Ira contribution limits for Roth IRA in 2024 – Roth IRA contribution limits for 2024 are a crucial aspect of retirement planning, offering individuals a tax-advantaged way to save for their future. Understanding these limits and how they affect your eligibility is essential for maximizing your retirement savings potential.

This guide will delve into the specifics of Roth IRA contribution limits for 2024, exploring factors like income thresholds, age-related adjustments, and the benefits of contributing to a Roth IRA. Whether you’re just starting your retirement journey or looking to optimize your existing savings strategy, this information will provide valuable insights.

Roth IRA Contribution Limits

A Roth IRA is a retirement savings account that allows you to make after-tax contributions, meaning you don’t pay taxes on the money you contribute. The benefit of a Roth IRA is that you can withdraw your contributions and earnings tax-free in retirement.

If you’ve donated your time or resources to a charity, you might be eligible for a mileage deduction. October 2024 mileage rate for charitable donations is set by the IRS and can help reduce your tax liability. Be sure to keep accurate records of your mileage and other relevant information to claim this deduction.

Contribution limits are the maximum amount of money you can contribute to a Roth IRA in a given year. These limits are set by the IRS and are subject to change each year.

Tax credits can help reduce your tax liability and put money back in your pocket. Tax credits for the October 2024 deadline may be available for various situations, such as education, child care, or energy efficiency. Make sure to explore these options to see if you qualify.

2024 Roth IRA Contribution Limits

The 2024 Roth IRA contribution limit is $7,000 for individuals under the age of 50. Those who are 50 and older can contribute an additional $1,000, bringing their total contribution limit to $8,000.

Self-employed individuals have unique tax obligations, including filing estimated taxes throughout the year. October 2024 tax deadline for self-employed individuals might be different from the standard deadline, so it’s crucial to double-check and ensure you’re in compliance. There are also specific deductions and credits available for the self-employed.

2024 Contribution Limits for Roth IRA: Ira Contribution Limits For Roth IRA In 2024

The Roth IRA is a popular retirement savings option that allows you to contribute after-tax dollars and potentially withdraw your earnings tax-free in retirement. The maximum amount you can contribute to a Roth IRA each year is subject to change, and it’s important to stay updated on the latest limits.

Life happens, and sometimes you need a little extra time to file your taxes. Tax filing extensions for October 2024 are available, but it’s important to note that an extension only grants you more time to file, not to pay.

You’ll still need to pay any taxes owed by the original deadline.

Contribution Limits for 2024

The maximum contribution limit for Roth IRAs in 2024 is $7,000. This represents an increase from the 2023 limit of $6,500. If you are 50 years or older, you can contribute an additional $1,000, bringing your total contribution limit to $8,000.

Understanding how tax brackets work is essential for planning your finances and maximizing your tax savings. Understanding tax brackets for 2024 can help you make informed decisions about your income and expenses. Tax brackets can change each year, so it’s crucial to stay updated.

Changes from Previous Years, Ira contribution limits for Roth IRA in 2024

The contribution limit for Roth IRAs has increased gradually over the years. The increase in 2024 is consistent with the adjustments made in previous years to account for inflation.

Freelancers are often considered self-employed, which means they have unique tax obligations. October 2024 tax deadline for freelancers might be different from the standard deadline, so it’s essential to research and file accordingly. Freelancers may also be eligible for specific deductions and credits.

Impact of Age on Contribution Limits

While there is no age limit to contribute to a Roth IRA, the contribution limit for those 50 and older is higher. This is designed to help older individuals catch up on their retirement savings.

If you use your vehicle for business purposes, you can deduct your mileage expenses. October 2024 mileage rate for business use is determined by the IRS and can vary each year. Keep accurate records of your business miles to maximize your deduction.

The maximum contribution limit for 2024 is $7,000, or $8,000 for those 50 and older.

The mileage rate can change each year, so it’s important to stay updated. Is the mileage rate changing in October 2024? You can find the latest mileage rate on the IRS website.

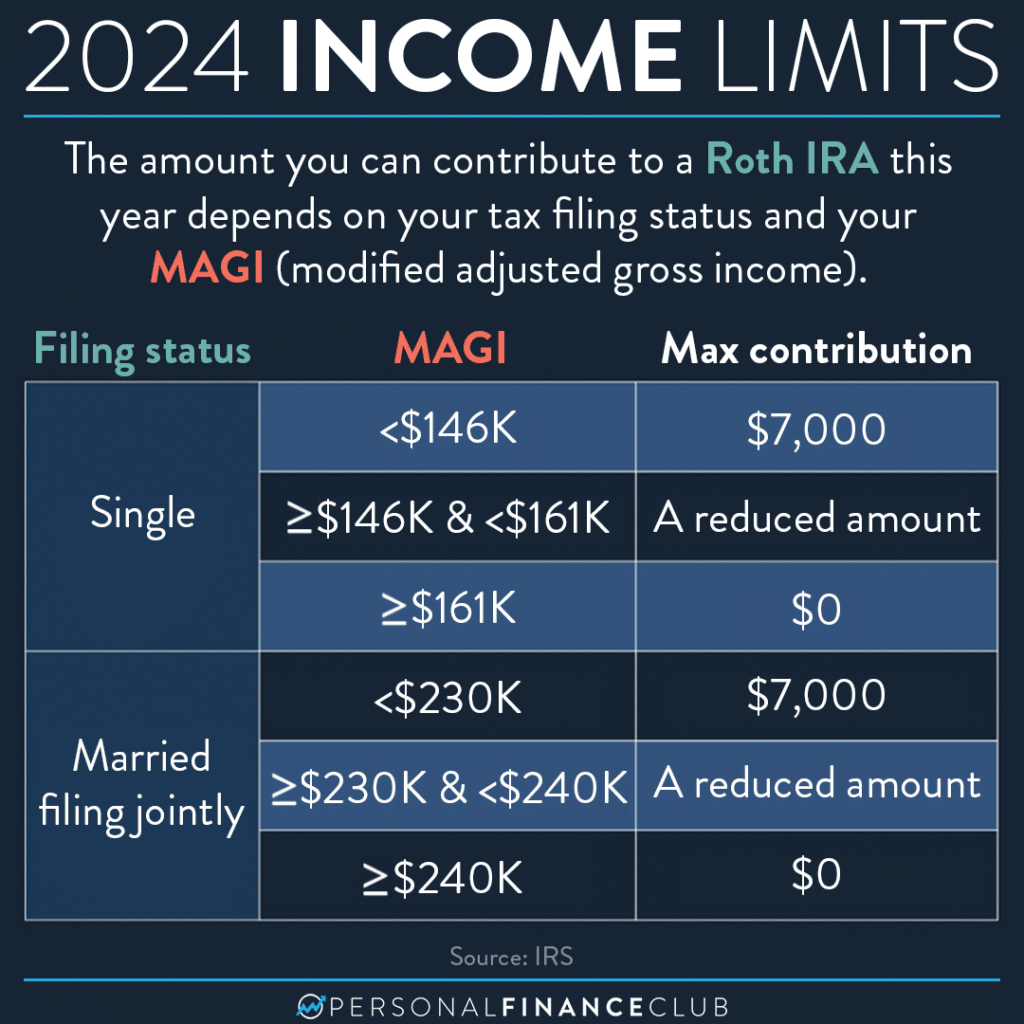

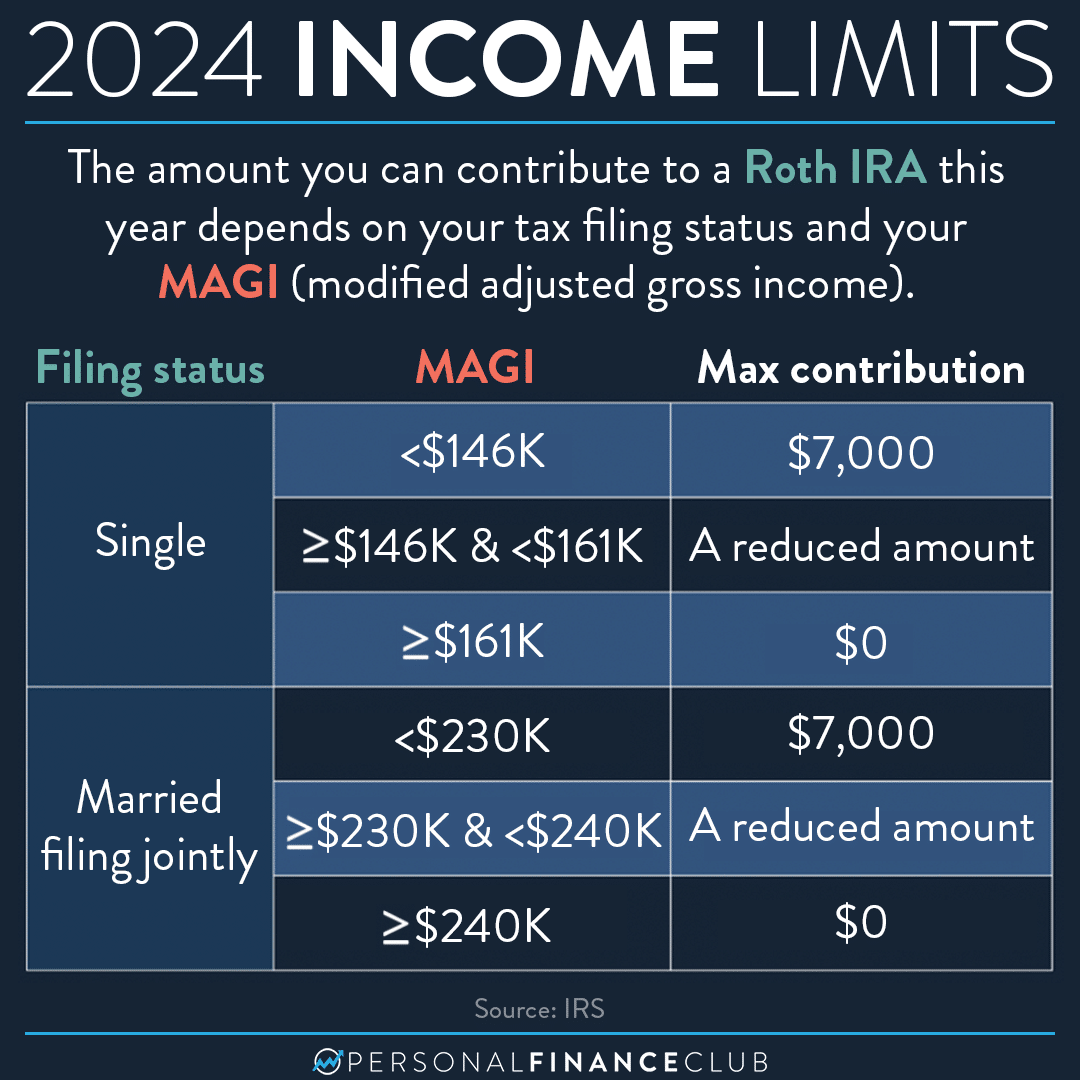

Income Eligibility for Roth IRA Contributions

Not everyone is eligible to contribute to a Roth IRA. The amount of income you earn can affect your eligibility. The IRS has set income limits for Roth IRA contributions, and if your income exceeds these limits, you may not be able to contribute or may only be able to contribute a reduced amount.

The mileage reimbursement rate is the amount you can receive for your business or medical mileage expenses. What is the mileage reimbursement rate for October 2024? This rate is often used by employers to reimburse employees for business travel expenses.

Income Limits for Roth IRA Contributions in 2024

The income limits for Roth IRA contributions are based on your modified adjusted gross income (MAGI). The MAGI is your adjusted gross income (AGI) plus certain deductions that are not allowed for Roth IRA purposes. Here are the 2024 income limits for Roth IRA contributions:

- Single Filers and Head of Household:You can contribute the full amount to a Roth IRA if your MAGI is $153,000 or less. If your MAGI is between $153,000 and $168,000, your contribution amount will be reduced. You cannot contribute to a Roth IRA if your MAGI is $168,000 or more.

The highest tax bracket in 2024 can vary depending on your filing status and income level. What is the highest tax bracket in 2024? Understanding this information can help you make informed financial decisions and plan for your taxes effectively.

- Married Filing Jointly:You can contribute the full amount to a Roth IRA if your combined MAGI is $228,000 or less. If your combined MAGI is between $228,000 and $243,000, your contribution amount will be reduced. You cannot contribute to a Roth IRA if your combined MAGI is $243,000 or more.

Phase-Out Rules

If your MAGI falls within the phase-out range, your contribution amount will be reduced. The reduction is calculated on a pro-rata basis. This means that the amount you can contribute is reduced by a percentage of your income that exceeds the limit.

For example, if your MAGI is $160,000 as a single filer, you can only contribute a portion of the full amount. The reduction is calculated as follows:

($160,000

The mileage rate used for tax purposes is set by the IRS and can change each year. How is the mileage rate calculated for October 2024? This rate is used to calculate deductions for business, medical, and charitable mileage expenses.

- $153,000) / ($168,000

- $153,000) = 0.466

This means you can only contribute 53.4% of the full amount.

The October 2024 tax deadline is quickly approaching, and it’s important to stay informed about any changes that might impact your filing. Tax changes impacting the October 2024 deadline could include new deductions, credits, or rates. Make sure you’re aware of these changes to ensure you file accurately and avoid any penalties.

Consequences of Exceeding the MAGI Limits

If your MAGI exceeds the limits for Roth IRA contributions, you cannot contribute to a Roth IRA. You will not be able to deduct contributions to a traditional IRA, but you may be able to contribute to a traditional IRA and convert it to a Roth IRA later.

Students often have unique tax situations, and it’s crucial to understand the specific deadlines and rules that apply to them. October 2024 tax deadline for students may differ from the general deadline, so it’s essential to research and file accordingly.

There may be specific deductions or credits available for students, so it’s worth exploring those options as well.

Factors Affecting Roth IRA Contributions

While the annual contribution limit for Roth IRAs is set, there are factors that can influence how much you can contribute in a given year. These factors are primarily related to your income and filing status.

Filing Status

Your filing status significantly impacts your Roth IRA contribution eligibility. While the annual contribution limit is a fixed amount, your ability to contribute the full amount depends on your adjusted gross income (AGI). The IRS sets income limits for Roth IRA contributions.

While you can’t deduct your commute to work, you might be able to claim mileage for certain situations, such as driving to a temporary work location or to a client meeting. October 2024 mileage rate for driving to work is important to understand, as it can help you reduce your tax burden.

If your AGI exceeds these limits, you may not be able to contribute the full amount or may be ineligible to contribute at all.

- Single Filers:In 2024, if your AGI is $153,000 or more, you can’t contribute to a Roth IRA. This limit is phased out between $148,000 and $153,000.

- Married Filing Jointly:If your AGI is $228,000 or more, you can’t contribute to a Roth IRA. This limit is phased out between $218,000 and $228,000.

- Head of Household:If your AGI is $188,000 or more, you can’t contribute to a Roth IRA. This limit is phased out between $178,000 and $188,000.

- Married Filing Separately:If your AGI is $114,000 or more, you can’t contribute to a Roth IRA. This limit is phased out between $109,000 and $114,000.

Number of Working Spouses

If both spouses work and are eligible to contribute to a Roth IRA, they can each contribute the full annual limit, even if they file jointly. This means that a married couple could potentially contribute twice the amount of a single individual.

Medical expenses can be costly, but you may be able to deduct some of those costs on your taxes. October 2024 mileage rate for medical expenses can be used to deduct the mileage you drive for medical appointments. Make sure to keep detailed records of your trips and expenses.

Catch-Up Contributions

Individuals aged 50 and older can make additional “catch-up” contributions to their Roth IRAs. These contributions are in addition to the regular annual limit. In 2024, the catch-up contribution limit is $1,000. This means that individuals aged 50 and older can contribute up to $7,500 to their Roth IRA in 2024.

Important Note:Even if you are eligible to contribute to a Roth IRA, you may not be able to contribute the full amount if your AGI exceeds the income limits.

Benefits of Contributing to a Roth IRA

Contributing to a Roth IRA offers several benefits, making it a popular choice for retirement savings. The primary advantage is the tax-free growth and withdrawals in retirement. This means that you won’t have to pay taxes on your earnings or withdrawals, making it a potentially more lucrative investment strategy than traditional IRAs.

Tax-Free Growth of Roth IRA Investments

One of the most significant benefits of a Roth IRA is that your investments grow tax-free. This means that any earnings from your investments, such as interest, dividends, or capital gains, are not subject to taxation while they remain in the account.

This allows your money to compound faster, potentially leading to a larger nest egg in retirement.

Tax-Free Withdrawals in Retirement

Another major advantage of a Roth IRA is that withdrawals in retirement are tax-free. This is a significant benefit, especially if you expect to be in a higher tax bracket in retirement. Withdrawing tax-free from a Roth IRA can help you maintain your standard of living during retirement without worrying about paying taxes on your savings.

Comparison with Traditional IRA Contributions

Traditional IRAs offer tax deductions on contributions, but withdrawals in retirement are taxed. Roth IRAs, on the other hand, offer tax-free withdrawals in retirement, but contributions are not tax-deductible. The best choice for you depends on your individual circumstances, including your current tax bracket and your expected tax bracket in retirement.

For example, if you are in a lower tax bracket now but expect to be in a higher tax bracket in retirement, a Roth IRA may be a better option. However, if you are in a higher tax bracket now and expect to be in a lower tax bracket in retirement, a traditional IRA may be more advantageous.

Ultimate Conclusion

Navigating the world of Roth IRA contributions can seem complex, but by understanding the key factors and utilizing the resources available, you can make informed decisions that align with your financial goals. Remember, a well-planned retirement strategy that incorporates a Roth IRA can lead to a more secure and financially fulfilling future.

Detailed FAQs

What happens if I exceed the Roth IRA contribution limit?

If you exceed the contribution limit, you may be subject to a 6% penalty on the excess contribution. Additionally, you may need to withdraw the excess amount to avoid penalties.

Can I contribute to both a Roth IRA and a traditional IRA in the same year?

Yes, you can contribute to both a Roth IRA and a traditional IRA in the same year, but your total contributions to both types of IRAs cannot exceed the annual limit.

Can I make Roth IRA contributions after age 70 1/2?

Yes, you can continue to contribute to a Roth IRA after age 70 1/2, but you are not eligible for catch-up contributions.