Auto Interest Rates play a crucial role in the overall cost of financing a car. Understanding how these rates are determined and how to potentially lower them is essential for any car buyer. This article delves into the intricacies of auto interest rates, exploring factors that influence them, different types of rates, and strategies for securing a favorable loan.

Ready to take control of your finances? Applying for a personal loan is a simple process. Use our Apply For Personal Loan tool to get started and see if you qualify for a loan today.

From credit scores and loan terms to vehicle type and market conditions, numerous factors contribute to the interest rate you’ll be offered. By understanding these factors, you can make informed decisions to minimize your financing costs and achieve a favorable car loan.

For those seeking a large loan, a jumbo loan might be the right solution. These loans often come with unique requirements and interest rates, so it’s essential to explore your options and find a lender that fits your needs.

Understanding Auto Interest Rates

Auto interest rates are a crucial factor in car financing, determining the cost of borrowing money to purchase a vehicle. They represent the percentage charged by lenders for the privilege of using their money. Understanding auto interest rates is essential for making informed financial decisions when buying a car.

Lowering your monthly car payments is possible with refinancing car loan. Compare current interest rates and explore your options to see if refinancing is right for you.

What are Auto Interest Rates?

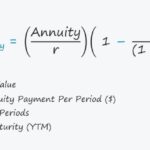

Auto interest rates are the annual percentage rate (APR) that lenders charge for car loans. They represent the cost of borrowing money to purchase a vehicle. The interest rate is calculated as a percentage of the loan amount, and it is applied to the outstanding balance each month.

The higher the interest rate, the more expensive the loan will be over time.

Factors Influencing Auto Interest Rates

Several factors influence auto interest rates, and it’s important to understand how these factors interact to determine the APR you’ll be offered.

- Credit Score:Your credit score is a major determinant of your auto interest rate. A higher credit score typically translates to lower interest rates. Lenders view borrowers with good credit as less risky and are more likely to offer them favorable terms.

- Loan Term:The length of your loan term also affects the interest rate. Longer loan terms generally come with higher interest rates because you’re borrowing the money for a longer period. However, longer terms can also result in lower monthly payments.

- Vehicle Type:The type of vehicle you’re financing can also impact the interest rate. New cars often have higher interest rates than used cars, as lenders perceive them as riskier investments.

- Market Conditions:Interest rates fluctuate based on broader market conditions, including the Federal Reserve’s monetary policy and overall economic health. When interest rates rise, auto loan rates typically follow suit.

Examples of Interest Rate Variations

Here are some examples of how different factors can affect the interest rate on a car loan:

- A borrower with a credit score of 750 might qualify for a 3% interest rate on a 5-year loan for a new car. However, a borrower with a credit score of 600 might receive a 6% interest rate on the same loan.

Citibank offers a range of personal loan options. Learn more about Citibank Personal Loan products and find the best fit for your financial goals.

This illustrates the significant impact of credit score on interest rates.

- A 3-year loan for a used car might have a 4% interest rate, while a 7-year loan for the same car might carry a 5% interest rate. This demonstrates how loan term can influence the interest rate.

Types of Auto Interest Rates

Auto interest rates can be categorized into different types, each with its own characteristics and implications for borrowers.

Need a personal loan quickly? Finding personal loans near me is now easier than ever. Our online tool helps you connect with local lenders offering a range of loan options to fit your specific needs.

Fixed Interest Rates

Fixed interest rates remain constant throughout the loan term. This means your monthly payments will stay the same, regardless of changes in market interest rates. This predictability can be beneficial for budgeting and financial planning.

Variable Interest Rates

Variable interest rates fluctuate based on market conditions. This means your monthly payments can change over time, depending on the direction of interest rates. Variable rates can offer lower initial payments compared to fixed rates, but they also carry the risk of higher payments if interest rates rise.

Choosing Between Fixed and Variable Rates

The choice between fixed and variable interest rates depends on your individual circumstances and risk tolerance.

- If you prefer predictable monthly payments and want to avoid the risk of rising interest rates, a fixed rate might be more suitable.

- If you’re comfortable with some uncertainty and believe interest rates are likely to stay low or even decline, a variable rate could offer lower initial payments.

Factors Affecting Auto Interest Rates

In addition to credit score, loan term, and vehicle type, several other factors can influence auto interest rates.

When it comes to buying a new car, understanding auto rates is essential. Compare offers from different lenders to find the best interest rates and financing terms for your new ride.

Credit Score

Your credit score is the most significant factor determining your auto interest rate. Lenders use your credit score to assess your creditworthiness and determine the risk associated with lending you money. A higher credit score indicates a lower risk, leading to lower interest rates.

Loan Term

The length of your loan term also plays a crucial role in setting the interest rate. Longer loan terms generally come with higher interest rates because you’re borrowing the money for a longer period. However, longer terms can result in lower monthly payments, which can be advantageous for borrowers with limited budgets.

If you’re looking to buy a home with an FHA loan, understanding FHA loan rates is crucial. These rates can fluctuate, so it’s best to shop around and compare offers from multiple lenders.

Vehicle Type

The type of vehicle you’re financing can also affect the interest rate. New cars often have higher interest rates than used cars because they depreciate more rapidly and pose a greater risk to lenders. Additionally, luxury vehicles and performance cars may carry higher interest rates due to their higher price tags and potential for higher maintenance costs.

Market Conditions

Interest rates fluctuate based on broader market conditions, including the Federal Reserve’s monetary policy and overall economic health. When interest rates rise, auto loan rates typically follow suit. Conversely, when interest rates decline, auto loan rates may also fall.

Strategies for Obtaining Lower Auto Interest Rates

While some factors influencing interest rates are beyond your control, you can take steps to improve your chances of securing a lower interest rate.

Small payday loans can provide temporary financial relief. Explore your options for small payday loans and find a lender that meets your specific needs.

Improve Your Credit Score

One of the most effective ways to qualify for lower interest rates is to improve your credit score. This involves paying your bills on time, keeping your credit utilization low, and avoiding unnecessary credit applications.

Shop Around for Car Loans

Don’t settle for the first loan offer you receive. Shop around and compare offers from different lenders to find the most competitive interest rates. Online lenders and credit unions often offer lower rates than traditional banks.

Wondering if you’ve been approved for a loan through Cashnetusa? You can check your status online with a quick and easy search using our Cashnetusa Approved tool. It’s a simple way to get the information you need.

Negotiate with a Lender

Once you’ve found a lender you’re comfortable with, don’t be afraid to negotiate the interest rate. Explain your financial situation and creditworthiness, and see if you can secure a lower rate.

For first-time homebuyers, Bank of America offers a range of programs. Learn more about their Bank Of America First Time Home Buyer options and take the first step towards owning your dream home.

Leverage Trade-Ins and Down Payments

Trading in an existing vehicle or making a down payment can improve your loan terms and potentially lower your interest rate. A larger down payment reduces the loan amount, making the loan less risky for the lender.

Understanding Auto Loan Terms and Conditions

Before signing a car loan agreement, it’s essential to understand the key terms and conditions associated with the loan.

APR (Annual Percentage Rate)

APR represents the total cost of borrowing money, including the interest rate and any fees associated with the loan. It’s important to compare APRs from different lenders to determine the most cost-effective option.

Need a loan quickly and easily? We can help you find quick easy loans with minimal hassle. Our streamlined application process makes it easy to get the funds you need, when you need them.

Loan Term

The loan term is the length of time you have to repay the loan. Longer loan terms generally come with higher interest rates but lower monthly payments. Shorter loan terms result in lower interest rates but higher monthly payments.

Amortization Schedule

An amortization schedule Artikels the breakdown of your loan payments over time, showing how much of each payment goes towards principal and interest. Understanding this schedule can help you track your loan progress and make informed financial decisions.

Looking to finance your next car purchase? Get started with our auto financing tool. We offer a range of options to help you find the perfect loan for your situation.

Auto Loan Calculators and Tools

Auto loan calculators and tools can be valuable resources for estimating monthly payments and total interest costs.

Benefits of Using Auto Loan Calculators

Auto loan calculators can help you:

- Estimate your monthly payments based on different loan terms and interest rates.

- Calculate the total interest cost of the loan.

- Compare different loan options and make informed decisions.

Popular Online Calculators and Resources

There are numerous online auto loan calculators available, including:

- Bankrate

- NerdWallet

- Experian

Making Informed Decisions

Using auto loan calculators can empower you to make informed decisions about car financing. By understanding the costs involved and exploring different loan options, you can choose a loan that aligns with your financial goals and budget.

Concluding Remarks

Navigating the world of auto interest rates can seem daunting, but with knowledge and a strategic approach, you can secure a car loan that aligns with your financial goals. By understanding the factors that influence interest rates, exploring different loan options, and leveraging strategies to improve your loan terms, you can drive away with confidence knowing you’ve made a smart financial decision.

Dreaming of a sparkling pool in your backyard? Secure the funds you need with pool financing. This specialized financing option can help you make your pool dreams a reality.

Helpful Answers

How can I improve my credit score to get a lower interest rate?

Looking to invest in a commercial property? A commercial property loan can help you secure the financing you need to make your dream a reality. These loans can be tailored to your specific needs, offering flexible terms and competitive rates.

Pay your bills on time, keep your credit utilization low, avoid opening too many new accounts, and consider disputing any errors on your credit report.

Understanding commercial loan interest rates is crucial for making informed financial decisions. Factors like your credit score, loan amount, and loan type can influence these rates, so it’s best to compare offers from multiple lenders.

What are the benefits of a fixed interest rate auto loan?

A fixed rate protects you from fluctuations in interest rates, ensuring predictable monthly payments over the life of the loan.

How do I find the best auto loan rates?

Shop around with multiple lenders, compare APRs and loan terms, and consider using online loan comparison tools.

What is the difference between APR and interest rate?

APR (Annual Percentage Rate) includes the interest rate plus any additional fees associated with the loan, providing a more comprehensive view of the overall cost of borrowing.