Tax calculator for October 2024: What are the latest tax brackets? – October 2024 Tax Brackets: What are the latest tax brackets? Understanding tax brackets is crucial for individuals and businesses alike, as they directly impact your financial planning. Tax changes can significantly alter your tax liability, making it essential to stay informed about the latest adjustments.

This guide will delve into the updated tax brackets for October 2024, highlighting key changes and their implications for different income levels.

We’ll explore strategies for optimizing your tax liability based on these new brackets, including maximizing deductions and credits. We’ll also discuss how income sources, such as wages, investments, and self-employment income, influence your tax calculations. By understanding these factors, you can make informed decisions to minimize your tax burden and maximize your financial well-being.

Tax Calculator for October 2024

Understanding tax brackets is crucial for both individuals and businesses. It helps you make informed financial decisions, plan for your future, and ensure you’re paying the correct amount of taxes. Tax brackets determine the percentage of your income that goes towards taxes, influencing your take-home pay and overall financial planning.

Are you over 50 and contributing to a 401(k)? It’s worth checking out the 401(k) limits for 2024 for over 50 to see how much you can contribute and maximize your retirement savings.

Tax changes can significantly impact your financial situation, making it essential to stay updated on the latest tax laws and regulations.

Wondering how much you’ll be paying in taxes in 2024? Check out the tax rates for each tax bracket in 2024 to get a better understanding of your potential tax liability. It’s important to know these rates, especially if you’re planning any major financial decisions like buying a house or starting a new business.

Tax Bracket Changes for October 2024

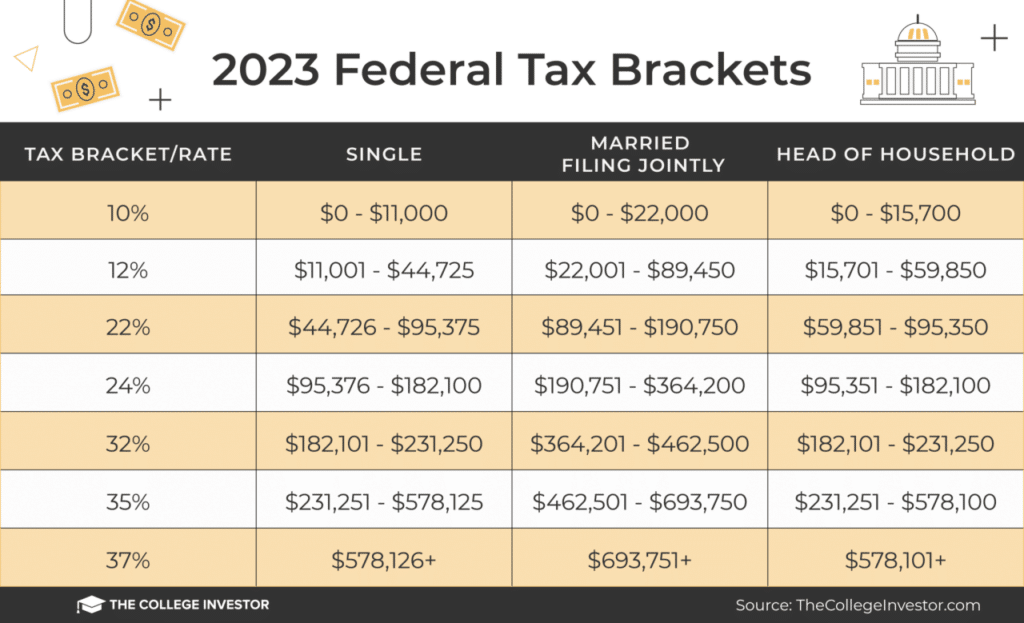

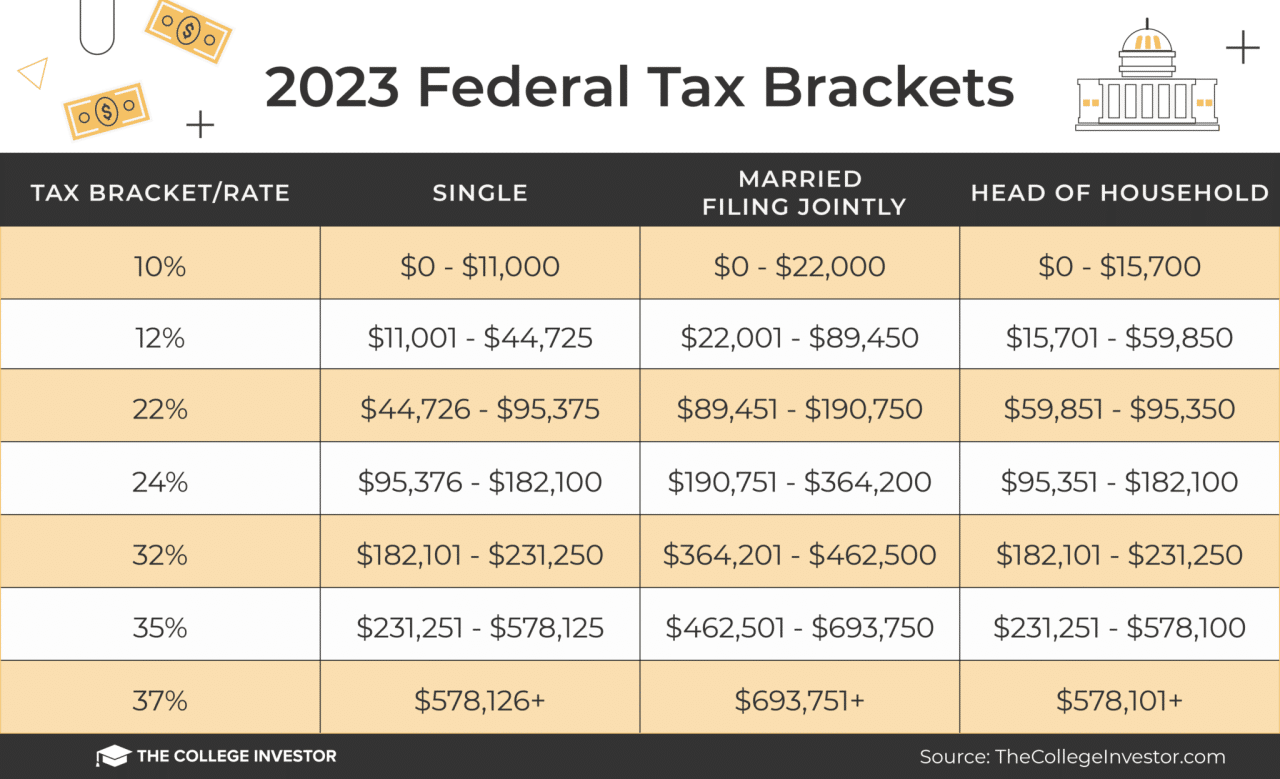

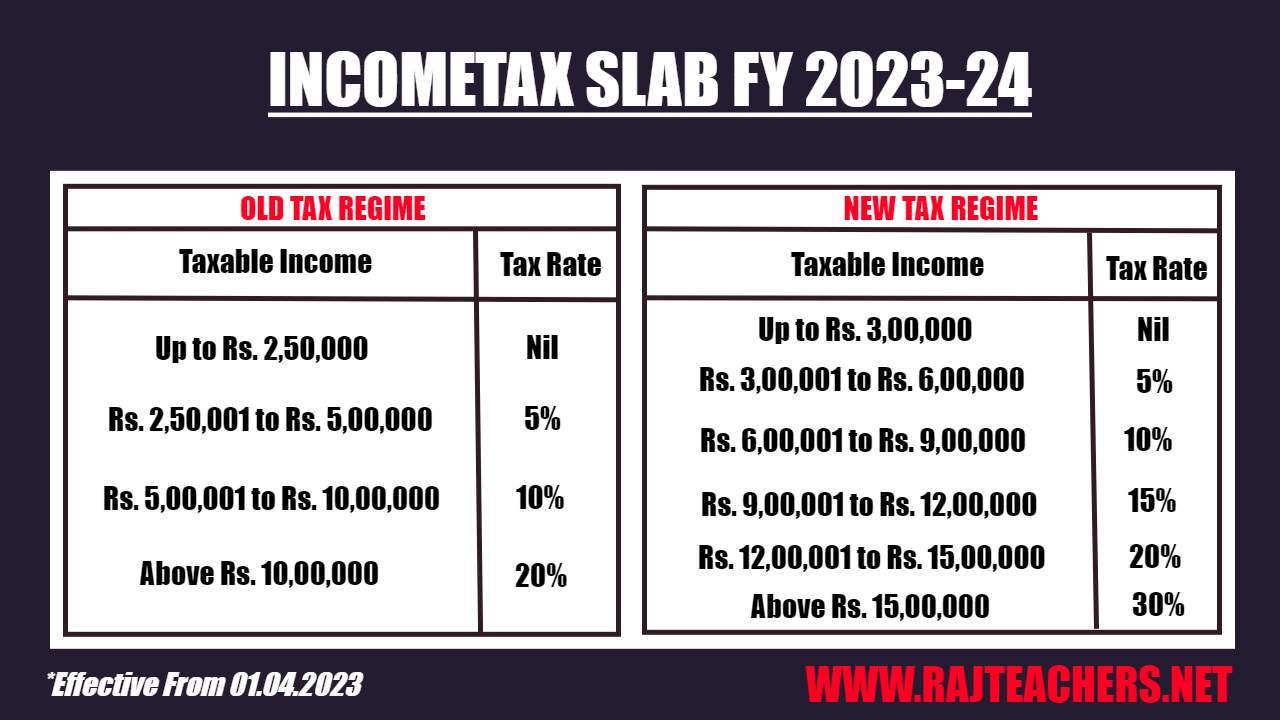

The tax brackets for October 2024 have been updated to reflect the latest economic conditions and policy changes. These changes could affect your tax liability, so it’s important to understand how they impact your income. The new tax brackets are as follows:

| Tax Bracket | Income Range | Tax Rate |

|---|---|---|

| 1 | $0

If you’re over 50, you might be eligible for catch-up contributions to your 401(k). Check out the 2024 401(k) limits for catch-up contributions to see how much you can contribute and maximize your retirement savings.

|

10% |

| 2 | $10,001

If you’re over 50 and contributing to an IRA, make sure to check the IRA contribution limits for 2024 for those over 50. You might be able to contribute more than someone younger.

|

12% |

| 3 | $40,001

Retirees often have different tax deadlines. The October 2024 tax deadline for retirees might be different from the regular deadline. It’s important to be aware of these deadlines to avoid penalties.

|

22% |

| 4 | $80,001

The tax brackets for 2024 in the United States are a key factor in determining your tax liability. Understanding these brackets can help you plan your finances and make informed decisions about your income and expenses.

|

24% |

| 5 | $170,001

Confused about how tax brackets work? The Understanding tax brackets for 2024 article explains the basics in a simple and easy-to-understand way. This knowledge can help you make informed decisions about your finances.

|

32% |

| 6 | $500,001+ | 37% |

Using a Tax Calculator

A tax calculator is a valuable tool for anyone seeking to estimate their tax liability accurately. It can help you understand your tax obligations, plan your finances, and make informed decisions regarding your income and expenses.

Planning a road trip in October 2024? Knowing the mileage rate for October 2024 can help you calculate your travel expenses and potentially save on taxes. This rate is adjusted periodically, so it’s good to stay up-to-date.

Benefits of Using a Tax Calculator, Tax calculator for October 2024: What are the latest tax brackets?

Tax calculators provide numerous benefits, including:

- Accurate Tax Estimates:Tax calculators use the latest tax laws and regulations to provide precise estimations of your tax liability. They consider various factors, such as your income, deductions, credits, and filing status, to ensure accuracy.

- Financial Planning:Knowing your potential tax liability can help you plan your finances effectively. You can adjust your spending, investments, or tax-saving strategies to minimize your tax burden and optimize your financial situation.

- Tax Filing Preparation:Tax calculators can provide insights into the necessary documents and information required for filing your taxes. They can help you identify potential tax deductions and credits, making the tax filing process smoother and more efficient.

- Tax Optimization:By analyzing your financial situation, tax calculators can help you identify tax-saving strategies and opportunities. They can suggest ways to minimize your tax liability through deductions, credits, and other tax planning strategies.

Reputable Online Tax Calculators

Several reputable online tax calculators are available for October 2024. These calculators offer a user-friendly interface and accurate estimations based on current tax laws.

Self-employed individuals have specific contribution limits for their IRAs. The IRA contribution limits for self-employed in 2024 can help you plan your retirement savings strategy.

- TurboTax:TurboTax is a well-known and widely used tax preparation software that also offers a free online tax calculator. It provides accurate tax estimates and guidance on various tax-related topics.

- H&R Block:H&R Block is another popular tax preparation company with a free online tax calculator. It offers a comprehensive set of features and tools to help you understand your tax obligations.

- TaxSlayer:TaxSlayer is a reputable online tax preparation service that provides a free tax calculator. It offers a user-friendly interface and accurate tax estimates based on current tax laws.

- Credit Karma:Credit Karma is a financial services company that offers a free online tax calculator. It provides insights into your tax liability and potential tax savings opportunities.

Key Features and Functionalities

Tax calculators typically offer a range of features and functionalities to help you understand your tax obligations. These features include:

- Income and Deduction Input:Tax calculators allow you to enter your income and various deductions, such as mortgage interest, charitable contributions, and medical expenses.

- Tax Bracket Calculation:They automatically calculate your tax liability based on your income and the applicable tax brackets for the current year.

- Tax Credit Calculation:Tax calculators can also calculate your eligibility for various tax credits, such as the earned income tax credit or child tax credit.

- Tax Filing Status Selection:You can choose your filing status, such as single, married filing jointly, or head of household, to ensure accurate tax calculations.

- Tax Planning Tools:Some tax calculators offer additional features, such as tax planning tools, that can help you optimize your tax liability and identify potential tax savings.

“Tax calculators can be a valuable resource for anyone seeking to understand their tax obligations and plan their finances effectively.”

Closure: Tax Calculator For October 2024: What Are The Latest Tax Brackets?

Navigating the complexities of tax regulations can be daunting, but with the right tools and knowledge, you can confidently manage your tax obligations. By staying informed about the latest tax brackets and utilizing online tax calculators, you can accurately estimate your tax liability and make informed financial decisions.

Remember to file your taxes on time to avoid penalties and leverage available deductions and credits to your advantage. Understanding the tax landscape empowers you to take control of your financial future and ensure you’re maximizing your financial potential.

Clarifying Questions

What are the penalties for late filing?

Penalties for late filing vary depending on the amount of tax owed and the length of the delay. The IRS generally charges a penalty of 0.5% of the unpaid taxes for each month or part of a month that taxes are late, up to a maximum penalty of 25%.

Can I claim deductions if I’m self-employed?

Yes, self-employed individuals are eligible for a variety of deductions, including business expenses, home office deductions, and health insurance premiums.

What are some examples of tax credits?

Common tax credits include the Earned Income Tax Credit (EITC), the Child Tax Credit, and the American Opportunity Tax Credit. These credits can directly reduce your tax liability.

Married couples need to consider their combined income when determining their IRA contributions. The IRA contribution limits for 2024 for married couples can help you make the most of your retirement savings.

The mileage rate is used for business expenses, and it’s calculated based on factors like fuel prices and vehicle maintenance. You can learn more about how it’s calculated by visiting the How is the mileage rate calculated for October 2024?

page.

The tax brackets for 2024 are slightly different from those in 2023. You can find a detailed comparison of the changes on the Tax bracket changes for 2024 vs 2023 page.

Non-profit organizations often need to use the W9 form to collect information from their donors. The W9 Form October 2024 for non-profit organizations provides guidance on completing this form.

Want to know how much you can contribute to your IRA in 2024? Check out the IRA contribution limits for 2024 to ensure you’re maximizing your retirement savings.

Understanding how tax brackets work is essential for managing your finances. The How will tax brackets affect my 2024 income? article explains how these brackets impact your income and taxes.