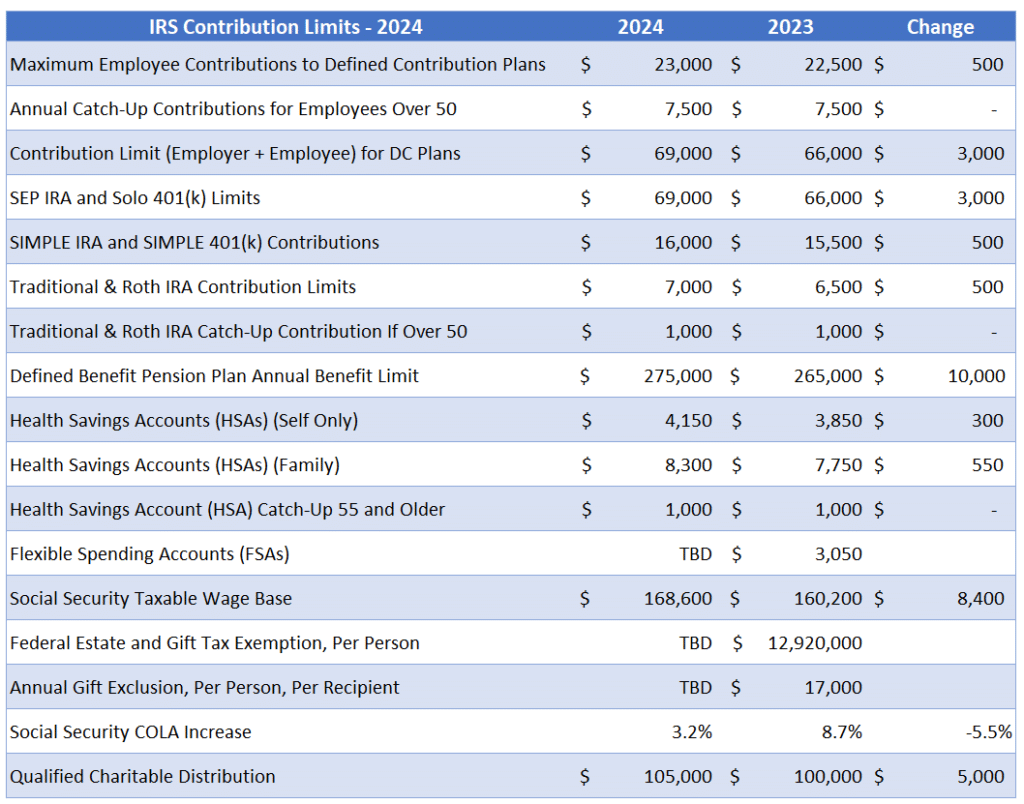

IRA contribution limits for 2024 vs 2023: Navigating the changes to your retirement savings. Whether you’re a seasoned investor or just starting, understanding how these limits impact your contributions is crucial. This guide explores the key differences between 2023 and 2024 limits, offering insights to help you maximize your retirement savings.

Traditional and Roth IRAs are popular retirement savings vehicles offering tax advantages. Contribution limits for these accounts can fluctuate, influenced by factors like inflation and government policies. The changes for 2024 are particularly important to consider, as they may impact your ability to save for the future.

This guide provides a clear overview of the 2023 and 2024 limits, highlighting key differences and offering strategies for maximizing your contributions.

Factors Affecting Contribution Limits

The annual contribution limits for IRAs are subject to change, reflecting economic and legislative influences. These limits are adjusted to keep pace with inflation and to ensure the continued viability of retirement savings programs.

Curious about how the mileage rate is calculated for October 2024? The mileage rate calculation can be a bit complex, but it’s essential for deducting business expenses. This rate can vary depending on the type of vehicle and the distance traveled, so it’s worth understanding the process.

Inflation and Economic Conditions, Ira contribution limits for 2024 vs 2023

Inflation plays a significant role in determining IRA contribution limits. The Internal Revenue Service (IRS) annually adjusts these limits based on the cost of living, as measured by the Consumer Price Index (CPI). This adjustment ensures that the purchasing power of contributions remains consistent over time, despite inflation.

Did you know that the mileage rate for medical expenses can differ? The October 2024 mileage rate for medical expenses is a helpful tool for claiming deductions related to healthcare. Be sure to consult the IRS guidelines for accurate calculations.

For instance, if the CPI increases by 3%, the IRA contribution limit might also increase by 3% to maintain the real value of contributions.Economic conditions can also influence contribution limits, though this is less direct than inflation. During periods of economic uncertainty or recession, lawmakers may consider adjusting contribution limits to encourage retirement savings and stimulate the economy.

Planning to contribute to your IRA? Check out the latest IRA contribution limits for 2024 to ensure you’re maximizing your savings. These limits can fluctuate, so staying informed is key to making the most of your retirement planning.

Conversely, in times of strong economic growth, contribution limits might be adjusted to ensure the long-term sustainability of retirement programs.

Epilogue

As you navigate the ever-changing landscape of retirement savings, understanding IRA contribution limits is essential. The differences between 2023 and 2024 highlight the importance of staying informed and adjusting your savings strategy as needed. By maximizing your contributions and leveraging the benefits of both traditional and Roth IRAs, you can build a solid foundation for a secure retirement.

Remember to consult with a financial advisor to create a personalized plan that aligns with your unique circumstances and goals.

FAQ Summary: Ira Contribution Limits For 2024 Vs 2023

What is the difference between a traditional IRA and a Roth IRA?

A traditional IRA allows you to deduct your contributions from your taxable income, reducing your tax bill in the present. However, you’ll pay taxes on your withdrawals in retirement. A Roth IRA, on the other hand, doesn’t offer tax deductions for contributions, but your withdrawals in retirement are tax-free.

Can I contribute to both a traditional and Roth IRA in the same year?

Yes, you can contribute to both a traditional and Roth IRA in the same year, but your total contributions across both accounts cannot exceed the annual limit.

What happens if I contribute more than the limit to my IRA?

If you contribute more than the annual limit, you may be subject to penalties. The IRS considers excess contributions as a tax liability, and you may also face a 6% penalty on the excess amount.

Can I withdraw contributions from my IRA before retirement?

You can withdraw contributions from your IRA before retirement, but you may have to pay taxes and penalties depending on your age and the reason for the withdrawal.

Tax brackets can significantly impact your bottom line. Understanding the tax bracket changes for 2024 vs 2023 can help you strategize your income and expenses. These changes are often announced well in advance, giving you time to plan accordingly.

Wondering what the new tax brackets are for 2024? The new tax brackets for 2024 are a key factor in determining your tax liability. Stay informed about these brackets to avoid surprises come tax season.

Filing as head of household? The tax brackets for head of household in 2024 can be advantageous for single parents or those supporting dependents. Understanding these brackets is crucial for maximizing your tax benefits.

The October 2024 tax deadline is fast approaching! Get a head start on your tax preparation with these helpful tax preparation tips. From gathering documents to utilizing online tools, these strategies can streamline the process and reduce stress.

Single filers should be aware of the tax brackets for single filers in 2024. These brackets can differ from other filing statuses, so it’s essential to understand how they affect your income and deductions.

Tax brackets can have a significant impact on your income. Learn how tax brackets will affect your 2024 income to make informed financial decisions. Understanding the relationship between income and tax brackets can help you plan for the year ahead.

The IRS offers valuable resources to help navigate the tax process. Explore the IRS resources for the October 2024 tax deadline , including online tools, publications, and contact information. These resources can provide guidance and support throughout the tax season.

Self-employed individuals have a different tax deadline than other taxpayers. The October 2024 tax deadline for self-employed individuals is an important date to remember. Stay organized and ensure you file your taxes on time to avoid penalties.

Stay informed about the tax brackets for 2024 in the United States to plan your finances effectively. These brackets can change annually, so it’s crucial to stay updated on the latest information.

Keep an eye out for any October 2024 mileage rate changes. These changes can impact your deductions, so staying informed is essential for maximizing your tax benefits.

The tax bracket changes for 2024 can affect your overall tax liability. Understanding these changes can help you plan your finances and make informed decisions about your income and expenses.

The tax landscape is constantly evolving. Stay informed about the tax changes impacting the October 2024 deadline to ensure you’re prepared for filing season. These changes could include new deductions, credits, or regulations that could affect your tax obligations.