Above Lending sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Above Lending is a leading financial institution dedicated to providing accessible and responsible lending solutions for individuals and businesses.

Finding the cheapest mortgage rates can save you thousands of dollars over the life of your loan. It’s worth shopping around to find the best deal.

This comprehensive guide delves into the company’s history, loan products, application process, customer experience, and future outlook, providing a clear understanding of how Above Lending is shaping the lending landscape.

If you’re in a financial bind and need money now, I need money now can help you find the right solution for your situation.

Above Lending’s mission is to empower borrowers by offering flexible and transparent loan options that cater to diverse needs. The company strives to create a positive and supportive lending environment, ensuring that customers feel valued and understood throughout their borrowing journey.

For a personal loan, best personal loan rates can vary greatly depending on your credit score and the lender. Compare rates from multiple lenders before you choose.

Final Summary

Above Lending stands out as a reliable and innovative force in the lending industry. Their commitment to customer satisfaction, coupled with a diverse range of loan products, positions them as a trusted partner for individuals and businesses seeking financial solutions.

Before you take out a HELOC, make sure you understand HELOC rates and fees, as they can vary widely.

As Above Lending continues to evolve and adapt to the changing lending landscape, their focus on responsible lending practices and customer-centric approach ensures their continued success and positive impact on the financial well-being of their clients.

A second mortgage can be a good way to tap into your home’s equity, but make sure you can afford the monthly payments.

FAQ Section: Above Lending

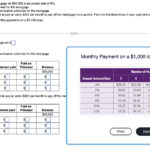

What are the typical interest rates for Above Lending loans?

Need a loan for a big purchase or to consolidate debt? Upgrade Loans is a great option for those with good credit, offering fast approval and low interest rates.

Interest rates vary depending on the type of loan, the borrower’s credit score, and other factors. It’s best to contact Above Lending directly for a personalized rate quote.

While they may seem tempting, payday advance loans come with extremely high interest rates and can easily lead to a debt spiral.

How long does it take to get a loan decision from Above Lending?

PNC Bank offers PNC HELOCs that can be used for home improvements, debt consolidation, or other major expenses.

Loan approval times can vary, but Above Lending strives to provide decisions within a reasonable timeframe. You can typically expect a decision within a few business days.

Looking for a new car? Credit union auto loans often have lower interest rates and more flexible terms than traditional banks.

What are the benefits of choosing Above Lending over other lenders?

Getting mortgage preapproval can give you a good idea of how much you can borrow, which helps you make a strong offer on your dream home.

Above Lending offers competitive interest rates, flexible repayment options, and a commitment to excellent customer service. They also have a strong reputation for responsible lending practices.

Does Above Lending offer any loan consolidation options?

If you’re looking to tap into your home’s equity, a Chase HELOC could be a good option. They offer competitive rates and flexible terms, making it a popular choice for homeowners.

Yes, Above Lending offers loan consolidation options to help borrowers simplify their debt and potentially lower their monthly payments.

The convenience of mobile loans allows you to apply and manage your loan from anywhere with an internet connection.

Chase Bank offers competitive Chase auto loan rates that can help you save money on your next vehicle purchase.

Tripoint Lending is a great option for those looking for a Tripoint Lending that offers a variety of loan products and services.

Before considering payday loans , explore other options like personal loans or credit card advances, as they often come with lower interest rates.