IRA Contribution Limits 2024: Navigating the landscape of retirement savings can be daunting, but understanding IRA contribution limits is a crucial step in securing your financial future. Whether you’re a seasoned investor or just starting out, knowing how much you can contribute to an IRA and the different types available can make a significant difference in your retirement planning.

IRAs, or Individual Retirement Accounts, offer tax advantages that can help you save for retirement more effectively. They come in various forms, each with its own unique features and benefits. This guide will delve into the intricacies of IRA contribution limits for 2024, explaining the different types of IRAs, eligibility requirements, and contribution strategies to help you make informed decisions about your retirement savings.

Understanding IRA Contribution Limits

Saving for retirement is a crucial aspect of financial planning. IRAs (Individual Retirement Accounts) play a significant role in this process, offering tax advantages that can help you accumulate wealth for your golden years. This guide will delve into the world of IRA contribution limits, providing you with the information you need to make informed decisions about your retirement savings.

IRA Contributions: How They Work

IRAs are designed to encourage individuals to save for retirement by providing tax advantages. These accounts allow you to grow your savings tax-deferred or tax-free, depending on the type of IRA you choose. * Tax-Advantaged Retirement Savings:Tax-advantaged retirement savings accounts like IRAs offer significant benefits compared to traditional savings accounts.

The primary advantage is that your contributions may be tax-deductible, reducing your current tax liability, or your withdrawals may be tax-free in retirement. This allows your savings to grow faster, as you are not paying taxes on your earnings until you withdraw them.

Role of IRAs in Retirement Planning

IRAs serve as a cornerstone of retirement planning. They offer a flexible and accessible way to save for your future, regardless of your employment status. Whether you are self-employed, employed by a company, or unemployed, you can open and contribute to an IRA.

These accounts can help you accumulate a substantial nest egg over time, ensuring you have the financial resources to enjoy a comfortable retirement.

Contribution Mechanics

Contributing to an IRA involves making regular deposits into your account. The contribution limits are set annually by the IRS and vary based on the type of IRA and your age. There are two primary types of contributions:

Pre-tax contributions

Looking for some extra cash? California might be sending out stimulus checks in October 2024. Check out this article to find out if you qualify and how much you could receive.

These contributions are deducted from your income before taxes are calculated. This reduces your taxable income, resulting in lower taxes in the present year. However, you will be taxed on the withdrawals during retirement.

After-tax contributions

These contributions are made with money that has already been taxed. This means you will not receive a tax deduction for your contributions. However, your withdrawals in retirement will be tax-free.

Types of IRAs

There are several types of IRAs, each with unique features and eligibility criteria. Understanding these differences is essential for choosing the right IRA for your specific circumstances.

- Traditional IRA:A Traditional IRA allows you to make pre-tax contributions, reducing your taxable income. This can lead to immediate tax savings. Your withdrawals in retirement will be taxed as ordinary income.

– Key Features:

– Tax-deductible contributions.

– Tax-deferred growth.

Planning for retirement? Annuity King Sarasota can help you build a secure future. Learn more about their services and how they can assist you in this guide.

– Taxable withdrawals in retirement.

- Roth IRA:A Roth IRA is funded with after-tax dollars. This means you won’t receive a tax deduction for your contributions. However, your withdrawals in retirement will be tax-free.

– Key Features:

– Non-deductible contributions.

– Tax-free growth.

– Tax-free withdrawals in retirement.

- SEP IRA:A SEP IRA is designed for self-employed individuals and small business owners. It allows you to contribute a percentage of your net self-employment income.

– Key Features:

– Available to self-employed individuals and small business owners.

– Higher contribution limits than traditional IRAs.

– Tax-deductible contributions.

– Tax-deferred growth.

– Taxable withdrawals in retirement.

- SIMPLE IRA:A SIMPLE IRA is a retirement savings plan for small businesses. It is a relatively straightforward and affordable option for employers to offer their employees.

– Key Features:

– Available to small businesses with 100 or fewer employees.

– Employer contributions are required.

– Tax-deductible contributions.

– Tax-deferred growth.

– Taxable withdrawals in retirement.

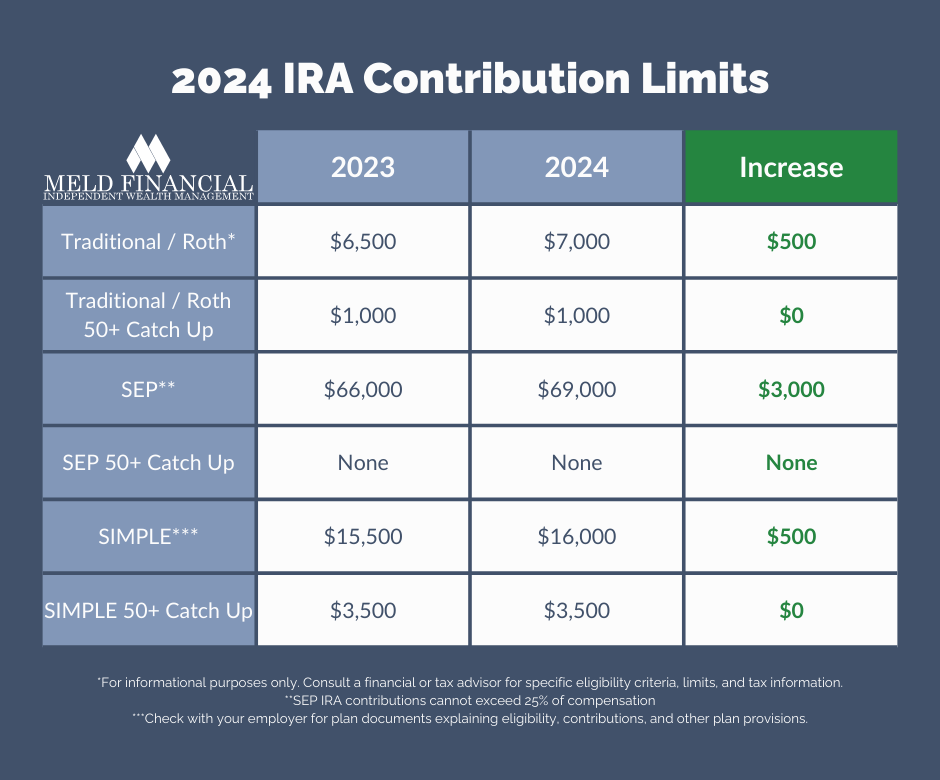

IRA Contribution Limits for 2024

The IRS sets annual contribution limits for IRAs. These limits can help you maximize your retirement savings while staying within the guidelines.

| Category | Traditional IRA | Roth IRA |

|---|---|---|

| Age under 50 | Contribution limit: $6,500 | Contribution limit: $6,500 |

| Age 50 and over | Contribution limit: $7,500 | Contribution limit: $7,500 |

| Catch-up Contribution Limit | $1,000 | $1,000 |

Key Takeaways

Understanding IRA contribution limits is essential for maximizing your retirement savings. By contributing the maximum allowable amount each year, you can take advantage of tax benefits and accumulate a substantial nest egg for your future. Your income level and other factors may influence your eligibility for certain IRA types and contribution limits.

It’s always a good idea to consult with a financial advisor to determine the best retirement savings strategy for your individual circumstances.

Eligibility Requirements

To contribute to an IRA, you must meet certain income eligibility requirements. These requirements vary depending on whether you’re contributing to a Traditional IRA or a Roth IRA.

Traditional IRA Income Eligibility

Income limits affect the deductibility of your Traditional IRA contributions. The higher your income, the less you can deduct, and at a certain income level, you may not be able to deduct your contributions at all.

- Deductibility:The amount of your Traditional IRA contribution that you can deduct is based on your modified adjusted gross income (MAGI). If your MAGI is below a certain threshold, you can deduct the full amount of your contribution. If your MAGI is above the threshold, your deduction may be limited or eliminated.

- Contribution Limits:The maximum amount you can contribute to a Traditional IRA in 2024 is $7,000 if you are 50 or older, and $6,500 if you are under 50. These limits are independent of your income.

- Spousal IRA:If one spouse is ineligible to contribute to a Traditional IRA due to income, the other spouse may still be able to contribute. The spouse with the lower income can still contribute to a Traditional IRA, even if the other spouse’s income exceeds the limits for deductibility.

Traditional IRA Phase-Out Ranges

Here are the MAGI phase-out ranges for Traditional IRA contributions in 2024:

- Single Filers:

- Fully deductible: $73,000 or less

- Partially deductible: $73,001 to $89,000

- Married Filing Jointly:

- Fully deductible: $153,000 or less

- Partially deductible: $153,001 to $179,000

- Head of Household:

- Fully deductible: $109,000 or less

- Partially deductible: $109,001 to $135,000

Roth IRA Income Eligibility, IRA Contribution Limits 2024

Income limits affect your eligibility to contribute to a Roth IRA. If your income is above a certain threshold, you may not be able to contribute to a Roth IRA.

The EV tax credit is having a significant impact on the auto industry. Find out how it’s affecting manufacturers and consumers in this article.

- Contribution Limits:The maximum amount you can contribute to a Roth IRA in 2024 is $7,000 if you are 50 or older, and $6,500 if you are under 50. These limits are independent of your income.

- Taxability:Roth IRA withdrawals in retirement are tax-free. However, your income may affect your eligibility to contribute to a Roth IRA. If you are ineligible to contribute to a Roth IRA due to income, you may still be able to convert a Traditional IRA to a Roth IRA.

- Spousal IRA:If one spouse is ineligible to contribute to a Roth IRA due to income, the other spouse may still be able to contribute. The spouse with the lower income can still contribute to a Roth IRA, even if the other spouse’s income exceeds the limits for eligibility.

Roth IRA Phase-Out Ranges

Here are the MAGI phase-out ranges for Roth IRA contributions in 2024:

- Single Filers:

- Fully allowed: $153,000 or less

- Partially allowed: $153,001 to $173,000

- Married Filing Jointly:

- Fully allowed: $228,000 or less

- Partially allowed: $228,001 to $248,000

- Head of Household:

- Fully allowed: $204,000 or less

- Partially allowed: $204,001 to $224,000

MAGI Phase-Out Ranges for Traditional and Roth IRA Contributions

| Filing Status | Traditional IRA Phase-Out Range | Roth IRA Phase-Out Range |

|---|---|---|

| Single | $73,001

|

$153,001

|

| Married Filing Jointly | $153,001

|

$228,001

|

| Head of Household | $109,001

|

$204,001

|

Contribution Strategies

Choosing the right IRA contribution strategy is crucial for maximizing your retirement savings and minimizing your tax burden. Understanding the advantages and disadvantages of Traditional and Roth IRAs is essential for making informed decisions.

Traditional IRA vs. Roth IRA

Traditional and Roth IRAs offer distinct tax benefits, making it essential to consider your individual circumstances when deciding which type is best for you.

- Traditional IRA:Contributions are tax-deductible in the year you make them, reducing your taxable income and potentially lowering your tax bill. However, withdrawals in retirement are taxed as ordinary income.

- Roth IRA:Contributions are not tax-deductible, but withdrawals in retirement are tax-free. This means you’ll pay taxes upfront, but you won’t owe any taxes on your distributions during retirement.

Maximizing IRA Contributions

To maximize your retirement savings, consider the following strategies:

- Contribute the maximum amount:The annual contribution limit for 2024 is $7,500 for individuals and $15,000 for couples. Contributing the maximum amount allows your savings to grow more quickly over time.

- Contribute early:Starting early gives your investments more time to compound, allowing you to accumulate a larger retirement nest egg.

- Consider a “catch-up” contribution:If you are 50 or older, you can contribute an additional $1,500 on top of the regular contribution limit. This allows you to catch up on your retirement savings if you started contributing later in life.

- Automatic contributions:Set up automatic contributions from your paycheck or bank account to ensure you consistently contribute to your IRA.

Choosing the Right IRA Type

The best IRA type for you depends on your individual circumstances, including your current income level, anticipated tax bracket in retirement, and risk tolerance.

- Traditional IRA:This option is generally suitable for individuals who expect to be in a lower tax bracket in retirement than they are now. The tax deduction on contributions can be significant, and you’ll pay taxes on withdrawals at a potentially lower rate in retirement.

- Roth IRA:This option is generally suitable for individuals who expect to be in a higher tax bracket in retirement than they are now. While you don’t receive a tax deduction on contributions, your withdrawals in retirement will be tax-free, saving you money in the long run.

Example:

Consider two individuals, Sarah and John, both in their early 30s. Sarah is currently in a low tax bracket and expects to be in a higher tax bracket in retirement. John is currently in a high tax bracket and expects to be in a lower tax bracket in retirement.Sarah might benefit from a Roth IRA, as she’ll pay taxes on her contributions now when her tax rate is lower, and her withdrawals will be tax-free in retirement when her tax rate is higher.

John might benefit from a Traditional IRA, as he’ll receive a tax deduction on his contributions now when his tax rate is higher, and his withdrawals will be taxed at a potentially lower rate in retirement.

Contribution Deadlines and Penalties: IRA Contribution Limits 2024

Knowing the deadlines for making IRA contributions and understanding the potential penalties for exceeding the limit or missing the deadline is crucial for maximizing your retirement savings. The IRS sets specific deadlines for contributions, and failing to meet these deadlines can result in penalties.

Contribution Deadline

The deadline for making IRA contributions for the 2024 tax year is April 15, 2025, unless this date falls on a weekend or holiday, in which case the deadline is extended to the next business day. However, if you are self-employed, you have until October 15, 2025, to make your IRA contributions.

This extended deadline applies only to contributions made directly to your IRA, not to contributions made through a rollover from another retirement account.

Want to improve the audio quality of your YouTube videos? Acoustic foam can help! Check out this guide for tips on choosing and installing the right foam for your needs.

Penalties for Exceeding Contribution Limits

Exceeding the IRA contribution limit can result in a 6% penalty on the excess contribution. This penalty is assessed each year the excess contribution remains in the IRA. For example, if you contribute $7,500 to a traditional IRA in 2024, exceeding the limit of $7,000, you will be penalized 6% of the $500 excess, which is $30.

This penalty is calculated on the excess contribution amount and not on the entire IRA balance.

Penalties for Late Contributions

If you miss the deadline for making your IRA contributions, you may face penalties. The penalty for late contributions is typically 25% of the missed contribution, although this penalty can be reduced or waived under certain circumstances. For instance, if you have a reasonable cause for missing the deadline, such as a serious illness or a natural disaster, you may be able to avoid the penalty.

However, it is crucial to document the reason for the late contribution and file the necessary paperwork with the IRS.

Penalty Calculation Methods

The penalty for exceeding the IRA contribution limit or making late contributions is calculated as follows:

* Penalty for excess contribution:6% of the excess contribution amount

Penalty for late contribution

25% of the missed contribution amount

These penalties are calculated annually and can be substantial, so it is essential to stay within the contribution limits and meet the deadlines.

IRA Contribution Options

Contributing to an IRA involves various methods, each offering unique advantages depending on your financial situation and goals. Understanding these options helps you choose the best strategy for maximizing your retirement savings.

Curious about the eligibility requirements for the California stimulus check? Find out who qualifies and what documentation is needed to receive your payment in this article.

Direct Contributions

Direct contributions are the most common way to fund an IRA. You can contribute directly from your own funds, either through regular deposits or lump-sum payments. This method allows you to control the amount and timing of your contributions, giving you flexibility in managing your retirement savings.

Rollovers

Rollovers involve transferring funds from another retirement account, such as a 401(k) or 403(b), into an IRA. This option is particularly useful when changing jobs or retiring, as it allows you to consolidate your retirement savings into a single account.

Rollovers are typically tax-free, but it’s crucial to consult with a financial advisor to ensure you understand the tax implications and potential penalties associated with your specific situation.

Rollover contributions can be made from a qualified retirement plan, such as a 401(k), 403(b), or governmental 457 plan, to a traditional IRA.

Transfers

Transfers are similar to rollovers, but they involve moving funds directly from one IRA to another. This option is useful for consolidating multiple IRAs or transferring funds from a traditional IRA to a Roth IRA, allowing you to take advantage of the tax benefits associated with Roth IRAs.

Transfers are generally tax-free, but it’s essential to understand the rules and potential penalties that may apply.

Transfers are direct transfers from one IRA to another IRA.

Comparison of Contribution Options

| Contribution Option | Suitability | Steps Involved |

|---|---|---|

| Direct Contributions | Suitable for individuals who want control over their contributions and timing. | 1. Choose an IRA custodian or provider.

|

| Rollovers | Suitable for individuals changing jobs or retiring, wanting to consolidate retirement savings. | 1. Contact your previous employer or retirement plan provider.

|

| Transfers | Suitable for individuals wanting to consolidate multiple IRAs or transfer funds from a traditional IRA to a Roth IRA. | 1. Contact both your current and new IRA custodians.

|

Tax Deductibility and Distributions

Understanding the tax implications of contributions and distributions from Traditional and Roth IRAs is crucial for maximizing retirement savings. This section will delve into the tax deductibility of Traditional IRA contributions, the tax treatment of distributions from both Traditional and Roth IRAs, and provide illustrative examples to enhance your comprehension.

Traditional IRA Contributions

Traditional IRA contributions are often tax-deductible, meaning you can deduct the amount you contribute from your taxable income, potentially lowering your tax liability in the current year. However, the deductibility of Traditional IRA contributions depends on your income level and whether you or your spouse are covered by a workplace retirement plan.

- Tax Deductibility based on Income:The deductibility of Traditional IRA contributions gradually phases out for taxpayers with higher incomes. For 2024, if your modified adjusted gross income (MAGI) is above certain thresholds, you may not be able to deduct the full contribution amount, or you may not be eligible for any deduction at all.

These thresholds vary depending on your filing status.

- Coverage by Workplace Retirement Plan:If you or your spouse are covered by a workplace retirement plan, the deductibility of Traditional IRA contributions may be limited. The limitation applies if your MAGI exceeds certain thresholds, which vary based on your filing status.

For instance, in 2024, if you are single and your MAGI exceeds $73,000, you may not be able to deduct any Traditional IRA contributions if you are covered by a workplace retirement plan.

If your contributions are not fully deductible, they may be partially deductible, or you may not be eligible for any deduction. In such cases, your contribution will still grow tax-deferred, but you will not receive the immediate tax benefit of a deduction.Traditional IRA contributions can potentially impact your adjusted gross income (AGI), which is used to calculate your eligibility for various tax credits and deductions.

Since contributions are generally tax-deductible, they can reduce your AGI, potentially making you eligible for additional tax benefits.

Traditional IRA Distributions

Distributions from Traditional IRAs are generally taxed as ordinary income in the year you receive them. The tax rate applied to the distribution will depend on your tax bracket in the year of withdrawal.

- Early Withdrawals:Withdrawals from a Traditional IRA before age 59 1/2 are generally subject to a 10% penalty, in addition to the regular income tax. However, there are exceptions to this penalty, such as withdrawals for certain medical expenses, disability, or first-time home purchases.

- Required Minimum Distributions (RMDs):You are generally required to start taking distributions from your Traditional IRA beginning at age 73. The amount of your RMD is calculated based on your account balance and life expectancy. These distributions are also taxed as ordinary income. Failure to take your RMD by the required deadline can result in a 50% penalty on the amount not withdrawn.

Roth IRA Distributions

Distributions from Roth IRAs are generally tax-free, as long as certain conditions are met. This tax-free benefit is one of the key advantages of Roth IRAs.

- Qualified Distributions:To be considered qualified and tax-free, Roth IRA distributions must meet specific criteria. These include:

- The distribution must be made after you reach age 59 1/2.

- The distribution must be made at least five years after your first Roth IRA contribution.

- The distribution must be for any reason, including for retirement, medical expenses, education, or home purchase.

- Non-Qualified Distributions:Distributions from a Roth IRA that do not meet the qualifications for tax-free withdrawals are considered non-qualified and are taxed as ordinary income. Additionally, a 10% penalty may apply if the distribution is taken before age 59 1/2.

Examples

Here are some examples illustrating the tax implications of Traditional and Roth IRA contributions and distributions:

- Example 1: Tax Deductibility of Traditional IRA ContributionsSuppose you are single and your MAGI for 2024 is $65,000. You contribute $6,500 to a Traditional IRA. Since your MAGI is below the phase-out threshold for single filers, you can deduct the entire $6,500 contribution from your taxable income.

This deduction will reduce your taxable income by $6,500, potentially lowering your tax liability.

- Example 2: Tax Treatment of Traditional IRA DistributionsImagine you are retired and receive a $20,000 distribution from your Traditional IRA in 2024. Since you are in a 12% tax bracket, you will be taxed on the $20,000 distribution at a 12% rate, resulting in a tax liability of $2, 400.

- Example 3: Tax Treatment of Roth IRA DistributionsLet’s say you are retired and receive a $30,000 distribution from your Roth IRA in 2024. Since you meet the requirements for qualified distributions, this withdrawal will be tax-free.

IRA Contribution Planning Tips

Planning your IRA contributions effectively is crucial for maximizing your retirement savings. This guide provides insights into various aspects of IRA contributions, helping you make informed decisions about your retirement planning.

Contribution Limits and Eligibility

Understanding the annual contribution limits and eligibility requirements is fundamental to planning your IRA contributions.

| IRA Type | 2024 Contribution Limit | Catch-Up Contribution Limit (Age 50+) |

|---|---|---|

| Traditional IRA | $6,500 | $1,000 |

| Roth IRA | $6,500 | $1,000 |

The contribution limits represent the maximum amount you can contribute to your IRA in a given year. Individuals aged 50 and over can contribute an additional amount known as the catch-up contribution.

Eligibility for contributing to a traditional or Roth IRA depends on your income and employment status. For traditional IRAs, there are no income limits, but you may not be eligible if you are covered by a retirement plan at work.

For Roth IRAs, income limits apply, and if you are covered by a retirement plan at work, your eligibility may be restricted.

It’s essential to note that contribution limits and eligibility requirements are subject to change by the IRS. Therefore, it’s always advisable to check for updates on the IRS website.

Tax Implications

Understanding the tax implications of contributing to a traditional or Roth IRA is crucial for making informed decisions.

Contributing to a traditional IRA offers tax advantages in the present. Contributions are tax-deductible, reducing your taxable income and potentially lowering your tax bill in the current year. Additionally, earnings in a traditional IRA grow tax-deferred, meaning you won’t be taxed on them until you withdraw the funds in retirement.

Contributing to a Roth IRA offers tax advantages in retirement. Contributions are not tax-deductible, but withdrawals in retirement are tax-free. This can be beneficial if you anticipate being in a higher tax bracket in retirement.

The decision between a traditional and Roth IRA depends on your individual circumstances and tax situation. If you expect to be in a lower tax bracket in retirement, a Roth IRA might be more advantageous. Conversely, if you anticipate being in a higher tax bracket in retirement, a traditional IRA might be a better option.

Here’s an example:

If you are in a 22% tax bracket now and anticipate being in a 24% tax bracket in retirement, a traditional IRA might be a better choice. The tax deduction for contributions would provide immediate tax savings. However, if you expect to be in a 12% tax bracket in retirement, a Roth IRA might be more advantageous. The tax-free withdrawals in retirement would outweigh the lack of tax deduction for contributions.

Catch-Up Contributions

Individuals aged 50 and over can contribute an additional amount to their IRA known as the catch-up contribution. This can be a valuable tool for accelerating retirement savings.

The catch-up contribution limit for 2024 is $1,000. This means individuals aged 50 and over can contribute up to $7,500 to their traditional or Roth IRA in 2024.

Catch-up contributions can significantly impact your retirement savings. For example, if you start contributing the catch-up amount at age 50 and continue for 15 years, you’ll have contributed an additional $15,000. Assuming a modest average annual return of 7%, this additional contribution could grow to over $30,000 by age 65.

Professional Financial Advice

Seeking professional financial advice can be valuable when planning your IRA contributions.

A financial advisor can help you develop a personalized retirement savings strategy that considers your individual circumstances, goals, and risk tolerance. They can also provide guidance on various aspects of IRA contributions, such as:

- Choosing between a traditional and Roth IRA

- Determining your contribution amount

- Investing your IRA funds

- Managing investment risk

- Planning for withdrawals in retirement

To find a qualified financial advisor, you can:

- Ask for referrals from friends, family, or colleagues

- Use online resources such as the Certified Financial Planner Board of Standards (CFP Board) or the National Association of Personal Financial Advisors (NAPFA)

- Check with your employer or insurance company for recommended advisors

Additional Tips

Maximizing your IRA contributions requires strategic planning. Here are some additional tips:

- Set up automatic contributions: Automating your contributions can help you stay on track with your savings goals.

- Consider direct rollovers: If you have money in a 401(k) or other qualified retirement plan, you can roll it over into an IRA to potentially gain access to a wider range of investment options.

- Contribute to a spousal IRA: If your spouse is not employed or has a low income, you may be able to contribute to a spousal IRA in their name. This can help boost your combined retirement savings.

- Diversify your IRA investments: Diversifying your investments across different asset classes can help reduce risk and potentially enhance returns.

- Manage investment risk: Your investment strategy should align with your risk tolerance and time horizon.

- Plan for withdrawals in retirement: Understanding how to withdraw from your IRA during retirement is crucial for tax planning and maximizing your income.

Impact of Inflation on IRA Contributions

Inflation plays a significant role in retirement planning, particularly when it comes to IRA contributions. Understanding how inflation impacts the real value of contributions and retirement savings is crucial for making informed financial decisions.

Impact on Contribution Limits

Over the past decade, IRA contribution limits have generally increased, reflecting the gradual rise in inflation. However, the real value of these limits, adjusted for inflation, has not always kept pace with the rising cost of living. This means that while the nominal contribution limits may appear to be increasing, the purchasing power of those contributions may be declining.

| Year | Nominal Contribution Limit | Inflation Rate | Real Contribution Limit (Adjusted for Inflation) |

|---|---|---|---|

| 2014 | $5,500 | 1.6% | $5,414 |

| 2015 | $5,500 | 0.1% | $5,495 |

| 2016 | $5,500 | 1.3% | $5,430 |

| 2017 | $5,500 | 2.1% | $5,389 |

| 2018 | $5,500 | 2.4% | $5,380 |

| 2019 | $6,000 | 1.8% | $5,895 |

| 2020 | $6,000 | 1.2% | $5,931 |

| 2021 | $6,000 | 4.7% | $5,735 |

| 2022 | $6,500 | 8.0% | $6,019 |

| 2023 | $6,500 | 6.4% | $6,108 |

Impact on Purchasing Power of Retirement Savings

Inflation erodes the purchasing power of retirement savings over time. This means that the same amount of money saved today will buy less in the future due to rising prices. The impact of inflation on the long-term growth of IRA investments can be significant, particularly for those who plan to retire many years in the future.

For example, a $6,500 IRA contribution made today may only have the purchasing power of approximately $3,500 in 20 years, assuming an average inflation rate of 3%.

Strategies for Mitigating Inflation

To mitigate the effects of inflation on retirement savings, investors can adopt strategies that aim to outpace inflation. This may involve adjusting investment strategies to include assets that tend to perform well during periods of inflation.Here are some investment options that can potentially hedge against inflation:

- Inflation-indexed bonds:These bonds adjust their principal value based on inflation, providing a hedge against rising prices.

- Real estate:Historically, real estate has been a good inflation hedge, as property values tend to rise with inflation.

- Commodities:Commodities, such as gold and oil, can act as a store of value during periods of inflation.

- Equities:Stocks have historically outpaced inflation over the long term, although their performance can be volatile in the short term.

- High-yield investments:Investments that offer higher returns, such as corporate bonds or emerging market equities, may provide a higher return to offset inflation.

Retirement Planning with IRAs

IRAs can be a powerful tool for building a secure retirement, offering tax advantages and potential for long-term growth. Understanding how to incorporate IRA contributions into your overall retirement planning strategy is crucial for maximizing your savings potential.

Diversifying Retirement Savings

Diversifying your retirement savings beyond IRAs is essential for mitigating risk and ensuring a balanced portfolio. This involves investing in a mix of assets with different risk profiles, such as stocks, bonds, and real estate. By spreading your investments across different asset classes, you can potentially reduce the impact of market fluctuations on your overall portfolio.

- Stocks: Stocks are considered a higher-risk investment but offer the potential for higher returns over the long term. They represent ownership in companies and are typically more volatile than bonds.

- Bonds: Bonds are considered a lower-risk investment compared to stocks. They represent loans made to companies or governments and offer a fixed rate of return.

- Real Estate: Real estate can be a valuable addition to a diversified portfolio, offering potential for both income generation and capital appreciation. However, it’s important to note that real estate investments can also be illiquid and require significant capital.

Estimating Retirement Savings Needs

Accurately estimating your retirement savings needs is a crucial step in developing a successful retirement plan. This involves considering factors such as your desired lifestyle, estimated expenses, and anticipated lifespan.

- Desired Lifestyle: Consider the level of comfort and activities you envision during retirement. Would you like to travel, pursue hobbies, or maintain a similar lifestyle to your pre-retirement years?

- Estimated Expenses: Project your annual expenses during retirement, including housing, healthcare, food, transportation, and entertainment. Factor in potential inflation and any changes in your spending habits.

- Anticipated Lifespan: Estimate how long you expect to live in retirement. The longer your lifespan, the more you’ll need to save.

A common rule of thumb is to aim to save 80% of your pre-retirement income. However, this is just a starting point, and your individual needs may vary.

Adjusting IRA Contributions

Once you’ve estimated your retirement savings needs, you can adjust your IRA contributions accordingly. If your projections indicate a need for higher savings, you may consider increasing your IRA contributions. Conversely, if your savings are on track, you may be able to reduce your contributions or allocate funds to other investment goals.

- Regular Review: Review your retirement plan regularly, at least annually, to ensure it remains aligned with your changing circumstances and goals. This includes assessing your savings progress, adjusting your contribution strategy, and considering any market fluctuations.

- Professional Guidance: Consider seeking guidance from a financial advisor to help you develop a comprehensive retirement plan that meets your specific needs and risk tolerance. A financial advisor can provide personalized recommendations and assist with managing your investments.

Resources and Additional Information

It’s important to have access to reliable resources and information when making decisions about your retirement savings. This section provides links to reputable sources and organizations that can help you learn more about IRAs and retirement planning.

Reputable Sources for Information

- Internal Revenue Service (IRS):The IRS website provides comprehensive information on IRA contribution limits, eligibility requirements, and tax deductions. You can find publications, forms, and guidance on the IRS website.

- U.S. Securities and Exchange Commission (SEC):The SEC provides investor education materials and resources on retirement planning, including information on IRAs. You can find information on choosing investments, understanding fees, and avoiding scams on the SEC website.

- Financial Industry Regulatory Authority (FINRA):FINRA offers resources and tools to help investors understand retirement savings options, including IRAs. You can find information on choosing the right IRA for your needs, investing strategies, and protecting your retirement savings on the FINRA website.

Organizations Offering Guidance on Retirement Savings

- AARP:AARP offers a wide range of resources on retirement planning, including information on IRAs, Social Security, and Medicare. You can find articles, calculators, and workshops on the AARP website.

- National Endowment for Financial Education (NEFE):NEFE provides financial education programs and resources to help individuals make informed decisions about their finances, including retirement savings. You can find information on budgeting, debt management, and retirement planning on the NEFE website.

- National Institute on Retirement Security (NIRS):NIRS conducts research and advocates for policies that support retirement security. You can find information on retirement savings trends, policy recommendations, and research reports on the NIRS website.

Websites and Resources for IRA Contributions and Retirement Planning

| Website | Description |

|---|---|

| IRS | Comprehensive information on IRA contribution limits, eligibility requirements, and tax deductions. |

| SEC | Investor education materials and resources on retirement planning, including information on IRAs. |

| FINRA | Resources and tools to help investors understand retirement savings options, including IRAs. |

| AARP | A wide range of resources on retirement planning, including information on IRAs, Social Security, and Medicare. |

| NEFE | Financial education programs and resources to help individuals make informed decisions about their finances, including retirement savings. |

| NIRS | Research and advocacy for policies that support retirement security. |

Epilogue

As you plan for your financial future, remember that IRA contribution limits are just one piece of the puzzle. By understanding these limits, exploring the different IRA options, and consulting with a financial advisor, you can develop a comprehensive retirement savings strategy that aligns with your goals and maximizes your potential for a secure and comfortable retirement.

FAQ

Can I contribute to both a Traditional and Roth IRA in the same year?

Yes, you can contribute to both a Traditional and Roth IRA in the same year, but there are income limitations for Roth IRA contributions. Check the current income limits to see if you qualify for both types of contributions.

What happens if I exceed the IRA contribution limit?

If you exceed the contribution limit, you’ll be subject to a penalty of 6% of the excess contribution. This penalty is assessed each year until the excess contribution is removed from your IRA.

Can I withdraw my IRA contributions before retirement?

You can withdraw your IRA contributions before retirement, but you may have to pay taxes and penalties depending on the type of IRA and your age. Early withdrawals from a Traditional IRA are typically subject to both taxes and a 10% penalty, while early withdrawals from a Roth IRA are usually tax-free and penalty-free if you meet certain conditions.

Can I roll over my 401(k) into an IRA?

Yes, you can roll over your 401(k) into an IRA. This can be a good option if you’re leaving your job and want to consolidate your retirement savings or if you want to have more control over your investments.

You’ll need to contact your former employer’s plan administrator to initiate the rollover process.