Ira contribution limits for traditional IRA in 2024 – Traditional IRA contribution limits for 2024 set the stage for this informative exploration, offering readers a glimpse into a crucial aspect of retirement planning. This guide delves into the maximum contribution amount for traditional IRAs in 2024, considering factors such as age and income limitations.

We’ll discuss the implications of exceeding the contribution limit and the tax deductibility of contributions. Understanding these limits and eligibility criteria is essential for maximizing your retirement savings and minimizing your tax burden.

The information provided here is intended for educational purposes only and should not be considered financial advice. It is crucial to consult with a qualified financial advisor before making any decisions about your retirement savings.

Traditional IRA Contribution Limits in 2024

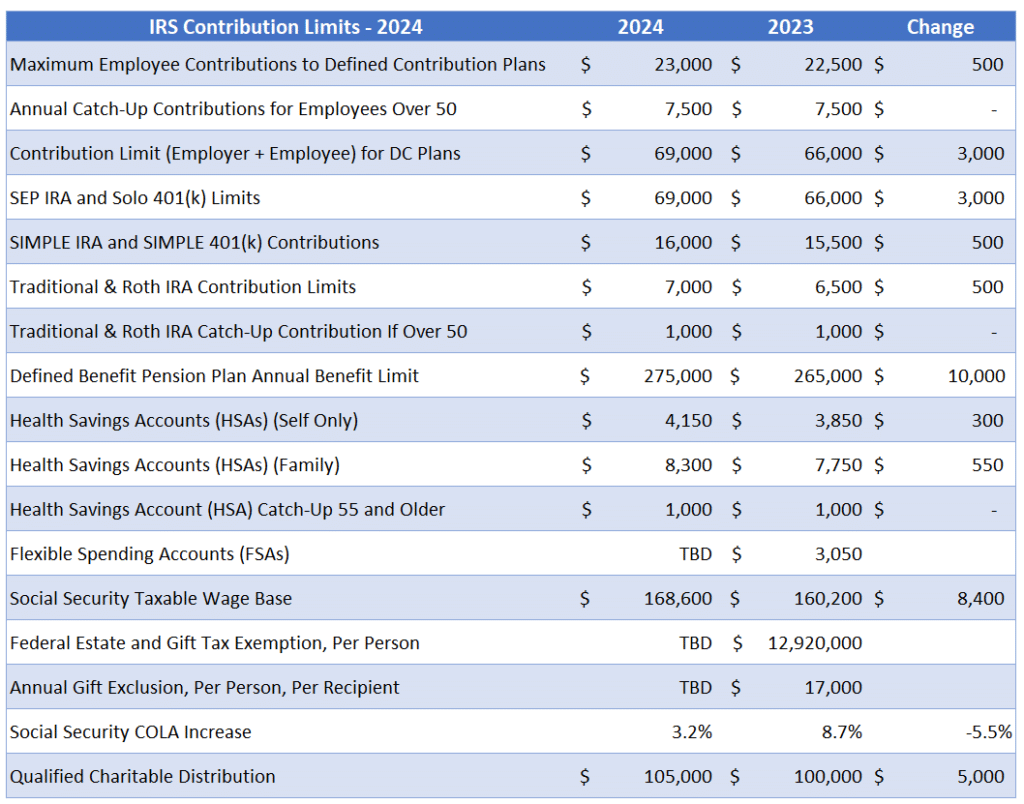

In 2024, you can contribute a maximum of $6,500 to a traditional IRA if you are under the age of 50. If you are 50 or older, you can contribute an additional $1,000 as a catch-up contribution, for a total of $7,500.

The October 2024 tax deadline is fast approaching, and it’s crucial to understand the various tax credits available to you. You can learn more about the tax credits for the October 2024 deadline on our website. Make sure to take advantage of any applicable credits to reduce your tax burden.

Contribution Limits Based on Age

The contribution limit for traditional IRAs can be impacted by your age. Here’s a breakdown:

- Under 50:You can contribute up to $6,500 in 2024.

- 50 or Older:You can contribute up to $7,500 in 2024, which includes the $1,000 catch-up contribution.

Consequences of Exceeding Contribution Limits, Ira contribution limits for traditional IRA in 2024

Exceeding the contribution limit for a traditional IRA can result in penalties.

For those who frequently drive for work or business purposes, the standard mileage rate is a key factor in determining tax deductions. Find out the standard mileage rate for October 2024 to ensure you’re claiming the correct amount.

If you exceed the contribution limit, the IRS will assess a 6% penalty on the excess contribution.

Understanding the tax brackets for 2024 is essential for planning your finances. We’ve compiled a comprehensive guide outlining the tax rates for each tax bracket in 2024 to help you navigate the tax landscape.

This penalty applies to the excess amount and is calculated annually. The penalty is assessed in addition to any regular income tax due on the excess contribution. For example, if you contribute $7,000 to a traditional IRA in 2024 and you are under the age of 50, you will be assessed a 6% penalty on the $500 excess contribution ($30).

Closing Notes

Navigating the world of traditional IRAs can be complex, but understanding the contribution limits, eligibility criteria, and tax implications is key to making informed decisions about your retirement savings. By carefully considering the information presented here and seeking professional guidance, you can create a robust retirement plan that aligns with your financial goals.

Detailed FAQs: Ira Contribution Limits For Traditional IRA In 2024

What happens if I contribute more than the IRA contribution limit?

If you exceed the contribution limit, you may be subject to a penalty. The IRS will assess a 6% penalty on the excess contribution. It’s important to avoid exceeding the limit to ensure you don’t incur any penalties.

Can I contribute to a traditional IRA if I’m already participating in a 401(k) plan?

Yes, you can contribute to a traditional IRA even if you have a 401(k) plan. However, your eligibility for tax deductions on your IRA contributions may be affected by your income level and participation in other retirement plans.

Are there any age limits for contributing to a traditional IRA?

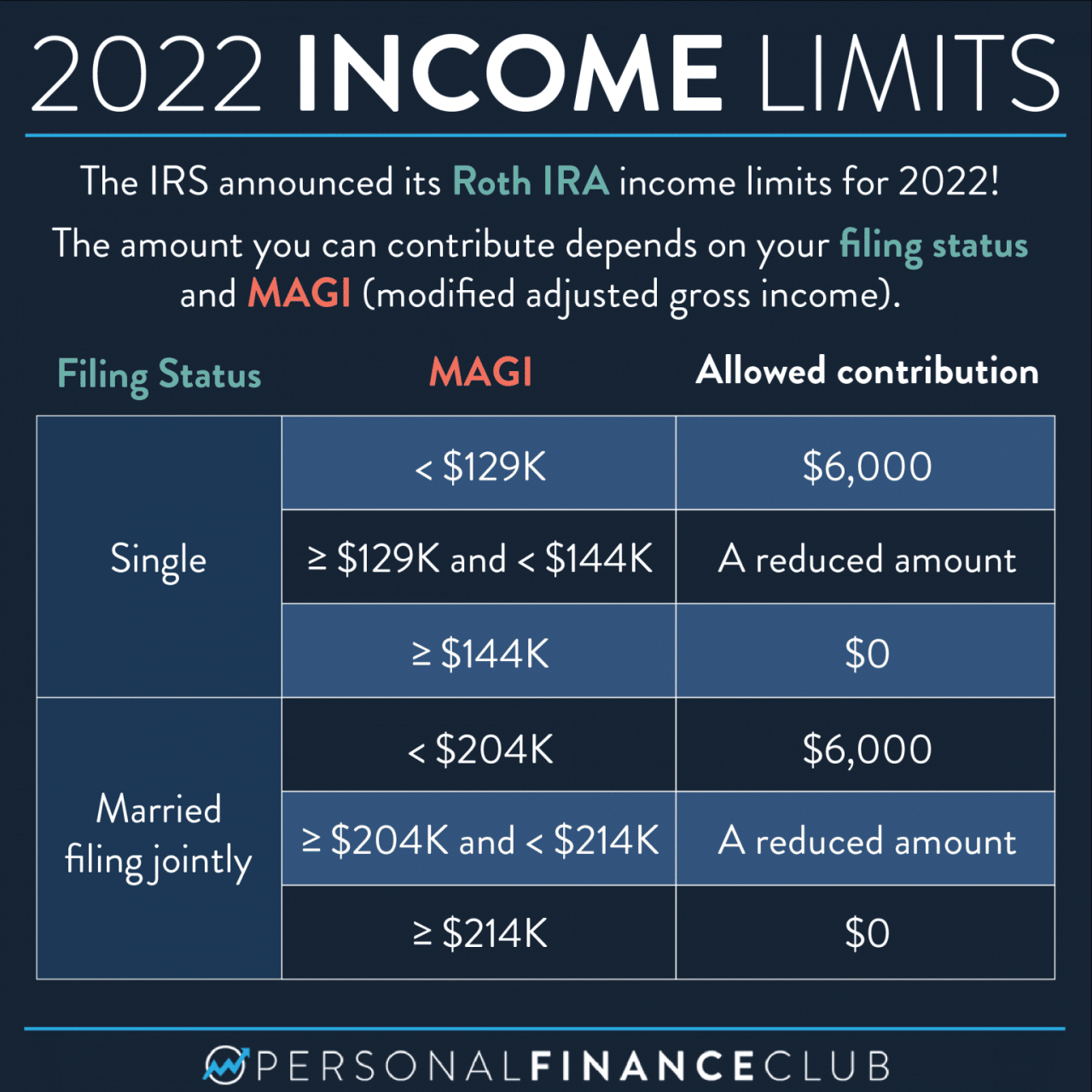

There is no age limit for contributing to a traditional IRA. However, there are income limitations based on your filing status. For example, if you are single and your modified adjusted gross income (MAGI) exceeds a certain threshold, you may not be eligible for a full tax deduction on your IRA contributions.

Planning for retirement involves understanding the contribution limits for various retirement accounts. Our website provides information on the IRA limits for October 2024 , allowing you to maximize your retirement savings.

Stay informed about any potential changes to the mileage rate for 2024. We’ve got you covered with details on whether the mileage rate is changing in October 2024 and what that means for your tax deductions.

With the new year comes potential changes to the tax bracket system. Keep up-to-date with the tax bracket changes for 2024 to understand how they may impact your tax liability.

Foreign nationals living in the U.S. have specific tax filing requirements. Learn about the October 2024 tax deadline for foreign nationals to ensure you meet your obligations.

When claiming medical expense deductions, it’s important to know the correct mileage rate for medical travel. Our website provides the October 2024 mileage rate for medical expenses to help you calculate your deductions.

Retirees have unique tax considerations, including deadlines. Check out the October 2024 tax deadline for retirees to ensure you file your taxes on time.

When donating to charities, you can deduct mileage expenses. Get the latest information on the October 2024 mileage rate for charitable donations to maximize your deductions.

Self-employed individuals have specific tax obligations. Find out the October 2024 tax deadline for self-employed individuals to ensure you meet your filing requirements.

Stay informed about the latest changes to the tax system, including the new tax brackets for 2024 , to understand how they may affect your tax liability.

Tax preparation can be overwhelming. Our website offers helpful tax preparation tips for the October 2024 deadline to make the process smoother.

Knowing the current mileage rate is crucial for various tax deductions. Learn the mileage rate for October 2024 to ensure you’re claiming the correct amount.

Don’t miss the deadline for filing your taxes. Find out what the tax deadline is for October 2024 to avoid any penalties.