Cash Advance No Credit Check sounds appealing, promising fast cash without the hassle of credit checks. But is it truly a solution or a slippery slope towards deeper financial trouble? These advances, often offered by payday lenders or online platforms, might seem like a lifeline in a pinch, but they come with steep interest rates and fees that can quickly spiral out of control.

Mobiloans is a company that provides online loans. You can learn more about their services by visiting their website at Mobiloans. It’s always a good idea to compare different lenders before making a decision.

Understanding the intricacies of “no credit check” cash advances is crucial for making informed financial decisions. This guide delves into the potential benefits and risks, exploring alternative options and emphasizing the importance of financial responsibility.

Looking for a quick and easy way to borrow money? Quick Loans Online can be a convenient option. However, it’s crucial to compare lenders and understand the terms before you apply. Make sure you’re comfortable with the interest rates and repayment terms before borrowing.

Introduction to Cash Advances

A cash advance is a short-term loan that allows you to borrow money against your credit card or bank account. It’s typically used for immediate financial needs, such as covering unexpected expenses or bridging a gap in your budget. The main difference between a cash advance and a traditional loan is that a cash advance is usually accessed directly from your existing credit card or bank account, while a traditional loan requires a separate application and approval process.

Need money quickly? Instant Payday Loans Online Guaranteed Approval might seem like a solution, but it’s important to understand the high interest rates and potential risks associated with these loans. Consider alternative options before resorting to payday loans.

Cash advances are often considered when faced with urgent financial situations, such as:

- Unexpected medical bills

- Car repairs

- Home emergencies

- Paying for travel expenses

“No Credit Check” Cash Advances

“No credit check” cash advances, as the name suggests, are offered without a traditional credit check. This means that lenders do not review your credit history to determine your creditworthiness. While this might seem appealing for those with poor credit, it’s crucial to understand the associated risks and potential downsides.

Jora Credit is a company that offers a variety of financial products and services. You can learn more about them by visiting their website at Jora Credit. It’s always a good idea to research different companies before choosing one to work with.

These types of advances often come with higher interest rates and fees compared to traditional loans. The lack of credit checks allows lenders to charge significantly more, as they assume a higher risk by lending to individuals with potentially poor credit histories.

If you’re planning to buy a home, a Mortgage Broker can help you navigate the process. They can shop around for the best rates and terms from multiple lenders, saving you time and effort. A mortgage broker can also provide valuable guidance and support throughout the process.

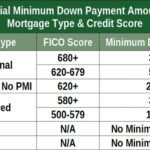

Here’s a comparison of interest rates and fees:

| Type of Loan | Typical Interest Rate | Typical Fees |

|---|---|---|

| Traditional Loan | 5-15% | Origination fee, late payment fee |

| “No Credit Check” Cash Advance | 20-40% or more | Origination fee, late payment fee, processing fee |

Providers of Cash Advances: Cash Advance No Credit Check

Cash advances are offered by various providers, each with its own eligibility criteria and application process.

If you’re a veteran or active-duty military member, you may be eligible for a VA Home Loan. These loans offer competitive interest rates and require no down payment. You can learn more about VA loans by visiting the VA website.

- Payday Lenders:These lenders typically offer small, short-term loans, often with high interest rates and fees. They often target individuals with poor credit or limited access to traditional credit. The application process is usually quick and simple, often requiring minimal documentation.

If you’re looking to tap into your home equity, a Chase Home Equity Loan might be a good option. These loans allow you to borrow against the equity you’ve built up in your home, which can be used for a variety of purposes, such as home improvements, debt consolidation, or even a vacation.

- Online Platforms:Many online platforms offer cash advances, often with a more streamlined application process. These platforms can provide faster approval times and potentially lower interest rates compared to traditional lenders.

- Credit Card Cash Advances:Most credit cards offer cash advances, allowing you to withdraw money directly from your credit card account. However, these advances usually come with higher interest rates and fees than regular credit card purchases.

It’s important to research and compare different providers to find the best option based on your individual needs and financial situation. Consider factors such as interest rates, fees, repayment terms, and the lender’s reputation.

A Subsidized Loan is a type of student loan where the government pays the interest while you’re in school and during grace periods. This can save you money on interest charges and make your loan repayment more manageable.

The Cost of Cash Advances

Cash advances can be expensive due to various fees associated with them:

- Origination Fee:This is a one-time fee charged by the lender for processing the loan.

- Interest Rate:This is the percentage charged on the amount borrowed. Cash advances often have higher interest rates than traditional loans.

- Late Payment Fee:This fee is charged if you fail to make a payment by the due date.

These fees can accumulate quickly, making cash advances a costly solution for short-term financial needs. For example, if you borrow $500 with a 30% interest rate and a $50 origination fee, you could end up paying significantly more than the initial loan amount.

Looking for a mortgage? Chase Mortgage Rates can be a good starting point for your research. They offer a variety of mortgage options, including fixed-rate and adjustable-rate mortgages. Be sure to compare rates and terms from multiple lenders before making a decision.

Alternatives to Cash Advances

Before considering a cash advance, explore alternative financial solutions that might be more affordable and manageable.

A Home Equity Line of Credit (HELOC) can be a flexible way to access your home equity. You can borrow money as needed, up to a certain limit, and only pay interest on the amount you borrow. HELOCs are often used for home improvements, debt consolidation, or unexpected expenses.

- Personal Loans:Personal loans offer fixed interest rates and repayment terms, making them a more predictable and potentially less expensive option than cash advances. However, they typically require a credit check and may have a longer approval process.

- Credit Cards:Using a credit card for purchases can provide a grace period for repayment without interest charges. However, it’s crucial to manage credit card spending responsibly and avoid accumulating high balances.

- Borrowing from Friends or Family:If you have a trusted friend or family member willing to lend you money, this could be a more affordable option with flexible repayment terms. However, it’s essential to discuss repayment terms clearly and avoid straining relationships.

Consider factors such as your credit score, interest rates, repayment terms, and the potential impact on your financial health when choosing an alternative solution.

If you’re a first-time homebuyer, you may be eligible for an FHA loan. FHA Mortgage Rates are typically lower than conventional mortgage rates, and you can often qualify with a lower credit score. You can learn more about FHA loans by visiting the FHA website.

Financial Responsibility and Cash Advances

It’s crucial to prioritize budgeting and financial planning to manage expenses effectively. Relying heavily on cash advances can lead to a cycle of debt, as high interest rates and fees can quickly spiral out of control. If you find yourself struggling with debt, seek professional help from a credit counselor or financial advisor.

If you’re planning to buy a home, you’ll need to know the current 30-Year Fixed Mortgage Rates. These rates fluctuate based on market conditions, so it’s important to stay informed. You can find current rates online or by contacting a mortgage lender.

Here are some tips for managing debt and improving financial health:

- Create a realistic budget and track your spending.

- Prioritize debt repayment and focus on high-interest debts first.

- Explore debt consolidation options to lower interest rates.

- Consider seeking professional financial advice.

Closing Notes

While cash advances without credit checks might seem like a quick fix, they often lead to a cycle of debt. It’s essential to carefully consider the long-term consequences before taking this route. Budgeting, exploring alternative financing options, and prioritizing financial responsibility are crucial for navigating financial challenges responsibly.

Question & Answer Hub

What are the common fees associated with cash advances?

Common fees include origination fees, interest rates, late payment fees, and sometimes even fees for early repayment. These fees can add up quickly, making it crucial to understand the total cost before borrowing.

If you need money fast, you might want to consider quick cash loans. These loans are typically small and can be approved quickly, but they often come with high interest rates. It’s important to compare different lenders and understand the terms before you borrow.

How can I avoid relying on cash advances?

Building a budget, saving for emergencies, and exploring alternative financing options like personal loans or credit cards can help you avoid relying on cash advances.

What are some red flags to watch out for when considering a cash advance?

Be wary of lenders who pressure you to borrow, have hidden fees, or don’t provide clear information about the terms and conditions. It’s essential to compare different providers and understand the potential risks before committing.

If you’re a Wells Fargo customer and need to access your home equity, a Wells Fargo HELOC could be a good option. They offer a variety of HELOC options, so be sure to compare rates and terms before making a decision.

Staying informed about current Interest Rates Today 30 Year Fixed is essential when planning to buy a home. These rates can fluctuate daily, so it’s a good idea to check them regularly. You can find current rates online or by contacting a mortgage lender.