How is the mileage rate calculated for October 2024? Understanding how mileage rates are determined is crucial for individuals and businesses seeking tax deductions for travel expenses. Whether you’re driving for work, medical appointments, or charitable purposes, knowing the current mileage rates and how they are calculated is essential for maximizing your tax benefits.

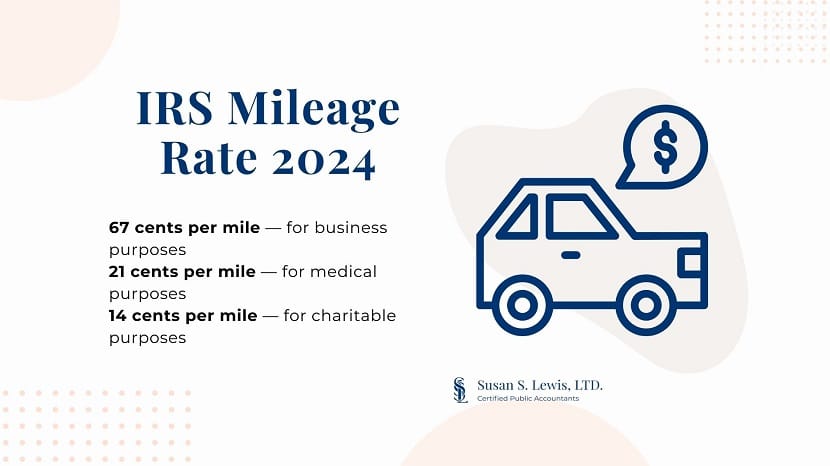

The Internal Revenue Service (IRS) sets standard mileage rates annually, which are used to calculate deductions for business, medical, and charitable travel. These rates are based on factors like fuel costs, vehicle maintenance, and depreciation. For October 2024, the IRS has established specific rates for each category, ensuring fairness and consistency in mileage calculations.

Calculating Mileage for October 2024

The standard mileage rate is used to calculate the deductible expenses for business, medical, and charitable trips. The IRS sets the standard mileage rate annually, and it is subject to change. For October 2024, you will need to refer to the official IRS website or publications to get the most accurate and up-to-date rate.

If you’re planning on driving for business purposes in October 2024, you’ll want to know the latest mileage rate. You can find the October 2024 mileage rate for business use to help you calculate your deductions.

Calculating Mileage for Business Trips

The standard mileage rate for business trips is used to deduct expenses for using your personal vehicle for business purposes. The IRS sets the rate, and it is subject to change annually. To calculate your mileage deduction, you will need to:* Track your mileage:Keep a detailed record of your business trips, including the date, starting and ending mileage, and the purpose of the trip.

To get a better understanding of where you fall in the tax bracket system, you can use a tax bracket calculator for 2024. This tool can help you estimate your tax liability.

Multiply the mileage by the standard mileage rate

The mileage rate for October 2024 is a key factor to consider when calculating deductions for business, medical, or moving expenses.

The IRS will provide the standard mileage rate for the year. Multiply your total business mileage by this rate to determine your deductible expense.

There might be some changes to the tax brackets in 2024. You can find out more about the tax bracket changes for 2024 to see how they might affect your tax liability.

Maintain accurate records

Each tax bracket has a specific tax rate. You can find the tax rates for each tax bracket in 2024 to understand how your income will be taxed.

The mileage reimbursement rate for October 2024 is important to know for those who are seeking reimbursement for business or medical travel.

Keep all your mileage logs and receipts for business trips, as you may need to provide this information to the IRS if you are audited.

If you’re filing as head of household, it’s important to understand the specific tax brackets that apply to you. You can learn about the tax brackets for head of household in 2024 to ensure you’re paying the correct amount of taxes.

For example, if the standard mileage rate for October 2024 is 65 cents per mile and you drove 500 miles for business purposes, your mileage deduction would be $325 (500 miles x $0.65 per mile).

The October 2024 tax deadline for businesses is coming up soon. Make sure you’re prepared to file your taxes on time to avoid any penalties.

Calculating Mileage for Medical and Charitable Purposes

You can also use the standard mileage rate to deduct expenses for medical and charitable trips. The IRS sets separate standard mileage rates for medical and charitable trips, and they may differ from the business mileage rate. To calculate your mileage deduction for medical or charitable trips, you will need to:* Track your mileage:Keep a detailed record of your medical or charitable trips, including the date, starting and ending mileage, and the purpose of the trip.

Missing the October 2024 tax deadline can lead to penalties. It’s crucial to file your taxes on time to avoid these consequences.

Multiply the mileage by the applicable standard mileage rate

If you’ve incurred medical expenses and need to calculate mileage for reimbursement, the October 2024 mileage rate for medical expenses can help you determine the appropriate amount.

The IRS will provide the standard mileage rates for medical and charitable trips for the year. Multiply your total mileage for each purpose by the corresponding rate to determine your deductible expense.

If you’re moving in October 2024, you might be eligible for mileage deductions. The October 2024 mileage rate for moving expenses can help you calculate your potential savings.

Maintain accurate records

Keep all your mileage logs and receipts for medical and charitable trips, as you may need to provide this information to the IRS if you are audited.

For example, if the standard mileage rate for medical trips in October 2024 is 20 cents per mile and you drove 100 miles for medical purposes, your mileage deduction would be $20 (100 miles x $0.20 per mile).

Freelancers have a specific tax deadline to keep in mind. The October 2024 tax deadline for freelancers is a crucial date to remember for filing your taxes.

Example of a Mileage Calculation, How is the mileage rate calculated for October 2024?

Here is an example of how to calculate mileage for a business trip:* Date:October 15, 2024

Distance

100 miles

Wondering about the highest tax bracket in 2024? You can find out more about the highest tax bracket in 2024 and how it might affect your taxes.

Purpose

Business meeting

If the standard mileage rate for business trips in October 2024 is 65 cents per mile, your mileage deduction would be $65 (100 miles x $0.65 per mile).

Concluding Remarks

Navigating the complexities of mileage rate calculations can seem daunting, but by understanding the process and utilizing the resources available, you can confidently claim the deductions you deserve. Whether you’re a small business owner, a volunteer, or an individual seeking medical care, accurate mileage records are vital for maximizing your tax benefits and ensuring compliance with IRS regulations.

Remember, staying informed and organized can make all the difference when it comes to your financial well-being.

Essential Questionnaire: How Is The Mileage Rate Calculated For October 2024?

What are the different types of mileage rates?

The IRS offers two main types of mileage rates: standard mileage rates and actual expenses. Standard mileage rates are fixed amounts per mile, while actual expenses involve tracking and documenting your actual costs for fuel, maintenance, and depreciation.

How often are mileage rates updated?

The IRS typically updates standard mileage rates annually, usually in January, to reflect changes in fuel costs, vehicle maintenance, and other relevant factors.

What are the penalties for inaccurate mileage records?

The IRS can impose penalties for inaccurate or incomplete mileage records. If you are audited and your records are found to be inadequate, you may be denied your mileage deduction or face additional penalties.

Can I claim mileage deductions for personal trips?

No, you cannot claim mileage deductions for personal trips. Mileage deductions are only allowed for business, medical, and charitable travel.

Single filers have their own set of tax brackets. You can learn about the tax brackets for single filers in 2024 to determine your tax obligations.

Foreign nationals living in the United States also have tax obligations. The October 2024 tax deadline for foreign nationals is important to note for those who need to file their taxes.