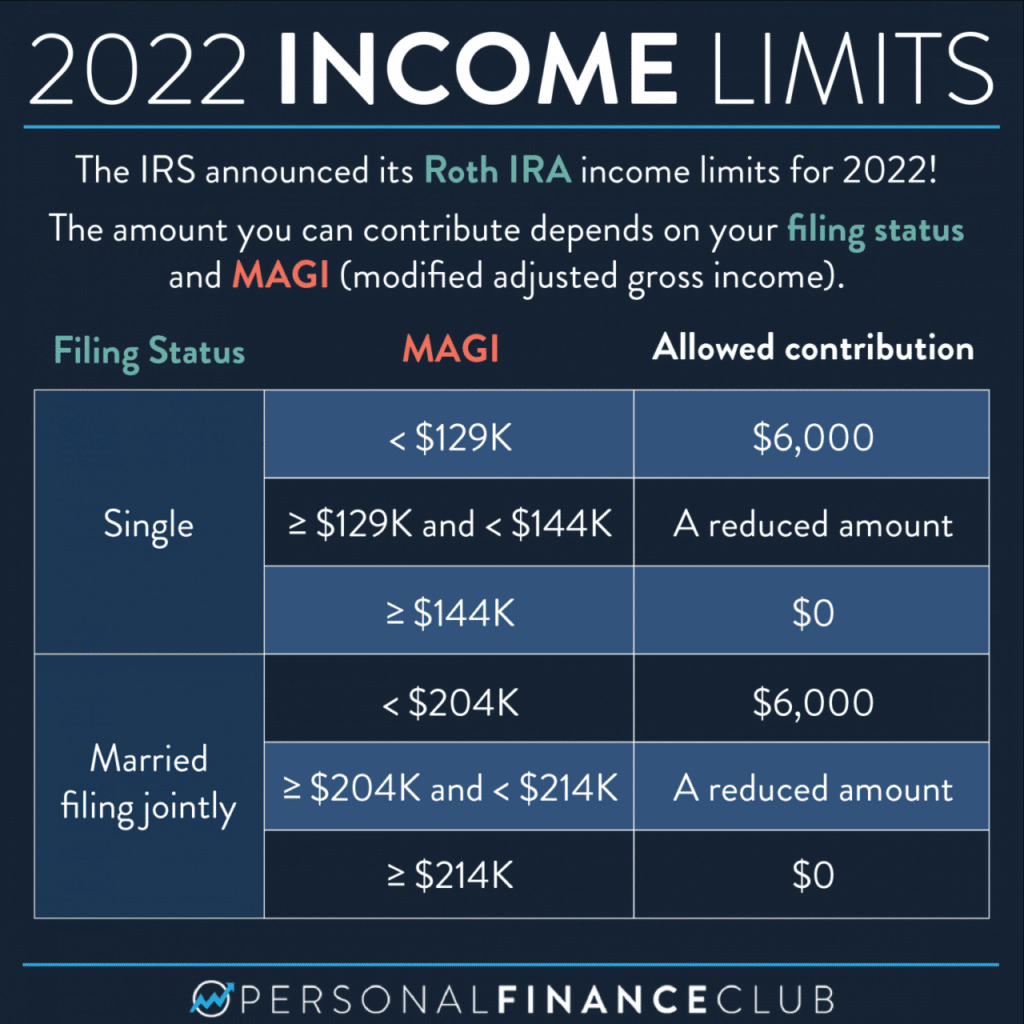

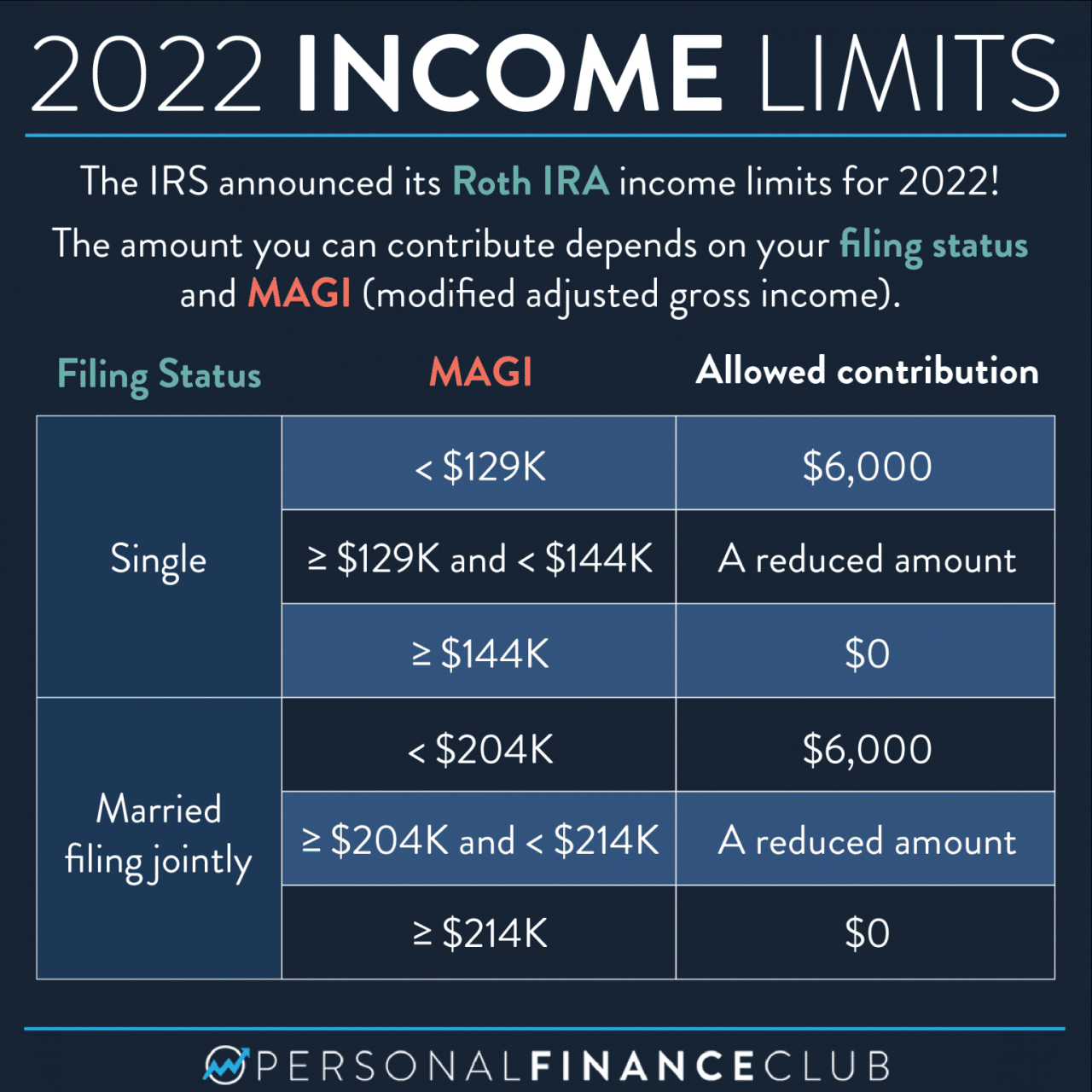

The following table Artikels the 2024 MAGI limits for Roth IRA contributions:| Filing Status | Phase-out Begins | Phase-out Ends ||—|—|—|| Single | $153,000 | $168,000 || Married Filing Jointly | $228,000 | $248,000 || Head of Household | $189,000 | $214,000 |

If you’re a single filer, it’s important to know the IRA contribution limits for your filing status. You can find the IRA contribution limits for 2024 for single filers to make informed decisions about your retirement savings.

Comparison with 2023 Limits

The 2024 MAGI limits for Roth IRA contributions are slightly higher than the 2023 limits. Here’s a comparison:| Filing Status | 2023 Phase-out Begins | 2023 Phase-out Ends | 2024 Phase-out Begins | 2024 Phase-out Ends ||—|—|—|—|—|| Single | $144,000 | $158,000 | $153,000 | $168,000 || Married Filing Jointly | $214,000 | $228,000 | $228,000 | $248,000 || Head of Household | $178,000 | $204,000 | $189,000 | $214,000 |

Non-profit organizations also have a tax extension deadline of October 2024. If your organization needs more time to file, you can find the necessary information on the tax extension deadline October 2024 for non-profit organizations.

Impact of Filing Status and Income on Roth IRA Eligibility

Your filing status and income play a significant role in determining your eligibility for Roth IRA contributions. For instance, a single filer with a MAGI of $160,000 would be eligible to contribute to a Roth IRA in 2024, but a married couple filing jointly with a MAGI of $235,000 would not be eligible.

Phase-Out for Roth IRA Contributions

The “phase-out” is a gradual reduction in your contribution limit as your MAGI increases. If your MAGI falls within the phase-out range, you may be able to contribute to a Roth IRA, but the amount you can contribute will be reduced.

For example, if you are single and your MAGI is $160,000 in 2024, you will not be able to contribute the full $6,500 to a Roth IRA. The exact amount you can contribute will be determined by a formula based on your MAGI and the phase-out range.

Example:Let’s say you are single and your MAGI is $160,000 in 2024. You are within the phase-out range for Roth IRA contributions. The phase-out range for single filers in 2024 is between $153,000 and $168,000. To calculate your contribution limit, you would use a formula that considers your MAGI and the phase-out range.

Corporations also have a tax extension deadline of October 2024. If your business needs more time to file, you can find the necessary information on tax extension deadline October 2024 for corporations.

Understanding the Roth IRA

A Roth IRA is a retirement savings plan that offers tax advantages, particularly for those who expect to be in a higher tax bracket during retirement than they are now. Unlike a traditional IRA, where contributions are tax-deductible and withdrawals are taxed in retirement, contributions to a Roth IRA are made with after-tax dollars, but withdrawals in retirement are tax-free.

If you’re using your vehicle for business purposes, the IRS mileage rate is important for deducting expenses. You can find the current IRS mileage rate for October 2024 to accurately calculate your deductions.

Key Features of a Roth IRA

The Roth IRA offers several key features that make it an attractive retirement savings option for many individuals.

Tax brackets can vary depending on your filing status. If you’re a single filer, you can check out the tax brackets for single filers in 2024 to understand how your income will be taxed.

- Tax-free withdrawals in retirement:This is perhaps the most significant advantage of a Roth IRA. Once you reach age 59 1/2 and have held the account for at least five years, you can withdraw both your contributions and earnings tax-free. This can be especially beneficial if you expect to be in a higher tax bracket in retirement.

- No Required Minimum Distributions (RMDs):Unlike traditional IRAs, Roth IRAs don’t have required minimum distributions (RMDs) after age 72. This means you can leave your money in the account to grow tax-free for as long as you want.

- Potential for Tax-Free Growth:Your Roth IRA contributions grow tax-deferred, meaning you don’t pay taxes on the earnings until you withdraw them. This allows your money to grow at a faster rate compared to taxable investments.

- Flexibility:Roth IRAs offer flexibility in terms of investment options. You can choose from a wide range of investments, including stocks, bonds, mutual funds, and exchange-traded funds (ETFs), to align with your risk tolerance and investment goals.

Comparison with Traditional IRA

- Contribution Deductibility:Traditional IRA contributions are tax-deductible, meaning you can deduct them from your taxable income in the year you make them. This can reduce your current tax liability. Roth IRA contributions are not tax-deductible, but withdrawals in retirement are tax-free.

Planning for retirement is important, and knowing your 401k contribution limit is crucial. You can find out how much can I contribute to my 401k in 2024 after taxes to maximize your retirement savings.

- Withdrawal Taxation:Traditional IRA withdrawals are taxed in retirement. Roth IRA withdrawals are tax-free.

- Tax Bracket:If you expect to be in a lower tax bracket in retirement than you are now, a traditional IRA might be more advantageous. If you expect to be in a higher tax bracket in retirement, a Roth IRA might be a better choice.

The standard deduction amount can affect your tax liability. You can find out the standard deduction amount for 2024 tax year to make informed decisions about your tax strategy.

Tax Implications of Contributions and Withdrawals

- Traditional IRA:

- Contributions:Tax-deductible in the year of contribution.

- Withdrawals:Taxed as ordinary income in retirement.

- Roth IRA:

- Contributions:Not tax-deductible.

- Withdrawals:Tax-free in retirement.

Potential Benefits of Contributing to a Roth IRA

- Tax-free Growth and Withdrawals:This is the primary benefit of a Roth IRA. By contributing after-tax dollars, you avoid paying taxes on the earnings and withdrawals in retirement.

- Potential for Higher Returns:The tax-free growth potential of a Roth IRA can lead to higher returns compared to taxable investments.

- Financial Security in Retirement:A Roth IRA can provide financial security in retirement, allowing you to enjoy your savings without having to worry about taxes.

Contribution Limits for Roth IRAs in 2024

The annual contribution limit for Roth IRAs in 2024 is the maximum amount you can contribute to your Roth IRA without facing penalties. Understanding this limit is crucial for maximizing your retirement savings potential.

Similar to corporations, small businesses also have a tax extension deadline of October 2024. You can find more information on tax extension deadline October 2024 for small businesses to ensure you’re meeting your tax obligations.

Contribution Limit for Roth IRAs in 2024

The maximum annual contribution limit for Roth IRAs in 2024 is $6,500. This means that you can contribute up to $6,500 to your Roth IRA during the year, regardless of your income level.

If you’re considering an IRA, it’s important to know the maximum contribution limit. The maximum IRA contribution for 2024 can help you plan your retirement savings strategy.

Contribution Limit for Individuals Aged 50 and Over

Individuals aged 50 and over are eligible for an additional “catch-up” contribution. In 2024, this catch-up contribution limit is $1,000. This means that individuals aged 50 and over can contribute a total of $7,500 to their Roth IRA ($6,500 regular contribution limit + $1,000 catch-up contribution).

Understanding the tax bracket changes for 2024 is essential for accurate tax planning. You can check out the tax bracket changes for 2024 to see how they may affect your income and tax liability.

Consequences of Exceeding the Contribution Limit

Exceeding the annual contribution limit for Roth IRAs can result in penalties. The Internal Revenue Service (IRS) may impose a 6% penalty on the amount exceeding the limit. Additionally, you may be required to withdraw the excess contribution, which could include any earnings on the excess amount.

Self-employed individuals have specific IRA contribution limits. You can find out the IRA contribution limits for self-employed in 2024 to make informed decisions about your retirement savings.

Contribution Limits and Retirement Savings Strategies

Contribution limits can significantly impact your retirement savings strategies. For instance, if you are nearing retirement and have a substantial income, you may want to consider contributing the maximum amount allowed to your Roth IRA. This can help you accumulate a larger nest egg for retirement and potentially reduce your tax liability in the future.

On the other hand, if you are younger and have a lower income, you may choose to contribute less to your Roth IRA and focus on other financial goals, such as paying down debt or saving for a down payment on a house.

Small businesses can benefit from using a tax calculator to estimate their tax liability. Check out the tax calculator for small businesses in October 2024 to get a better understanding of your tax obligations.

Factors Influencing Roth IRA Eligibility

While meeting the modified adjusted gross income (MAGI) requirements is crucial, other factors can influence your eligibility to contribute to a Roth IRA. Understanding these factors can help you determine your eligibility and make informed decisions about your retirement savings.

Self-employed individuals can use a tax calculator to estimate their tax liability. You can find a tax calculator for self-employed individuals in October 2024 to help you prepare for your tax obligations.

Age and Residency Status

Your age and residency status are also important considerations for Roth IRA eligibility. While there is no upper age limit for contributing to a Roth IRA, you must be a U.S. citizen, resident alien, or a U.S. national to be eligible.

Being Claimed as a Dependent

If you are claimed as a dependent on someone else’s tax return, you may not be eligible to contribute to a Roth IRA, regardless of your income. This rule applies even if you have earned income and meet the MAGI requirements.

The October 2024 deadline for filing taxes is fast approaching, and it’s crucial to be prepared. You can find detailed information on how to file taxes by the October 2024 deadline , including important deadlines and resources.

Previous Contributions to Other Retirement Accounts

Your previous contributions to other retirement accounts, such as traditional IRAs or 401(k)s, do not directly affect your eligibility to contribute to a Roth IRA. However, they can indirectly impact your eligibility by affecting your MAGI. If you have made large contributions to other retirement accounts, it could potentially increase your MAGI beyond the limit for Roth IRA contributions.

Tax Filing Status

Your tax filing status plays a role in determining your Roth IRA eligibility. For example, if you are filing as “married filing separately,” you may not be eligible to contribute to a Roth IRA, even if your income is below the MAGI limit.

Understanding IRA contribution limits is essential for both short-term and long-term financial planning. You can find the latest information on IRA contribution limits for 2024 and 2025 to make informed decisions about your retirement savings.

Consequences of Ineligibility

Contributing to a Roth IRA when you don’t meet the eligibility requirements can have serious consequences. You might face penalties, including taxes and interest, and could even be required to withdraw your contributions.

Correcting Ineligible Contributions

If you discover that you’ve made an ineligible contribution to a Roth IRA, you have options to correct the situation. The IRS allows you to withdraw the ineligible contribution, along with any earnings, before the tax filing deadline for the year in which the contribution was made.

This way, you can avoid penalties.

Penalties for Ineligible Contributions

The IRS imposes penalties for ineligible Roth IRA contributions. These penalties can include a 6% excise tax on the amount of the ineligible contribution, as well as interest on the tax owed.

Penalties Table

| Penalty | Description |

|---|---|

| 6% Excise Tax | Applied to the amount of the ineligible contribution. |

| Interest | Charged on the tax owed from the date of the contribution until the date the tax is paid. |

Maximizing Retirement Savings, Am I eligible to contribute to a Roth IRA in 2024

Even if you’re not eligible for a Roth IRA, there are other strategies to maximize your retirement savings. Consider contributing to a traditional IRA, which allows tax-deductible contributions and offers tax-deferred growth. You can also explore employer-sponsored retirement plans like 401(k)s, which often come with matching contributions.

Wrap-Up

Navigating the world of retirement savings can be complex, especially when it comes to Roth IRA eligibility. Understanding the rules and regulations surrounding contributions is crucial for maximizing your retirement savings potential. By carefully considering your income, filing status, and other relevant factors, you can determine if contributing to a Roth IRA is the right choice for you.

Remember, seeking guidance from a qualified financial advisor can provide personalized insights and help you develop a comprehensive retirement savings strategy.

FAQ Explained: Am I Eligible To Contribute To A Roth IRA In 2024

What is the maximum contribution limit for a Roth IRA in 2024?

The maximum annual contribution limit for a Roth IRA in 2024 is $6,500. Individuals aged 50 and over can contribute an additional $1,000, bringing their total contribution limit to $7,500.

Can I contribute to a Roth IRA if I’m self-employed?

Yes, self-employed individuals can contribute to a Roth IRA. However, they will need to make contributions through a self-directed Roth IRA account.

What happens if I contribute to a Roth IRA when I’m not eligible?

If you contribute to a Roth IRA when you’re not eligible, your contribution may be considered an excess contribution. Excess contributions are subject to penalties and may need to be withdrawn, potentially with penalties and interest.

Can I contribute to a Roth IRA if I’m already contributing to a 401(k)?

Yes, you can contribute to both a Roth IRA and a 401(k) as long as you meet the eligibility requirements for both. However, you may want to consider your overall retirement savings strategy and how these contributions will impact your financial goals.