Tax brackets for head of household in 2024 are a crucial aspect of financial planning for individuals who qualify for this filing status. This guide provides a comprehensive overview of the tax brackets, deductions, credits, and other considerations that head of household filers should be aware of.

Understanding these nuances can help optimize your tax liability and maximize your financial well-being.

The head of household filing status offers unique tax benefits for individuals who maintain a household and provide more than half the support for a qualifying dependent. This status often results in lower tax rates compared to single filers, making it advantageous for many taxpayers.

Navigating the tax system can be complex, but this guide aims to provide clarity and insights into the specific tax implications for head of household filers in 2024.

Head of Household Filing Status

The Head of Household filing status is a tax filing option for unmarried individuals who pay more than half the costs of keeping up a home for a qualifying child. This status often results in lower taxes than filing as single, offering significant tax benefits for those who qualify.

Head of Household Eligibility Criteria

To qualify for Head of Household status, you must meet the following criteria:

- You are unmarried, divorced, legally separated, or widowed.

- You pay more than half the costs of keeping up a home for a qualifying child.

- The qualifying child lives with you for more than half the year.

- You can claim the qualifying child as a dependent on your tax return.

Advantages and Disadvantages of Filing as Head of Household

Advantages

- Lower tax rates:Head of Household filing status has tax rates that are generally lower than those for single filers, leading to potential tax savings.

- Higher standard deduction:The standard deduction for Head of Household filers is higher than the standard deduction for single filers, further reducing taxable income.

- Access to certain tax credits:Some tax credits, such as the Child Tax Credit, may be available to Head of Household filers with qualifying children.

Disadvantages

- Limited eligibility:Only unmarried individuals who meet specific criteria can claim Head of Household status.

- Potential for higher taxes in some cases:If your income is very high, filing as Head of Household might not offer significant tax advantages compared to other filing statuses.

Key Requirements for Head of Household Status

The following table summarizes the key requirements for claiming Head of Household status:

| Requirement | Explanation |

|---|---|

| Unmarried | You must be unmarried, divorced, legally separated, or widowed. |

| Qualifying Child | You must have a qualifying child who lives with you for more than half the year. |

| More Than Half the Costs of Keeping Up a Home | You must pay more than half the costs of keeping up a home for the qualifying child. |

| Dependent | You must be able to claim the qualifying child as a dependent on your tax return. |

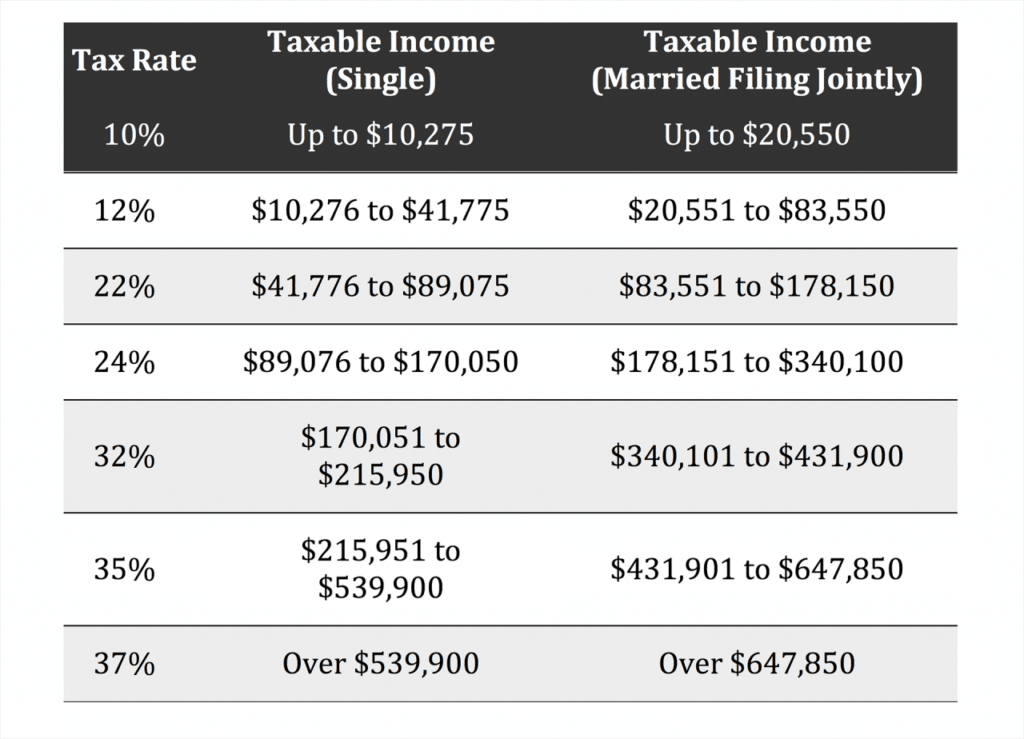

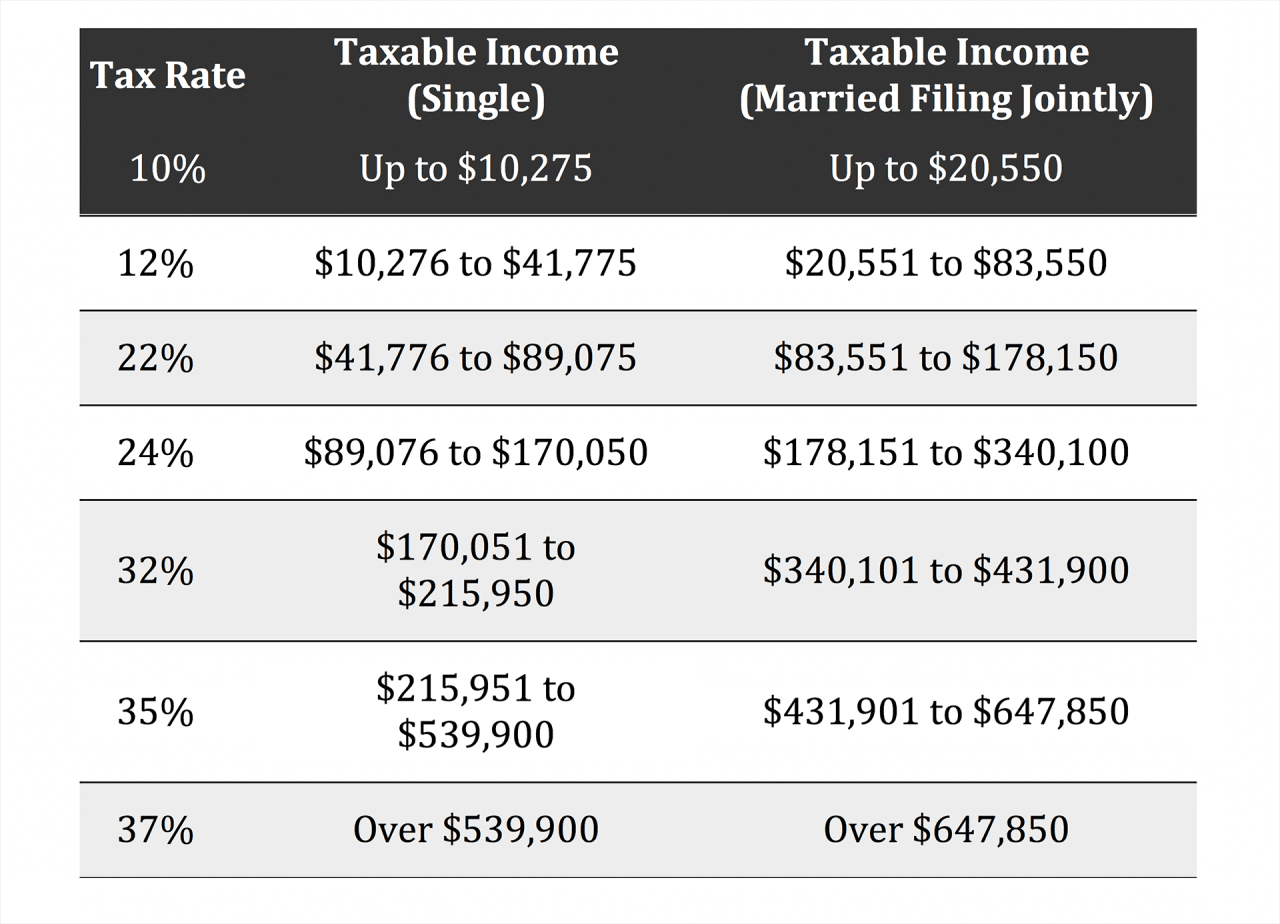

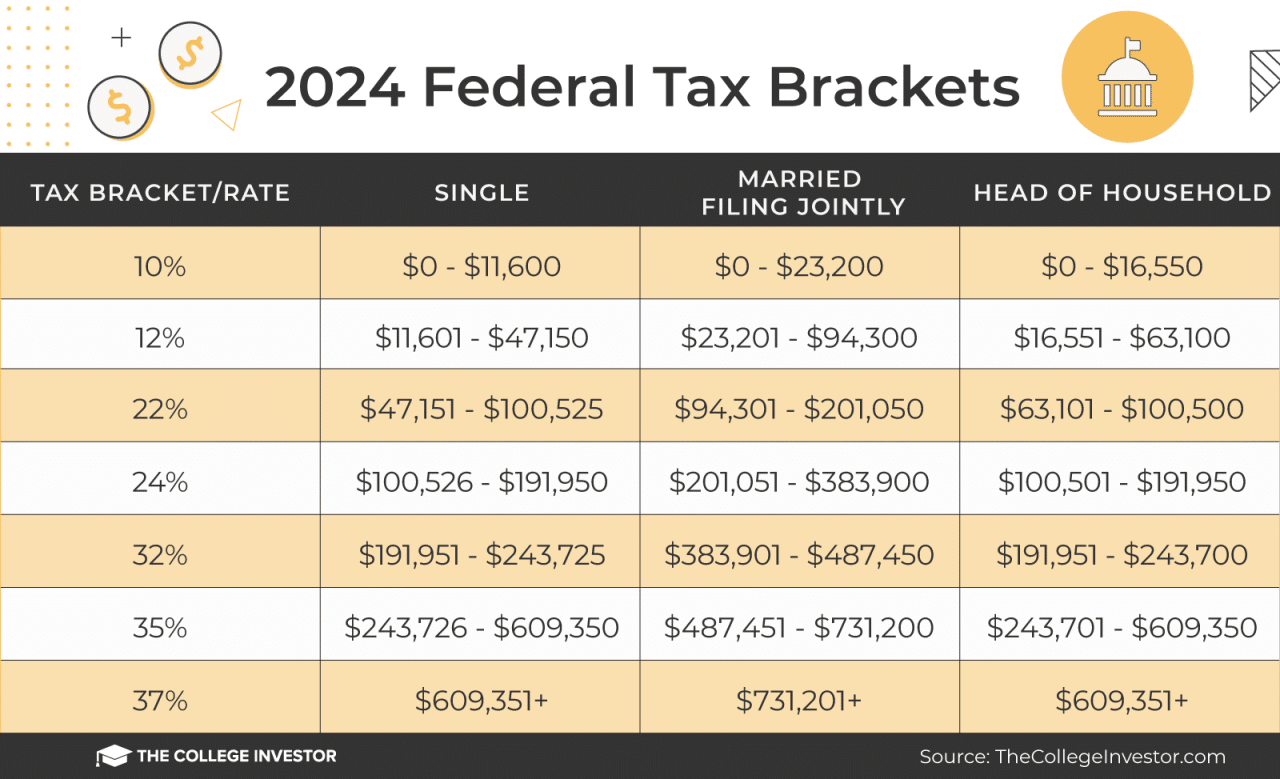

2024 Tax Brackets for Head of Household

The tax brackets for Head of Household filers in 2024 determine the amount of federal income tax you owe based on your taxable income. The higher your taxable income, the higher the tax rate you’ll pay on a portion of your income.

Southern California experienced an early morning earthquake originating in Ontario. Early morning Ontario earthquake shakes parts of Southern California reports on the earthquake’s magnitude and impact on the region.

Tax Brackets for Head of Household Filers in 2024, Tax brackets for head of household in 2024

The following table shows the tax brackets for Head of Household filers in 2024:

| Income Range | Tax Rate | Tax Owed |

|---|---|---|

$0

|

10% | 10% of taxable income up to $10,950 |

| $10,951

Get the latest insights on Arkansas football recruiting with Otis Kirk’s expert analysis. WATCH: Arkansas Football Recruiting Report with Otis Kirk (10-6-24) provides a comprehensive overview of the Razorbacks’ recruiting efforts and potential for the future.

|

12% | $1,095 + 12% of taxable income over $10,950 |

$46,276

|

22% | $5,178 + 22% of taxable income over $46,275 |

| $101,751

The Ravens’ matchup against the Bengals provided a thrilling game with plenty of action. Postgame Notes and Quotes: Ravens at Bengals offers a comprehensive recap of the game, including post-game quotes and key stats.

|

24% | $18,210 + 24% of taxable income over $101,750 |

| $192,151

The tragic news of TikTok star Taylor Rousseau Grigg’s passing at the age of 25 has shocked the online community. TikTok star Taylor Rousseau Grigg dead at 25 shares details about her life and impact on social media.

|

32% | $39,478 + 32% of taxable income over $192,150 |

| $578,126

The Bills’ Week 5 victory over the Texans offered valuable insights into their performance. Top 3 things we learned from Bills at Texans | Week 5 highlights the key takeaways from the game, showcasing the Bills’ strengths and areas for improvement.

|

35% | $157,754 + 35% of taxable income over $578,125 |

| $1,000,001+ | 37% | $313,254 + 37% of taxable income over $1,000,000 |

How Tax Brackets Work

The tax brackets are progressive, meaning that the tax rate increases as your taxable income increases. For example, if your taxable income is $50,000, you will pay 10% on the first $10,950, 12% on the income between $10,951 and $46,275, and 22% on the income between $46,276 and $50,000.

Tax Liability = (Tax Rate

- Taxable Income)

- Tax Credits

Tax credits can reduce your tax liability, while deductions can reduce your taxable income. The amount of tax you owe is determined by your taxable income, the tax brackets, and any applicable tax credits or deductions.

The college football landscape has shifted with Alabama’s fall from grace and the rise of Big Ten teams. College Football Rankings: Alabama falls, Big Ten teams stack top provides an updated look at the top teams in the nation.

Standard Deduction and Exemptions for Head of Household

The standard deduction is a fixed amount that taxpayers can subtract from their taxable income, reducing their tax liability. Head of Household filers have a higher standard deduction than single filers, reflecting their unique financial circumstances. This section will discuss the standard deduction amount for Head of Household filers in 2024 and explain the implications of claiming the standard deduction versus itemizing deductions.

It will also cover the availability of personal exemptions for Head of Household filers.

Robert Lewandowski’s first-half hat trick led Barcelona to a convincing victory, showcasing his scoring prowess. First-half hat trick for Lewandowski as Barcelona top ahead of provides a recap of the game’s key moments and highlights.

Standard Deduction Amount

The standard deduction amount for Head of Household filers in 2024 is expected to be $20,800. This amount is significantly higher than the standard deduction for single filers, which is projected to be $13,850. The increased standard deduction reflects the fact that Head of Household filers often have greater financial responsibilities, such as supporting a child or other dependent.

Standard Deduction vs. Itemized Deductions

Taxpayers have the option of claiming either the standard deduction or itemizing their deductions. Itemized deductions include expenses such as mortgage interest, state and local taxes, charitable contributions, and medical expenses. If the total amount of your itemized deductions exceeds the standard deduction, you should itemize to minimize your tax liability.

The Seahawks’ comeback effort fell short in their Week 5 loss, leaving fans disappointed. Rapid Reactions: Seahawks Comeback Falls Short In Week 5 Loss provides a quick analysis of the game’s key moments and what went wrong for Seattle.

However, if your itemized deductions are less than the standard deduction, claiming the standard deduction will result in a lower tax bill.

Personal Exemptions

Personal exemptions are no longer available for federal income tax purposes. This means that Head of Household filers cannot claim a personal exemption for themselves or their dependents. The elimination of personal exemptions was part of the Tax Cuts and Jobs Act of 2017.

The Packers’ victory over the Rams was fueled by turnovers and a strong defensive performance. Recap: Turnovers help Packers defeat Rams, 24-19 provides a detailed analysis of the game’s key moments and highlights.

Tax Credits for Head of Household Filers

Head of household filers can benefit from various tax credits designed to reduce their tax liability. These credits are valuable tools for lowering your tax burden, particularly if you’re raising a child or pursuing higher education.

The Bears’ dominant victory over the Panthers solidified their position in the standings. Rapid Recap: Bears improve to 3-2 with rout of Panthers provides a quick recap of the game’s key moments and highlights.

Child Tax Credit

The Child Tax Credit is a significant credit for families with qualifying children. It provides a substantial tax reduction for each eligible child.

- Eligibility:You must have a qualifying child who is under 17 years old at the end of the tax year, is your dependent, and lives with you for more than half the year.

- Credit Amount:The Child Tax Credit is worth up to $2,000 per qualifying child in 2024.

- Refundable Portion:A portion of the Child Tax Credit is refundable, meaning you can receive a refund even if you don’t owe any taxes.

- Phase-Out:The credit begins to phase out for taxpayers with adjusted gross incomes above certain thresholds. For 2024, the phase-out begins at $400,000 for single filers.

Education Credits

Education credits can help offset the costs of higher education. There are two primary education credits available: the American Opportunity Tax Credit and the Lifetime Learning Credit.

The Jets’ trip to London didn’t go as planned, as they fell short against the Vikings. Jets-Vikings Game Recap | Green & White Fall Short in London provides a detailed analysis of the game, highlighting key moments and player performances.

- American Opportunity Tax Credit:This credit is available for the first four years of post-secondary education.

- Eligibility:You must be enrolled at least half-time in a qualified educational institution, be pursuing a degree or other recognized educational credential, and not have a felony drug conviction.

Michigan’s victory over Washington provided valuable insights into their team’s strengths and weaknesses. Michigan football: What we learned vs. Washington: ‘Don’t let this highlights the key takeaways from the game and what Michigan needs to focus on going forward.

- Credit Amount:The credit is worth up to $2,500 per eligible student, with the amount phased out for higher income levels.

- Refundable Portion:A portion of the American Opportunity Tax Credit is refundable.

- Eligibility:You must be enrolled at least half-time in a qualified educational institution, be pursuing a degree or other recognized educational credential, and not have a felony drug conviction.

- Lifetime Learning Credit:This credit is available for courses taken to acquire job skills, improve existing job skills, or pursue a degree.

- Eligibility:You must be enrolled in a qualified educational institution, taking courses for at least one academic period beginning in the tax year.

Catch all the live updates and action from the Cowboys’ showdown against the Steelers. Cowboys vs. Steelers score today: Live updates, how to watch provides everything you need to know about this exciting matchup.

- Credit Amount:The credit is worth up to 20% of the first $10,000 in educational expenses, up to a maximum of $2,000.

- Non-Refundable:The Lifetime Learning Credit is not refundable.

- Eligibility:You must be enrolled in a qualified educational institution, taking courses for at least one academic period beginning in the tax year.

Other Tax Credits

Head of household filers may be eligible for other tax credits, depending on their individual circumstances.

The Giants’ victory over the Seahawks was a decisive one, showcasing their offensive prowess. Instant Analysis: Giants defeat Seahawks, 29-20 provides a quick breakdown of the game’s key moments and highlights.

- Earned Income Tax Credit (EITC):The EITC is a refundable credit for low- and moderate-income working individuals and families. The amount of the credit depends on your income, filing status, and number of qualifying children.

- Premium Tax Credit:If you purchase health insurance through the Marketplace, you may be eligible for a premium tax credit to help offset the cost of your premiums.

- Child and Dependent Care Credit:This credit can help offset the costs of childcare for qualifying dependents.

- Retirement Savings Contributions Credit:If you contribute to a retirement savings plan, you may be eligible for this credit, which can help reduce your tax liability.

Tax Planning Considerations for Head of Household: Tax Brackets For Head Of Household In 2024

Tax planning is crucial for Head of Household filers to minimize their tax liability and maximize their financial well-being. By implementing strategic tax planning strategies, you can optimize your tax outcomes and keep more of your hard-earned money.

The Cardinals pulled off a stunning upset against the 49ers, showcasing their resilience and offensive firepower. Cardinals vs. 49ers highlights, analysis: Arizona rallies to stun S.F. provides a recap of the game’s key moments and highlights.

Deductions and Credits

Maximizing deductions and credits is essential for Head of Household filers. These tax benefits can significantly reduce your taxable income and lower your overall tax bill.

- Standard Deduction:The standard deduction for Head of Household filers in 2024 is $20,800. This deduction can be claimed instead of itemizing deductions.

- Itemized Deductions:If your itemized deductions exceed the standard deduction, you can choose to itemize. This may include deductions for mortgage interest, state and local taxes, charitable contributions, and medical expenses.

- Child Tax Credit:The Child Tax Credit for 2024 is $2,000 per qualifying child under the age of 17.

- Credit for Other Dependents:You may be eligible for a credit for other dependents, such as a qualifying relative or a student who meets certain requirements.

- Earned Income Tax Credit (EITC):The EITC is a refundable tax credit for low-to-moderate-income working individuals and families. The credit amount varies depending on your income and the number of qualifying children.

- Education Credits:If you are paying for college or vocational school, you may be eligible for the American Opportunity Tax Credit or the Lifetime Learning Credit.

Income and Expense Adjustments

Adjusting your income or expenses can also have a significant impact on your tax liability.

- Tax-Advantaged Retirement Accounts:Contributing to a traditional IRA or 401(k) can reduce your taxable income and potentially lower your tax bill.

- Health Savings Accounts (HSAs):If you have a high-deductible health plan, you can contribute to an HSA to pay for eligible medical expenses. Contributions are tax-deductible, and withdrawals for qualified medical expenses are tax-free.

- Flexible Spending Accounts (FSAs):FSAs allow you to set aside pre-tax dollars to pay for eligible healthcare and dependent care expenses.

- Homeownership:Mortgage interest and property taxes can be deducted on your federal income taxes.

- Charitable Contributions:Donations to qualified charities are deductible on your federal income taxes.

Tax Planning Strategies

Here are some tax planning strategies that Head of Household filers can implement:

- Tax-Loss Harvesting:This strategy involves selling investments that have lost value to offset capital gains and reduce your tax liability.

- Bunching Deductions:You can group together certain deductions, such as medical expenses, to exceed the threshold for itemized deductions.

- Estate Planning:Estate planning can help minimize estate taxes and ensure your assets are distributed according to your wishes.

- Retirement Planning:Consider the tax implications of your retirement savings and distributions.

Example: Adjusting Income

Imagine you are a Head of Household filer with an adjusted gross income (AGI) of $75,000. You are considering making a $5,000 contribution to a traditional IRA. By making this contribution, your AGI would decrease to $70,000. This could potentially lower your tax liability by placing you in a lower tax bracket and reducing your taxable income.

Conclusion

By understanding the tax brackets, deductions, and credits available to head of household filers in 2024, individuals can take advantage of opportunities to minimize their tax liability. Careful planning and consideration of these factors can lead to significant financial savings.

Whether you are a single parent, a homeowner with a dependent, or simply meet the criteria for head of household filing, the information presented here empowers you to make informed decisions and optimize your tax situation.

FAQ Resource

What are the qualifications for head of household filing status?

To qualify as head of household, you must be unmarried and pay more than half the costs of keeping up a home for a qualifying child or other dependent who lives with you for more than half the year.

What are the main differences between head of household and single filing status?

Head of household typically has lower tax rates than single filers, resulting in lower tax liability. The standard deduction is also higher for head of household filers.

Are there any specific tax credits available for head of household filers?

Yes, head of household filers can claim various tax credits, including the Child Tax Credit, the Earned Income Tax Credit, and the American Opportunity Tax Credit, among others. Eligibility criteria and benefits may vary based on specific circumstances.

How do I determine if itemizing deductions is advantageous for me as a head of household filer?

Compare the total amount of your itemized deductions (such as mortgage interest, property taxes, and charitable contributions) to the standard deduction amount for head of household filers. If your itemized deductions exceed the standard deduction, itemizing may result in a lower tax liability.