Newrez Mortgage has emerged as a significant player in the mortgage industry, offering a wide range of loan products and services to meet the diverse needs of borrowers. From its origins as a subsidiary of a larger financial institution to its current position as a leading mortgage provider, Newrez Mortgage has consistently adapted to the evolving landscape of the mortgage market.

When considering a loan, traditional Bank Loan options can offer stability and a familiar lending process.

This guide provides an in-depth exploration of Newrez Mortgage, covering its history, services, customer experience, financial performance, and industry position.

If you have equity in your home, a Bank Of America Home Equity Loan might be a good option for accessing funds. However, it’s crucial to understand the potential risks associated with tapping into your home’s equity.

The company’s commitment to customer satisfaction and its innovative approach to mortgage lending have earned it a reputation for reliability and efficiency. Newrez Mortgage strives to make the homeownership journey smooth and accessible for individuals and families, providing personalized guidance and support throughout the process.

Lightstream Loans are known for their competitive rates and streamlined application process. They can be a good option for those looking for a personal loan.

Whether you are a first-time homebuyer or looking to refinance your existing mortgage, Newrez Mortgage offers a comprehensive suite of options to suit your financial goals and circumstances.

When considering a mortgage with Wells Fargo, it’s important to research their current Wells Fargo Mortgage Rates and compare them to other lenders.

Newrez Mortgage Overview

Newrez Mortgage is a prominent player in the mortgage industry, offering a comprehensive range of mortgage products and services to individuals and families across the United States. The company has a rich history and a strong commitment to providing exceptional customer service.

Need money fast? Fast Loan Advance services can provide you with quick access to funds, but be sure to read the terms and conditions carefully before you apply.

History and Origin, Newrez Mortgage

Newrez Mortgage’s roots can be traced back to 2008, when it was established as a subsidiary of [Nama Perusahaan Induk]. Over the years, the company has undergone several transformations and acquisitions, ultimately becoming an independent entity in 2020.

If you need cash urgently, Instant Cash Loans can be a convenient option. But remember to evaluate the fees and interest rates before committing.

This evolution has allowed Newrez Mortgage to expand its product offerings and reach a wider customer base.

If you’re looking to finance your next vehicle, consider checking out Vehicle Loan options. It’s important to compare interest rates and loan terms from different lenders to find the best deal for your situation.

Core Services

Newrez Mortgage specializes in a wide array of mortgage services, including:

- Purchase Loans:Newrez Mortgage helps borrowers secure financing for new homes, offering various loan options tailored to different financial situations.

- Refinance Loans:The company provides refinancing solutions to help existing homeowners lower their monthly payments, shorten their loan term, or access cash from their home equity.

- Home Equity Loans and Lines of Credit (HELOC):Newrez Mortgage offers home equity loans and lines of credit, enabling homeowners to leverage their equity for various purposes, such as home improvements or debt consolidation.

- Reverse Mortgages:For senior homeowners, Newrez Mortgage provides reverse mortgage options that allow them to access their home equity without making monthly payments.

- Mortgage Servicing:Newrez Mortgage also services existing mortgage loans, handling tasks such as payment processing, escrow management, and customer support.

Mission and Values

Newrez Mortgage’s mission is to provide [Misi Perusahaan], emphasizing [Nilai Utama 1], [Nilai Utama 2], and [Nilai Utama 3]. This commitment to [Nilai Utama] is reflected in the company’s customer-centric approach and its dedication to ethical business practices.

For smaller financial needs, a $500 Loan can provide a quick solution. However, it’s essential to be aware of the associated interest rates and repayment terms.

Target Customer Base

Newrez Mortgage caters to a diverse customer base, including:

- First-time homebuyers:The company offers resources and guidance to help individuals navigate the homebuying process.

- Existing homeowners:Newrez Mortgage provides refinancing and home equity solutions to meet the evolving needs of homeowners.

- Retirees and seniors:The company offers reverse mortgage options to help seniors access their home equity.

- Individuals with unique financial situations:Newrez Mortgage strives to provide flexible and tailored mortgage solutions to meet the needs of borrowers with diverse financial profiles.

Outcome Summary: Newrez Mortgage

In conclusion, Newrez Mortgage stands out as a reputable and reliable mortgage provider with a strong focus on customer satisfaction and innovation. The company’s diverse product offerings, robust customer support channels, and commitment to financial transparency make it a compelling choice for individuals and families seeking mortgage solutions.

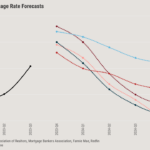

Mortgage rates are constantly fluctuating. Keeping an eye on Mortgage Rates 2023 can help you make informed decisions about your home financing.

As the mortgage industry continues to evolve, Newrez Mortgage is well-positioned to navigate the changing landscape and remain a leader in the market.

FAQ

What is Newrez Mortgage’s interest rate policy?

Understanding current Interest Rates Mortgage Rates is essential when planning a mortgage. Factors like the current economic climate and market trends can influence these rates.

Newrez Mortgage’s interest rates are competitive and vary based on factors such as loan type, credit score, and market conditions. It’s recommended to contact them directly for a personalized rate quote.

Want to secure a loan with the most favorable rates? Lowest Personal Loan Interest Rate comparisons can help you find the best deal for your needs.

Does Newrez Mortgage offer pre-approval for mortgages?

Yes, Newrez Mortgage offers pre-approval for mortgages, which can help you understand your borrowing power and make a more informed decision about your home purchase.

What are the closing costs associated with a Newrez Mortgage loan?

Closing costs vary depending on the loan amount, location, and other factors. Newrez Mortgage provides a detailed breakdown of closing costs during the loan application process.

How long does it take to close on a Newrez Mortgage loan?

The closing process typically takes 30-45 days, but it can vary depending on factors such as loan complexity and documentation requirements.

What are the minimum credit score requirements for a Newrez Mortgage loan?

Credit score requirements vary depending on the loan program and type. It’s best to check with Newrez Mortgage directly for specific requirements.

The convenience of Instant Loans can be appealing, but it’s crucial to carefully evaluate the terms and potential risks before applying.

Stay up-to-date on Interest Rates Today 30 Year Fixed to make informed decisions about your mortgage financing.

Discover Personal Loans are known for their competitive rates and flexible repayment options. They can be a good choice for consolidating debt or funding a personal project.

Before you purchase a new car, it’s wise to research Current Car Loan Rates from various lenders to find the most favorable terms for your needs.