IRA contribution limits for 2024 and beyond are a crucial aspect of retirement planning, as they dictate how much you can save annually towards your future financial security. Understanding these limits, as well as potential changes in the coming years, is essential for maximizing your retirement savings and ensuring a comfortable future.

This guide delves into the specifics of IRA contribution limits for 2024, explores potential future adjustments, and examines key factors influencing these changes. We’ll also cover catch-up contributions, income limitations, and effective strategies for maximizing your IRA contributions. By gaining a comprehensive understanding of these elements, you can navigate the complexities of IRA contributions and make informed decisions for your retirement savings.

IRA Contribution Limits for 2024

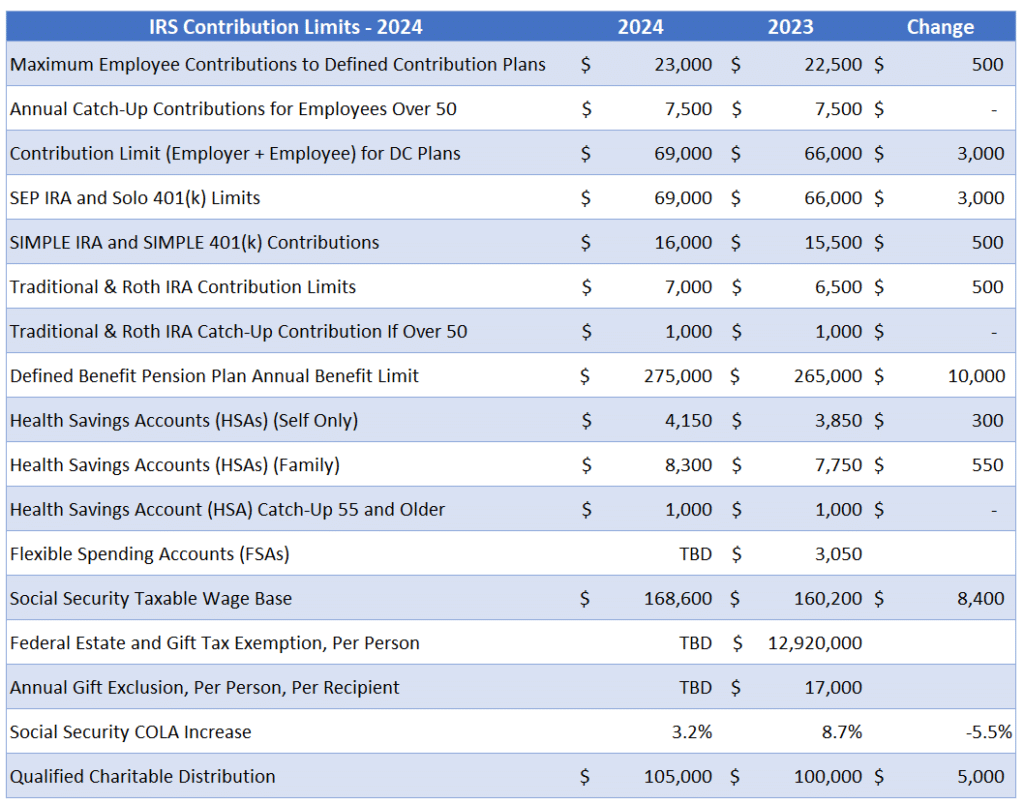

The annual contribution limit for traditional and Roth IRAs is the maximum amount you can contribute to your account each year without incurring a penalty. This limit is set by the IRS and can change from year to year.

Students often have different tax deadlines, and October 2024 might be relevant for some. Check here for information on student tax deadlines.

Contribution Limits for 2024

The annual contribution limit for traditional and Roth IRAs for 2024 is $6,500. If you are 50 or older, you can contribute an additional $1,000, known as a catch-up contribution, for a total of $7,500.

Missing the October 2024 tax deadline can have consequences. Learn about the potential penalties for late filing.

Contribution Limits by Age

Here is a table summarizing the contribution limits for different age groups in 2024:

| Age | Contribution Limit |

|---|---|

| Under 50 | $6,500 |

| 50 and older | $7,500 |

Changes to Contribution Limits

The annual contribution limit for traditional and Roth IRAs has increased from $6,500 in 2023 to $6,500 in 2024. This means that individuals can contribute more to their IRAs in 2024 than they could in 2023.

Tax brackets for qualifying widow(er)s can be complex, but this resource breaks down the specific rates for 2024.

IRA Contribution Limits for Beyond 2024

Predicting future IRA contribution limits is a complex endeavor, influenced by various factors. However, understanding the historical trends and potential drivers of change can provide insights into the potential future landscape.

The standard mileage rate for October 2024 is used for business and medical expenses. Get the latest information on the current rate.

Factors Influencing Future Changes

The IRA contribution limits are adjusted annually to reflect inflation, as measured by the Consumer Price Index (CPI). However, other factors can influence future changes, including:

- Economic Growth:Strong economic growth might lead to increased contributions, reflecting higher incomes and a more robust economy. Conversely, economic downturns could result in a slower pace of increases or even freezes.

- Government Policy:Policy changes related to retirement savings, such as tax incentives or changes in eligibility criteria, can significantly impact IRA contribution limits. For example, the SECURE Act of 2019 raised the age for required minimum distributions (RMDs) from 70 1/2 to 72, potentially increasing IRA contribution limits.

A tax bracket calculator can help you estimate your tax liability for 2024. Use this tool to get a personalized estimate.

- Demographic Trends:An aging population and increasing life expectancies could necessitate higher IRA contribution limits to ensure adequate retirement savings.

Projected IRA Contribution Limits

Based on historical trends and considering potential factors, the following table projects IRA contribution limits for the next five years:

| Year | Projected IRA Contribution Limit |

|---|---|

| 2025 | $7,000 |

| 2026 | $7,250 |

| 2027 | $7,500 |

| 2028 | $7,750 |

| 2029 | $8,000 |

It is crucial to note that these are just projections based on current trends and may vary depending on economic conditions and government policies.

Tax bracket changes can occur from year to year. Stay updated on any changes to the tax brackets for 2024.

IRA Contribution Limits and Income Limits: Ira Contribution Limits For 2024 And Beyond

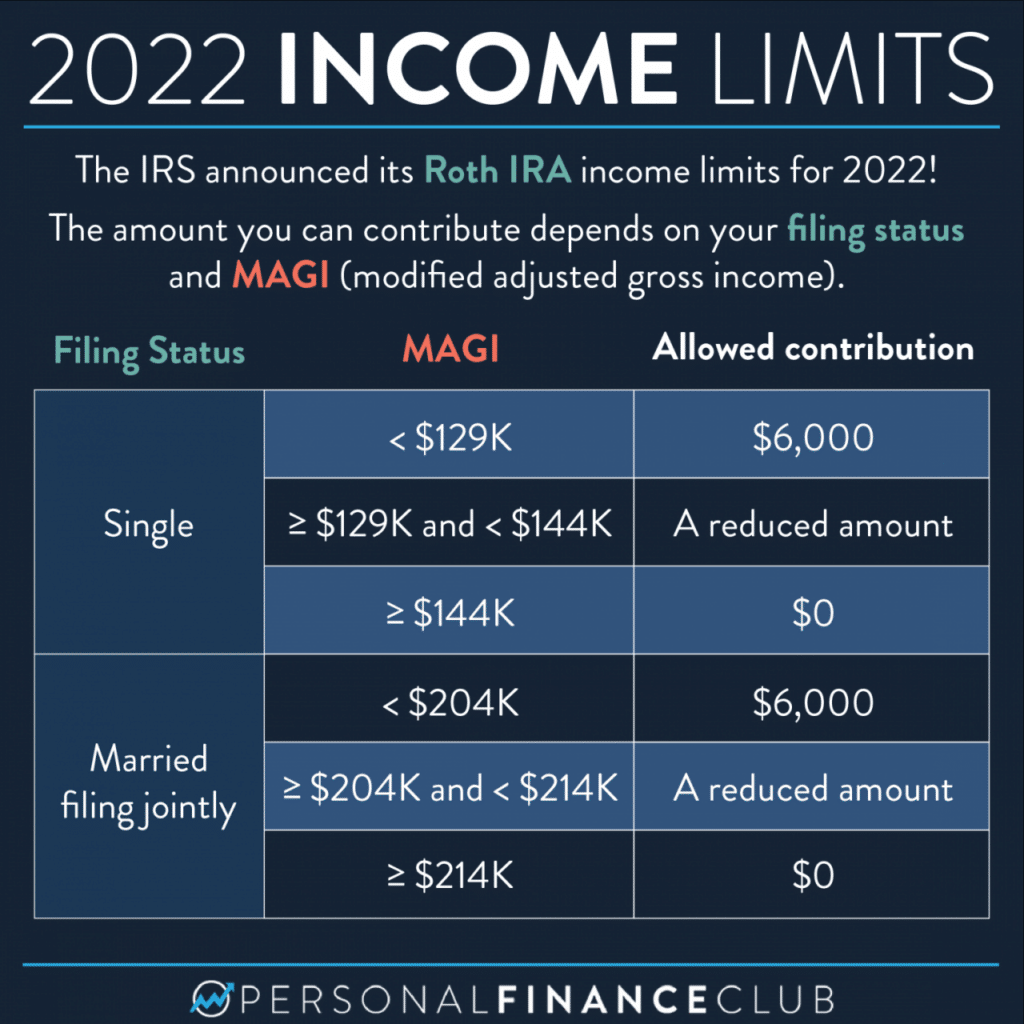

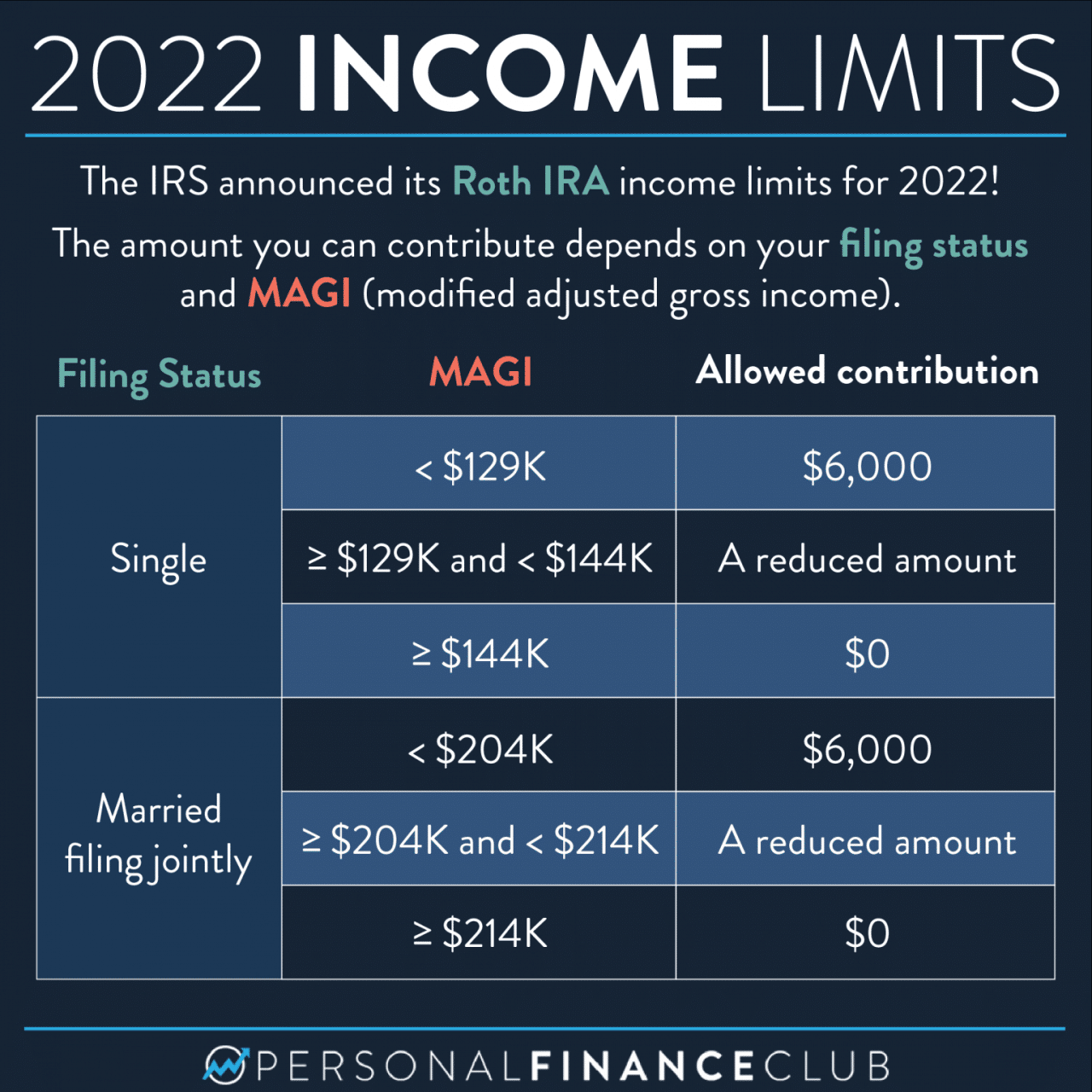

IRA contribution limits are adjusted annually to reflect inflation, but there are also income limits for contributing to a traditional IRA. Income limits for Roth IRAs also exist. These income limits can affect your eligibility to make contributions to these retirement accounts.

The mileage rate for October 2024 is a key factor for many, especially those who use their vehicles for work or medical purposes. This link provides the current mileage rate for the month.

Income Limitations for Traditional IRAs

The income limitations for contributing to a traditional IRA depend on your filing status. If your modified adjusted gross income (MAGI) exceeds the limit, you may not be able to contribute to a traditional IRA, or your deduction may be limited.

For self-employed individuals, the October 2024 tax deadline is crucial. Make sure you know when you need to file your taxes to avoid penalties.

The following table summarizes the income limitations for traditional IRAs for 2024:

| Filing Status | Income Limit |

|---|---|

| Single Filers | $73,000 |

| Married Filing Jointly | $146,000 |

| Head of Household | $109,000 |

| Qualifying Widow(er) | $146,000 |

| Married Filing Separately | $73,000 |

Income Limitations for Roth IRAs

The income limitations for contributing to a Roth IRA are similar to those for traditional IRAs. If your MAGI exceeds the limit, you may not be able to contribute to a Roth IRA. The following table summarizes the income limitations for Roth IRAs for 2024:

| Filing Status | Income Limit |

|---|---|

| Single Filers | $153,000 |

| Married Filing Jointly | $228,000 |

| Head of Household | $204,000 |

| Qualifying Widow(er) | $228,000 |

| Married Filing Separately | $114,000 |

IRA Contribution Strategies

Maximizing your IRA contributions can significantly impact your retirement savings. There are several strategies to consider, including choosing between Roth and Traditional IRAs and adjusting contributions based on your income and tax bracket.

Businesses have their own tax deadlines, and October 2024 is a key date for many. Stay informed about the specific deadline for your business.

Choosing Between Roth and Traditional IRAs, Ira contribution limits for 2024 and beyond

The decision between a Roth IRA and a Traditional IRA hinges on your current tax situation and your expected tax bracket in retirement. Here’s a breakdown of the key differences:

- Roth IRA: Contributions are made with after-tax dollars, and withdrawals in retirement are tax-free. This option is beneficial for individuals who anticipate being in a higher tax bracket in retirement.

- Traditional IRA: Contributions are made with pre-tax dollars, reducing your taxable income in the present. Withdrawals in retirement are taxed as ordinary income. This option is beneficial for individuals who anticipate being in a lower tax bracket in retirement.

The tax brackets for 2024 in the United States determine the amount of taxes you pay. Find out what the tax brackets are for this year.

Adjusting Contributions Based on Income and Tax Bracket

Your income and tax bracket play a crucial role in determining your IRA contribution strategy.

If you’re being reimbursed for mileage expenses, you’ll need to know the current reimbursement rate. This resource provides the latest information on the mileage reimbursement rate.

- High-Income Individuals: If you anticipate being in a high tax bracket in retirement, a Roth IRA might be a more advantageous choice. Contributions are made with after-tax dollars, leading to tax-free withdrawals in retirement.

- Low-Income Individuals: If you anticipate being in a lower tax bracket in retirement, a Traditional IRA might be more beneficial. You can deduct contributions from your current taxable income, resulting in tax savings.

Decision-Making Flowchart for IRA Contribution Strategies

The following flowchart illustrates the decision-making process for choosing the best IRA contribution strategy:

[Image of a flowchart with the following steps:]

For married couples filing separately in 2024, it’s essential to understand the specific tax brackets. This link provides a detailed breakdown of the rates.

1. Current Tax Bracket

Are you in a high or low tax bracket?

Are you curious about whether the mileage rate is changing in October 2024? Find out here if there are any updates to the standard mileage rate for business and medical expenses.

2. Expected Retirement Tax Bracket

Do you anticipate being in a higher or lower tax bracket in retirement?

3. Roth IRA

If you anticipate being in a higher tax bracket in retirement, a Roth IRA might be more advantageous.

4. Traditional IRA

If you anticipate being in a lower tax bracket in retirement, a Traditional IRA might be more beneficial.

5. Other Considerations

Factors such as age, investment goals, and risk tolerance can also influence your decision.

Epilogue

As you navigate the ever-evolving landscape of retirement planning, staying informed about IRA contribution limits is paramount. By understanding the current rules, potential future changes, and strategies for maximizing contributions, you can confidently build a robust retirement nest egg. Remember to consult with a financial advisor for personalized guidance tailored to your individual circumstances.

FAQ Resource

What is the difference between a Traditional IRA and a Roth IRA?

A Traditional IRA allows for tax deductions on contributions, while distributions are taxed in retirement. Conversely, a Roth IRA offers tax-free distributions in retirement but contributions are not tax-deductible.

Can I contribute to both a Traditional IRA and a Roth IRA in the same year?

Yes, you can contribute to both a Traditional IRA and a Roth IRA in the same year, but there are income limitations for Roth IRA contributions.

What happens if I contribute more than the IRA contribution limit?

If you exceed the contribution limit, you may face penalties and taxes on the excess contributions. It’s essential to stay within the limits to avoid these consequences.

Can I withdraw contributions from my IRA before retirement?

You can withdraw contributions from a Traditional IRA at any time without penalty, but withdrawals from a Roth IRA before age 59 1/2 are generally subject to taxes and penalties.

October 2024 might bring changes to the mileage rate. Find out if there are any updates to the mileage rate for this month.

Understanding tax brackets for 2024 is crucial for accurate tax planning. This guide can help you navigate the different tax brackets.