Personal Loan Interest sets the stage for this exploration, offering readers a comprehensive guide to understanding the financial implications of borrowing money. This guide delves into the intricacies of interest rates, their impact on loan repayments, and strategies for managing these costs effectively.

Need a loan but don’t want to wait for traditional approval processes? Explore personal loans near you that can offer quick funding options.

Whether you’re considering a personal loan for debt consolidation, home improvement, or a major purchase, understanding how interest rates work is crucial. This guide provides valuable insights into the different types of interest rates, the factors that influence them, and the importance of comparing options before making a decision.

Whether you’re buying your first home or refinancing, finding the right mortgage lender is essential. Shop around and compare rates and fees to ensure you’re getting the best deal.

Understanding Personal Loan Interest

Personal loans are a common financial tool used by individuals to cover various expenses, such as home improvements, medical bills, or debt consolidation. However, it’s essential to understand the concept of interest associated with personal loans before taking one out.

Interest is the cost of borrowing money, and it’s expressed as a percentage of the loan amount. This article will delve into the intricacies of personal loan interest, covering its different types, factors influencing it, and strategies for managing it effectively.

Shopping for a mortgage? It’s crucial to compare rates from different lenders to find the best deal. Explore lowest mortgage rates available in the market.

Types of Interest Rates, Personal Loan Interest

Personal loans typically come with two primary types of interest rates: fixed and variable.

If you’re looking for a way to access your home equity, a HELOC could be a good option. These loans allow you to borrow against the value of your home, providing you with a flexible line of credit.

- Fixed Interest Rates: Fixed interest rates remain constant throughout the loan term. This means your monthly payments will stay the same, providing predictability and stability. It’s a good option for borrowers who prefer a consistent payment schedule and want to avoid the risk of rising interest rates.

Struggling with overwhelming debt? Loan debt relief programs can help you manage your finances and potentially reduce your monthly payments.

- Variable Interest Rates: Variable interest rates fluctuate based on market conditions. This means your monthly payments can change over time, potentially increasing or decreasing. While variable rates can offer lower initial interest rates, they carry the risk of higher payments in the future.

Securing a competitive auto loan rate can save you money over the life of your loan. Compare lowest auto loan rates from various lenders to find the best deal for you.

Factors Influencing Interest Rates

Several factors determine the interest rate you’ll receive on a personal loan. These factors can vary depending on the lender and your individual financial situation.

- Credit Score: Your credit score is a crucial factor influencing your interest rate. A higher credit score generally translates to lower interest rates, as lenders perceive you as a lower risk borrower.

- Loan Amount: Larger loan amounts often come with higher interest rates, as lenders face a greater risk with larger loans.

- Loan Term: Longer loan terms generally result in lower monthly payments but higher overall interest costs. Conversely, shorter loan terms lead to higher monthly payments but lower overall interest costs.

- Debt-to-Income Ratio: Lenders assess your debt-to-income ratio (DTI), which is the percentage of your monthly income dedicated to debt payments. A higher DTI can lead to higher interest rates, as it suggests you may have difficulty managing your finances.

- Loan Purpose: Some lenders may offer lower interest rates for specific loan purposes, such as home improvements or debt consolidation.

- Market Conditions: Interest rates are influenced by broader economic factors, such as inflation and the Federal Reserve’s monetary policy.

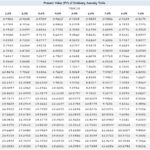

Calculating Personal Loan Interest

Understanding how personal loan interest is calculated is crucial for making informed financial decisions. Here’s a step-by-step guide to calculate the total interest payable on a personal loan.

Interested in home financing options? BHG Loans offers a variety of loan products, including mortgages and home equity loans.

Step-by-Step Calculation

- Determine the Loan Amount (P): This is the principal amount you borrow.

- Identify the Annual Interest Rate (r): This is the percentage charged on the loan annually.

- Determine the Loan Term (n): This is the duration of the loan, typically expressed in years or months.

- Calculate the Monthly Interest Rate (i): Divide the annual interest rate (r) by 12 to get the monthly interest rate (i). For example, if the annual interest rate is 5%, the monthly interest rate would be 5%/12 = 0.4167%.

- Calculate the Total Number of Payments (N): Multiply the loan term (n) by the number of payments per year (typically 12). For example, a 5-year loan would have 5 years

12 payments/year = 60 payments.

- Calculate the Monthly Payment (PMT): Use the following formula: PMT = (P

- i) / (1

- (1 + i)^-N). For example, with a loan amount of $10,000, a monthly interest rate of 0.4167%, and a loan term of 60 months, the monthly payment would be approximately $188.71.

- Calculate the Total Amount Repaid (TR): Multiply the monthly payment (PMT) by the total number of payments (N). In the example above, the total amount repaid would be $188.71/month

60 months = $11,322.60.

- Calculate the Total Interest Paid (TI): Subtract the loan amount (P) from the total amount repaid (TR). In this case, the total interest paid would be $11,322.60

$10,000 = $1,322.60.

Example Table

| Loan Amount (P) | Interest Rate (r) | Loan Term (n) | Total Interest (TI) |

|---|---|---|---|

| $5,000 | 5% | 3 years | $450.75 |

| $10,000 | 7% | 5 years | $2,108.54 |

| $20,000 | 9% | 7 years | $6,938.68 |

Simple vs. Compound Interest

Understanding the difference between simple and compound interest is crucial for managing personal loan payments.

Looking for personal loans? Credit Karma can help you compare loan options and find the best fit for your needs.

- Simple Interest: Simple interest is calculated only on the principal amount borrowed. It’s a straightforward calculation, but it results in lower interest costs compared to compound interest.

- Compound Interest: Compound interest is calculated on both the principal and accumulated interest. This means that interest is earned on previously earned interest, leading to faster growth in interest costs. Most personal loans use compound interest, which can significantly impact the total amount repaid.

Impact of Interest Rates on Personal Loan Repayments: Personal Loan Interest

Interest rates play a significant role in determining the total amount you’ll repay on a personal loan. Higher interest rates lead to higher total repayment amounts, while lower interest rates result in lower repayment amounts.

Looking for a loan from a responsible lender? Oportun offers loans to borrowers with varying credit scores and aims to provide financial services to underserved communities.

Repayment Schedules with Different Interest Rates

Let’s consider two scenarios with the same loan amount and term but different interest rates.

- Scenario 1: Loan Amount- $10,000, Term – 5 years, Interest Rate – 5% : In this scenario, the monthly payment would be approximately $188.71, and the total interest paid would be $1,322.60.

- Scenario 2: Loan Amount- $10,000, Term – 5 years, Interest Rate – 10% : In this scenario, the monthly payment would be approximately $212.47, and the total interest paid would be $2,748.20.

As you can see, even a small difference in interest rates can significantly impact the total amount you repay over the loan term. In Scenario 2, with a higher interest rate of 10%, the total interest paid is more than double compared to Scenario 1 with a 5% interest rate.

If you need money quickly, there are several options available. Consider fast loan options such as payday loans or personal loans, but be aware of the potential high interest rates and fees.

Financial Implications of Interest Rate Choice

Choosing a loan with a higher interest rate can have significant financial implications. You’ll end up paying more in interest charges, reducing your financial flexibility and potentially increasing your overall debt burden. It’s crucial to explore options with lower interest rates to minimize your financial burden.

If you’re in the market for a new car, you might be interested in auto loan rates for a longer term. This can lower your monthly payments but may lead to higher overall interest costs.

Strategies for Managing Personal Loan Interest

Managing personal loan interest effectively is essential for minimizing your financial burden and maximizing your financial well-being. Here are some strategies to consider.

Strategies for Minimizing Interest

- Shop Around for Lower Rates: Compare interest rates from multiple lenders before making a decision. Online comparison tools can streamline this process.

- Improve Your Credit Score: A higher credit score can qualify you for lower interest rates. Pay your bills on time, keep your credit utilization low, and avoid opening too many new accounts.

- Consider Debt Consolidation: Consolidating multiple personal loans into one with a lower interest rate can save you money on interest charges. However, ensure the new loan’s terms are favorable and don’t trap you in a longer repayment period.

- Make Extra Payments: Making extra payments on your loan can help you pay it off faster and reduce the total interest paid. Even small extra payments can make a significant difference over time.

- Negotiate a Lower Rate: Don’t be afraid to negotiate with lenders for a lower interest rate. You may be able to leverage your creditworthiness, existing relationships with the lender, or current market conditions to secure a better rate.

Benefits and Drawbacks of Consolidation

Debt consolidation can be a helpful strategy for managing personal loan interest, but it’s essential to consider both its benefits and drawbacks.

- Benefits:

- Lower monthly payments

- Lower overall interest costs

- Simplified repayment schedule

- Drawbacks:

- Potential for longer repayment term

- Higher overall interest costs if the new loan has a higher interest rate

- Risk of incurring additional fees for consolidation

The Importance of Understanding Interest Rates

Understanding the interest rates associated with personal loans is crucial for borrowers to make informed financial decisions and avoid potential pitfalls.

Want to find lenders in your area? Use a lender directory to locate lenders near you and compare their loan options.

Potential Risks of High Interest Rates

- Higher Total Repayment: High interest rates lead to significantly higher total repayment amounts, increasing your financial burden.

- Reduced Financial Flexibility: Higher payments due to high interest rates can strain your budget, limiting your ability to save, invest, or cover unexpected expenses.

- Debt Trap: High interest rates can trap you in a cycle of debt, making it difficult to pay off your loan and achieve financial stability.

Importance of Comparing Interest Rates

Before taking out a personal loan, it’s essential to compare interest rates from multiple lenders. This allows you to choose the most favorable terms and minimize your overall interest costs. Online comparison tools can simplify this process.

A bridge loan can provide short-term financing for those who need to close on a new property before selling their existing home.

Summary

By understanding the fundamentals of personal loan interest, you can make informed financial decisions that align with your individual needs and goals. Armed with this knowledge, you can navigate the world of personal loans with confidence, minimizing the impact of interest rates and maximizing your financial well-being.

For a predictable monthly payment, fixed-rate home loans offer peace of mind. Your interest rate stays the same throughout the life of the loan, so you’ll know exactly how much you’ll be paying each month.

Common Queries

What is the difference between a fixed and a variable interest rate?

Getting pre-approved for a home loan can give you a better idea of how much you can afford and help you make a more confident offer. Explore your options with home loan pre-approval today.

A fixed interest rate remains the same throughout the loan term, while a variable interest rate can fluctuate based on market conditions. Fixed rates provide predictable monthly payments, while variable rates can offer potential savings if interest rates decline.

How can I improve my chances of getting a lower interest rate on a personal loan?

Improving your credit score, having a stable income, and providing collateral can all increase your chances of securing a lower interest rate. Shop around and compare offers from multiple lenders to find the most competitive rates.

What are the risks associated with high-interest personal loans?

High-interest loans can lead to a significant increase in the total amount you repay, making it more difficult to manage your debt. If you are unable to make timely payments, you may face late fees and penalties, further increasing your debt burden.