Insurance Agent 2024: Navigating the Digital Shift. The insurance industry is undergoing a rapid transformation, driven by technological advancements and evolving consumer expectations. Insurance agents are at the forefront of this change, adapting their roles and skillsets to thrive in a digitally-driven landscape.

If you’ve received a traffic ticket and need to prove financial responsibility, you might be required to file an SR-22.

This shift presents both opportunities and challenges for insurance agents. They must embrace technology, master digital marketing strategies, and prioritize building trust with clients in a virtual world. This article explores the key trends shaping the insurance industry in 2024, the evolving role of the insurance agent, and the essential skills and tools for success in this dynamic environment.

Pennie is a health insurance marketplace in Pennsylvania. Find out if you qualify for coverage and explore available plans at Pennie Insurance 2024.

The Evolving Landscape of Insurance

The insurance industry is undergoing a significant transformation, driven by technological advancements, changing consumer expectations, and a growing awareness of emerging risks. As we step into 2024, it’s crucial for insurance agents to understand the key trends shaping this dynamic landscape and adapt their strategies accordingly.

Aflac is known for its supplemental insurance plans. Check out their life insurance options for 2024 at Aflac Life Insurance 2024.

Key Trends Shaping the Insurance Industry in 2024

The insurance industry in 2024 is characterized by several key trends that are redefining how insurance is bought, sold, and delivered. These trends include:

- Increased Digitalization:The rise of digital technologies is driving a shift towards online insurance platforms, mobile apps, and automated processes. This trend empowers consumers to compare policies, purchase coverage, and manage claims digitally, creating a more convenient and accessible experience.

- Data-Driven Insights:Data analytics is becoming increasingly important in insurance. Insurers are leveraging data to assess risk more accurately, personalize policies, and develop innovative products tailored to specific customer segments. This data-driven approach enhances risk management and improves customer satisfaction.

- Focus on Customer Experience:Consumers today expect personalized, seamless, and convenient insurance experiences. Insurers are responding by investing in customer relationship management (CRM) systems, omnichannel communication strategies, and proactive customer service initiatives.

- Emerging Risks and Coverage:The world is facing new and evolving risks, including cyber threats, climate change, and emerging technologies. Insurers are developing innovative products and services to address these emerging risks, providing coverage for previously unanticipated events.

Technological Advancements Impacting Insurance Agents

The insurance industry is embracing a range of technological advancements that are transforming the role of insurance agents. These advancements include:

- Artificial Intelligence (AI):AI is being used to automate tasks, improve risk assessment, and personalize customer interactions. Chatbots, for example, are being used to provide instant customer support and answer common questions. AI-powered underwriting systems are also being developed to streamline the policy issuance process.

Choosing the right health insurance plan can be overwhelming. Explore a range of options by browsing Health Insurance Companies 2024.

- Internet of Things (IoT):IoT devices are collecting data on driving habits, home security, and health conditions, providing insurers with valuable insights to personalize policies and offer discounts based on individual risk profiles. This data-driven approach enables insurers to offer more accurate and tailored coverage.

AA is a well-known insurance provider, and their car insurance policies are worth exploring. Find out more about their plans for 2024 at AA Car Insurance 2024.

- Blockchain Technology:Blockchain technology is being explored for its potential to enhance transparency, security, and efficiency in insurance transactions. It can streamline claims processing, reduce fraud, and improve data management.

- Cloud Computing:Cloud computing platforms enable insurers to access and manage data securely and efficiently, allowing for greater scalability and flexibility in their operations. This technology supports the development of innovative insurance solutions and enhances data analytics capabilities.

Examples of Insurance Products and Services Adapting to Changing Consumer Needs

Insurance products and services are evolving to meet the changing needs of consumers. Here are some examples:

- On-demand insurance:This type of insurance allows consumers to purchase coverage for specific events or periods, offering flexibility and affordability. For instance, on-demand insurance can be used for short-term rentals, travel, or specific activities.

- Usage-based insurance:This model offers premiums based on actual usage, encouraging safe driving habits or responsible energy consumption. This approach provides incentives for positive behavior and rewards customers who demonstrate lower risk profiles.

- Micro-insurance:Micro-insurance provides affordable coverage for specific needs, such as mobile phone insurance or accident coverage. This type of insurance is particularly relevant for individuals with limited financial resources and helps expand insurance access to underserved populations.

- Insurtech startups:A growing number of insurtech startups are disrupting the traditional insurance industry by offering innovative products and services that leverage technology to provide greater convenience, affordability, and personalization. These startups are challenging established players and driving innovation within the sector.

Finding the best car insurance rates can be a hassle. Check out Freeway Insurance Near Me 2024 to find a convenient location and get a quote.

The Role of the Insurance Agent in 2024

The role of the insurance agent is evolving rapidly in the digital age. While technology is automating certain tasks, the human element remains essential in building trust, providing personalized advice, and navigating complex insurance decisions.

State Farm is a well-established insurance provider with a wide network. Locate a State Farm agent near you by visiting State Farm Insurance Near Me 2024.

Evolving Responsibilities of an Insurance Agent in the Digital Age

In 2024, insurance agents are expected to take on a more consultative and advisory role, leveraging their expertise to guide clients through the complexities of insurance. Here are some key responsibilities:

- Personalized Advice:Agents need to understand their clients’ individual needs and risk profiles to recommend the most appropriate insurance solutions. This requires a deep understanding of various insurance products and the ability to tailor recommendations to specific situations.

- Technology Integration:Agents must be comfortable using technology platforms and tools to manage client information, analyze data, and communicate effectively. This includes using online platforms, CRM systems, and digital marketing tools.

- Risk Management Guidance:As new risks emerge, agents must stay informed about evolving threats and advise clients on how to mitigate them. This includes understanding the impact of climate change, cyber threats, and emerging technologies on insurance needs.

- Relationship Building:Building strong relationships with clients is crucial, even in a digital environment. Agents need to be approachable, responsive, and provide ongoing support throughout the insurance lifecycle.

Importance of Building Trust and Rapport with Clients in a Virtual Environment

In the digital age, building trust and rapport with clients is even more critical. While virtual interactions offer convenience, they also create challenges in establishing personal connections. Here’s how agents can foster trust and build relationships:

- Active Listening:Agents must actively listen to clients’ concerns, understand their needs, and tailor their communication accordingly. This requires empathy, patience, and a willingness to address questions and concerns comprehensively.

- Transparency and Honesty:Agents should be transparent about their services, fees, and any limitations associated with insurance products. Honesty and integrity are essential for building trust and maintaining long-term relationships.

- Proactive Communication:Agents should proactively communicate with clients, providing updates, offering support, and addressing any issues promptly. Regular communication builds trust and demonstrates commitment to client satisfaction.

- Personalized Content:Agents can leverage technology to create personalized content, such as tailored emails, newsletters, or social media posts, that resonate with clients’ specific interests and needs. This personalized approach fosters engagement and strengthens relationships.

Essential Skills and Qualifications for Success as an Insurance Agent in 2024

To thrive in the evolving insurance landscape, agents need a combination of technical skills, soft skills, and industry knowledge. Here are some essential skills and qualifications:

- Technical Skills:Agents need to be proficient in using technology platforms, including CRM systems, online insurance platforms, and digital marketing tools. They should also be comfortable with data analysis and using technology to enhance client communication.

- Soft Skills:Strong communication, interpersonal, and problem-solving skills are essential. Agents must be able to build rapport with clients, listen actively, and provide clear and concise explanations. Empathy and the ability to understand and address client concerns are also critical.

- Industry Knowledge:A deep understanding of insurance products, regulations, and industry trends is essential. Agents should stay informed about emerging risks and new coverage options to provide comprehensive advice to clients.

- Continuous Learning:The insurance industry is constantly evolving, so agents must be committed to ongoing learning and development. They should actively seek out training opportunities to stay updated on new technologies, regulations, and best practices.

Technology Tools for Insurance Agents: Insurance Agent 2024

Technology plays a crucial role in streamlining operations, enhancing client communication, and improving efficiency for insurance agents. A wide range of tools and platforms are available to support agents in their daily tasks and enhance their overall effectiveness.

Comparing insurance quotes from different providers can save you money. Use a comparison tool like Compare Insurance 2024 to find the best rates.

Overview of Popular Insurance Technology Platforms and Tools

Here’s a detailed overview of some of the most popular insurance technology platforms and tools:

- Customer Relationship Management (CRM) Systems:CRM systems are designed to manage client interactions, track communication, and organize customer data. These platforms help agents streamline their workflow, personalize communication, and provide better customer service.

- Online Insurance Platforms:Online insurance platforms allow agents to access policy information, generate quotes, and manage client accounts digitally. These platforms simplify the insurance process for both agents and clients, making it more convenient and efficient.

- Digital Marketing Tools:Digital marketing tools empower agents to reach potential clients online through search engine optimization (), social media marketing, and email campaigns. These tools help agents build their online presence and generate leads.

- Data Analytics Tools:Data analytics tools enable agents to analyze client data, identify trends, and make data-driven decisions. This includes tools for risk assessment, customer segmentation, and performance tracking.

- Automated Underwriting Systems:Automated underwriting systems streamline the policy issuance process by using AI to assess risk and generate quotes quickly. This technology reduces processing time and improves efficiency.

- Claims Management Platforms:Claims management platforms facilitate the processing of insurance claims, providing agents with tools to track claim status, communicate with clients, and manage documentation. These platforms streamline the claims process and improve customer satisfaction.

How Technology Tools Can Streamline Operations, Enhance Client Communication, and Improve Efficiency

Technology tools can significantly enhance the efficiency and effectiveness of insurance agents. Here’s how:

- Streamlined Operations:Technology tools automate repetitive tasks, such as generating quotes, processing claims, and managing client data. This frees up agents to focus on more strategic activities, such as building relationships and providing personalized advice.

- Enhanced Client Communication:Technology platforms facilitate seamless communication with clients through email, chat, and video conferencing. This allows agents to provide prompt responses, address inquiries quickly, and build stronger relationships.

- Improved Efficiency:Technology tools streamline workflows, improve data accuracy, and provide real-time insights. This enables agents to work more efficiently, make informed decisions, and provide better service to clients.

- Increased Productivity:By automating tasks and streamlining processes, technology tools empower agents to handle a larger volume of clients and work more productively. This increases overall efficiency and allows agents to maximize their time and resources.

Technology Solutions for Insurance Agents

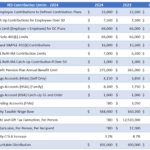

The following table showcases different technology solutions for insurance agents, including their key features and benefits:

| Technology Solution | Key Features | Benefits |

|---|---|---|

| CRM Systems (Salesforce, HubSpot) | Client management, communication tracking, data analysis, task automation | Improved customer service, personalized communication, streamlined workflow, increased productivity |

| Online Insurance Platforms (Policygenius, Lemonade) | Quote generation, policy management, online applications, digital documentation | Convenience for clients, faster processing times, reduced paperwork, enhanced transparency |

| Digital Marketing Tools (Google Ads, Mailchimp) | optimization, social media marketing, email campaigns, lead generation | Increased brand visibility, targeted marketing, lead generation, cost-effective outreach |

| Data Analytics Tools (Tableau, Power BI) | Data visualization, trend analysis, risk assessment, customer segmentation | Data-driven decision-making, improved risk management, personalized recommendations, enhanced customer insights |

| Automated Underwriting Systems (AI-powered systems) | Risk assessment, quote generation, automated policy issuance | Faster processing times, reduced manual work, improved accuracy, increased efficiency |

| Claims Management Platforms (Guidewire, Duck Creek) | Claim tracking, communication with clients, documentation management, fraud detection | Streamlined claims process, improved customer satisfaction, reduced processing time, enhanced transparency |

Marketing and Sales Strategies for Insurance Agents

In today’s competitive landscape, insurance agents need to adopt effective marketing and sales strategies to reach potential clients and build a successful practice. Leveraging technology and focusing on personalized approaches are crucial for standing out in the market.

National Insurance offers a variety of coverage options. Get a quote and learn more about their plans for 2024 at National Insurance 2024.

Effective Marketing Channels for Reaching Potential Clients in 2024

Here are some of the most effective marketing channels for reaching potential clients in 2024:

- Search Engine Optimization ():Optimizing your website and content for search engines helps you attract organic traffic from potential clients searching for insurance solutions online. This includes using relevant s, creating high-quality content, and building backlinks to your website.

- Social Media Marketing:Social media platforms like Facebook, LinkedIn, and Instagram offer valuable opportunities to connect with potential clients, share valuable content, and build brand awareness. Creating engaging content, running targeted ads, and interacting with followers are key strategies for success.

- Email Marketing:Email marketing allows you to nurture leads, provide valuable information, and promote your services to a targeted audience. Building an email list, segmenting your subscribers, and creating personalized content are essential for effective email marketing.

- Content Marketing:Creating and sharing valuable content, such as blog posts, articles, videos, and infographics, can attract potential clients and establish your expertise. This content should address their concerns, answer their questions, and provide insights into insurance-related topics.

- Online Advertising:Online advertising platforms like Google Ads and Facebook Ads allow you to target specific demographics and interests, reaching potential clients with tailored messages. Running effective ad campaigns requires careful targeting, compelling ad copy, and tracking results to optimize your campaigns.

Progressive offers a variety of insurance products, including car insurance. Get a quick quote for 2024 at Progressive Insurance Quote 2024.

- Referral Programs:Encouraging existing clients to refer their friends and family can be a powerful way to generate leads. Offering incentives for referrals and providing exceptional service to existing clients can increase referral rates.

Innovative Sales Strategies for Insurance Agents, Insurance Agent 2024

Here are some innovative sales strategies that insurance agents can implement:

- Personalized Consultations:Instead of generic sales pitches, offer personalized consultations to understand clients’ specific needs and provide tailored solutions. This approach builds trust and demonstrates your commitment to providing exceptional service.

- Value-Based Selling:Focus on the value you provide, rather than just selling features. Highlight the benefits of your services, such as peace of mind, financial security, and risk mitigation. This approach resonates with clients who are looking for solutions, not just products.

Allstate is a trusted name in homeowners insurance. Get a quote and learn about their coverage options for 2024 at Allstate Homeowners Insurance 2024.

- Storytelling:Use storytelling to connect with clients on a personal level. Share real-life examples of how insurance has helped people in similar situations. This approach makes your message more relatable and memorable.

- Building a Community:Create a community around your brand by hosting events, webinars, or online forums where clients can connect and share their experiences. This fosters engagement and builds loyalty.

- Leveraging Technology:Use technology to streamline your sales process, automate tasks, and personalize interactions. This includes using CRM systems, online platforms, and digital tools to manage leads, track progress, and improve efficiency.

Importance of Building a Strong Online Presence and Leveraging Social Media

In today’s digital world, having a strong online presence is essential for any insurance agent. This includes:

- Professional Website:Create a professional website that showcases your services, expertise, and client testimonials. Make sure your website is mobile-friendly, easy to navigate, and provides valuable information to potential clients.

- Social Media Presence:Establish a presence on relevant social media platforms, such as LinkedIn, Facebook, and Twitter. Share valuable content, engage with followers, and build relationships with potential clients.

- Online Reviews:Encourage satisfied clients to leave positive reviews on your website, Google My Business, and other relevant platforms. Positive reviews build credibility and trust with potential clients.

- Content Marketing:Create and share valuable content, such as blog posts, articles, videos, and infographics, that address clients’ concerns and demonstrate your expertise. This content should be optimized for search engines and shared on social media.

Summary

The future of insurance agents is bright, but it requires adaptability and a willingness to embrace the digital landscape. By staying informed about industry trends, leveraging technology effectively, and prioritizing client relationships, insurance agents can navigate the challenges and seize the opportunities that lie ahead.

Bright Health offers a variety of health insurance plans, so it’s worth checking out their offerings for 2024 at Bright Health Insurance 2024.

The insurance agent of tomorrow will be a skilled communicator, a technology expert, and a trusted advisor, playing a vital role in helping individuals and businesses secure their financial futures.

FAQ Corner

What are some of the most popular insurance technology platforms?

For peace of mind while traveling, consider getting travel health insurance. It can cover medical expenses and other unforeseen situations.

Some of the most popular insurance technology platforms include Salesforce, HubSpot, and Insureon. These platforms offer a range of tools for managing client relationships, automating tasks, and enhancing communication.

Planning a trip abroad in 2024? It’s essential to have annual travel insurance to safeguard yourself against unexpected events.

How can insurance agents leverage social media effectively?

Insurance agents can leverage social media by creating valuable content, engaging with their audience, and building a strong online presence. Platforms like LinkedIn, Facebook, and Twitter offer opportunities to connect with potential clients and establish themselves as industry experts.

What are some examples of innovative sales strategies for insurance agents?

Innovative sales strategies for insurance agents include personalized outreach, leveraging data analytics, and offering digital-first experiences. Agents can use data to tailor their approach to individual clients and offer online tools for policy management and communication.

Petsbest offers pet insurance plans to help cover unexpected veterinary expenses. Explore their options for 2024 at Petsbest 2024.