Standard deduction for married filing separately in 2024 offers a unique approach to tax filing for married couples who choose to file their taxes individually. This method allows each spouse to claim their own standard deduction, potentially resulting in a lower overall tax liability compared to filing jointly.

However, it’s essential to understand the intricacies of this filing status, as it may come with certain drawbacks and impact eligibility for various tax benefits.

This article will delve into the specifics of the standard deduction for married filing separately in 2024, examining the amount, factors that influence it, and the tax implications of choosing this filing status. We’ll also explore alternative filing options and provide guidance on making the best decision based on your individual circumstances.

Alternatives to Filing Separately

Filing separately might seem like the only option for married couples who want to file their taxes independently, but there are other filing statuses that might offer better tax benefits. Choosing the right filing status can significantly impact your tax liability, so it’s essential to consider your individual circumstances before making a decision.

Knowing the tax brackets for 2024 can help you plan your finances effectively. Check out the tax bracket information for 2024 to get a better understanding of how your income will be taxed.

Filing Jointly

When a married couple files jointly, they combine their income and deductions and file a single tax return. This status often results in the lowest tax liability, as it allows couples to take advantage of lower tax brackets and higher standard deductions.

If you’re making charitable donations, the mileage rate for October 2024 can be helpful for calculating your deductions. You can find this rate here.

However, it also means that both spouses are equally responsible for all tax obligations, including any unpaid taxes or penalties.

For small business owners, the contribution limits for IRAs can be different. You can find details on this page.

- Benefits:

- Lower tax liability due to lower tax brackets and higher standard deduction.

- Access to more tax credits and deductions available only to married couples filing jointly.

- Simplifies tax preparation with a single return.

- Drawbacks:

- Both spouses are equally responsible for all tax obligations, including any unpaid taxes or penalties.

- Can be disadvantageous if one spouse has significantly higher income than the other.

- Can be challenging if the couple is in the process of separating or divorcing.

Head of Household, Standard deduction for married filing separately in 2024

The head of household filing status is available to unmarried individuals who pay more than half the cost of keeping a home for a qualifying child or dependent. It offers a lower tax rate than single filing and a higher standard deduction than married filing separately.

If you’re looking for the latest information on IRA limits for October 2024, you can find it here. This information can be helpful for anyone planning their retirement savings.

- Benefits:

- Lower tax liability due to lower tax brackets and higher standard deduction.

- Can be a better option than filing separately if one spouse has a dependent child.

- Drawbacks:

- Not available to married couples.

- Requires meeting specific criteria, such as paying more than half the cost of keeping a home for a qualifying child or dependent.

Choosing the Right Filing Status

Ultimately, the best filing status for a married couple depends on their individual circumstances. Here are some factors to consider:

- Income Levels:If one spouse has significantly higher income than the other, filing separately might be advantageous to avoid being pushed into a higher tax bracket.

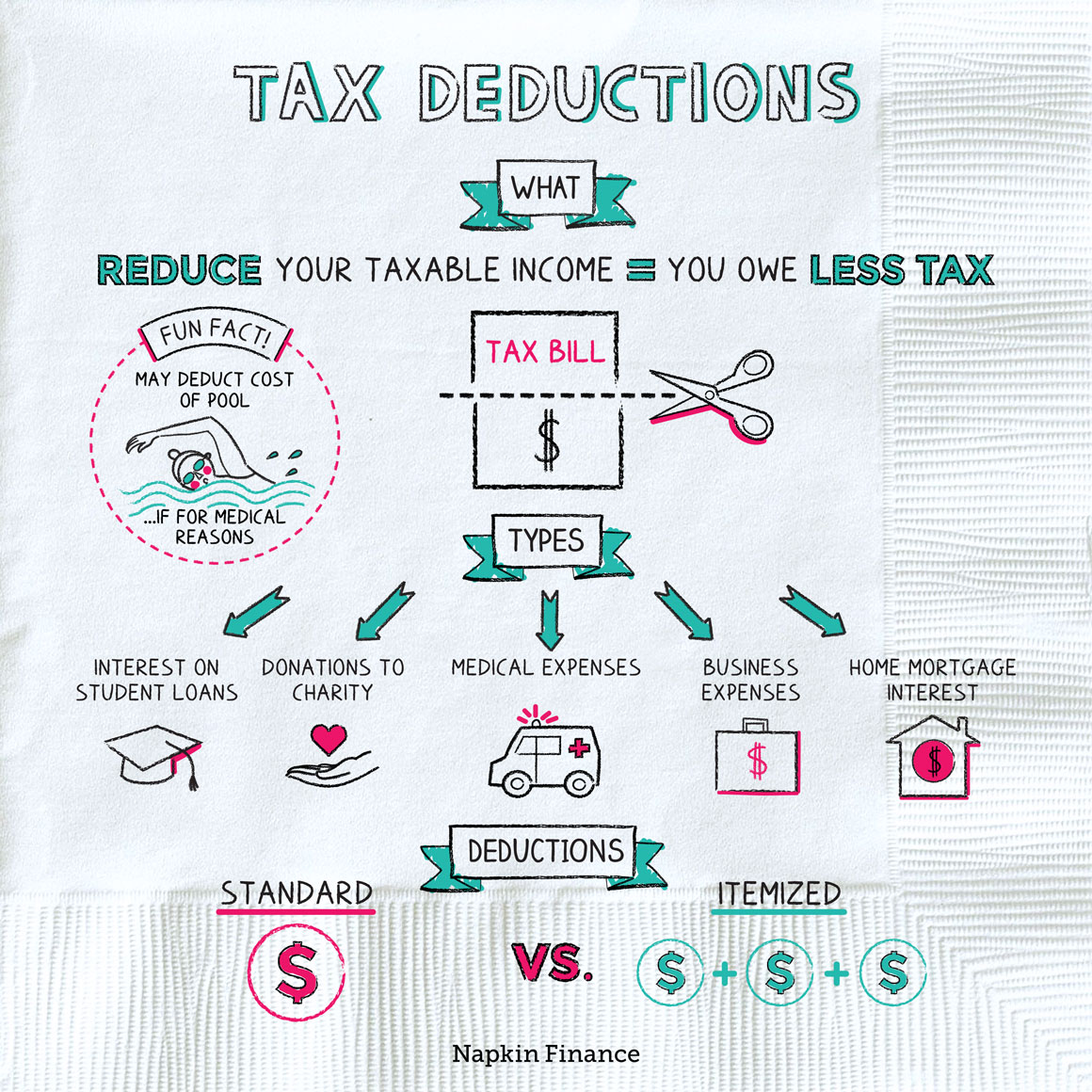

- Deductions and Credits:Some tax credits and deductions are only available to married couples filing jointly. Consider if you qualify for these benefits.

- Financial Responsibilities:If one spouse is responsible for paying most of the couple’s debts, filing separately might help protect them from liability for the other spouse’s debts.

- Marital Status:If the couple is in the process of separating or divorcing, filing separately might be the most appropriate option.

Concluding Remarks

Navigating the complexities of tax filing, especially for married couples, requires careful consideration of all available options. Understanding the nuances of the standard deduction for married filing separately in 2024, including its potential benefits and drawbacks, is crucial for making informed decisions.

By weighing the factors discussed in this article, couples can determine whether this filing status aligns with their financial goals and tax situation. Ultimately, seeking professional advice from a qualified tax advisor is highly recommended to ensure you’re taking advantage of the most beneficial filing status for your unique circumstances.

Key Questions Answered: Standard Deduction For Married Filing Separately In 2024

What are the potential disadvantages of filing separately?

Filing separately can lead to a higher overall tax liability compared to filing jointly. Additionally, it may limit your eligibility for certain tax benefits and credits.

Can I switch from filing separately to filing jointly after I’ve already filed?

You can amend your tax return to change your filing status, but this must be done within the timeframe allowed by the IRS.

What if my spouse has a higher income than me? Should we still file separately?

This is a complex situation, and you should consult with a tax professional to determine the best course of action. Factors like deductions and credits can significantly impact your tax liability.

How does filing separately affect deductions for medical expenses?

When filing separately, each spouse can claim deductions for their own medical expenses, but the amount may be limited by the percentage of adjusted gross income (AGI) threshold.

If you need to find the mileage rate for October 2024, you can usually find it on the IRS website or by searching online. You can also check this link for more information.

Planning for your retirement? You might be wondering how much you can contribute to your 401k in 2024. Find the answer here.

There are often changes to mileage rates throughout the year. To see if there have been any changes for October 2024, check out this page.

For those saving for retirement, knowing the maximum 401k contribution limit for 2024 can be important. You can find this information here.

Partnerships need to fill out a W9 Form. For October 2024, you can find the necessary information and instructions here.

If you’re over 50, you may be able to contribute more to your IRA. You can find the IRA contribution limits for 2024 for those over 50 here.

The IRA contribution limits can vary depending on your age. To find the specific limits for 2024, you can check this page.

Moving expenses can be deductible, and the mileage rate for October 2024 can be used to calculate these deductions. You can find this information here.

If you’re married, you may be able to contribute more to your IRA. You can find the contribution limits for married couples in 2024 here.

Understanding IRA contribution limits is important for anyone saving for retirement. You can find the IRA contribution limits for 2024 here.

Sometimes you need more time to file your taxes. If you need a tax filing extension for October 2024, you can find more information here.