How much can I contribute to my 401k in 2024? This question is on the minds of many Americans as they plan for their financial future. The answer, thankfully, is quite straightforward. The IRS sets annual contribution limits for 401(k) plans, and these limits are subject to change each year.

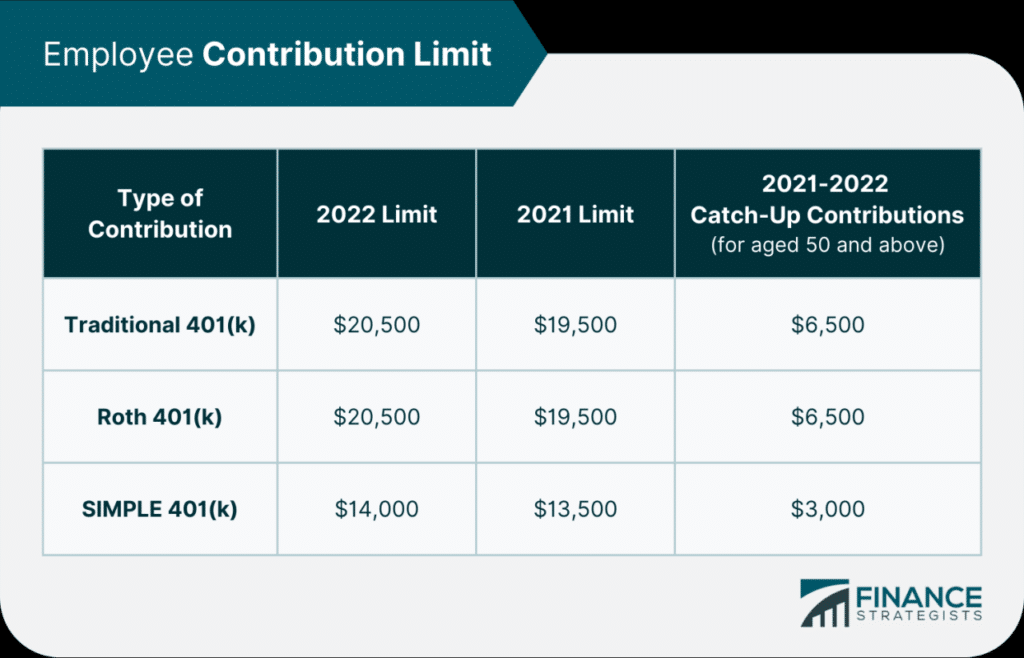

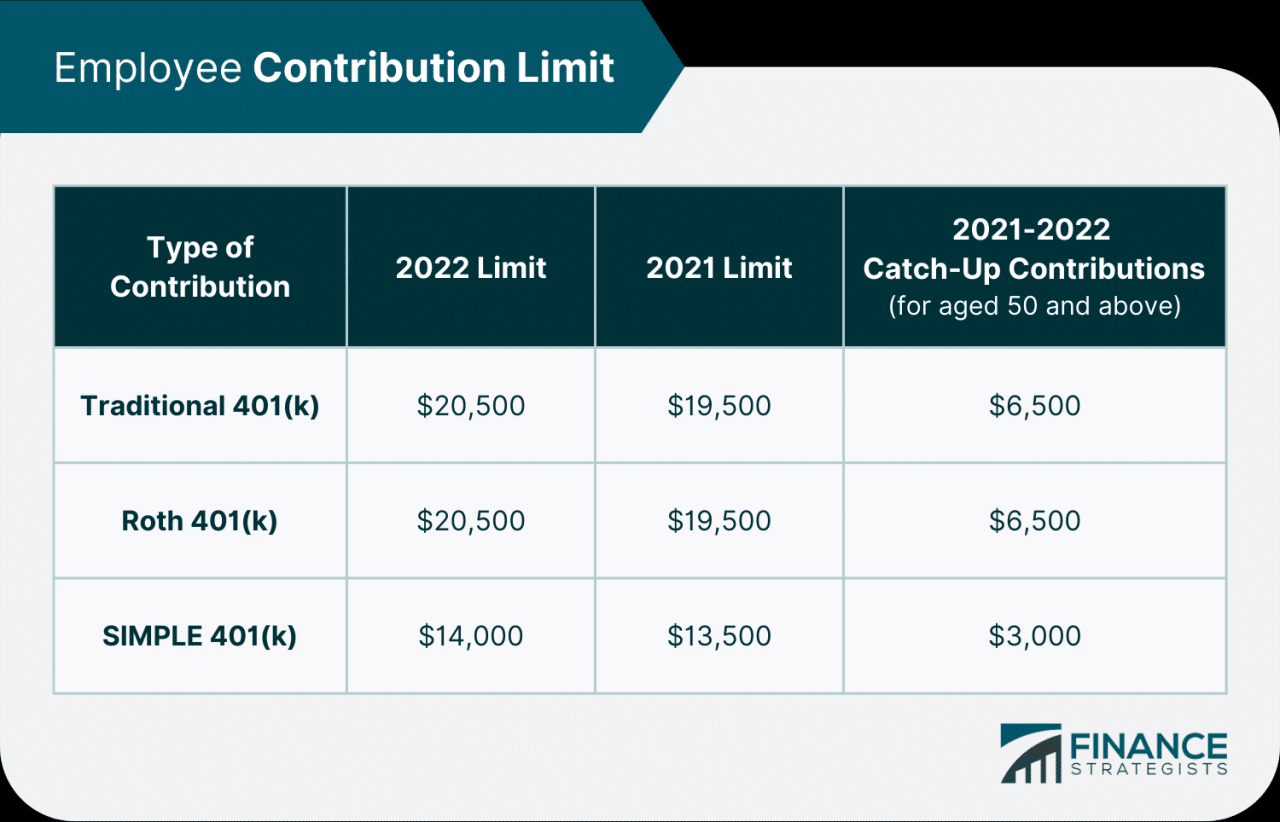

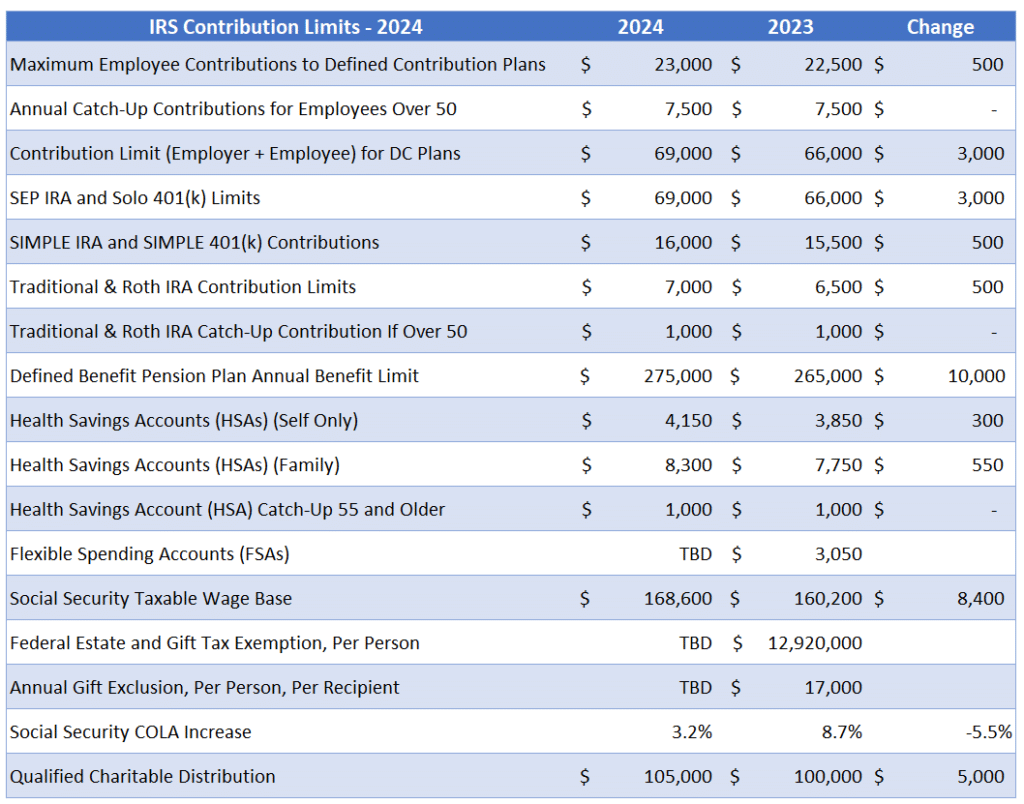

In 2024, the maximum contribution amount for most individuals is $22,500. However, there are several factors that can influence your individual contribution amount, including your income level, your employer’s matching program, and your other financial obligations.

Understanding these factors is crucial for making informed decisions about your retirement savings. This article will explore the ins and outs of 401(k) contributions in 2024, helping you make the most of your retirement savings potential.

Strategies for Increasing Contributions: How Much Can I Contribute To My 401k In 2024

Gradually increasing your 401(k) contributions can significantly enhance your retirement savings. This strategy involves systematically raising your contribution percentage over time, allowing you to adapt to higher contributions while maximizing your savings potential.

If you’re married filing separately, it’s important to understand the tax brackets that apply to your situation. Check out the tax brackets for married filing separately in 2024 to get a clear picture.

Design a Plan to Gradually Increase Contributions Over Time, How much can I contribute to my 401k in 2024

A gradual approach to increasing contributions can help you adjust to higher savings levels and avoid financial strain. Here’s a plan to consider:

- Start Small:Begin by increasing your contribution by a small percentage, such as 1% or 2%. This allows you to acclimate to the change without drastically impacting your budget.

- Schedule Regular Increases:Set a schedule for future contribution increases. For example, you can aim to increase your contribution by 1% every six months or annually. This consistent approach ensures steady progress towards your savings goals.

- Align with Salary Increases:Tie your contribution increases to your salary raises. When you receive a raise, allocate a portion of the extra income towards your 401(k). This ensures your contributions keep pace with your income growth.

- Review and Adjust:Regularly review your financial situation and adjust your contribution plan as needed. You may need to accelerate increases if your income grows significantly or if your financial goals change.

Tips for Budgeting and Prioritizing Retirement Savings

Effective budgeting and prioritizing retirement savings are crucial for maximizing your contributions. Here are some tips to help you achieve your savings goals:

- Track Your Expenses:Regularly track your income and expenses to identify areas where you can cut back. This helps you understand your spending habits and identify opportunities for savings.

- Create a Budget:Develop a detailed budget that allocates your income to essential expenses, savings, and discretionary spending. This provides a clear framework for managing your finances and prioritizing your savings goals.

- Automate Savings:Set up automatic contributions to your 401(k) from your paycheck. This ensures consistent contributions and reduces the risk of forgetting or delaying savings.

- Consider Your Financial Goals:Determine your retirement savings goals and create a plan to achieve them. This helps you prioritize your savings and make informed decisions about your contribution levels.

Benefits of Automating Contributions

Automating your 401(k) contributions offers significant advantages for maximizing your savings. Here are some key benefits:

- Consistency:Automatic contributions ensure regular and consistent savings, eliminating the risk of forgetting or delaying contributions.

- Time Savings:Automating contributions frees up your time and mental energy, allowing you to focus on other financial priorities.

- Compounding Growth:Regular contributions, even small amounts, can benefit from the power of compounding. This allows your savings to grow exponentially over time.

- Financial Discipline:Automating contributions helps you develop financial discipline by making saving a regular habit.

Considerations for Early Retirement

Early retirement is a dream for many, but it requires careful planning and strategic financial management. Your 401(k) contribution strategy plays a crucial role in achieving your early retirement goals.

Self-employed individuals have specific IRA contribution limits. Make sure you’re aware of the IRA contribution limits for self-employed in 2024 to maximize your retirement savings.

Impact of Early Retirement on Contribution Strategies

Planning for early retirement requires a different approach to 401(k) contributions. Since you’ll be relying on your retirement savings for a longer period, you’ll need to consider the potential impact of inflation and adjust your contribution strategy accordingly.

Businesses have a different tax deadline than individuals, so make sure you’re aware of the October 2024 tax deadline for your business.

- Increased Contributions:To reach your retirement goals, you may need to contribute more than the standard 15% of your income. This can be achieved by gradually increasing your contribution percentage over time, or by taking advantage of catch-up contributions if you’re over 50.

The mileage rate is an important deduction for many, and it’s calculated based on IRS guidelines. Learn more about how the mileage rate is determined for October 2024.

- Maximizing Employer Match:If your employer offers a matching contribution, ensure you’re maximizing this benefit to boost your retirement savings.

- Investment Allocation:Your investment allocation should reflect your longer retirement timeline. Consider a more conservative approach with a higher allocation to bonds, which tend to be less volatile than stocks.

Managing Retirement Funds in Early Retirement

Once you’ve reached early retirement, you’ll need to carefully manage your retirement funds to ensure they last throughout your retirement years.

Are you retired and wondering about the tax deadline? You’ll need to file your taxes by October 2024 , which gives you plenty of time to gather your documents and prepare.

- Withdrawals:When you withdraw funds from your 401(k), you’ll need to consider the tax implications. Withdrawals before age 59 1/2 are generally subject to a 10% penalty, as well as your regular income tax rate.

- Investment Strategy:Your investment strategy should be adjusted to reflect your lower income and longer retirement horizon. Consider reducing your exposure to riskier assets like stocks and increasing your allocation to more conservative investments like bonds.

- Expenses:Monitor your expenses carefully and look for ways to reduce them. This may involve downsizing your home, reducing your travel expenses, or finding ways to save on healthcare costs.

Ultimate Conclusion

Maximizing your 401(k) contributions in 2024 offers a significant advantage for your financial future. By taking advantage of the tax benefits, building a secure retirement nest egg, and leveraging the power of compounding growth, you can set yourself up for a comfortable and fulfilling retirement.

Remember to review your contribution strategy regularly, adjust it as needed, and seek professional advice if you have any questions.

FAQ Summary

What is the catch-up contribution limit for those aged 50 and over in 2024?

Individuals aged 50 and over can contribute an additional $7,500 in 2024, bringing their total maximum contribution to $30,000.

Can I contribute more than the maximum amount to my 401(k) in 2024?

No, you cannot contribute more than the annual maximum allowed by the IRS. Contributing more than the limit may result in penalties.

What happens if I don’t reach the maximum contribution limit for my 401(k) in 2024?

You can always increase your contributions in future years. It’s never too late to start saving for retirement, and even small contributions can add up over time.

Couples have different IRA contribution limits than individuals. Find out the IRA contribution limits for married couples in 2024 to plan your retirement savings.

Tax brackets can affect your income, so it’s helpful to understand how they work. Read about how tax brackets will affect your 2024 income to make informed financial decisions.

The tax brackets for head of household are different than other filing statuses. Check out the tax brackets for head of household in 2024 to understand your tax obligations.

Foreign nationals have specific tax filing requirements. Make sure you’re aware of the October 2024 tax deadline for foreign nationals to avoid any penalties.

Tax brackets have specific thresholds that determine your tax rate. Learn about the tax bracket thresholds for 2024 to plan your finances.

The W9 form is important for businesses and individuals. Be sure to meet the October 2024 deadline for filing the W9 form to avoid any issues.

IRA contribution limits are an important factor in retirement planning. Find out the IRA contribution limits for 2024 to maximize your savings.

Single filers have their own set of tax brackets. Review the tax brackets for single filers in 2024 to understand your tax obligations.

IRA contribution limits can change from year to year. Compare the IRA contribution limits for 2024 vs 2023 to see if there are any adjustments.

There are many potential tax deductions available to you. Make sure you’re aware of the tax deductions for the October 2024 deadline to minimize your tax burden.