W9 Form October 2024 for non-profit organizations is an essential document that helps ensure proper tax reporting and compliance. This guide delves into the intricacies of the W9 form, explaining its purpose, requirements, and implications for non-profit entities. We’ll cover everything from filling out the form correctly to understanding the potential consequences of non-compliance.

Understanding the W9 form is crucial for any non-profit organization that receives payments from individuals, businesses, or government agencies. The form provides essential information about the organization, including its tax identification number (TIN), which is used for tax reporting purposes.

By correctly filling out and submitting the W9 form, non-profits can streamline their tax processes and ensure they are meeting their legal obligations.

W9 Form Overview for Non-Profit Organizations

The W9 form is a crucial document for non-profit organizations, particularly when they engage in financial transactions with other entities. This form serves as a vital tool for tax reporting and compliance, ensuring accurate information exchange between the non-profit and its partners.

Planning for your retirement? The IRA contribution limits for 2024 by age can help you understand how much you can contribute based on your age. This knowledge can help you make informed decisions about your savings.

Key Information on the W9 Form

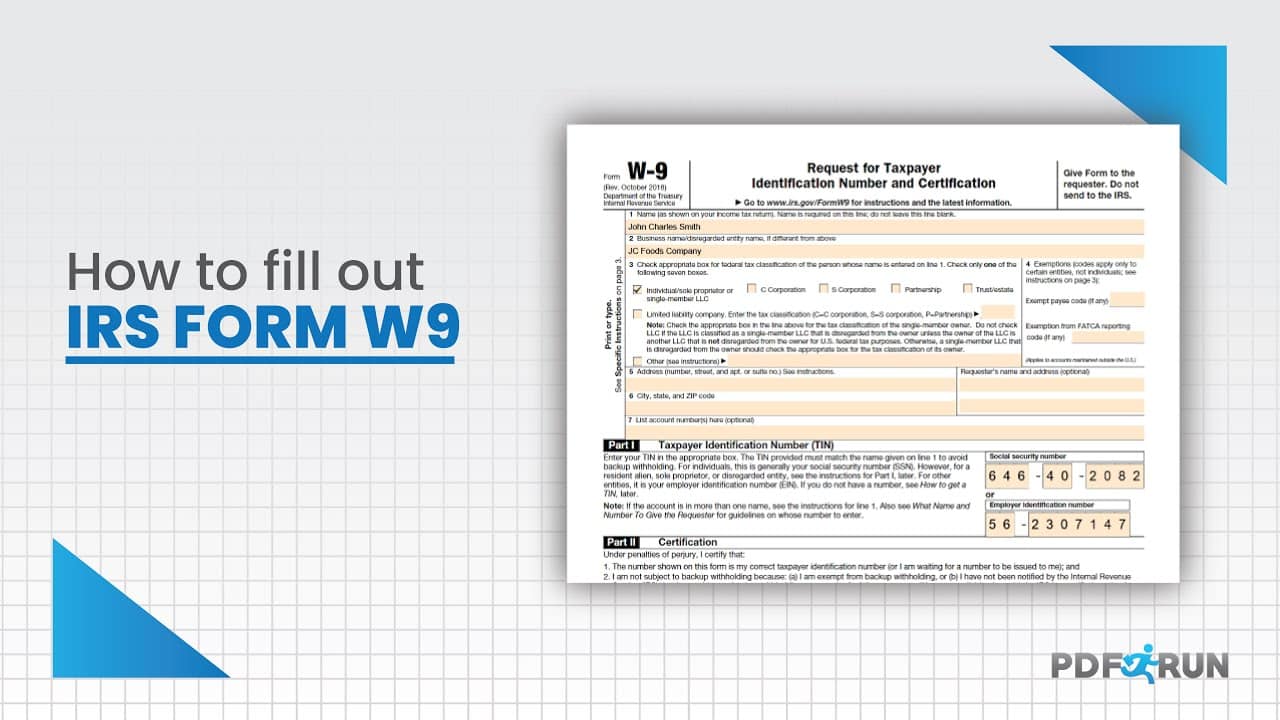

The W9 form requires non-profit organizations to provide essential information about their identity and tax status. This information is crucial for the recipient of the form, typically a payer, to accurately report income and withhold taxes appropriately.

Are you self-employed? Knowing the IRA contribution limits for self-employed in 2024 is crucial for maximizing your retirement savings. Make sure you understand the limits and take advantage of the opportunities available to you.

- Name:The full legal name of the non-profit organization as it appears on its IRS-approved articles of incorporation or other official documents.

- Taxpayer Identification Number (TIN):This is the non-profit’s unique identifier, usually an Employer Identification Number (EIN) issued by the IRS.

- Address:The physical address of the non-profit organization, including the street address, city, state, and zip code.

- Exemption Status:This section indicates whether the non-profit is exempt from federal income tax. Non-profits typically mark “Exempt from Federal Income Tax” and provide their exemption code.

- Other Information:This section might include details about the non-profit’s business activities, type of organization, and other relevant information.

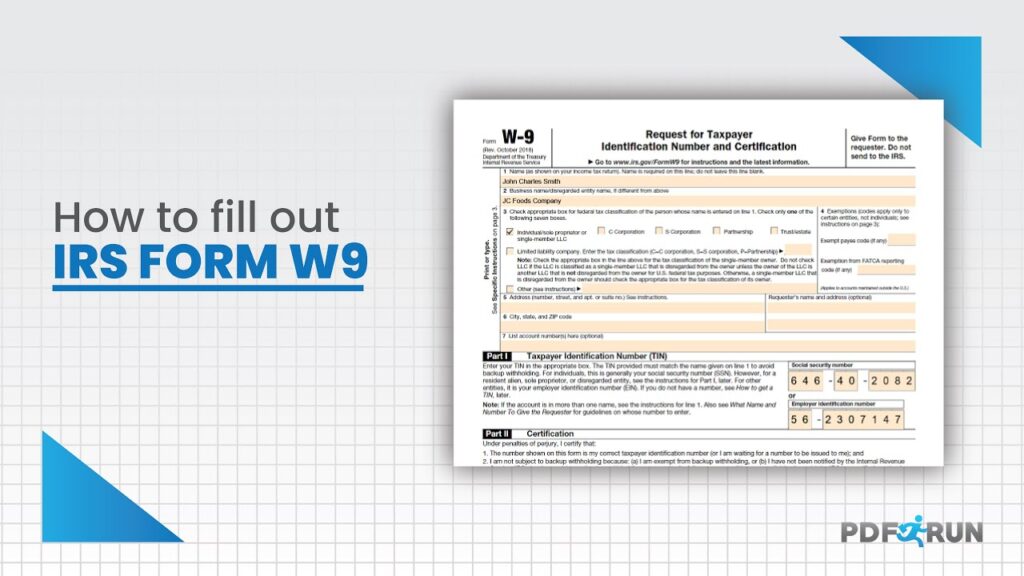

Filling Out the W9 Form, W9 Form October 2024 for non-profit organizations

Filling out the W9 form for a non-profit organization is a straightforward process. Here’s a step-by-step guide:

- Obtain a W9 Form:Download the latest version of the W9 form from the IRS website or request a copy from the payer.

- Provide Your Organization’s Information:Enter the non-profit’s legal name, TIN (EIN), address, and exemption status accurately.

- Complete Other Information:If required, provide additional information, such as the type of organization or business activities.

- Sign and Date:The form must be signed by an authorized representative of the non-profit organization and dated.

- Return the Form:Return the completed W9 form to the payer. This can be done electronically or by mail, depending on the payer’s instructions.

W9 Form and Tax Implications

The W9 form plays a crucial role in tax reporting for non-profit organizations. It provides essential information about the organization to the payer, enabling them to accurately report payments made to the non-profit on their tax returns. This information ensures that the non-profit is properly classified for tax purposes and that the payer can fulfill their tax obligations correctly.

Don’t let procrastination cost you! Missing the October 2024 tax deadline could result in penalties. Learn more about the tax penalties for missing the October 2024 deadline and avoid any unnecessary financial burdens.

Tax Reporting for Non-Profits

The W9 form is essential for non-profits to accurately report their income and expenses for tax purposes. Here’s how:

- Reporting Donations:Non-profits receive donations from individuals and corporations. When a donor makes a donation, the non-profit will request a W9 form to obtain the donor’s tax identification number (TIN). This information is crucial for the non-profit to issue a Form 1099-NEC to the donor, reporting the donation amount.

The October 2024 tax deadline is fast approaching! If you’re still working on your taxes, make sure to check out this guide on how to file taxes by the October 2024 deadline. It’s packed with helpful tips to ensure you file everything correctly and on time.

The donor can then use this information to claim a charitable contribution deduction on their tax return.

- Reporting Grants:Non-profits often receive grants from government agencies or private foundations. Similar to donations, the non-profit will request a W9 form from the grantmaker to obtain their TIN. This information is used to issue a Form 1099-NEC to the grantmaker, reporting the grant amount received.

Looking to donate to charity? Make sure you’re aware of the October 2024 mileage rate for charitable donations. This rate can help you maximize your tax deductions for your generosity.

The grantmaker can then use this information to report the grant expense on their tax return.

- Reporting Other Income:Non-profits may also generate income from other sources, such as membership fees, program fees, or sales of goods and services. When receiving payments from these sources, the non-profit may need to request a W9 form from the payer to obtain their TIN.

Thinking about your IRA contributions for the future? It’s helpful to know the IRA contribution limits for 2024 and 2025. This can help you plan your savings strategy and maximize your contributions.

This information is used to issue a Form 1099-NEC to the payer, reporting the income received.

Consequences of Incorrect or Incomplete Information

Providing incorrect or incomplete information on the W9 form can lead to several tax implications:

- Incorrect Tax Reporting:The payer may not be able to accurately report the payment made to the non-profit on their tax return, leading to potential penalties or audits. For example, if the non-profit’s TIN is incorrect, the payer may report the payment under the wrong tax identification number, resulting in incorrect tax reporting.

Curious about how the tax brackets will impact your income in 2024? Check out this guide on how tax brackets will affect your 2024 income. It provides a clear explanation of the tax brackets and their potential impact on your finances.

- Delayed or Denied Tax Deductions:The donor or grantmaker may not be able to claim the charitable contribution or grant expense deduction on their tax return if the non-profit provides incorrect or incomplete information on the W9 form. This could lead to delays in processing their tax return or even denial of the deduction.

If you’re self-employed, it’s important to be aware of the October 2024 tax deadline for self-employed individuals. Make sure you file your taxes on time to avoid any penalties or complications.

- Potential Penalties:The non-profit may face penalties for providing incorrect or incomplete information on the W9 form. These penalties can vary depending on the severity of the error and the circumstances surrounding it.

W9 Form Resources

The W9 form is an essential document for non-profit organizations. It’s vital to understand the form’s purpose, completion, and relevant resources.

Looking to maximize your retirement savings? Knowing the IRA contribution limits for traditional IRA in 2024 is essential. This can help you make the most of your contributions and build a solid retirement nest egg.

IRS Website Resources

The Internal Revenue Service (IRS) is the primary source of information for W9 forms. Their website offers comprehensive resources, including the W9 form itself, instructions, and FAQs.

- The IRS website provides the official W9 form for download. It’s crucial to use the most recent version to ensure compliance.

- The IRS website features detailed instructions for completing the W9 form. These instructions cover each section, providing clear guidance on what information is required and how to provide it.

- The IRS website has a dedicated section for frequently asked questions (FAQs) related to the W9 form. This section addresses common inquiries and provides valuable insights into various aspects of the form.

Contact Information for W9 Form Inquiries

| Agency | Contact Information |

|---|---|

| IRS | 1-800-829-1040 |

| IRS Taxpayer Advocate Service | 1-877-777-4778 |

| Federal Trade Commission | 1-877-382-4357 |

Final Conclusion: W9 Form October 2024 For Non-profit Organizations

Navigating the world of non-profit tax compliance can seem daunting, but understanding the W9 form is a crucial step towards ensuring your organization remains in good standing. By diligently following the guidelines Artikeld in this guide, you can confidently navigate the complexities of W9 form filing and maintain your non-profit’s financial integrity.

Remember, accurate and timely W9 form submission is vital for maintaining your organization’s tax compliance and fostering a positive relationship with the IRS.

Detailed FAQs

What happens if I don’t file a W9 form on time?

Failing to file a W9 form on time can result in penalties, including fines and delays in receiving payments. It can also lead to complications with your organization’s tax reporting.

How do I obtain a copy of the W9 form?

The W9 form is available for download from the official IRS website.

What is the difference between an EIN and a TIN?

An EIN (Employer Identification Number) is a specific type of TIN (Taxpayer Identification Number) assigned to businesses, including non-profit organizations. All non-profits have an EIN.

Can I use the same W9 form for all my transactions?

You may need to provide a new W9 form for each individual or entity you receive payments from. It’s best to consult with a tax professional to determine the specific requirements for your organization.

Understanding the IRA limits for October 2024 is crucial for making informed decisions about your retirement savings. This information can help you maximize your contributions and ensure a comfortable future.

Planning for the long term? It’s important to know the IRA contribution limits for 2024 and beyond. This information can help you make informed decisions about your savings and ensure a secure retirement.

Don’t forget about tax deductions! Make sure you’re aware of all the available tax deductions for the October 2024 deadline. Taking advantage of these deductions can help you save money on your taxes.

Knowing the tax brackets for 2024 in the United States is essential for understanding how your income will be taxed. This information can help you make informed financial decisions and plan for your future.

If you’re a foreign national living in the United States, it’s important to know the October 2024 tax deadline for foreign nationals. This deadline may differ from the standard deadline, so make sure you’re aware of the specific requirements.

If you use your vehicle for business purposes, make sure you’re aware of the October 2024 mileage rate for business use. This rate can help you claim tax deductions for your business expenses.