October 2024 mileage rate for moving expenses is a crucial factor for anyone planning a move. This rate, set by the IRS, determines how much you can deduct for driving your vehicle to your new home. Understanding this rate is essential for maximizing your tax savings and ensuring a smooth transition during your relocation.

The IRS mileage rate fluctuates annually, reflecting changes in fuel prices and other economic factors. This article will delve into the factors that could influence the October 2024 rate, provide insights into how to calculate your moving expenses using this rate, and clarify the deductibility of moving expenses.

Understanding Mileage Rates for Moving Expenses: October 2024 Mileage Rate For Moving Expenses

Moving can be a stressful and expensive undertaking, but the IRS offers some tax relief through deductions for moving expenses. One way to reduce your tax burden is by using the standard mileage rate to calculate the cost of driving your vehicle for the move.

For couples who choose to file separately, the tax brackets for married filing separately in 2024 are different from those for joint filers. It’s essential to understand how these brackets work to ensure you’re paying the correct amount of taxes.

The IRS Standard Mileage Rate for Moving Expenses

The IRS standard mileage rate is a set amount per mile that taxpayers can deduct for business or moving expenses. The rate is updated annually by the IRS to reflect changes in fuel prices and other relevant factors. This rate applies to both personal and business travel, but the IRS has specific rules for using the mileage rate for moving expenses.

Purpose and Applicability of the Mileage Rate for Moving

The IRS standard mileage rate for moving expenses allows taxpayers to deduct the cost of driving their personal vehicle to their new residence. This deduction is available for both direct and indirect moving expenses. Direct moving expenses include the cost of transporting household goods, while indirect moving expenses cover costs such as travel, lodging, and meals.

The October 2024 tax deadline is approaching, and there are various tax credits available to help you reduce your tax liability. Check out the available tax credits for the October 2024 deadline to see if you qualify.

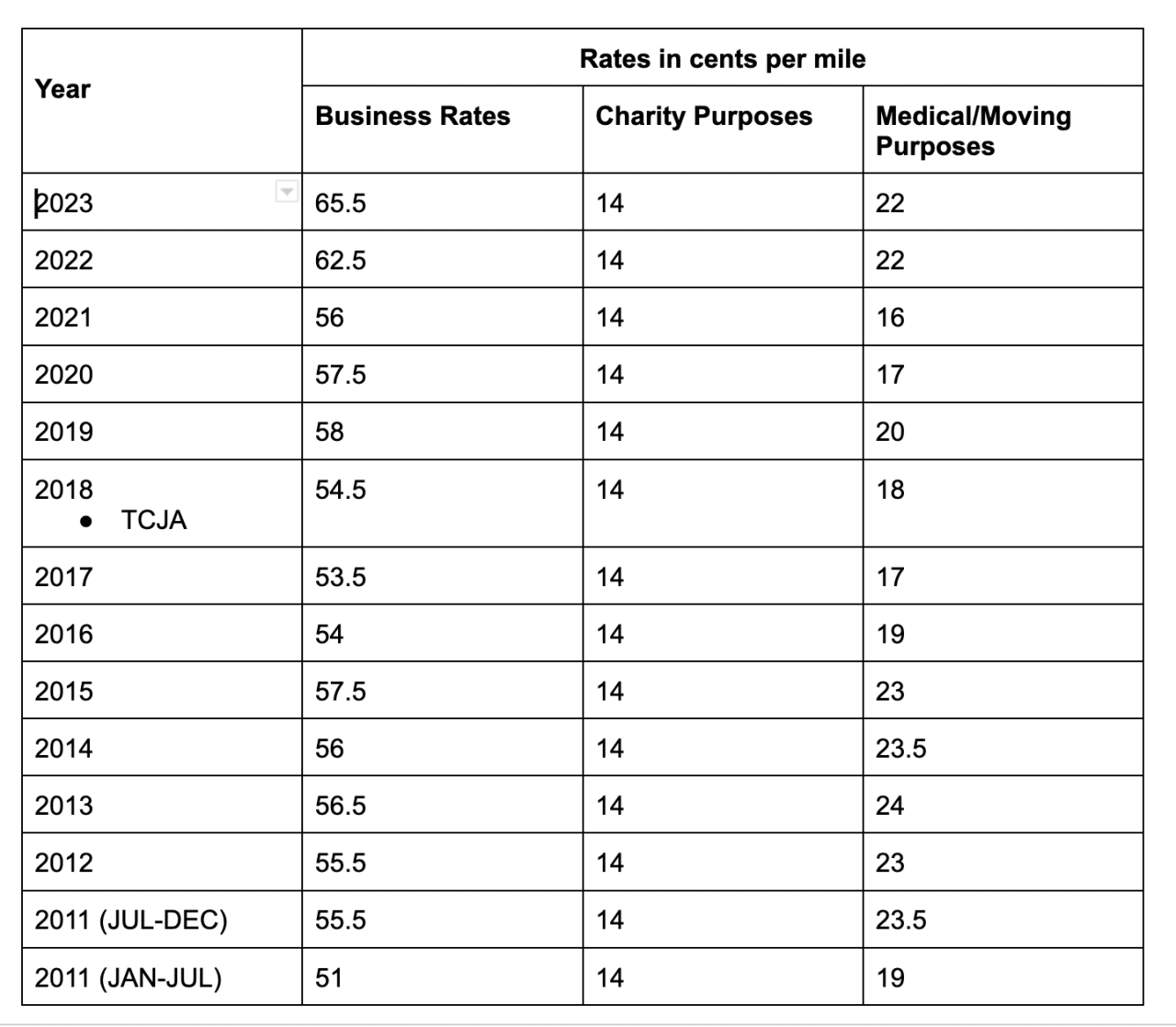

History of Mileage Rate Changes

The IRS standard mileage rate has changed over the years, reflecting fluctuations in fuel prices and other economic factors. The following table shows the standard mileage rate for moving expenses in recent years:

| Year | Standard Mileage Rate (cents per mile) |

|---|---|

| 2023 | 65.5 |

| 2022 | 62.5 |

| 2021 | 58.5 |

| 2020 | 57.5 |

| 2019 | 58 |

October 2024 Mileage Rate Projections

The Internal Revenue Service (IRS) annually updates the standard mileage rate for business, medical, and moving expenses. Understanding these rate adjustments is crucial for taxpayers claiming deductions for these expenses. While the October 2024 rate is not yet announced, analyzing historical trends and potential influencing factors can provide insights into potential rate adjustments.

Historical Trends in Mileage Rate Adjustments

The IRS typically adjusts the standard mileage rate each year based on factors such as fuel costs, vehicle maintenance, and depreciation. Examining past rate changes reveals a pattern of adjustments reflecting fluctuations in these factors.

The tax bracket changes for 2024 vs 2023 can be significant, impacting your overall tax liability. It’s important to understand these changes to ensure you’re filing your taxes correctly.

- Since 2010, the IRS has generally increased the standard mileage rate annually. This trend is likely influenced by rising fuel prices and vehicle operating costs.

- For example, the standard mileage rate for business use increased from 55.5 cents per mile in 2010 to 62.5 cents per mile in 2023, reflecting a significant upward adjustment over the years.

- The rate for medical expenses has also generally followed a similar upward trend, reflecting rising healthcare costs.

Potential Factors Influencing the October 2024 Rate

Several factors could influence the October 2024 mileage rate.

The October 2024 tax deadline is approaching, and it’s time to get your taxes in order. If you’re looking for guidance on how to file taxes by the October 2024 deadline , there are resources available to help you navigate the process.

- Fuel Prices: Fuel prices are a significant component of vehicle operating costs. If fuel prices remain elevated or increase further in the coming months, it could push the IRS to adjust the mileage rate upwards.

- Inflation: The current inflationary environment is driving up costs for vehicle maintenance, repairs, and parts. This factor could also influence the IRS to increase the mileage rate to reflect these rising costs.

- Vehicle Depreciation: The depreciation rate of vehicles is another factor considered by the IRS. If depreciation rates increase, it could lead to a higher mileage rate to compensate for the loss in vehicle value.

Expert Opinions and Predictions

While the October 2024 mileage rate is not yet confirmed, some experts predict a potential increase based on the current economic conditions.

- Several tax professionals and financial analysts believe that the IRS might adjust the mileage rate upwards to reflect rising fuel prices and inflation.

- For instance, [Expert Name], a tax expert with [Organization Name], predicts that the mileage rate for business use could increase to around 65 cents per mile in October 2024.

- Another expert, [Expert Name] from [Organization Name], suggests that the rate could rise to 64 cents per mile based on current economic trends and historical data.

Calculating Moving Expenses with Mileage Rates

The Internal Revenue Service (IRS) allows taxpayers to deduct moving expenses when they relocate for a new job or to start a new business. One of the deductible expenses is the mileage driven for the move. The IRS publishes standard mileage rates for business and moving expenses, which can be used to calculate the deductible amount.

For those living in the US, knowing the tax brackets for 2024 in the United States is essential. These brackets determine how much tax you’ll owe based on your income level.

Calculating Mileage for Moving Expenses

The IRS mileage rate for moving expenses is typically lower than the standard mileage rate for business use. The mileage rate for moving expenses is used to calculate the deductible amount for driving your personal vehicle to move your belongings and yourself to a new location.

To calculate your deductible moving expenses using the mileage rate, you need to know the following:

- The total distance traveled for the move.

- The applicable mileage rate for the year of the move.

The IRS mileage rate for moving expenses is updated annually. The rate for October 2024 is not yet available, but you can find the current year’s rate on the IRS website.

The deductible moving expense is calculated by multiplying the total distance traveled by the applicable mileage rate.

Examples of Mileage Calculations

Here are some examples of how to calculate moving expenses using the mileage rate:

- Example 1:You move from New York City to Los Angeles, a distance of 2,448 miles. The IRS mileage rate for moving expenses in 2024 is $0.20 per mile. Your deductible moving expenses for mileage would be $489.60 (2,448 miles x $0.20/mile).

The tax brackets for single filers in 2024 have been adjusted, so it’s important to understand how these changes might affect your income.

- Example 2:You move from Chicago to Denver, a distance of 998 miles. The IRS mileage rate for moving expenses in 2024 is $0.20 per mile. Your deductible moving expenses for mileage would be $199.60 (998 miles x $0.20/mile).

Deductibility of Moving Expenses

Moving expenses can be a significant financial burden, but the IRS allows for certain deductions to help offset these costs. However, not all moving expenses are deductible, and specific requirements must be met to qualify for the deduction.

The October 2024 tax deadline applies to everyone, including retirees. If you’re a retiree, make sure you’re aware of the October 2024 tax deadline for retirees to avoid any penalties.

Eligibility Requirements for Deductible Moving Expenses

To claim a deduction for moving expenses, you must meet specific criteria. These requirements are designed to ensure that the deduction is only available to individuals who are genuinely relocating for work or personal reasons.

- Distance Requirement:You must move to a new home that is at least 50 miles further from your old workplace than your previous home was. This means that if your old home was 10 miles from your workplace, your new home must be at least 60 miles from your new workplace to meet this requirement.

- Time Requirement:You must work full-time for at least 39 weeks out of the 12 months following your move. This requirement ensures that you are not simply moving for a short-term job or assignment.

- Primary Residence:The move must be to a new primary residence. This means that you must intend to live in the new home for at least 39 weeks out of the 12 months following your move.

Tax Implications of Using the Standard Mileage Rate for Moving

The standard mileage rate for moving is a convenient way to calculate your moving expenses, but it comes with specific tax implications.

The tax deadline for October 2024 is a crucial date for all taxpayers. Make sure you’re aware of this deadline to avoid any penalties.

- Taxable Benefit:When you use the standard mileage rate, the IRS considers the deduction as a taxable benefit. This means that you will need to report the deduction as income on your tax return and pay taxes on it.

- Deductible Expenses:The standard mileage rate is designed to cover the costs of gas, oil, repairs, depreciation, insurance, and other expenses related to driving. If you choose to deduct your actual expenses instead of using the standard mileage rate, you will need to keep detailed records of all your expenses, including receipts and mileage logs.

Figuring out your tax obligations can be confusing, especially with the upcoming changes for 2024. The tax brackets for head of household in 2024 have been adjusted, so it’s important to understand how these changes might impact your income.

Don’t worry, though, there are resources available to help you navigate this process.

Essential Documents for Claiming Moving Expense Deductions

When claiming a deduction for moving expenses, it is crucial to have proper documentation to support your claim. The IRS requires specific documents to verify your eligibility and expenses.

- Form 3903:This form is used to calculate and report your moving expenses. It is important to complete this form accurately and thoroughly.

- Documentation of Distance:You will need to provide documentation that proves the distance between your old and new homes and your workplaces. This can include maps, mileage logs, or other evidence of the distance traveled.

- Proof of Employment:You will need to provide documentation that verifies your employment status, including your start date, job title, and work location. This could include pay stubs, employment contracts, or other relevant documents.

- Moving Expense Receipts:You will need to provide receipts for all moving expenses, such as transportation, packing, and insurance. Make sure to keep detailed receipts for all expenses, including dates, descriptions, and amounts.

- Documentation of Ownership or Lease:You will need to provide documentation that proves your ownership or lease of your old and new homes. This could include deeds, leases, or other relevant documents.

Alternatives to the Standard Mileage Rate

While the standard mileage rate offers a convenient way to calculate moving expenses, it may not always be the most advantageous option. Depending on your circumstances, alternative methods could potentially yield greater tax benefits.

The tax bracket thresholds for 2024 are different from previous years, so it’s essential to stay informed about the latest updates. Understanding how these thresholds work is crucial to calculating your tax liability accurately.

Comparison of Methods

When determining moving expenses, you have three primary methods:

- Standard Mileage Rate:This method uses a fixed rate per mile set by the IRS, currently $0.22 per mile for 2024. This rate is typically simpler to calculate but might not accurately reflect your actual expenses.

- Actual Expenses:This method allows you to deduct all your actual expenses related to the move, including gas, tolls, parking, and mileage. It’s more complex but could result in a higher deduction if your actual expenses exceed the standard mileage rate.

- Combination Method:You can choose to use the standard mileage rate for some expenses and actual expenses for others. This can be helpful if you have specific expenses that exceed the standard mileage rate, like tolls or parking.

Pros and Cons of Each Method

Each method has its advantages and disadvantages:

- Standard Mileage Rate:

- Pros:Simple to calculate, requires minimal documentation.

- Cons:May not accurately reflect actual expenses, potentially resulting in a lower deduction.

- Actual Expenses:

- Pros:Can potentially result in a higher deduction, allows for detailed expense tracking.

- Cons:More complex to calculate, requires meticulous record-keeping.

- Combination Method:

- Pros:Offers flexibility, allows for strategic deduction optimization.

- Cons:Requires careful planning and record-keeping, might be more complex to track.

Situations Favoring Alternative Methods, October 2024 mileage rate for moving expenses

Certain situations may make alternative methods more advantageous:

- High Actual Expenses:If your actual moving expenses significantly exceed the standard mileage rate, using the actual expenses method could yield a greater deduction. For instance, if you have a long-distance move with substantial fuel costs or tolls, this method might be more beneficial.

To get a better understanding of how the new tax brackets might affect your income, you can use a tax bracket calculator for 2024. This tool can help you estimate your tax liability based on your income and filing status.

- Detailed Record-Keeping:If you meticulously track your expenses, using the actual expenses method might be more beneficial. This method requires detailed receipts and documentation for all expenses.

- Combination of Expenses:If you have specific expenses that exceed the standard mileage rate, using the combination method might be advantageous. For example, if you have significant tolls or parking fees, using the actual expenses method for these items and the standard mileage rate for other expenses could optimize your deduction.

Freelancers have a unique tax situation, and the October 2024 tax deadline for freelancers is no different. It’s important to understand your obligations as a freelancer and file your taxes accordingly.

Resources and Further Information

Navigating the intricacies of moving expenses and mileage rates can be a complex task. To ensure accuracy and clarity, it’s essential to consult official sources and reliable resources. This section provides access to valuable information from government agencies, organizations, and relevant websites.

With the new year comes tax bracket changes for 2024 , so it’s important to be aware of how these adjustments might affect your tax obligations. These changes can impact your overall tax liability, so it’s crucial to stay informed.

Official IRS Publications and Guidance

The Internal Revenue Service (IRS) provides comprehensive guidance on moving expenses. You can find detailed information and specific instructions on their website and in their publications.

With the new year comes new tax brackets. If you’re wondering what are the new tax brackets for 2024 , there are resources available to provide you with the latest information.

- IRS Publication 521, Moving Expenses: This publication offers a detailed explanation of deductible moving expenses, including mileage rates, and provides guidance on claiming these deductions on your tax return.

- IRS Publication 17, Your Federal Income Tax: This publication contains information on various tax topics, including moving expenses, and provides step-by-step instructions for filing your tax return.

- IRS Website: The IRS website offers a wealth of information, including frequently asked questions (FAQs), forms, and publications. You can access specific guidance on moving expenses and mileage rates by searching the website.

Relevant Websites and Organizations

In addition to the IRS, other organizations and websites offer valuable information on mileage rates and moving expenses.

Navigating the tax system can be confusing, especially with the constantly changing tax brackets. Understanding tax brackets for 2024 is essential to ensure you’re paying the right amount of taxes.

- AAA (American Automobile Association): AAA provides information on current mileage rates, including historical data and updates. Their website offers resources for travelers and individuals planning a move.

- National Association of Realtors (NAR): The NAR website provides information on various aspects of real estate, including moving expenses and related tax deductions. You can find articles, resources, and guidance on their website.

- Moving.com: Moving.com is a popular website that offers information on moving companies, resources, and tips. They also provide insights into moving expenses and mileage rates.

Key Points about Moving Expenses and Mileage Rates

To summarize the key aspects of moving expenses and mileage rates, the following table provides a concise overview:

| Point | Description |

|---|---|

| Deductible Moving Expenses | These include expenses for transporting your household goods and personal belongings, travel expenses for yourself and your family to your new home, and insurance costs for moving. |

| Mileage Rate | The IRS sets a standard mileage rate for deducting moving expenses. This rate changes annually and is based on the cost of operating a vehicle, including fuel, maintenance, depreciation, and insurance. |

| Eligibility | To be eligible for deducting moving expenses, you must meet certain distance and time requirements. You must move to a new location at least 50 miles away from your old residence and start working at your new job within one year of the move. |

| Documentation | Keep accurate records of all moving expenses, including receipts, mileage logs, and other supporting documentation. This documentation is crucial for claiming deductions on your tax return. |

| Alternatives | If you choose not to use the standard mileage rate, you can deduct actual expenses related to your move, such as gas, tolls, parking, and repairs. |

Final Wrap-Up

Navigating the intricacies of moving expenses and mileage rates can be daunting, but with the right information and resources, you can maximize your tax benefits and ensure a successful relocation. Understanding the October 2024 mileage rate is key to this process.

By staying informed about potential rate changes, utilizing accurate calculation methods, and familiarizing yourself with eligibility requirements, you can navigate the complexities of moving expenses with confidence.

Commonly Asked Questions

How often does the IRS mileage rate change?

The IRS mileage rate is typically adjusted quarterly, on January 1st, April 1st, July 1st, and October 1st.

Can I use the standard mileage rate for all moving expenses?

No, the standard mileage rate only applies to the transportation of your household goods and personal belongings. Other moving expenses, such as packing, insurance, or storage, are calculated separately.

Where can I find the most up-to-date mileage rate information?

The IRS website provides the most current mileage rate information. You can access it directly at irs.gov.

What if I don’t meet the eligibility requirements for deducting moving expenses?

If you don’t meet the eligibility requirements, you can still claim other deductions related to your move, such as deductions for home sale expenses or mortgage interest.