What is the 401k contribution limit for 2024 for Roth? This question is top of mind for many individuals looking to maximize their retirement savings. A Roth 401(k) plan offers a unique opportunity to grow your retirement nest egg tax-free, but understanding the contribution limits is crucial for making informed financial decisions.

In 2024, the contribution limit for Roth 401(k) plans is set at a specific amount, which represents the maximum amount you can contribute each year. This limit can change from year to year, so staying updated is essential. This article delves into the intricacies of Roth 401(k) contribution limits, exploring the factors that influence them, and highlighting the benefits of maximizing your contributions.

Understanding 401(k) Contribution Limits

A 401(k) plan is a retirement savings plan that allows employees to contribute pre-tax dollars to an account that grows tax-deferred. One of the key aspects of a 401(k) plan is the contribution limit, which sets the maximum amount of money that an employee can contribute to their 401(k) account each year.

If you’re thinking about contributing to a traditional IRA, you might be wondering how much you can put in. The good news is that the contribution limit for 2024 is pretty generous , so you can potentially save a lot for retirement.

These limits are set by the IRS and are designed to ensure that individuals don’t contribute too much to their retirement accounts and end up with a large tax liability in retirement.

If you’re married, you might be wondering about the IRA contribution limits for 2024. The limits for married couples are the same as for individuals, so you can each contribute the same amount. Check the specific limits to make sure you’re maximizing your contributions.

Contribution Limit History and Evolution

The 401(k) contribution limit has evolved significantly over the years, reflecting changes in retirement savings needs and economic conditions. The first 401(k) plan was introduced in 1981, and the initial contribution limit was $7,500. Over the years, the contribution limit has steadily increased to keep pace with inflation and the rising cost of living.

Here’s a brief overview of the evolution of the 401(k) contribution limit:

- 1981: $7,500

- 1990: $9,500

- 2000: $10,500

- 2010: $16,500

- 2020: $19,500

Understanding Roth 401(k) Plans

A Roth 401(k) is a type of 401(k) plan that allows you to contribute after-tax dollars. This means that your contributions are not tax-deductible in the year you make them. However, when you withdraw your money in retirement, it’s tax-free.

This can be a beneficial option for individuals who expect to be in a higher tax bracket in retirement than they are today.

The Roth 401(k) contribution limit is the same as the traditional 401(k) contribution limit. For 2024, the limit is $24,500.

If you’re a qualifying widow(er), you may be eligible for a higher standard deduction in 2024. This deduction can help reduce your tax liability, so it’s worth checking the specific amount you can claim.

2024 Contribution Limits for Roth 401(k) Plans

The contribution limit for Roth 401(k) plans in 2024 is the same as the limit for traditional 401(k) plans, which is $22,500. This means that you can contribute up to $22,500 to your Roth 401(k) in 2024, regardless of whether you contribute to a traditional 401(k) or not.

IRA contribution limits are set each year, and they can vary depending on your age and filing status. In 2024, you can contribute a certain amount to an IRA, and the limits are different for those who are 50 and older.

Contribution Limit Changes, What is the 401k contribution limit for 2024 for Roth

The contribution limit for Roth 401(k) plans increased from $22,500 in 2023 to $22,500 in 2024. This is a significant increase, as it allows you to contribute more to your retirement savings each year.

Understanding how tax brackets work is essential for planning your finances. The tax brackets for 2024 will determine how much tax you’ll pay on your income, so it’s important to understand how they affect your income.

Factors Influencing Future Contribution Limits

Several factors can influence future changes in contribution limits for Roth 401(k) plans. These include:

- Inflation:The cost of living increases over time, which can impact the purchasing power of your retirement savings. To keep pace with inflation, contribution limits may need to be adjusted upwards.

- Economic Growth:When the economy is strong, people tend to earn more money. This can lead to an increase in contribution limits, as individuals have more disposable income to save for retirement.

- Government Policy:The government can influence contribution limits through legislation and regulations. For example, the government may increase contribution limits to encourage people to save for retirement.

Factors Affecting Individual Contribution Limits

While the general 401(k) contribution limit applies to everyone, there are certain factors that can affect how much an individual can contribute to their Roth 401(k) plan. These factors are primarily related to age and income, and understanding them can help individuals maximize their retirement savings.

Businesses need to provide their employees with a W9 form so they can report their tax information correctly. In October 2024, there may be specific requirements for the W9 form, so it’s important to understand the latest requirements.

Age

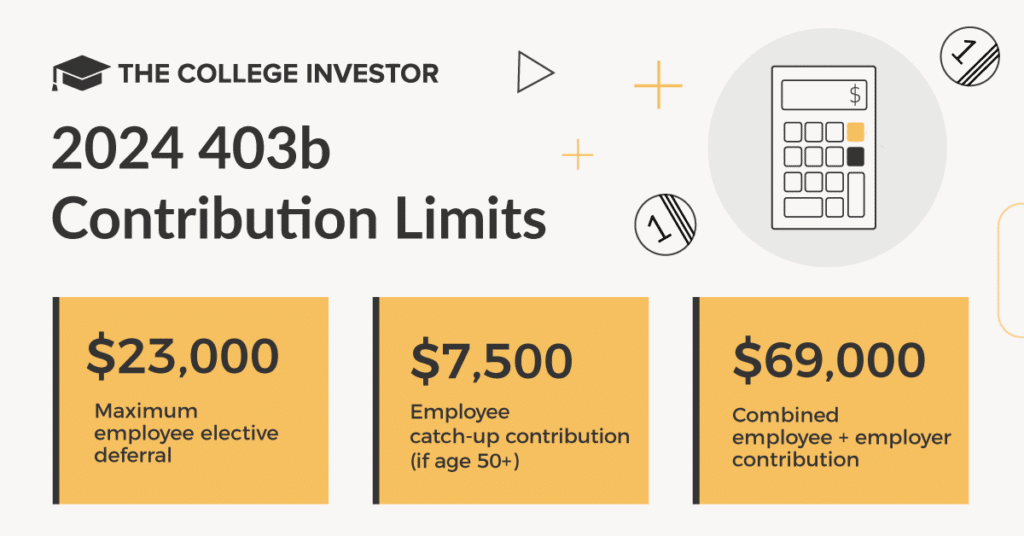

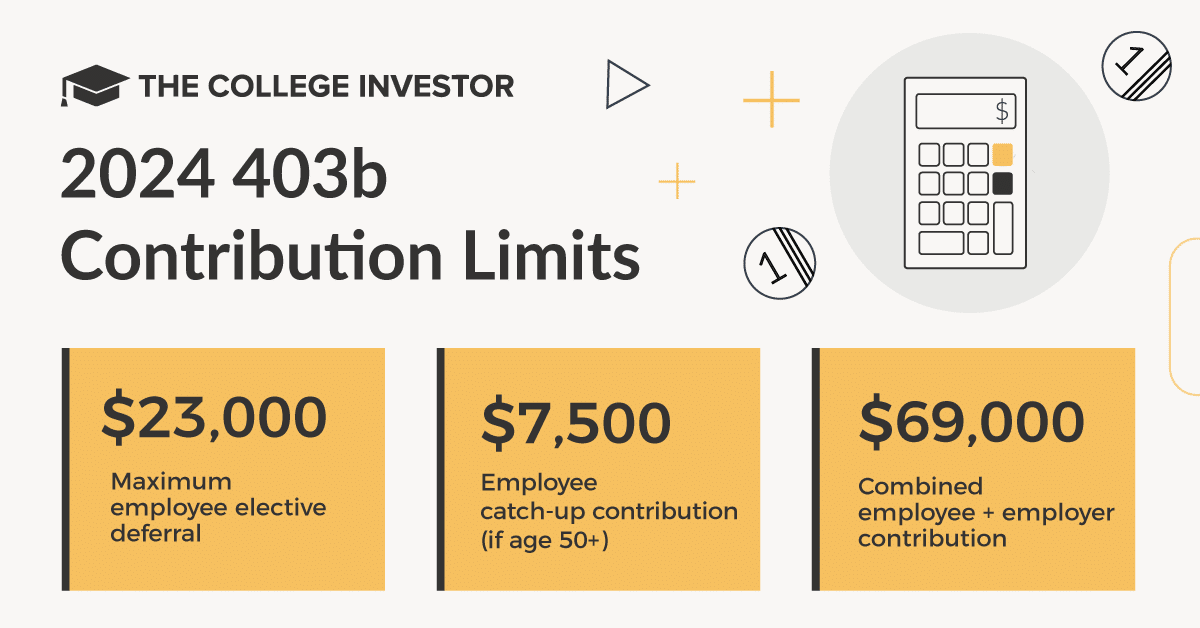

The age of an individual can influence their contribution limit in a couple of ways. Firstly, individuals aged 50 and older can contribute an additional amount known as the “catch-up contribution.” This allows them to contribute more to their retirement savings to make up for lost time.

Filing your taxes as a married couple? You’ll want to know the standard deduction for married filing jointly in 2024. This deduction can help lower your tax liability, so it’s important to understand the amount you can claim.

For 2024, the catch-up contribution is an additional $7,500. This means that someone aged 50 or older can contribute a total of $30,000 to their Roth 401(k) plan, while someone under 50 can contribute a maximum of $22,500.

The W9 form is used to provide your tax information to businesses and organizations. If you need to fill one out in October 2024, there are some things to keep in mind. Make sure you understand the instructions and requirements so you can complete it correctly.

The catch-up contribution limit for 2024 is $7,500. This applies to individuals aged 50 and older.

If you’re not sure whether you can claim the standard deduction in 2024, it’s best to check. There are certain situations where you might not be eligible, so it’s important to understand the rules and requirements.

Income

The income of an individual also plays a role in determining their contribution limit. While the contribution limit itself is not directly tied to income, high earners may face limitations on the amount they can contribute to their Roth 401(k) due to income-related restrictions.

Capital gains can be a bit tricky when it comes to taxes. If you’re looking for help calculating your capital gains taxes in October 2024, there are some online tools that can help. A tax calculator can help you figure out your tax liability based on your income and gains.

This is because Roth contributions are made with after-tax dollars, and high earners may not be able to contribute as much after taxes. For instance, if someone earns over a certain income threshold, they may not be eligible to contribute to a Roth IRA.

If you’re an independent contractor, you’ll need to fill out a W9 form to provide your tax information to your clients. The form is used to report your name, address, and tax identification number, so it’s important to have the correct information ready.

This income limit can vary from year to year, but for 2024, the limit is $153,000 for single filers and $228,000 for married couples filing jointly.

Students often have different tax deadlines than other taxpayers. In October 2024, the tax deadline for students may be different, so it’s important to be aware of the specific deadline to avoid penalties.

For 2024, the income limit for contributing to a Roth IRA is $153,000 for single filers and $228,000 for married couples filing jointly.

If you’re driving for business purposes, you can deduct your mileage expenses. The standard mileage rate for October 2024 is set by the IRS, so make sure you’re using the correct rate when calculating your deduction.

Planning for Retirement with Roth 401(k) Contributions

Planning for retirement is a crucial aspect of financial well-being, and Roth 401(k) contributions can be a powerful tool to achieve your retirement goals. This section will provide insights into setting realistic retirement goals, maximizing Roth 401(k) contributions throughout your working career, and understanding the potential growth of your contributions over time.

Saving for retirement through a 401(k) is a great way to build your nest egg, and in 2024, you can contribute even more if you’re over 50. The catch-up contribution limit allows you to put away extra money, so make sure you’re taking advantage of it.

Setting Retirement Goals and Aligning with Roth 401(k) Contributions

To effectively plan for retirement, it’s essential to establish clear and realistic goals. This involves determining your desired lifestyle in retirement, considering factors like housing expenses, healthcare costs, travel, and hobbies. Once you have a clear picture of your desired lifestyle, you can estimate the amount of funds you’ll need to support it.

Looking to maximize your retirement savings in 2024? The maximum 401(k) contribution limit is set each year, so it’s good to know the current limit so you can contribute the full amount.

For instance, if you envision a comfortable retirement with travel and leisure activities, you might need a larger retirement nest egg than someone who plans to live a more modest lifestyle. Once you have a retirement savings goal in mind, you can align it with your Roth 401(k) contributions.

This involves calculating how much you need to contribute each year to reach your goal, considering the potential growth of your investments over time.

To determine your required annual contribution, you can use a retirement calculator or consult with a financial advisor.

Maximizing Contributions Throughout Your Working Career

Maximizing Roth 401(k) contributions throughout your working career can significantly boost your retirement savings. Here are some strategies to consider:* Start early:The earlier you begin contributing to a Roth 401(k), the more time your investments have to grow through compounding.

Increase contributions gradually

If you can’t afford to contribute the maximum amount immediately, gradually increase your contributions over time as your income grows.

Take advantage of employer matching

If your employer offers matching contributions, be sure to contribute enough to receive the full match. This is essentially free money that can significantly accelerate your retirement savings.

Consider automatic contributions

Set up automatic contributions to your Roth 401(k) so you consistently contribute even when you might forget or are busy.

Review your contributions regularly

As your income and financial situation change, it’s essential to review your Roth 401(k) contributions and adjust them accordingly.

Illustrative Example of Roth 401(k) Growth

The following table illustrates the potential growth of Roth 401(k) contributions over time, considering various investment scenarios. This example assumes an annual contribution of $22,500 and an average annual return of 7%, 9%, and 11%, respectively.

| Years | 7% Return | 9% Return | 11% Return |

|---|---|---|---|

| 10 | $305,777 | $364,354 | $430,335 |

| 20 | $816,538 | $1,217,087 | $1,817,164 |

| 30 | $1,936,499 | $3,488,259 | $6,468,198 |

As you can see, even a modest annual contribution can accumulate significantly over time, especially with consistent investment growth. It’s important to note that these are just hypothetical examples, and actual returns may vary depending on market conditions and investment choices.

Outcome Summary

Understanding the 2024 Roth 401(k) contribution limit is a crucial step in your retirement planning journey. By taking advantage of this tax-advantaged savings vehicle, you can set yourself up for a more secure and comfortable future. Remember to consult with a financial advisor to personalize your retirement strategy and make informed decisions about your contributions.

Popular Questions: What Is The 401k Contribution Limit For 2024 For Roth

What is the difference between a traditional 401(k) and a Roth 401(k)?

The primary difference lies in the tax treatment. Traditional 401(k) contributions are pre-tax, meaning you pay taxes on your withdrawals in retirement. Roth 401(k) contributions are made with after-tax dollars, allowing you to withdraw your funds tax-free in retirement.

Can I contribute to both a traditional 401(k) and a Roth 401(k) in the same year?

No, you cannot contribute to both a traditional and Roth 401(k) simultaneously within the same plan. You must choose one or the other.

Can I withdraw my Roth 401(k) contributions before retirement?

Yes, you can withdraw your contributions (not earnings) from a Roth 401(k) at any time without penalty. However, withdrawals of earnings before age 59 1/2 are generally subject to taxes and a 10% penalty.