Standard deduction for married filing jointly in 2024 sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Understanding this crucial aspect of tax preparation is essential for married couples seeking to maximize their tax benefits.

This guide delves into the intricacies of the standard deduction, exploring its calculation, eligibility requirements, and potential impact on tax liability.

The standard deduction is a fixed amount that taxpayers can choose to deduct from their taxable income instead of itemizing their deductions. This simplifies the tax filing process and can be advantageous for those who do not have significant itemized deductions.

For married couples filing jointly, the standard deduction amount is generally higher than for single filers, reflecting the shared financial responsibilities of married individuals.

Itemized Deductions vs. Standard Deduction: Standard Deduction For Married Filing Jointly In 2024

When filing your taxes, you have the option of claiming the standard deduction or itemizing your deductions. The standard deduction is a fixed amount that you can subtract from your taxable income, while itemized deductions allow you to deduct specific expenses.

Partnerships need to understand the W9 Form requirements for October 2024. This guide explains the specific information needed.

Choosing the method that benefits you most depends on your individual circumstances.

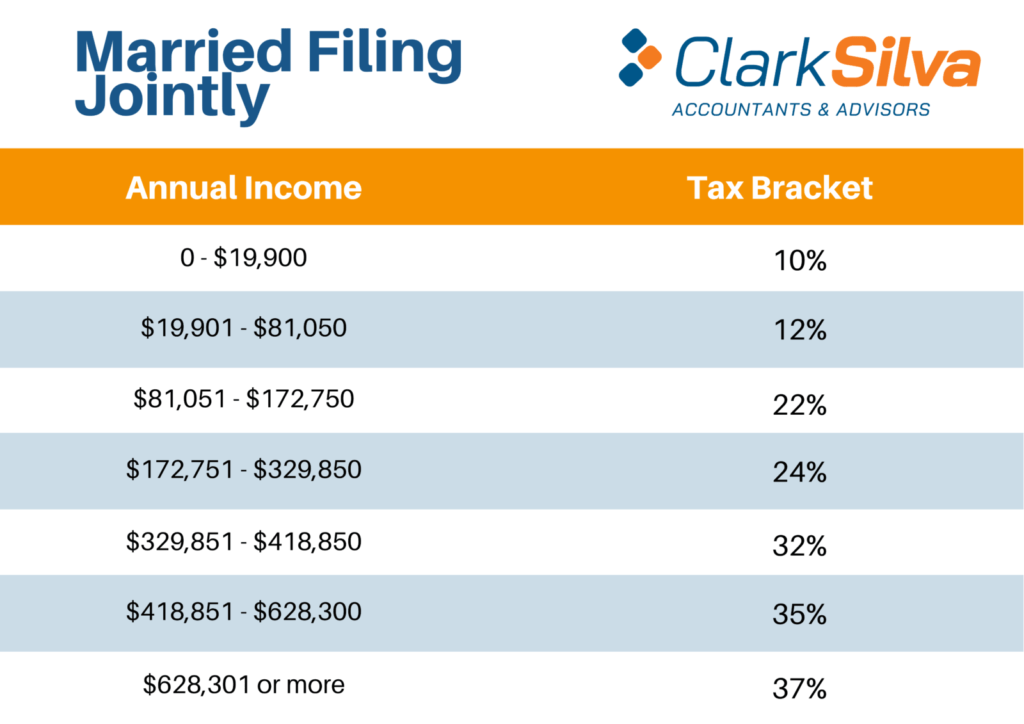

Understanding tax bracket changes for 2024 is crucial for accurate tax planning. This article provides details on the updated tax brackets.

Comparing Itemized Deductions and the Standard Deduction

The standard deduction is a set amount that depends on your filing status. This amount is adjusted annually for inflation. The standard deduction is simpler to claim, as you don’t need to gather receipts or documentation for specific expenses. However, the standard deduction may not be the most beneficial option for everyone, as it doesn’t account for specific expenses that may be deductible.Itemized deductions allow you to deduct certain expenses, such as medical expenses, charitable contributions, state and local taxes, and mortgage interest.

Understanding the W9 Form requirements for businesses in October 2024 is crucial for accurate tax reporting. This guide explains the necessary information and how to complete the form correctly.

This can result in a lower taxable income and potentially a lower tax liability. However, itemizing requires more effort, as you need to gather documentation and calculate the amount of each deduction.

Planning for retirement? Knowing the IRA contribution limits for 2024 and beyond is essential. This guide provides the updated limits.

Common Itemized Deductions

Here is a table outlining common itemized deductions and their potential impact on filing jointly:

| Deduction | Potential Impact |

|---|---|

| Medical Expenses | You can deduct medical expenses exceeding 7.5% of your adjusted gross income (AGI). |

| State and Local Taxes (SALT) | You can deduct up to $10,000 in state and local taxes, including property taxes, income taxes, and sales taxes. |

| Charitable Contributions | You can deduct cash contributions up to 60% of your AGI and non-cash contributions up to 30% of your AGI. |

| Mortgage Interest | You can deduct interest paid on up to $750,000 in qualified mortgage debt. |

Scenario for Itemizing Deductions

Consider a married couple with significant medical expenses exceeding 7.5% of their AGI. They also have a large mortgage and make substantial charitable contributions. In this scenario, itemizing deductions could be more beneficial than taking the standard deduction, as their itemized deductions would likely exceed the standard deduction amount.

Curious about the highest tax bracket in 2024? This article details the highest tax bracket and its corresponding rate.

Standard Deduction Changes in 2024

The standard deduction is a fixed amount that taxpayers can subtract from their taxable income instead of itemizing their deductions. For married couples filing jointly, the standard deduction amount can fluctuate based on factors like inflation and legislative changes. Let’s examine the potential adjustments to the standard deduction for married couples filing jointly in 2024.

Stay ahead of the tax deadline by following these tax preparation tips for October 2024. This guide offers valuable advice.

Standard Deduction Amount for Married Filing Jointly in 2024, Standard deduction for married filing jointly in 2024

The standard deduction for married couples filing jointly in 2024 is projected to increase due to inflation adjustments. The Internal Revenue Service (IRS) annually adjusts the standard deduction to reflect changes in the cost of living. While the exact amount is not yet finalized, it is anticipated to be higher than the 2023 amount of $27,800.

If you’re an independent contractor, it’s essential to know the specific W9 Form requirements for October 2024. This resource provides insights into the relevant information you need to provide.

The increase will likely be based on the Consumer Price Index (CPI) for Urban Wage Earners and Clerical Workers (CPI-W) inflation rate.

Maximize your retirement savings by understanding the 401k contribution limits for 2024. This article explains the current limits.

Impact of Standard Deduction Changes on Tax Liability

An increase in the standard deduction will generally result in lower tax liability for most taxpayers. The higher standard deduction allows taxpayers to deduct a larger amount from their taxable income, reducing the amount of income subject to taxes.

The mileage reimbursement rate for October 2024 is crucial for tracking business expenses. This article provides the latest rate information.

For example, if a married couple filing jointly has a taxable income of $100,000 in 2024, and the standard deduction increases to $28,500, their taxable income will be reduced to $71,500 ($100,000$28,500). This lower taxable income will result in a lower tax liability compared to 2023 when the standard deduction was $27,800.

The IRS mileage rate is used to calculate business-related travel expenses. This resource offers the current IRS mileage rate for October 2024.

Key Updates and Potential Implications

- The standard deduction is subject to annual adjustments based on inflation, which is determined by the CPI-W.

- Increases in the standard deduction can lead to lower tax liability for taxpayers, as it reduces their taxable income.

- Taxpayers should be aware of the standard deduction amount for their filing status in 2024, as it can impact their tax liability.

Final Wrap-Up

Navigating the world of tax deductions can be complex, especially for married couples. By understanding the standard deduction for married filing jointly in 2024, couples can make informed decisions about their tax filing strategy and potentially save money. Whether you’re a seasoned tax filer or a first-time taxpayer, this guide provides valuable insights to help you maximize your tax benefits and ensure a smooth filing experience.

Quick FAQs

What are the potential penalties for filing jointly if one spouse is deceased?

If one spouse is deceased, the surviving spouse can generally file as “Qualifying Widow(er)” for two years following the year of death. However, there may be penalties for filing jointly if the deceased spouse had significant tax liabilities or if there are other complications with the deceased spouse’s estate.

What happens if I am legally separated but not divorced?

Legally separated couples can still file jointly if they meet the requirements. However, if you are separated, you may want to consult with a tax professional to determine the best filing status for your situation.

What are the advantages of itemizing deductions over the standard deduction?

Itemizing deductions may be more beneficial if you have significant deductible expenses such as mortgage interest, charitable contributions, or medical expenses. However, itemizing can be more complex and requires keeping detailed records of your expenses.

Stay informed about the tax bracket thresholds for 2024 to accurately calculate your tax liability. This article outlines the updated thresholds.

The mileage rate for October 2024 is used for business-related travel expenses. This resource provides the current mileage rate.

Planning to contribute to your IRA in 2024? This article details the maximum contribution amount for 2024.

Get a clear picture of the tax rates for each tax bracket in 2024. This guide provides a breakdown of the tax rates for each bracket.

If you’re self-employed, it’s important to know the IRA contribution limits for 2024. This resource explains the limits for self-employed individuals.