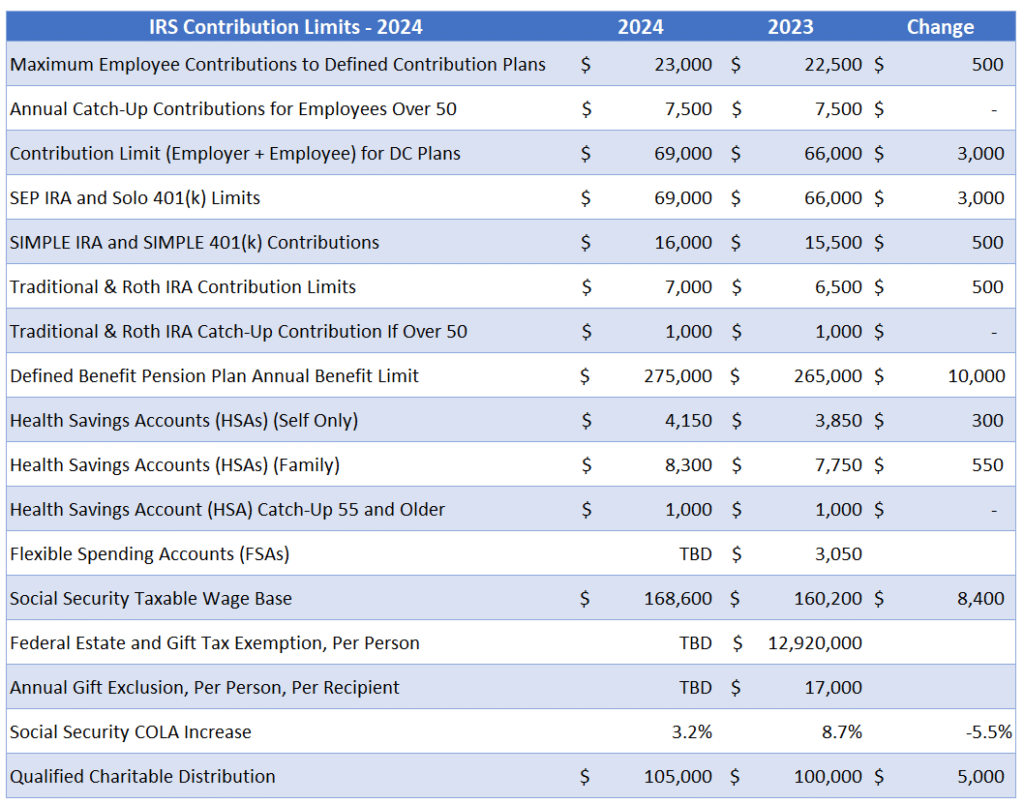

2024 401k contribution limits for employees are a crucial factor in retirement planning, offering a chance to maximize savings and build a secure financial future. These limits, set by the IRS, determine the maximum amount individuals can contribute to their 401(k) plans each year, impacting how much they can save for retirement.

Understanding these limits is essential for making informed financial decisions and taking full advantage of the benefits offered by 401(k) plans.

The 2024 contribution limits represent a valuable tool for employees to enhance their retirement savings. The limits, set by the IRS, provide a clear framework for individuals to maximize their contributions and potentially increase their retirement nest egg. This guide will delve into the details of these limits, explaining their significance and providing insights into how they can be leveraged to achieve financial goals.

Resources and Further Information

Navigating the complexities of 401(k) plans can be challenging. To help you make informed decisions about your retirement savings, we’ve compiled a list of valuable resources that provide comprehensive information on 401(k) plans and contribution limits.

If you’re single, you’ll want to know the tax brackets for 2024. You can find the breakdown of those brackets here.

Reputable Resources for 401(k) Information, 2024 401k contribution limits for employees

This table lists reputable organizations and government websites that provide reliable information on 401(k) plans and contribution limits.

Are you curious about how your taxes will be affected in 2024? Check out the new tax brackets for 2024 here to see how they’ll impact your income.

| Organization | Website | Description |

|---|---|---|

| Internal Revenue Service (IRS) | https://www.irs.gov/ | The IRS website provides comprehensive information on 401(k) plans, including contribution limits, tax implications, and eligibility requirements. |

| U.S. Department of Labor | https://www.dol.gov/ | The Department of Labor’s website offers information on employee retirement income security, including regulations and resources for 401(k) plans. |

| Financial Industry Regulatory Authority (FINRA) | https://www.finra.org/ | FINRA provides investor education and resources on retirement planning, including information on 401(k) plans and investment options. |

| Employee Benefits Security Administration (EBSA) | https://www.dol.gov/agencies/ebsa/ | EBSA, a division of the Department of Labor, enforces laws protecting employee retirement and health benefits, including 401(k) plans. |

| National Institute on Retirement Security (NIRS) | https://www.nirs.org/ | NIRS is a non-profit organization dedicated to promoting retirement security. It provides research, education, and advocacy on retirement issues, including 401(k) plans. |

| American Retirement Association (ARA) | https://www.americanretirementassociation.org/ | The ARA is a professional organization for retirement professionals. It provides resources and education on retirement planning, including 401(k) plans. |

Closing Notes: 2024 401k Contribution Limits For Employees

Navigating the world of 401(k) contributions can be complex, but understanding the 2024 contribution limits is a crucial step towards a secure retirement. By taking advantage of the maximum contribution limits, utilizing employer matching programs, and considering catch-up contributions, employees can significantly boost their retirement savings and pave the way for a comfortable future.

Remember to consult with a financial advisor to create a personalized retirement plan that aligns with your individual goals and circumstances.

FAQ Resource

What happens if I contribute more than the 401(k) limit?

If you exceed the 401(k) contribution limit, you may be subject to penalties. The excess contributions will be considered taxable income in the year they were made, and you may also face a 10% penalty on the excess amount.

It’s important to stay within the limits to avoid these penalties.

Can I contribute to both a 401(k) and a Roth IRA?

Yes, you can contribute to both a 401(k) and a Roth IRA, but there may be income limits that apply. The contribution limits for each account are separate, so you can contribute to both up to the maximum amount allowed.

However, if your income exceeds certain thresholds, you may not be eligible to contribute to a Roth IRA.

Are there any tax deductions for 401(k) contributions?

Yes, traditional 401(k) contributions are typically tax-deductible, meaning you can reduce your taxable income by the amount you contribute. This can result in lower taxes in the current year. However, you will be taxed on the withdrawals during retirement.

Roth 401(k) contributions are made with after-tax dollars, so you won’t receive a tax deduction in the current year, but withdrawals during retirement will be tax-free.

The Seahawks had a close game this week, but ultimately their comeback fell short. Read the full recap of the game and the reactions to the loss here.

The October 2024 tax deadline is approaching, so make sure you’re prepared to file on time. You can find tips and advice on how to file your taxes by the deadline here.

Moving can be expensive, but you can get reimbursed for your mileage. Find out what the mileage rate is for moving expenses in October 2024 here.

The tax brackets for 2024 are different than they were in 2023. Learn about the changes and how they might affect you here.

If you’re a freelancer, you’ll need to file a W9 form. The deadline for filing a W9 form in October 2024 is approaching, so make sure you’re prepared. Find out more about the deadline here.

The October 2024 tax deadline for freelancers is fast approaching! Find out more about the deadline and how to file your taxes here.

If you’re using your car for medical appointments, you can deduct your mileage. Learn about the mileage rate for medical expenses in October 2024 here.

The W9 form has undergone some changes in 2024. Find out about the updates and how they might affect you here.

Tax deductions can help you save money on your taxes. Find out about the deductions you can claim for the October 2024 deadline here.

Businesses need to understand the requirements for the W9 form in October 2024. Learn about the requirements here.

If you drive to work, you can deduct your mileage. Find out what the mileage rate is for driving to work in October 2024 here.

If you’re a small business owner, you can contribute to an IRA. Find out the IRA contribution limits for small business owners in 2024 here.

Want to know the mileage rate for October 2024? Find out the exact rate here.