Medicare Cost 2024 sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. This comprehensive guide delves into the intricacies of Medicare costs in 2024, exploring the various components, influencing factors, and potential cost-saving strategies.

Need insurance for your boat or other marine assets? Marine Insurance 2024 offers a detailed guide to marine insurance options.

We’ll analyze the standard monthly premiums, deductibles, and coinsurance amounts for Medicare Part A, Part B, and Part D, providing a clear understanding of the financial implications for beneficiaries. Additionally, we’ll examine the impact of income-related monthly adjustment amounts (IRMAA) on Medicare Part B premiums and explore the factors that influence the cost of Medicare Part D premiums.

Looking for the best pet insurance options for your furry friend? Petsbest 2024 offers comprehensive coverage and affordable rates.

This guide aims to empower readers with the knowledge and insights needed to navigate the complexities of Medicare costs, enabling them to make informed decisions about their healthcare coverage. We’ll delve into the factors contributing to the rising costs of Medicare, including inflation, healthcare utilization, and technological advancements, offering a balanced perspective on the current state of Medicare financing.

Thinking about Geico for your homeowners insurance? Geico Homeowners Insurance 2024 offers insights into their plans and coverage options.

Medicare Overview in 2024: Medicare Cost 2024

Medicare is a federal health insurance program that provides coverage for individuals aged 65 and older, as well as younger people with certain disabilities. It is divided into four parts: Part A (Hospital Insurance), Part B (Medical Insurance), Part C (Medicare Advantage), and Part D (Prescription Drug Coverage).

If you’re looking for information about HPSO insurance, Hpso Insurance 2024 provides a detailed overview of their plans and benefits.

In 2024, Medicare continues to evolve with several key changes and updates impacting beneficiaries.

Just got your driver’s license? New Driver Insurance 2024 can help you find affordable insurance specifically designed for new drivers.

Key Changes and Updates to Medicare in 2024, Medicare Cost 2024

- Expanded Coverage for Mental Health Services:Medicare is expanding coverage for mental health services in 2024, including increased access to telehealth and counseling.

- New Benefits for Diabetes Management:Medicare is introducing new benefits for individuals with diabetes, including access to advanced diabetes management programs and continuous glucose monitoring devices.

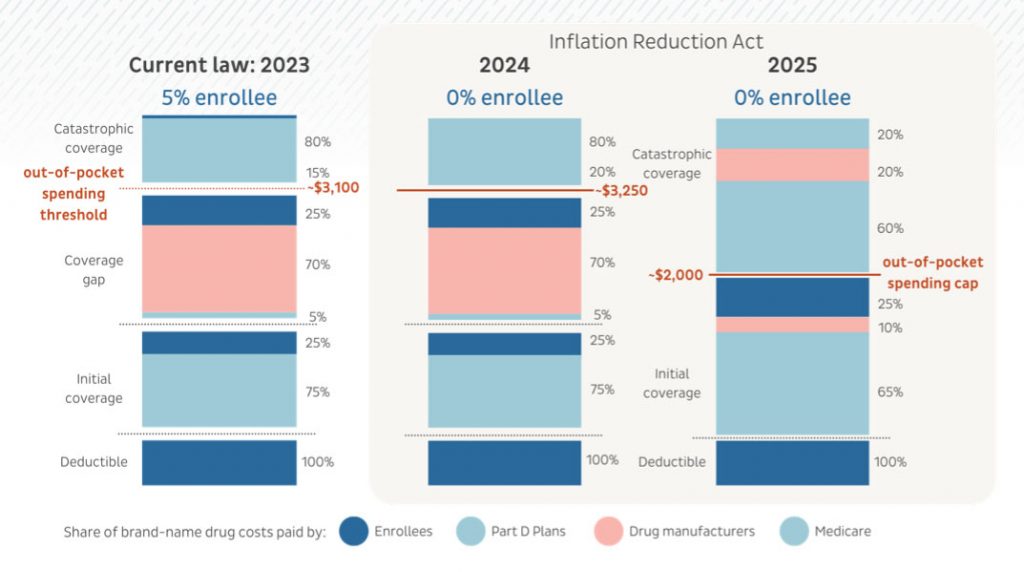

- Updates to Prescription Drug Coverage:Medicare Part D is undergoing updates in 2024, including changes to the formulary (list of covered drugs) and potential adjustments to copayments and deductibles.

- Increased Focus on Value-Based Care:Medicare is shifting towards value-based care models in 2024, which emphasize quality of care and patient outcomes over the volume of services provided.

Medicare Enrollment and Beneficiary Demographics

- Growing Number of Beneficiaries:The number of Medicare beneficiaries is steadily increasing as the population ages.

- Diverse Beneficiary Population:Medicare beneficiaries come from diverse backgrounds and have varying healthcare needs.

- Geographic Variations:Medicare enrollment and utilization patterns vary across different regions of the United States.

Medicare Costs in 2024

Understanding the different types of costs associated with Medicare is crucial for beneficiaries to plan their healthcare expenses. Medicare costs can be broken down into premiums, deductibles, coinsurance, and copayments.

The Hartford is a well-known insurance provider. Thehartford 2024 provides an overview of their insurance products and services.

Types of Medicare Costs

- Premiums:Monthly fees paid by beneficiaries to maintain Medicare coverage.

- Deductibles:A fixed amount beneficiaries pay before Medicare begins to cover healthcare services.

- Coinsurance:A percentage of the cost of healthcare services that beneficiaries pay after meeting the deductible.

- Copayments:A fixed amount beneficiaries pay for specific healthcare services, such as doctor visits or prescriptions.

Estimated Average Medicare Costs for 2024

- Part A (Hospital Insurance):

- Premium:Most beneficiaries do not pay a premium for Part A, as they have already paid into the program through payroll taxes.

- Deductible:$1,600 for each benefit period (60 days of hospitalization).

- Coinsurance:Varies depending on the length of stay and type of care.

- Part B (Medical Insurance):

- Premium:$164.90 per month in 2024 (standard premium).

- Deductible:$226 in 2024.

- Coinsurance:Varies depending on the type of service.

- Part C (Medicare Advantage):

- Premiums:Vary widely depending on the plan and coverage.

- Deductibles:May be higher or lower than Original Medicare.

- Copayments and Coinsurance:Vary based on the specific plan.

- Part D (Prescription Drug Coverage):

- Premiums:Vary based on the plan and prescription drug costs.

- Deductibles:Range from $480 to $550 in 2024.

- Copayments and Coinsurance:Vary based on the plan and specific drugs.

Factors Contributing to Rising Medicare Costs

- Inflation:The cost of healthcare services and prescription drugs has been rising faster than inflation.

- Healthcare Utilization:As the population ages, healthcare utilization increases, leading to higher costs.

- Technological Advancements:New technologies and treatments can be expensive, but they also improve healthcare outcomes.

Last Recap

Navigating Medicare costs in 2024 requires a comprehensive understanding of the various components, influencing factors, and available cost-saving strategies. This guide has provided a detailed analysis of Medicare costs, empowering readers with the knowledge needed to make informed decisions about their healthcare coverage.

Protecting your investment as a landlord is essential. Landlord Insurance 2024 can help you find the right coverage for your property.

By understanding the nuances of premiums, deductibles, coinsurance, and the role of Medicare Advantage plans, beneficiaries can effectively manage their healthcare expenses and ensure they receive the necessary medical care. As we look toward the future, it’s crucial to remain informed about potential trends in Medicare costs and their implications for beneficiaries, policymakers, and the overall healthcare system.

Finding the right individual health insurance plan can be overwhelming. Individual Health Insurance 2024 helps you navigate the process and find the best coverage for your needs.

Key Questions Answered

What are the key differences between Original Medicare and Medicare Advantage?

Looking for information on State Farm’s homeowners insurance? State Farm Homeowners Insurance 2024 provides a comprehensive overview of their plans and benefits.

Original Medicare offers traditional fee-for-service coverage, while Medicare Advantage provides managed care options with varying benefits and cost structures. Original Medicare typically has higher out-of-pocket costs but offers broader coverage nationwide. Medicare Advantage plans often have lower premiums and out-of-pocket limits but may have limited provider networks and require referrals.

How can I estimate my Medicare Part B premiums for 2024?

The standard monthly premium for Medicare Part B in 2024 is $164.90. However, your actual premium may vary depending on your income. The income-related monthly adjustment amount (IRMAA) can increase your premium if your income exceeds certain thresholds. You can find detailed information about IRMAA and estimated premiums on the Social Security Administration website.

Save time and get the best rates with Insurance Quotes Online 2024. This platform allows you to compare quotes from multiple providers easily.

What are some tips for reducing Medicare costs?

Looking to compare different travel insurance options for your next trip? Check out Travel Insurance Compare 2024 for a comprehensive overview of plans and coverage.

Consider enrolling in a Medicare Advantage plan, which often offers lower premiums and out-of-pocket costs. Take advantage of preventive services covered by Medicare, such as annual wellness visits and screenings, to catch health issues early. Negotiate prescription drug prices with your pharmacy or consider joining a prescription drug discount program.

Explore the benefits of Medicare supplemental insurance (Medigap) to help cover out-of-pocket costs.

Seeking information on property insurance options? Property Insurance 2024 provides a comprehensive guide to different types of property insurance.

For information on life insurance plans from Mutual of Omaha, check out Mutual Of Omaha Life Insurance 2024. It provides an overview of their policies and features.

Workers’ compensation insurance is crucial for businesses. Workers Compensation Insurance 2024 offers insights into this type of insurance.

Finding affordable life insurance can be challenging. Cheap Life Insurance 2024 provides tips and resources to help you find affordable life insurance options.