Payday Advance Near Me is a term that often pops up when unexpected expenses arise, and you need quick cash. These short-term loans, also known as cash advances, can provide immediate financial relief, but they come with high interest rates and potentially steep repayment terms.

Are you looking to lower your monthly car payments? You might want to consider refinancing your car loan. Check out Refinancing Car Loan for information about how this process works.

Understanding the advantages and disadvantages of payday advances is crucial before considering them as a financial solution.

PNC Bank also offers HELOC options. You can find out more about their program at Pnc Heloc. Make sure to compare rates and terms from different lenders to find the best fit for your needs.

Payday advances are typically designed for individuals facing temporary financial shortfalls, such as unexpected car repairs or medical bills. However, it’s important to carefully evaluate your options and consider the potential risks associated with these loans before committing to one.

Interested in finding out the current auto rates? You can check out the latest rates at Auto Rates. This site provides a comprehensive overview of rates from various lenders, helping you make an informed decision.

While they can offer convenience and accessibility, the high interest rates and short repayment periods can lead to a cycle of debt if not managed responsibly.

Looking for a variety of loan options in one place? Check out Loan Places. This site offers a wide range of loan products, including personal loans, auto loans, and mortgages.

What are Payday Advances?

Payday advances, also known as cash advance loans, are short-term, high-interest loans that are typically due on your next payday. They are designed to help people bridge a gap in their finances until their next paycheck arrives. Payday advances are often marketed as a quick and easy way to get cash in a pinch, but it’s important to understand the potential risks and drawbacks before considering this type of loan.

Bank of America offers a HELOC option for homeowners. You can find more information about their program at Bank Of America Heloc. Be sure to compare rates and terms with other lenders before making a decision.

How Payday Advances Work, Payday Advance Near Me

The process of obtaining a payday advance is typically straightforward and quick. Borrowers typically provide a lender with a post-dated check or authorization to electronically debit their bank account for the amount of the loan plus fees. The loan is then disbursed to the borrower, usually in cash or deposited directly into their bank account.

Need quick cash in a pinch? You can find out about different types of quick cash loans at Quick Cash Loans. These loans are designed to provide fast access to funds, but it’s important to understand the terms and conditions before you borrow.

On the borrower’s next payday, the lender cashes the check or withdraws the funds from their bank account to repay the loan.

If you’re shopping for a new car, you’ll want to secure the lowest possible loan rate. Check out Lowest Auto Loan Rates for a comparison of rates from various lenders.

Situations Where People Seek Payday Advances

People may turn to payday advances for various reasons, such as:

- Unexpected expenses, like car repairs or medical bills

- Covering essential bills, such as rent or utilities

- Paying off other debts, such as credit card bills

- Emergency situations, like a job loss or natural disaster

Advantages and Disadvantages of Payday Advances: Payday Advance Near Me

Advantages of Payday Advances

Payday advances offer some potential benefits, including:

- Convenience and Accessibility:Payday advances are generally easy to obtain, with minimal paperwork and quick approval times. They are often available to borrowers with less-than-perfect credit histories.

- Fast Funding:Borrowers can typically receive funds within a day or two, providing quick access to cash in emergency situations.

Disadvantages of Payday Advances

Payday advances come with significant drawbacks, including:

- High Interest Rates:Payday advances carry extremely high interest rates, often exceeding 400% APR. These rates can quickly turn a small loan into a large debt burden.

- Short Repayment Terms:Payday advances are typically due on your next payday, leaving little time to repay the loan. This can lead to a cycle of debt, as borrowers may find themselves needing to take out another payday advance to cover the previous one.

- Potential for Debt Traps:The high interest rates and short repayment terms can trap borrowers in a cycle of debt, making it difficult to escape. Borrowers may find themselves taking out multiple payday advances to cover previous loans, leading to a snowball effect of increasing debt.

Wells Fargo is a well-known mortgage lender. You can learn more about their mortgage products and services at Wells Fargo Mortgage. Be sure to compare rates and terms from different lenders before making a decision.

Comparison with Other Short-Term Borrowing Options

While payday advances offer quick access to cash, other short-term borrowing options may be more advantageous in the long run. These alternatives include:

- Personal Loans:Personal loans typically have lower interest rates and longer repayment terms than payday advances. However, they may require a credit check and have stricter eligibility requirements.

- Credit Cards:Credit cards can offer a more flexible way to borrow money, but they also come with high interest rates if balances are not paid off in full each month. It’s crucial to use credit cards responsibly and avoid carrying a balance.

Need money fast? There are several types of instant loans available. You can explore your options at Instant Loans. These loans can provide quick access to funds, but remember to read the fine print carefully.

- Small Loans from Family or Friends:Borrowing from family or friends can be a good option if you have a trusted relationship and can agree on clear repayment terms.

Finding Payday Advance Providers Near Me

Types of Payday Advance Providers

Payday advances are offered by various types of businesses, including:

- Storefront Lenders:These are traditional brick-and-mortar lenders that operate physical locations. They often have a more personal approach to lending and may offer face-to-face interactions.

- Online Lenders:Online lenders operate solely through websites and mobile apps. They typically offer a more convenient and streamlined application process.

- Mobile Apps:Some mobile apps provide payday advance services directly through their platform, offering quick and easy access to funds.

Finding Payday Advance Providers in Your Area

To find payday advance providers near you, you can use various methods, such as:

- Online Search Engines:Search for s like “payday loans near me” or “cash advance near me” to find local lenders in your area.

- Location-Based Services:Use apps like Google Maps or Yelp to search for payday advance providers in your vicinity.

- Online Directories:Websites that specialize in financial services often list payday advance providers in different locations.

Choosing a Payday Advance Provider

When choosing a payday advance provider, it’s important to consider several factors:

- Reputation:Research the lender’s reputation by reading online reviews and checking with the Better Business Bureau.

- Interest Rates and Fees:Compare interest rates and fees among different lenders to find the most affordable option.

- Customer Reviews:Read customer reviews to get insights into the lender’s customer service and overall experience.

- Transparency:Ensure the lender provides clear and transparent information about their loan terms, fees, and repayment process.

Alternatives to Payday Advances

Alternative Financial Solutions

Before resorting to payday advances, consider exploring alternative financial solutions that may be more beneficial in the long run:

- Personal Loans:Personal loans typically have lower interest rates and longer repayment terms than payday advances. They can be obtained from banks, credit unions, or online lenders. However, they may require a credit check and have stricter eligibility requirements.

- Credit Cards:Credit cards can offer a more flexible way to borrow money, but it’s crucial to use them responsibly and avoid carrying a balance. If you can pay off your balance in full each month, you can avoid high interest charges.

Planning to build a new home? You’ll need a construction loan to finance the project. Learn more about construction loans at Construction Loan to see if this is the right option for you.

- Budgeting Strategies:Creating a budget can help you identify areas where you can cut back on spending and free up cash flow. This can help you avoid the need for short-term loans.

- Negotiating with Creditors:If you’re struggling to make payments on existing debts, consider negotiating with your creditors for a payment plan or lower interest rate.

- Community Resources:Local organizations and charities may offer financial assistance programs or resources for people in need.

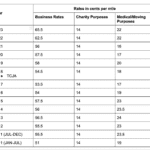

Comparison of Payday Advances and Alternatives

| Feature | Payday Advance | Personal Loan | Credit Card |

|---|---|---|---|

| Interest Rate | High (often exceeding 400% APR) | Lower than payday advances | Varies, but can be high if balances are not paid off in full each month |

| Loan Amount | Typically small (up to a few hundred dollars) | Can range from a few hundred to tens of thousands of dollars | Depends on credit limit |

| Repayment Term | Short (typically due on your next payday) | Longer than payday advances (months or years) | Minimum monthly payments, but balances can be carried over |

| Eligibility Requirements | Typically less strict, often requiring only proof of income and a bank account | May require a credit check and stricter eligibility requirements | Requires a credit check and approval |

Responsible Use of Payday Advances

Tips for Responsible Borrowing and Repayment

If you do decide to take out a payday advance, it’s essential to borrow responsibly and make every effort to repay the loan on time. Here are some tips:

- Budget Carefully:Create a budget to ensure you can afford the loan repayment and avoid overspending.

- Understand the Terms:Carefully read the loan agreement and understand the interest rates, fees, and repayment terms before signing.

- Avoid Overspending:Only borrow what you absolutely need and avoid taking out multiple payday advances to cover previous loans.

- Repay on Time:Make every effort to repay the loan on time to avoid late fees and additional interest charges.

Evaluating Whether a Payday Advance is Right for You

Before taking out a payday advance, ask yourself these questions:

- Is this a true emergency?Payday advances should only be used for urgent situations where other options are not available.

- Can I afford the repayment?Make sure you can comfortably afford the repayment amount without jeopardizing your financial stability.

- Have I explored all other options?Consider alternative financial solutions before resorting to payday advances.

Financial Literacy and Debt Management Support

If you’re struggling with debt or need help managing your finances, there are resources available to support you. Consider reaching out to:

- Credit Counseling Agencies:Credit counseling agencies can provide guidance on budgeting, debt management, and financial literacy.

- Nonprofit Organizations:Many nonprofit organizations offer financial assistance programs and resources for people in need.

- Financial Literacy Websites:Online resources provide information on personal finance, budgeting, and debt management.

Final Review

In conclusion, payday advances can provide a lifeline in times of need, but they should be approached with caution. Thoroughly research and compare different providers, understand the terms and conditions, and only borrow what you can afford to repay. If you’re struggling with debt, consider seeking professional financial advice or exploring alternative solutions such as personal loans or budgeting strategies.

Looking to get a better interest rate on your current car loan? You can find out how to refinance your car at Refinancing A Car. This could save you money over the life of the loan.

Responsible borrowing practices are key to maintaining financial stability and avoiding a potential debt trap.

If you’re a veteran, you may be eligible for a VA loan. Check out the current VA loan rates at Va Loan Rates Today to see if this type of financing is right for you.

FAQ Compilation

What are the typical interest rates on payday advances?

Interest rates on payday advances can vary widely depending on the lender and your location. However, they are generally much higher than traditional loans, often exceeding 400% APR.

How long do I have to repay a payday advance?

Payday advances usually have short repayment terms, typically two weeks to a month. This can make it difficult to repay the loan in full and can lead to a cycle of debt if you’re unable to make the full payment on time.

Sometimes you need cash quickly, and a same-day cash advance might be the solution. You can find out more about these loans at Same Day Cash Advance. Just be sure to understand the associated fees and repayment terms.

Are payday advances legal in my state?

The legality of payday advances varies by state. Some states have strict regulations, while others have banned them altogether. It’s important to check the laws in your state before considering a payday advance.

Before you start house hunting, it’s wise to get pre-approved for a mortgage. You can learn more about this process and find lenders at Mortgage Pre Approval. This will give you a clear picture of how much you can afford to borrow.

What are the consequences of defaulting on a payday advance?

Looking for the best HELOC lenders? You can find a list of the top options at Best Heloc Lenders. These lenders offer competitive rates and flexible terms, so you can find the perfect loan for your needs.

Defaulting on a payday advance can have serious consequences, including damage to your credit score, collection efforts, and even legal action. It’s essential to prioritize repayment and avoid defaulting if possible.