Roth Contribution Limits 2024: Planning for a Secure Retirement. In 2024, the Roth IRA offers a powerful tool for building a comfortable retirement, allowing individuals to grow their savings tax-free. Understanding the contribution limits, eligibility requirements, and strategies for maximizing your Roth IRA contributions is essential for making the most of this valuable retirement savings vehicle.

This guide will delve into the specifics of Roth IRA contribution limits in 2024, providing a clear understanding of how income levels affect your contribution potential. We’ll also explore strategies for maximizing your contributions, the benefits of catch-up contributions, and how Roth IRAs fit into a comprehensive retirement savings plan.

By understanding these key elements, you can make informed decisions about your Roth IRA contributions and set yourself up for a financially secure future.

Roth IRA Contribution Limits for 2024: Roth Contribution Limits 2024

The Roth IRA is a popular retirement savings option that allows you to make after-tax contributions, potentially grow your investments tax-free, and withdraw your earnings tax-free in retirement. However, there are limits on how much you can contribute each year.

Here’s a breakdown of the Roth IRA contribution limits for 2024.

Contribution Limits for 2024

The maximum contribution limit for Roth IRAs in 2024 is $7,000 for individuals under age 50. This limit is the same as it was in 2023.

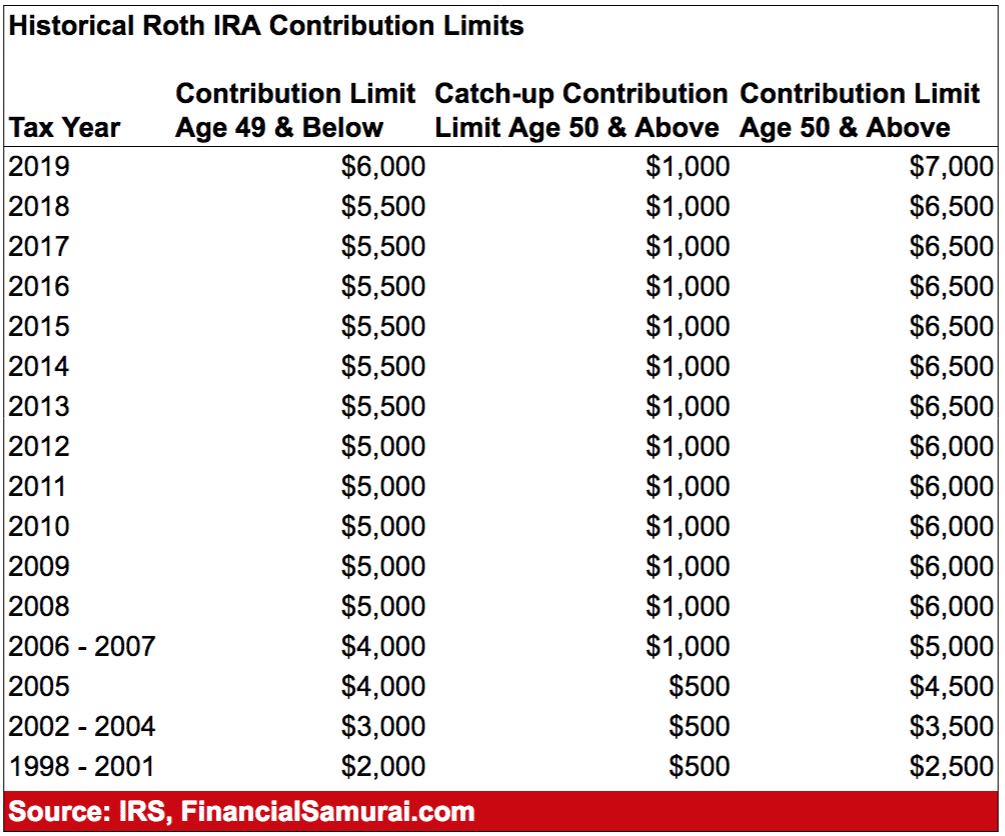

Catch-Up Contributions

Individuals aged 50 and over can contribute an additional $1,000 to their Roth IRA in 2024, bringing their total contribution limit to $8,000. This catch-up contribution allows older individuals to contribute more to their retirement savings and potentially increase their nest egg.

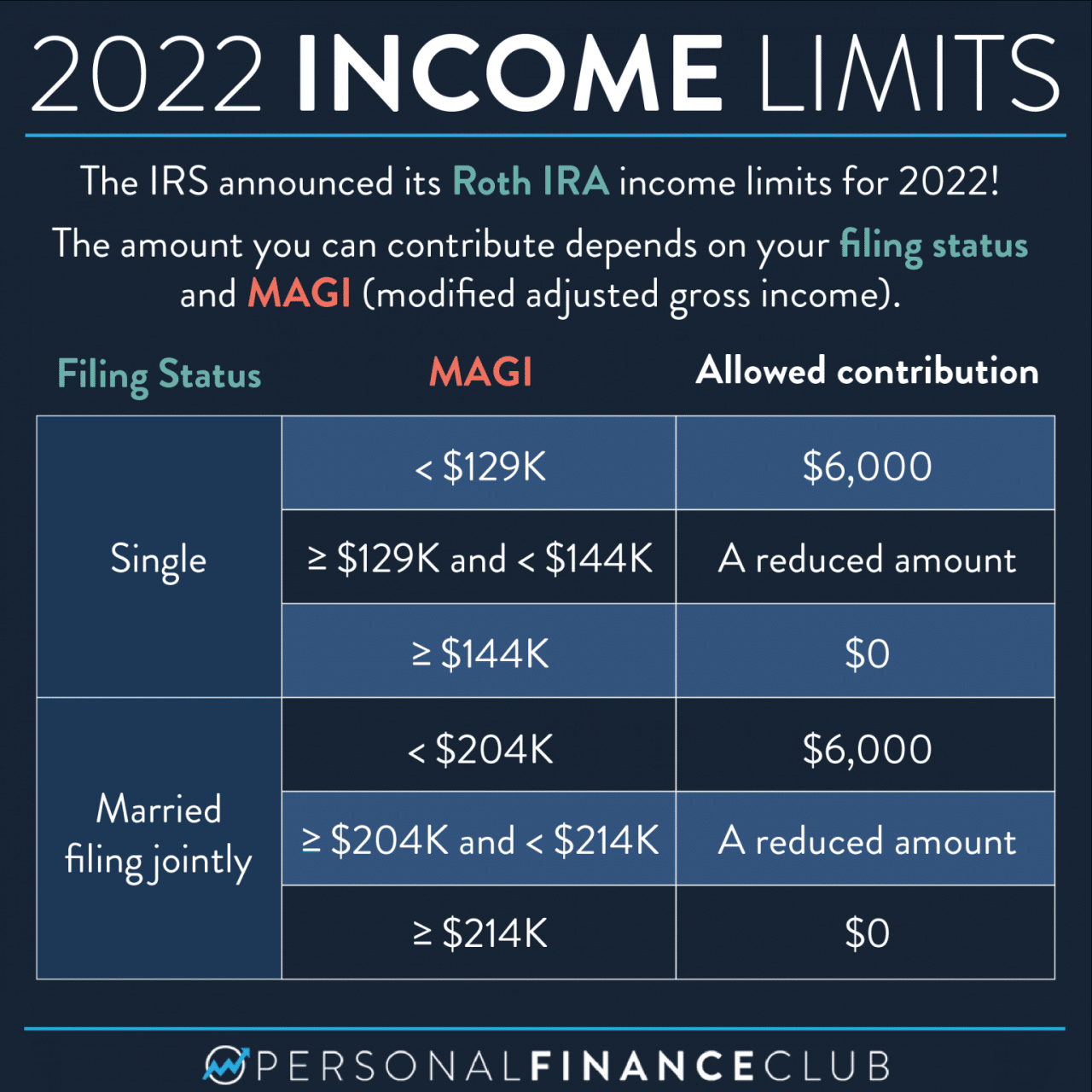

Phase-Out Range for Contributions

The Roth IRA contribution limit is phased out for individuals with higher modified adjusted gross income (MAGI). This means that if your MAGI falls within a certain range, you may not be able to contribute the full amount or any amount at all.

The phase-out range for 2024 is as follows:

| Income Level | MAGI Range | Contribution Limit |

|---|---|---|

| Single Filers | $0

|

Full Limit |

$153,001

|

Reduced Limit | |

| $228,001 or more | Not Eligible | |

| Married Filing Jointly | $0

|

Full Limit |

$228,001

|

Reduced Limit | |

| $342,001 or more | Not Eligible |

The exact amount of the reduced contribution limit depends on your MAGI. If your MAGI falls within the phase-out range, you can use the IRS’s online tools or consult a financial advisor to determine your specific contribution limit.

Key Takeaways

The Roth IRA contribution limits for 2024 remain the same as in 2023, with a standard contribution limit of $7,000 for individuals under age 50 and a catch-up contribution of $1,000 for those aged 50 and over. The contribution limit is phased out for individuals with higher MAGI, making it essential to consider your income level when determining your contribution strategy.

If you’re unsure about your eligibility or the exact amount you can contribute, it’s always a good idea to consult with a financial advisor or tax professional.

Eligibility for Roth IRA Contributions

While Roth IRAs offer tax-free withdrawals in retirement, not everyone qualifies to contribute. The IRS sets income limits for those eligible to contribute to a Roth IRA. These limits are based on your modified adjusted gross income (MAGI) for the tax year.

If your MAGI exceeds the limit, you may not be able to contribute to a Roth IRA.

Don’t forget about taxes! The 2024 tax deadline is coming up, so make sure you’re prepared to file on time.

Income Limits for Roth IRA Contributions in 2024

The income limits for Roth IRA contributions in 2024 are as follows:

If your MAGI is at or below these limits, you can contribute the full amount to a Roth IRA.

- Single filers:$153,000

- Married filing jointly:$228,000

- Head of household:$189,000

- Qualifying widow(er):$228,000

- Married filing separately:$114,000

If your MAGI exceeds these limits, you may not be able to contribute the full amount, or you may not be eligible to contribute at all.

Impact of Exceeding the Income Limits

If your MAGI exceeds the income limits, you may not be able to contribute the full amount to a Roth IRA. The amount you can contribute is phased out gradually. For example, if you are single and your MAGI is between $153,000 and $168,000, you can only contribute a portion of the full amount.

If your MAGI exceeds the income limits by a certain amount, you may not be eligible to contribute to a Roth IRA at all.

It is important to note that these income limits are subject to change each year. You can find the most up-to-date information on the IRS website.

Benefits of Roth IRA Contributions

A Roth IRA offers several tax advantages that can significantly benefit your retirement savings. These advantages stem from the fact that you contribute after-tax dollars, meaning you won’t have to pay taxes on your withdrawals in retirement.

Tax-Free Withdrawals in Retirement

The primary benefit of a Roth IRA is the ability to withdraw your contributions and earnings tax-free in retirement. This means you won’t owe any federal income tax on your withdrawals, regardless of how much your investments have grown. This can be a significant advantage, especially if you expect to be in a higher tax bracket in retirement.

“For example, if you contribute $6,500 to a Roth IRA in 2024 and it grows to $100,000 by the time you retire, you can withdraw the entire $100,000 tax-free.”

If you’re in Sarasota and looking for retirement planning solutions, check out Annuity King Sarasota 2024 , a guide to secure retirement.

Tax-Free Growth of Investments

Another significant benefit of a Roth IRA is that your investments grow tax-free. This means that any earnings from your investments, such as interest, dividends, or capital gains, are not subject to federal income tax. This can result in a larger nest egg for retirement, as you are not losing a portion of your earnings to taxes.

“For example, if you invest $6,500 in a Roth IRA and it earns an average annual return of 7%, it will grow to over $50,000 in 25 years, all tax-free.”

Comparison to Traditional IRA Contributions

While a traditional IRA offers tax deductions on contributions, it requires you to pay taxes on your withdrawals in retirement. A Roth IRA, on the other hand, requires you to contribute after-tax dollars, but your withdrawals are tax-free. The best option for you depends on your individual circumstances and tax situation.

“If you expect to be in a lower tax bracket in retirement, a traditional IRA might be more advantageous. However, if you expect to be in a higher tax bracket in retirement, a Roth IRA could be the better choice.”

Looking to save for retirement outside of your 401k? You might want to consider an IRA. Check out the IRA limits for 2024 to see how much you can contribute.

Strategies for Maximizing Roth IRA Contributions

In 2024, individuals can contribute up to \$6,500 to a Roth IRA, or \$7,500 if they are age 50 or older. This strategy allows individuals to grow their retirement savings tax-free. Maximizing your Roth IRA contributions can significantly boost your retirement savings.

Here are several strategies to help you make the most of your Roth IRA in 2024.

Strategies for Maximizing Contributions

There are several strategies you can employ to maximize your Roth IRA contributions. These strategies can help you contribute the maximum amount allowed, even if you have limited income.

- Contribute early and often:The earlier you start contributing to your Roth IRA, the more time your money has to grow tax-free. Even small contributions can make a big difference over time. For example, if you contribute \$500 per month to a Roth IRA that earns an average annual return of 7%, you’ll have over \$300,000 in your account after 30 years.

- Automate your contributions:Set up automatic contributions from your checking account to your Roth IRA. This takes the guesswork out of saving and ensures you contribute regularly, even if you forget.

- Consider a Roth IRA conversion:If you have a traditional IRA, you can convert it to a Roth IRA. This will allow you to pay taxes on the money now and avoid paying taxes on it in retirement.

- Maximize your contributions during periods of higher income:If you expect your income to be higher in the future, consider contributing the maximum amount to your Roth IRA now. This will help you take advantage of the tax benefits while you are in a higher tax bracket.

- Use tax-advantaged strategies:Consider strategies like tax-loss harvesting to reduce your overall tax burden and free up more money to contribute to your Roth IRA.

Catch-Up Contributions

Individuals aged 50 and older can make catch-up contributions to their Roth IRA. This allows them to contribute an additional \$1,000 on top of the regular contribution limit. Catch-up contributions can significantly accelerate your retirement savings.

Catch-Up Contribution Limits

| Age Group | Catch-Up Contribution Limit ||—|—|| 50-59 | \$1,000 || 60-69 | \$1,000 || 70+ | \$1,000 |

Incorporating Roth IRA Contributions into a Comprehensive Retirement Savings Plan

Your Roth IRA should be part of a comprehensive retirement savings plan. Consider your overall financial situation and goals when deciding how much to contribute to your Roth IRA.

- High earners:If you are a high earner, you may be able to contribute the maximum amount to your Roth IRA and still have enough money left over to invest in other retirement savings vehicles, such as a 401(k) or a traditional IRA.

- Early retirees:If you are planning to retire early, you may want to contribute more to your Roth IRA than someone who plans to retire later. This will give your money more time to grow tax-free.

- Balancing Roth IRA contributions with other retirement savings vehicles:You may want to consider diversifying your retirement savings by contributing to both a Roth IRA and a 401(k) or a traditional IRA. This can help you reduce your tax burden and ensure that your money is invested in a variety of assets.

5. Considerations for Roth IRA Contributions

Before diving into the details of Roth IRA contributions, it’s essential to understand the various factors that might influence your decision to contribute to a Roth IRA. This section explores some key considerations, including the tax implications, comparisons with other retirement savings options, and the withdrawal rules.

Tax Implications, Roth Contribution Limits 2024

Roth IRA contributions are made with after-tax dollars, meaning you’ve already paid taxes on the money you contribute. This leads to a significant advantage in retirement: your withdrawals are tax-free. In contrast, traditional IRA contributions are made with pre-tax dollars, reducing your taxable income in the present but leading to taxable withdrawals in retirement.

Here’s a table illustrating the tax implications of Roth IRA contributions compared to traditional IRA contributions for someone who expects to be in a higher tax bracket in retirement:| Contribution Phase | Tax Treatment of Contributions | Tax Treatment of Withdrawals in Retirement ||—|—|—|| Roth IRA | After-tax | Tax-free || Traditional IRA | Pre-tax | Taxable |Let’s imagine you contribute $6,500 to a Roth IRA in 2024.

You’ve already paid taxes on that $6,500. When you withdraw it in retirement, you won’t have to pay any taxes on it. If you contributed $6,500 to a traditional IRA, you’d be able to deduct that contribution from your taxable income in 2024.

However, when you withdraw it in retirement, you’ll have to pay taxes on that $6,500.This tax-free withdrawal benefit is particularly valuable for those who anticipate being in a higher tax bracket in retirement. If your income increases significantly in retirement, you’ll avoid paying a higher tax rate on your withdrawals from a Roth IRA.

Comparison with Other Retirement Savings Options

Roth IRAs aren’t the only retirement savings option available. Comparing their features with other options like 401(k) plans and traditional IRAs can help you make an informed decision.Here’s a table comparing the key features of each option:| Option | Contribution Limits | Tax Treatment of Contributions | Tax Treatment of Withdrawals | Eligibility Requirements ||—|—|—|—|—|| Roth IRA | $6,500 (2024) | After-tax | Tax-free | Must have earned income || Traditional IRA | $6,500 (2024) | Pre-tax | Taxable | Must have earned income || 401(k) | Varies by employer | Pre-tax (traditional) or after-tax (Roth) | Taxable (traditional) or tax-free (Roth) | Offered by employer |While both Roth and traditional IRAs have the same contribution limit, 401(k) plans have higher contribution limits.

Planning to contribute to an IRA? Make sure you’re aware of the IRA contribution limits for 2024 to maximize your savings.

The tax treatment of contributions and withdrawals in 401(k) plans depends on whether you choose a traditional or Roth 401(k).

Roth IRA Withdrawal Rules

To fully understand the benefits of a Roth IRA, it’s crucial to understand the withdrawal rules. Withdrawals from a Roth IRA are tax-free and penalty-free if certain conditions are met:* Age 59 1/2 or Older:If you’re 59 1/2 or older, you can withdraw your contributions and earnings tax-free and penalty-free.

Knowing the 2024 tax brackets can help you understand how much of your income will be taxed at different rates.

Five Years of Account Ownership

You must have held the Roth IRA for at least five years before withdrawing earnings.

Qualifying Expenses

You can withdraw contributions (not earnings) tax-free and penalty-free at any age for qualifying expenses, such as a first-time home purchase, education expenses, or medical expenses exceeding 7.5% of your adjusted gross income. However, there are specific rules for early withdrawals, and penalties may apply:* Early Withdrawals:If you withdraw earnings before age 59 1/2 and it’s not for a qualifying expense, the earnings portion of the withdrawal will be taxed and subject to a 10% penalty.

Withdrawals Before Five Years

If you withdraw contributions or earnings before the five-year holding period, the earnings portion will be taxed and subject to a 10% penalty.Here are some key factors that influence the taxability and penalty-free status of Roth IRA withdrawals:* Age:Withdrawals are generally tax-free and penalty-free after age 59 1/2.

Five-Year Holding Period

You must have held the Roth IRA for at least five years before withdrawing earnings tax-free and penalty-free.

Qualifying Expenses

Withdrawals for certain expenses, like education or medical expenses, may be tax-free and penalty-free even before age 59 1/2.

Withdrawal Type

The EV tax credits are having a significant impact on the auto industry in 2024 , driving innovation and adoption of electric vehicles.

Withdrawals of contributions are generally tax-free and penalty-free, while withdrawals of earnings may be subject to taxes and penalties if certain conditions are not met.

If you drive for work, you can deduct mileage expenses. Make sure you’re using the right rate by checking the 2024 mileage rate.

Roth IRA Contribution Deadline

The deadline for making Roth IRA contributions for the 2024 tax year is April 15, 2025. This is the same deadline as for filing your federal income tax return. However, if you are self-employed or have a small business, you have until October 15, 2025to file your taxes and make your Roth IRA contribution.

Consequences of Missing the Deadline

Missing the deadline for making a Roth IRA contribution means you will not be able to claim the contribution on your tax return for that year. This means you will not receive the tax benefits of making a Roth IRA contribution, such as the ability to withdraw your earnings tax-free in retirement.

Making Contributions for Previous Years

It is possible to make contributions for previous years if you missed the deadline. This is known as a “catch-up contribution”. However, there are certain rules that apply.

To make a catch-up contribution, you must have earned income for the year you are making the contribution for.

You can make catch-up contributions for up to five years back.

The amount you can contribute is limited to the maximum contribution amount for that year.

You can make catch-up contributions even if you are over the age of 50.

For example, if you missed the deadline to make a Roth IRA contribution for 2023, you can still make a contribution for 2023 in 2024. However, you will need to have earned income for 2023 and the contribution amount will be limited to the 2023 contribution limit.

Impact of Inflation on Roth IRA Contributions

Inflation can significantly impact the purchasing power of your Roth IRA contributions over time. As prices rise, the value of your contributions may erode, potentially diminishing your retirement savings. Understanding how inflation affects your Roth IRA is crucial for maximizing its long-term benefits.

It’s important to understand your tax obligations. The standard deduction for 2024 may be a helpful factor in determining your tax liability.

Inflation’s Impact on Purchasing Power

Inflation erodes the purchasing power of money over time. This means that the same amount of money will buy fewer goods and services in the future compared to today. For example, if the inflation rate is 3%, a $100 contribution today will have the same purchasing power as $97 in one year.

This erosion of purchasing power can significantly impact your retirement savings.

Strategies for Adjusting Contributions to Account for Inflation

- Increase Contributions Regularly:To combat inflation, consider increasing your Roth IRA contributions annually to keep pace with rising prices. This ensures your savings grow faster than inflation, preserving their purchasing power.

- Invest in Assets That Outpace Inflation:Consider investing in assets that have historically outpaced inflation, such as stocks and real estate. These investments offer the potential for higher returns, helping your savings grow faster than inflation.

Inflation’s Impact on Retirement Income

Inflation can also impact your retirement income. As prices rise, you’ll need more money to maintain your living standards. If your retirement savings haven’t kept pace with inflation, you may face a lower standard of living in retirement.

If you’re working with a company, you’ll likely need to fill out a W9 form. Get the latest information on the W9 form for 2024 to make sure you’re providing the correct information.

Example of Inflation’s Impact on Retirement Income

Imagine you retire with $1 million in your Roth IRA. Assuming an average annual inflation rate of 3%, that $1 million will have the same purchasing power as $553,676 in 20 years. This illustrates how inflation can significantly erode the value of your retirement savings over time.

“It is important to factor inflation into your retirement planning to ensure that your savings keep pace with rising prices and provide you with a comfortable standard of living in retirement.”

Interested in the California stimulus check? Learn about the eligibility requirements for the California stimulus check in October 2024.

Role of Roth IRA Contributions in Retirement Planning

Retirement planning involves securing your financial future by strategically saving and investing for the time when you stop working. Roth IRA contributions play a crucial role in this process, offering tax advantages and potential for growth that can significantly enhance your retirement security.

Understanding Roth IRA Contributions

Roth IRA contributions are after-tax contributions to a retirement account that allows for tax-free withdrawals in retirement. This means that the money you contribute is taxed upfront, but the earnings and withdrawals in retirement are tax-free.

- Tax Advantages:Roth IRA contributions offer a unique tax advantage. The earnings and withdrawals during retirement are tax-free, making it a valuable tool for retirement planning.

- Tax-Free Withdrawals in Retirement:Unlike traditional IRAs, where you pay taxes on withdrawals in retirement, Roth IRA withdrawals are tax-free, making it a potentially more attractive option for those who anticipate being in a higher tax bracket during retirement.

- Flexibility:Roth IRAs offer flexibility in terms of contribution limits and withdrawal options. You can contribute up to a certain limit each year, and you can withdraw your contributions at any time without penalty.

- Difference from Traditional IRAs:Unlike traditional IRAs, where contributions are tax-deductible but withdrawals are taxed in retirement, Roth IRA contributions are taxed upfront, but withdrawals are tax-free.

Building a Secure Retirement

Roth IRA contributions can play a significant role in building a secure retirement by providing tax-free income in retirement, helping mitigate inflation risks, and maximizing the benefits of compounding.

- Tax-Free Withdrawals:Roth IRA withdrawals are tax-free in retirement, providing a steady stream of income without any tax burden. This can significantly enhance your retirement lifestyle and financial security.

- Inflation Protection:Roth IRA contributions can help mitigate inflation risks. As the value of money declines over time due to inflation, Roth IRA withdrawals provide tax-free income, helping maintain your purchasing power in retirement.

- Compounding Growth:The power of compounding plays a significant role in maximizing Roth IRA growth. Your earnings accumulate tax-free, and these earnings continue to generate more earnings, leading to exponential growth over time.

Supplementing Retirement Income

Roth IRA contributions can supplement other retirement income sources, providing additional financial flexibility and security.

- Bridging the Gap:Roth IRA contributions can help bridge the gap between your savings and expenses in retirement, ensuring a comfortable lifestyle and financial independence.

- Social Security Supplement:Roth IRA contributions can supplement Social Security benefits, providing a more robust retirement income stream and enhancing your overall financial well-being.

- Covering Unexpected Expenses:Roth IRA contributions can help cover unexpected retirement expenses, such as medical costs, home repairs, or travel, providing peace of mind and financial stability.

Strategic Planning with Roth IRAs

Roth IRA contributions can be strategically utilized to meet specific retirement goals, ensuring a fulfilling and financially secure retirement.

- Early Retirement:Roth IRA contributions can be used to fund early retirement, providing financial independence and flexibility to pursue personal interests and passions.

- Travel and Leisure:Roth IRA contributions can fund travel and leisure activities in retirement, allowing you to enjoy your golden years and explore new experiences.

- Healthcare Costs:Roth IRA contributions can be used to cover healthcare costs in retirement, ensuring financial security and peace of mind as you navigate the complexities of healthcare expenses.

Roth IRA Contribution Rules and Regulations

Understanding the rules and regulations governing Roth IRA contributions is essential for maximizing retirement savings and minimizing tax liabilities. This section delves into the key aspects of Roth IRA contribution rules, their implications for retirement planning, and strategies for navigating their complexities.

Key Rules and Regulations Governing Roth IRA Contributions

The following table Artikels the key rules and regulations governing Roth IRA contributions:

| Rule | Details |

|---|---|

| Annual Contribution Limits | The maximum amount individuals can contribute to a Roth IRA in 2024 is $7,000. Individuals aged 50 and over can contribute an additional $1,000 as a catch-up contribution, bringing their total contribution limit to $8,000. |

| Income Eligibility Limits | Individuals with modified adjusted gross income (MAGI) exceeding certain thresholds cannot contribute to a Roth IRA or can only contribute partially. For 2024, the income limits for full Roth IRA contributions are $153,000 for single filers and $228,000 for married couples filing jointly. Individuals with MAGI exceeding these limits can contribute partially until reaching the phase-out limits of $168,000 for single filers and $240,000 for married couples filing jointly. |

| Age Restrictions | There are no age restrictions for contributing to a Roth IRA. Individuals can contribute to a Roth IRA regardless of their age, as long as they meet the income eligibility requirements. |

| Contribution Deadlines | The deadline for making Roth IRA contributions for a given tax year is typically April 15th of the following year. However, if you are self-employed or have a deadline extension, you may have until October 15th to make your contribution. |

| Catch-Up Contributions | Individuals aged 50 and over can make additional contributions to their Roth IRA, known as catch-up contributions. The catch-up contribution limit for 2024 is $1,000. This allows older individuals to make larger contributions and potentially accelerate their retirement savings. |

| Contribution Limits for Spouses | When filing jointly, each spouse can contribute the maximum amount to their individual Roth IRA, up to the annual contribution limit. This means a married couple can contribute a total of $14,000 in 2024, or $16,000 if both spouses are aged 50 or older. |

Implications of Roth IRA Contribution Rules for Retirement Planning

The rules governing Roth IRA contributions have significant implications for retirement planning, affecting tax implications, retirement income strategies, investment growth potential, and withdrawal penalties.

Tax Implications

Roth IRA contributions are made with after-tax dollars, meaning you’ve already paid taxes on the money you’re contributing. This results in tax-free withdrawals in retirement, allowing you to enjoy your savings without paying taxes on them.

California residents may be eligible for a stimulus check. Find out the amount and payment schedule for the California stimulus check in October 2024.

Retirement Income Planning

Roth IRA contributions can be a valuable tool for retirement income planning, especially for individuals expecting to be in a higher tax bracket in retirement. By contributing to a Roth IRA, you can potentially reduce your tax liability in retirement and enjoy tax-free income.

Investment Growth Potential

Roth IRA contributions provide tax-free growth potential. Any investment earnings within a Roth IRA grow tax-deferred, allowing your money to compound faster than in a taxable account.

Early Withdrawal Penalties

Withdrawals from a Roth IRA before age 59 1/2 are generally subject to a 10% penalty, in addition to any applicable taxes. However, there are exceptions to this rule, such as withdrawals for qualified education expenses or first-time home purchases.

Tax-Free Withdrawals

Withdrawals from a Roth IRA after age 59 1/2 are tax-free and penalty-free, as long as the contributions were made at least five years prior to the withdrawal. This makes Roth IRAs an attractive option for individuals seeking tax-free retirement income.

Navigating the Complexities of Roth IRA Contribution Rules

Understanding the intricacies of Roth IRA contribution rules can be challenging. Here are some tips for navigating their complexities and making informed decisions:

Choosing the Right Contribution Strategy

Determining the optimal contribution amount for your Roth IRA depends on various factors, including your income, age, and financial goals. Consider consulting with a financial advisor to create a personalized contribution strategy.

Understanding Income Eligibility

It’s crucial to understand how your income affects your Roth IRA contribution eligibility. Individuals with MAGI exceeding the income limits may not be eligible for full contributions or may face restrictions.

Looking to improve your audio quality? Discover the benefits of acoustic foam for your YouTube videos in 2024.

Maximizing Contribution Limits

Contributing the maximum amount allowed each year can significantly accelerate your retirement savings. Consider maximizing your contributions to take advantage of the tax-free growth potential.

Avoiding Contribution Errors

Common errors include exceeding contribution limits, failing to meet income eligibility requirements, or missing deadlines. Carefully review your contributions and consult with a financial advisor to avoid potential mistakes.

Make the most of your 401k contributions! Find out the maximum 401k contribution for 2024 to ensure you’re taking advantage of all the benefits.

Resources for Additional Information

For further guidance and detailed information on Roth IRA contribution rules and regulations, you can refer to reputable websites such as the Internal Revenue Service (IRS) website or the U.S. Securities and Exchange Commission (SEC) website.

Roth IRA Contribution Resources

It’s essential to have access to reliable information when making financial decisions, especially regarding retirement savings. Fortunately, numerous resources are available to help you understand Roth IRA contributions and make informed choices.

Planning for retirement? Make sure you’re aware of the 401k limits for 2024 , so you can maximize your contributions and build a strong nest egg.

Here’s a breakdown of reputable resources for obtaining further information about Roth IRA contributions:

Official Government Websites

The official government websites are the most reliable sources for accurate and up-to-date information on Roth IRA contributions. These websites provide detailed information on eligibility, contribution limits, tax implications, and other important aspects.

- Internal Revenue Service (IRS):The IRS website provides comprehensive information on Roth IRA contributions, including publications, FAQs, and tax forms. You can find detailed guidance on eligibility requirements, contribution limits, and tax treatment. https://www.irs.gov/

- U.S. Department of Labor:The Department of Labor website offers resources on retirement savings, including information on Roth IRAs. You can find educational materials and guidance on choosing the right retirement plan. https://www.dol.gov/

Financial Institutions

Many financial institutions offer resources and tools to help you understand Roth IRA contributions. These resources can provide valuable information on specific products, investment options, and account management.

- Banks and Credit Unions:Many banks and credit unions offer Roth IRA accounts. They often provide educational materials, online calculators, and financial advisors to help you make informed decisions.

- Brokerage Firms:Brokerage firms specializing in retirement planning can provide guidance on Roth IRA contributions, investment strategies, and account management. They may offer research tools, market analysis, and personalized investment advice.

Professional Advice

Seeking professional advice from a financial advisor or tax professional can be beneficial, especially if you have complex financial situations or need personalized guidance. These professionals can help you:

- Determine your eligibility for Roth IRA contributions.

- Develop a personalized retirement savings strategy.

- Choose the right investment options for your Roth IRA.

- Optimize your tax benefits.

Final Wrap-Up

Maximizing your Roth IRA contributions in 2024 can be a powerful strategy for building a comfortable retirement. By understanding the contribution limits, eligibility requirements, and strategies for maximizing your contributions, you can take advantage of the tax benefits and potential for tax-free growth offered by Roth IRAs.

Remember to consider your individual financial situation and consult with a financial advisor to develop a personalized retirement savings plan that includes Roth IRA contributions.

FAQ Section

What happens if I exceed the income limits for Roth IRA contributions?

If your modified adjusted gross income (MAGI) exceeds the income limits for Roth IRA contributions, you may not be able to contribute the full amount or may not be eligible at all. The contribution limits are phased out for those with higher incomes.

Can I contribute to a Roth IRA if I already have a 401(k)?

Yes, you can contribute to both a Roth IRA and a 401(k) if you meet the eligibility requirements for both. However, you may need to consider your overall contribution limits and income restrictions.

Is there a limit on how much I can withdraw from my Roth IRA?

There’s no limit on how much you can withdraw from your Roth IRA, but you can only withdraw your contributions (the money you put in) tax-free and penalty-free. Earnings on your contributions may be subject to taxes and penalties if withdrawn before age 59 1/2.