Ira contribution limits for SIMPLE IRA in 2024 – SIMPLE IRA contribution limits for 2024 offer a valuable opportunity for individuals to save for retirement while potentially benefiting from tax advantages. These plans, designed for small businesses and their employees, allow both employers and employees to contribute, building a nest egg for the future.

This guide explores the intricacies of SIMPLE IRA contribution limits in 2024, including the maximum contributions for both employees and employers, as well as a comparison to previous years. It delves into the factors to consider when determining contribution amounts, highlighting the tax benefits and strategies for maximizing savings.

Additionally, it sheds light on withdrawal rules, tax implications, and potential penalties associated with early withdrawals, providing a comprehensive understanding of this retirement savings option.

SIMPLE IRA Basics

A SIMPLE IRA, or Savings Incentive Match Plan for Employees, is a retirement savings plan that is designed for small businesses. It’s a way for employers to offer their employees a tax-advantaged way to save for retirement.

If you’re planning on using the standard mileage rate for business travel, you’ll need to know the current rate. You can find the mileage rate for October 2024 on the linked page.

The main purpose of a SIMPLE IRA is to provide a simple and affordable way for both employers and employees to save for retirement.

The mileage rate for business travel can change, so it’s a good idea to check if there are any updates. You can find out if the mileage rate is changing in October 2024 on the linked page.

Eligibility Requirements

There are some requirements for employees to be eligible to participate in a SIMPLE IRA.

Students often have different tax deadlines, so it’s important to be aware of the specific deadline for October 2024. You can find more details about the October 2024 tax deadline for students on the linked page.

- An employee must be at least 18 years old.

- They must have worked for the employer for at least 12 months.

- They must be expected to work at least 1,000 hours in the current year.

Differences Between a SIMPLE IRA and a Traditional IRA

A SIMPLE IRA and a traditional IRA are both retirement savings plans that offer tax advantages, but there are some key differences between them.

IRA contribution limits can change each year, so it’s a good idea to check the current limits. You can find out more about the IRA limits for October 2024 on the linked page.

- Employer Contributions:SIMPLE IRAs allow for employer contributions, while traditional IRAs do not.

- Contribution Limits:The contribution limits for SIMPLE IRAs are higher than for traditional IRAs. In 2024, the maximum contribution limit for SIMPLE IRAs is $15,500, while the maximum contribution limit for traditional IRAs is $7,000.

- Withdrawals:Withdrawals from a SIMPLE IRA before age 59 1/2 are generally subject to a 25% penalty, plus taxes. However, there are some exceptions to this rule, such as if you are disabled or if you are taking the money to pay for certain medical expenses.

The tax deadline for October 2024 might be different depending on your situation. You can find the latest information on the tax deadline for October 2024 to make sure you’re prepared.

2024 Contribution Limits

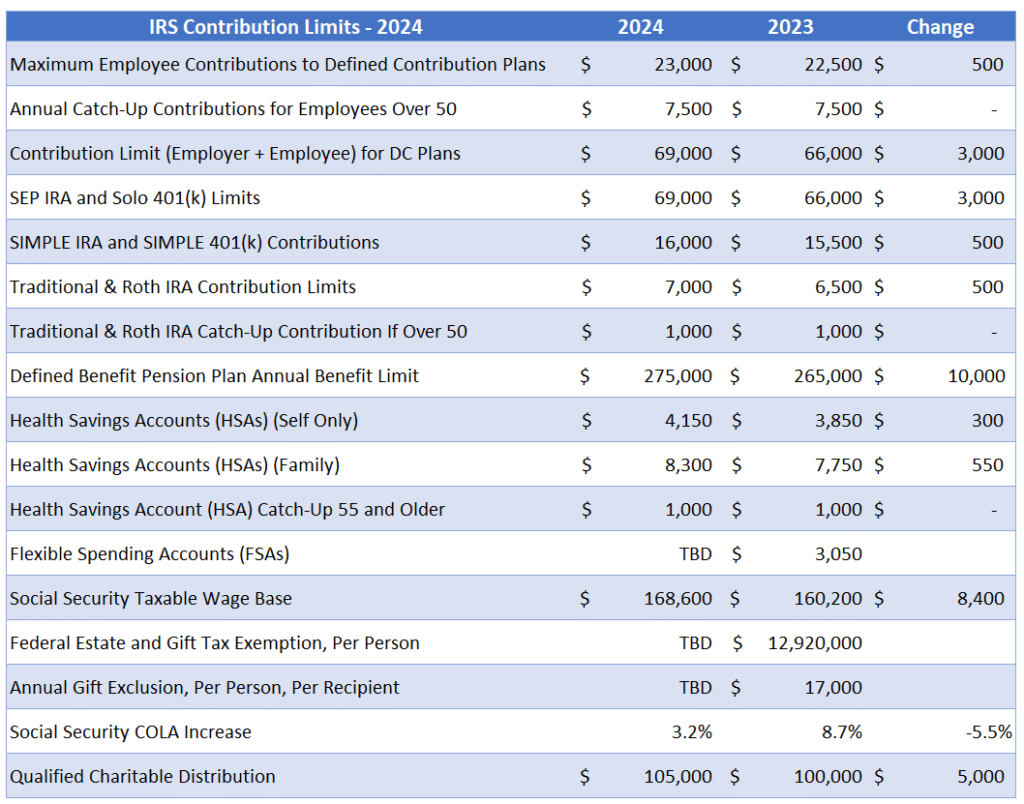

The 2024 contribution limits for SIMPLE IRAs are designed to help both employees and employers save for retirement. The limits are adjusted annually to reflect inflation and economic conditions.

If you’re over 50, you might be eligible for an increased IRA contribution limit. You can find out more about the IRA contribution limits for people over 50 in 2024 on the linked page.

Employee Contribution Limit

The maximum amount an employee can contribute to a SIMPLE IRA in 2024 is $15,500. This is an increase from the 2023 limit of $15,000.

The tax bracket thresholds for 2024 are important to know when figuring out how much you’ll owe in taxes. You can find the latest information on tax bracket thresholds for 2024 to make sure you’re prepared.

Employer Matching Contribution Limit

Employers who offer SIMPLE IRAs can choose to make matching contributions to their employees’ accounts. The maximum matching contribution limit for 2024 is 3% of the employee’s compensation.

Missing the tax deadline can result in penalties, so it’s important to be aware of the consequences. The tax penalties for missing the October 2024 deadline are outlined on the linked page.

Contribution Limit Comparison

The following table shows the contribution limits for SIMPLE IRAs in the past few years:

| Year | Employee Contribution Limit | Employer Matching Contribution Limit |

|---|---|---|

| 2024 | $15,500 | 3% of compensation |

| 2023 | $15,000 | 3% of compensation |

| 2022 | $14,500 | 3% of compensation |

| 2021 | $14,000 | 3% of compensation |

Contribution Strategies

When deciding how much to contribute to your SIMPLE IRA, there are several factors to consider. These factors will help you make an informed decision about your contribution amount and ultimately help you reach your financial goals.

Businesses have different tax deadlines than individuals. You can find the specific deadline for businesses on the October 2024 tax deadline for businesses page.

Tax Advantages of Contributing to a SIMPLE IRA

Contributing to a SIMPLE IRA offers several tax advantages. These benefits can significantly impact your overall financial well-being.

If you’re using the standard mileage rate for business travel, you’ll want to know the current rate. You can find the mileage reimbursement rate for October 2024 on the linked page.

- Tax-Deferred Growth:Your contributions grow tax-deferred, meaning you won’t pay taxes on your earnings until you withdraw them in retirement. This allows your money to grow at a faster rate than it would in a taxable account.

- Traditional SIMPLE IRA:Contributions are tax-deductible, which reduces your taxable income for the year, potentially lowering your tax bill.

- Roth SIMPLE IRA:Contributions are made with after-tax dollars, but withdrawals in retirement are tax-free. This is beneficial if you expect to be in a higher tax bracket in retirement.

Maximizing Contributions

You can maximize your contributions to your SIMPLE IRA in several ways. This can significantly increase your retirement savings over time.

Foreign nationals may have different tax deadlines than U.S. citizens. You can find more information on the October 2024 tax deadline for foreign nationals on the linked page.

- Contribute the Full Amount:The maximum contribution amount for 2024 is $15,500. By contributing the full amount, you’re taking full advantage of the tax benefits and maximizing your savings potential.

- Increase Contributions Gradually:If you can’t contribute the full amount immediately, consider gradually increasing your contributions over time. This will help you reach your savings goals without putting too much strain on your budget.

- Consider Catch-Up Contributions:If you’re 50 or older, you can contribute an additional $4,000 in catch-up contributions. This allows you to save even more for retirement in your later years.

Example of Maximizing Contributions, Ira contribution limits for SIMPLE IRA in 2024

Let’s say you’re 35 years old and earn $60,000 per year. You decide to contribute the full $15,500 to your SIMPLE IRA in 2024. Assuming an average annual return of 7%, your account could grow to over $400,000 by the time you retire at age 67.

There are some changes to the tax brackets for 2024, so it’s worth checking out the details. You can learn more about these tax bracket changes for 2024 and how they might affect your tax bill.

This illustrates the power of maximizing your contributions and taking advantage of the tax benefits of a SIMPLE IRA.

The Seahawks had a tough loss in Week 5, and it’s definitely worth reading about their comeback attempt. Check out the Rapid Reactions: Seahawks Comeback Falls Short In Week 5 Loss article for a detailed breakdown.

Withdrawal Rules

Accessing your SIMPLE IRA funds before age 59 1/2 generally isn’t recommended, as it usually involves penalties and taxes. However, there are exceptions, and understanding these rules is crucial to make informed decisions about your retirement savings.

Early Withdrawals

You can withdraw money from your SIMPLE IRA before age 59 1/2 without penalty under certain circumstances.

- Disability: If you become disabled, you can withdraw funds from your SIMPLE IRA tax-free and penalty-free.

- Death: Your beneficiaries can inherit your SIMPLE IRA funds tax-free and penalty-free.

- First-time Homebuyer: You can withdraw up to $10,000 tax-free and penalty-free for a first-time home purchase. This applies only to funds that have been in the account for at least two years.

- Higher Education Expenses: You can withdraw funds for higher education expenses for yourself, your spouse, or a dependent. This withdrawal is tax-free and penalty-free if the funds are used for tuition, fees, books, supplies, and other related expenses. You can withdraw up to $10,000 per student.

Retirees have their own set of tax rules and deadlines. If you’re a retiree, make sure to check the October 2024 tax deadline for retirees to ensure you file on time.

- Medical Expenses: If you have unreimbursed medical expenses that exceed 7.5% of your adjusted gross income, you can withdraw funds from your SIMPLE IRA to cover these expenses. This withdrawal is tax-free and penalty-free.

Tax Implications

When you withdraw funds from your SIMPLE IRA before age 59 1/2, you will generally have to pay taxes and a 10% early withdrawal penalty.

Note:The 10% penalty may not apply if you qualify for one of the exceptions listed above.

If you need to know the IRS mileage rate for business travel, you can find the most up-to-date information on the IRS mileage rate for October 2024 page.

Penalties for Early Withdrawals

If you withdraw funds from your SIMPLE IRA before age 59 1/2 without qualifying for an exception, you will generally have to pay a 10% penalty on the amount withdrawn, in addition to your regular income tax rate. This penalty is imposed by the IRS and is meant to discourage early withdrawals.

Example:Let’s say you withdraw $10,000 from your SIMPLE IRA before age 59 1/2, and your tax bracket is 22%. You will have to pay $2,200 in taxes (22% of $10,000) and a $1,000 penalty (10% of $10,000), for a total of $3,200.

Concluding Remarks: Ira Contribution Limits For SIMPLE IRA In 2024

Understanding SIMPLE IRA contribution limits for 2024 empowers individuals to make informed decisions about their retirement savings. By leveraging the benefits of this plan, employees and employers can contribute to a secure financial future, while potentially benefiting from tax advantages and the peace of mind that comes with having a solid retirement plan in place.

Question Bank

What are the eligibility requirements for a SIMPLE IRA?

To be eligible for a SIMPLE IRA, you must be an employee of a small business that offers the plan. There are no age or income restrictions.

What are the tax benefits of contributing to a SIMPLE IRA?

Contributions to a SIMPLE IRA are made with pre-tax dollars, meaning you won’t pay taxes on them until you withdraw the money in retirement. This can significantly reduce your current tax liability.

Can I withdraw my contributions from a SIMPLE IRA before age 59 1/2?

You can withdraw your contributions from a SIMPLE IRA before age 59 1/2 without penalty, but you will be taxed on the withdrawn amount. However, early withdrawals of employer contributions may be subject to penalties.

How do I choose between a SIMPLE IRA and a traditional IRA?

The best choice for you depends on your individual circumstances. If you work for a small business that offers a SIMPLE IRA, it’s a good option to consider. However, if you’re self-employed or work for a company that doesn’t offer a SIMPLE IRA, a traditional IRA may be a better fit.