IRA contribution limits for married couples in 2024 provide a roadmap for building a secure financial future. This guide delves into the intricacies of Traditional and Roth IRA contributions, highlighting the benefits and limitations for married couples. Whether you’re just starting your retirement savings journey or looking to optimize your existing strategy, understanding these limits is crucial.

Navigating the world of IRAs can seem daunting, but this comprehensive overview simplifies the process. We’ll explore the maximum contributions allowed, discuss how income levels influence these limits, and shed light on the tax implications of both Traditional and Roth IRAs.

Furthermore, we’ll delve into spousal IRA contributions, outlining their unique benefits and how they can contribute to a couple’s overall financial well-being.

Understanding IRA Contribution Limits

Individual Retirement Accounts (IRAs) are a popular way for married couples to save for retirement. These accounts offer tax advantages that can help you grow your savings over time. However, there are contribution limits that you need to be aware of.

Filing as head of household? The tax brackets for head of household in 2024 are different from those for single filers, so it’s important to know the specific rates.

IRA Contribution Limits for Married Couples

Contribution limits for traditional and Roth IRAs are the same for both single filers and married couples filing jointly. The maximum amount you can contribute to an IRA in 2024 is $7,500. If you are 50 or older, you can contribute an additional $1,500, bringing the total to $9,000.

Contribution Limits Based on Income

While the contribution limit is the same for all taxpayers, there are income limitations that may affect your ability to contribute to a Roth IRA.

If your modified adjusted gross income (MAGI) exceeds certain thresholds, you may not be able to contribute to a Roth IRA. For 2024, these thresholds are $160,000 for single filers and $228,000 for married couples filing jointly. If your MAGI is above these limits, you can still contribute to a traditional IRA, but you will not be able to claim the tax deduction.

If you’re retired, you might be wondering about the October 2024 tax deadline for retirees. It’s the same for everyone else, so be sure to get your taxes filed on time to avoid any penalties.

Traditional IRA vs. Roth IRA

There are two main types of IRAs: traditional and Roth. The main difference between the two is when you pay taxes on your contributions and withdrawals.

- Traditional IRA: You make contributions with pre-tax dollars, meaning you won’t pay taxes on them until you withdraw them in retirement. This can result in lower taxes in retirement, but you will need to pay taxes on your withdrawals.

- Roth IRA: You make contributions with after-tax dollars, meaning you won’t have to pay taxes on your withdrawals in retirement. This can be advantageous if you expect to be in a higher tax bracket in retirement.

Contribution Limits for Traditional IRAs

Traditional IRAs offer tax benefits for retirement savings, allowing you to potentially reduce your current tax liability. Contributions to a Traditional IRA may be tax-deductible, meaning you can deduct your contributions from your taxable income, resulting in lower taxes in the present.

However, you’ll be taxed on withdrawals during retirement.

Curious about the mileage rate for October 2024 ? It’s a standard rate used for business travel and other qualifying expenses.

Don’t wait until the last minute! Use these tax preparation tips for the October 2024 deadline to make the process smoother and less stressful.

Tax Benefits of Traditional IRA Contributions

The primary tax benefit of Traditional IRA contributions is the potential for tax-deductible contributions. This means that your contributions may be eligible for a tax deduction, reducing your taxable income for the year. This can result in lower taxes in the present.

However, you’ll be taxed on withdrawals during retirement.

Income Limits for Deductible Contributions

The deductibility of Traditional IRA contributions is subject to income limits. These limits vary depending on your filing status and whether you are covered by a retirement plan at work. For 2024, the income limits for deductibility of Traditional IRA contributions are:

| Filing Status | Phase-out Begins | Phase-out Ends |

| Single | $73,000 | $83,000 |

| Married Filing Jointly | $146,000 | $166,000 |

| Head of Household | $104,000 | $124,000 |

| Married Filing Separately | $73,000 | $83,000 |

If your modified adjusted gross income (MAGI) falls within the phase-out range, you may be eligible for a partial deduction. For example, if you are single and your MAGI is $78,000, you may be eligible for a reduced deduction.

Tax brackets are subject to change, and it’s important to understand the tax bracket changes for 2024 vs 2023. This information can help you adjust your financial planning accordingly.

Examples of Contribution Limits

Let’s look at some examples of how contribution limits may vary based on income levels:* Example 1:A single individual with a MAGI of $60,000 can contribute the full $6,500 to their Traditional IRA in 2024 and deduct the entire contribution from their taxable income.

Example 2

A married couple filing jointly with a MAGI of $150,000 can still contribute the full $6,500 each to their Traditional IRAs in 2024, but the deduction may be limited or phased out.

Students have a separate tax deadline, so be sure to check the October 2024 tax deadline for students to ensure you file on time.

Tax Implications of Traditional IRA Contributions

While Traditional IRA contributions may provide tax benefits in the present, there are tax implications to consider for withdrawals in retirement:* Taxable Withdrawals:When you withdraw money from your Traditional IRA in retirement, the withdrawals are taxed as ordinary income. This means that you’ll pay income tax on the amount you withdraw.

Required Minimum Distributions (RMDs)

Starting at age 73, you are generally required to take minimum distributions from your Traditional IRA each year. These distributions are taxable as ordinary income.

Note:The deductibility of Traditional IRA contributions is subject to change based on legislation and IRS guidance. It’s essential to consult with a tax professional for personalized advice.

Missing the October 2024 tax deadline can result in penalties. It’s important to file on time or request an extension if needed.

Contribution Limits for Roth IRAs: Ira Contribution Limits For Married Couples In 2024

The Roth IRA is a retirement savings plan that offers tax-free withdrawals in retirement. To qualify for tax-free withdrawals, you must contribute after-tax dollars. While you don’t get a tax deduction for your contributions, your earnings grow tax-deferred, and you don’t have to pay taxes on withdrawals in retirement.

Planning a move in October 2024? You might be interested in the October 2024 mileage rate for moving expenses. This rate can help you deduct your transportation costs for moving, potentially saving you money on your taxes.

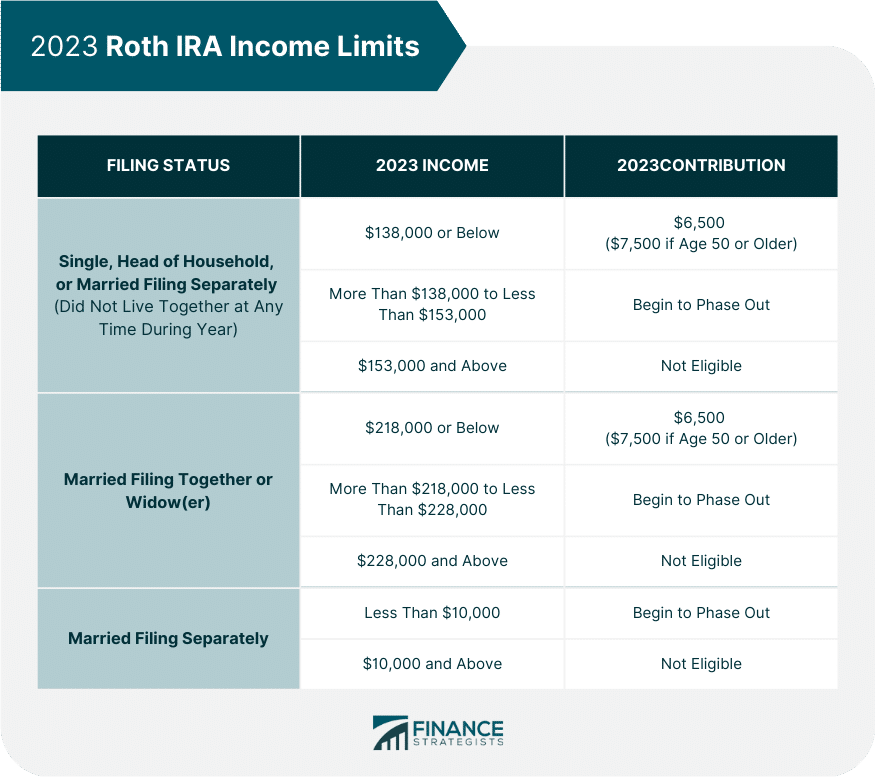

Income Limits for Contributing to Roth IRAs

The Roth IRA offers tax-free withdrawals in retirement, but there are income limits for contributing to a Roth IRA. If your modified adjusted gross income (MAGI) exceeds these limits, you may not be able to contribute to a Roth IRA, or your contributions may be limited.

The income limits for contributing to Roth IRAs vary based on your filing status. For 2024, the limits are as follows:

- Single filers: If your MAGI is $153,000 or greater, you cannot contribute to a Roth IRA. If your MAGI is between $144,000 and $153,000, you can contribute a reduced amount.

- Married filing jointly: If your MAGI is $228,000 or greater, you cannot contribute to a Roth IRA. If your MAGI is between $214,000 and $228,000, you can contribute a reduced amount.

- Head of household: If your MAGI is $186,000 or greater, you cannot contribute to a Roth IRA. If your MAGI is between $177,000 and $186,000, you can contribute a reduced amount.

- Married filing separately: If your MAGI is $114,000 or greater, you cannot contribute to a Roth IRA. If your MAGI is between $107,000 and $114,000, you can contribute a reduced amount.

Examples of Contribution Limits Based on Income

Here are some examples of how contribution limits may vary based on income levels:

- A single filer with a MAGI of $145,000 can contribute to a Roth IRA, but the amount they can contribute will be reduced. They will be able to contribute a portion of the full contribution limit.

- A married couple filing jointly with a MAGI of $220,000 can contribute to a Roth IRA, but the amount they can contribute will be reduced. They will be able to contribute a portion of the full contribution limit.

- A single filer with a MAGI of $155,000 cannot contribute to a Roth IRA because their MAGI exceeds the income limit. They may be able to contribute to a traditional IRA instead, but they will not be able to enjoy the tax-free withdrawals that come with a Roth IRA.

Potential Tax Implications of Roth IRA Contributions

While you don’t receive a tax deduction for your contributions, there are some potential tax implications to consider.

- Your contributions are not tax deductible. You will not be able to claim a tax deduction for your contributions, unlike traditional IRAs.

- You may have to pay taxes on your earnings if you withdraw your contributions before age 59 1/2 and it has been less than five years since you opened the account.

- If you withdraw your contributions after age 59 1/2 and it has been five years since you opened the account, you will not have to pay taxes on your earnings. This is one of the main benefits of a Roth IRA.

Spousal IRA Contributions

Spousal IRAs allow married couples to contribute to a retirement account for a non-working spouse, even if they do not have earned income. These contributions can provide significant tax benefits and help couples build a strong retirement nest egg.

Spousal IRA Contribution Rules and Limits

Spousal IRA contributions are subject to the same rules and limits as traditional and Roth IRAs. The maximum contribution limit for 2024 is $7,500 for individuals under 50 and $11,500 for those 50 and older. This limit applies to both the working and non-working spouse.

For those seeking reimbursement for business travel, the mileage reimbursement rate for October 2024 is important to know. It’s a standard rate set by the IRS that helps ensure fair compensation for travel expenses.

However, the non-working spouse must be married to the working spouse at the end of the year to be eligible for the contribution.

Tax Benefits of Spousal IRA Contributions

Spousal IRA contributions offer several tax benefits, including:* Tax-deferred growth:Traditional IRA contributions are tax-deductible, meaning you don’t have to pay taxes on them until you withdraw the money in retirement.

Tax-free growth

Roth IRA contributions are made with after-tax dollars, but withdrawals in retirement are tax-free.

The new tax brackets for 2024 have been announced, and they might impact your tax liability. Review the new rates to understand how they might affect your finances.

Potential for tax savings

By contributing to a spousal IRA, couples can reduce their overall tax liability and potentially save on taxes in the future.

Examples of How Spousal IRA Contributions Can Benefit a Married Couple

* A stay-at-home parent:A stay-at-home parent can contribute to a spousal IRA and start building a retirement nest egg, even though they don’t have earned income.

A couple with a significant income gap

If one spouse earns significantly more than the other, contributing to a spousal IRA can help the lower-earning spouse build a retirement nest egg.

A couple with a high income

Couples with high incomes may find that traditional IRA contributions are not tax-deductible. However, they can still contribute to a spousal IRA and enjoy the tax benefits of tax-deferred growth.

Tips for Maximizing Spousal IRA Contributions

* Start early:The earlier you start contributing to a spousal IRA, the more time your money has to grow.

The IRS resources for the October 2024 tax deadline are a great place to find information about filing your taxes correctly and on time. They offer guidance on various tax topics, including deductions and credits.

Contribute the maximum amount

Understanding the tax brackets for 2024 in the United States is essential for planning your finances. Knowing your tax bracket can help you make informed decisions about your income and expenses.

Take advantage of the full contribution limit each year to maximize your retirement savings.

Consider Roth vs. Traditional

The best type of IRA for you will depend on your individual circumstances and tax situation.

Consult a financial advisor

Ready to file your taxes? Follow these steps on how to file taxes by the October 2024 deadline to ensure a smooth and successful filing process.

A financial advisor can help you develop a retirement savings plan that includes spousal IRA contributions.

Other Factors Affecting Contribution Limits

While the annual contribution limits for IRAs are generally fixed, there are several other factors that can influence how much you can contribute in a given year. Understanding these factors is crucial to ensure you maximize your contributions while remaining compliant with IRS regulations.

Filing Status

Your filing status can significantly affect your ability to contribute to a traditional IRA. If you’re married filing separately, you may not be able to contribute to a traditional IRA if your spouse is covered by a retirement plan at work.

This is because the IRS considers the couple’s income together when determining eligibility for traditional IRA contributions.

For example, if your spouse participates in a retirement plan at work and you are filing separately, you may not be eligible to contribute to a traditional IRA even if you have earned income.

Previous IRA Contributions, Ira contribution limits for married couples in 2024

Your previous IRA contributions can also affect your current contribution limits. If you’ve already contributed the maximum amount to a traditional IRA in a previous year, you won’t be able to contribute more in the current year.

For instance, if you contributed $6,500 to a traditional IRA in 2023, you can only contribute an additional $6,500 in 2024, bringing your total contribution to $13,000.

The October 2024 tax deadline for self-employed individuals is the same as for everyone else, but there are some specific tax considerations for those who work for themselves.

Special Considerations for Individuals with Certain Retirement Plans

If you participate in a retirement plan at work, your eligibility for traditional IRA contributions may be limited based on your modified adjusted gross income (MAGI). For example, if your MAGI exceeds a certain threshold, you may not be able to deduct contributions to a traditional IRA.

In 2024, if your MAGI exceeds $153,000 as a single filer or $228,000 as a married couple filing jointly, you won’t be able to deduct your traditional IRA contributions. However, you can still contribute to a traditional IRA, but you won’t receive a tax deduction for your contributions.

Don’t forget to take advantage of available tax credits for the October 2024 deadline. These credits can reduce your tax liability and potentially save you money.

Adjusting Contribution Strategies

Your contribution strategy should be tailored to your individual circumstances. If you’re unsure about your eligibility or how to maximize your contributions, it’s advisable to consult with a financial advisor or tax professional. They can provide personalized guidance based on your income, age, and retirement goals.

Resources and Additional Information

To ensure you’re maximizing your IRA contributions, it’s crucial to access accurate and up-to-date information. This section provides links to reputable government websites and financial institutions, as well as resources for retirement planning and advice.

Government Websites

The following government websites offer valuable information about IRA contributions and retirement planning:

- Internal Revenue Service (IRS):The IRS website provides comprehensive information about IRA contributions, including eligibility requirements, contribution limits, and tax deductions. You can find detailed guidance on topics such as the traditional IRA, Roth IRA, and spousal IRA. The IRS website also offers a variety of publications and forms related to retirement savings.

- U.S. Department of Labor:The Department of Labor’s website provides information about retirement plans, including IRAs. You can find resources on topics such as choosing the right retirement plan, understanding your investment options, and protecting your retirement savings.

Financial Institutions

Financial institutions, such as banks and brokerage firms, can offer guidance on IRA contributions and retirement planning. They may provide resources such as:

- IRA Account Opening:Many financial institutions offer IRA accounts with various investment options and features.

- Investment Advice:Financial advisors can provide personalized guidance on investment strategies, asset allocation, and risk management for your retirement savings.

- Retirement Planning Tools:Some institutions offer online calculators and tools to help you estimate your retirement savings needs and track your progress.

Financial Planning and Retirement Advice

There are numerous resources available to help you with financial planning and retirement advice:

- Financial Planners:Certified Financial Planners (CFPs) are professionals who provide comprehensive financial planning services, including retirement planning. They can help you develop a personalized retirement strategy and make informed decisions about your investments.

- Retirement Planning Books and Websites:There are many books and websites dedicated to retirement planning, offering guidance on topics such as saving, investing, and managing your retirement funds.

- Retirement Planning Seminars and Workshops:Many financial institutions and community organizations offer seminars and workshops on retirement planning, providing valuable information and insights.

Key Factors Affecting IRA Contribution Limits for Married Couples

The following table summarizes the key factors affecting IRA contribution limits for married couples:

| Factor | Description | Impact on Contribution Limit |

|---|---|---|

| Age | Individuals of any age can contribute to an IRA, but the contribution limit may be reduced for those who are 50 or older. | Increased contribution limit for those 50 and older. |

| Modified Adjusted Gross Income (MAGI) | MAGI is used to determine eligibility for Roth IRA contributions and tax deductions for traditional IRA contributions. | May limit eligibility for Roth IRA contributions or tax deductions for traditional IRA contributions. |

| Filing Status | Married couples filing jointly have a higher contribution limit than single filers. | Higher contribution limit for married couples filing jointly. |

| Spousal IRA Contributions | A non-working spouse can contribute to a spousal IRA, even if they have no earned income. | Increased contribution limit for the couple as a whole. |

Decision-Making Process for Choosing Between Traditional and Roth IRAs

The flowchart below illustrates the decision-making process for choosing between Traditional and Roth IRAs:

Start

Are you comfortable with tax deductions now and paying taxes on withdrawals in retirement?

Yes:Consider a Traditional IRA

No:Consider a Roth IRA

Are you confident that your tax bracket will be lower in retirement than it is now?

Yes:Consider a Roth IRA

No:Consider a Traditional IRA

Are you concerned about potential changes in tax laws in the future?

Yes:Consider a Roth IRA

No:Consider a Traditional IRA

End

Summary

By understanding the IRA contribution limits for married couples in 2024, you can make informed decisions about your retirement savings strategy. Whether you prioritize tax deductions today or tax-free withdrawals in retirement, the right IRA can help you achieve your financial goals.

Remember to consult with a financial advisor to determine the best approach for your specific circumstances.

Key Questions Answered

Can I contribute to both a Traditional and Roth IRA in the same year?

Yes, you can contribute to both a Traditional and Roth IRA in the same year, but there are limits on the total amount you can contribute overall.

What happens if I exceed the IRA contribution limit?

If you exceed the IRA contribution limit, you may be subject to penalties. It’s essential to track your contributions carefully and avoid exceeding the limits.

Can I withdraw contributions from my IRA before retirement?

You can withdraw contributions from your IRA before retirement, but there may be penalties depending on the type of IRA and your age.

How do I know which type of IRA is right for me?

The best type of IRA for you depends on your individual circumstances, including your income level, tax bracket, and anticipated retirement income. It’s advisable to consult with a financial advisor to determine the most suitable option.