Housing Interest Rates 2023 2024 are a hot topic, influencing the decisions of both buyers and sellers in the real estate market. The current rate environment is dynamic, driven by a complex interplay of economic factors, including inflation, unemployment, and Federal Reserve policies.

Understanding the historical trends, current rates, and potential future predictions is crucial for making informed decisions about buying, selling, or refinancing a home.

This guide explores the current state of housing interest rates, analyzes historical trends, and delves into the factors that shape this ever-changing landscape. We’ll examine the impact of interest rates on the housing market, provide insights into potential future trends, and offer strategies for homebuyers navigating this evolving environment.

Seeking expert guidance? Connecting with Mortgage Advisors 2024 can help you navigate the complex world of mortgages and find the best loan for your needs. If you’re considering a shorter term, you might want to check out 5 Year Fixed Mortgage Rates 2024.

Current Housing Interest Rates

Mortgage interest rates are a crucial factor for anyone considering buying a home. They directly impact the affordability and overall cost of homeownership. In 2023 and 2024, interest rates have been fluctuating, presenting both challenges and opportunities for potential homebuyers.

If you’re looking for the best possible rate, research Best Home Loan Interest Rates 2024. Don’t forget to consider the terms and conditions carefully. For businesses seeking financing, exploring Commercial Mortgage Rates 2024 is a good starting point.

This article provides a comprehensive overview of current housing interest rates, historical trends, influencing factors, and strategies for navigating this dynamic market.

Current Mortgage Interest Rates

As of October 26, 2023, average mortgage interest rates for various loan types are as follows:

- 30-Year Fixed-Rate Mortgage:7.25%

- 15-Year Fixed-Rate Mortgage:6.50%

- Adjustable-Rate Mortgage (ARM):6.75% (initial rate)

It’s important to note that these rates are subject to change daily. Factors such as economic indicators, Federal Reserve policies, and investor sentiment can influence interest rate fluctuations. It’s always recommended to consult with a mortgage lender for the most up-to-date information and personalized rate quotes.

Factors Influencing Current Interest Rate Trends, Housing Interest Rates 2023 2024

Several factors contribute to the current trends in mortgage interest rates. These include:

- Inflation:Rising inflation, as measured by the Consumer Price Index (CPI), often leads to higher interest rates. The Federal Reserve aims to control inflation by increasing interest rates, making borrowing more expensive and potentially slowing down economic growth.

- Federal Reserve Policies:The Federal Reserve (Fed) plays a significant role in setting interest rate targets. The Fed’s monetary policy decisions, such as raising or lowering the federal funds rate, directly impact mortgage rates.

- Economic Growth:Strong economic growth can lead to higher interest rates as investors demand higher returns on their investments. Conversely, weak economic growth may result in lower interest rates to stimulate borrowing and spending.

- Global Economic Events:Global economic events, such as international trade disputes or geopolitical tensions, can also impact interest rates. These events can create uncertainty in the market, leading to fluctuations in borrowing costs.

Historical Trends in Housing Interest Rates

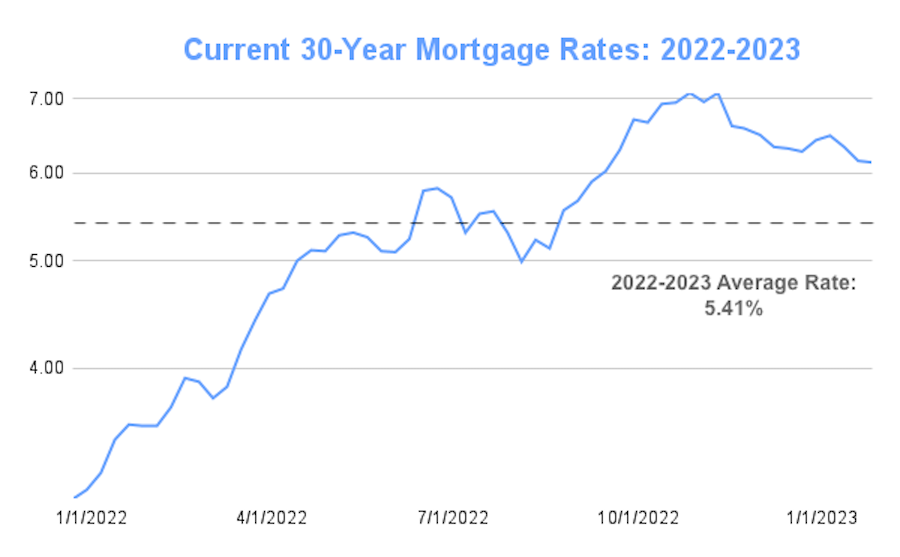

Over the past decade, housing interest rates have experienced significant fluctuations. Examining historical trends can provide insights into the cyclical nature of mortgage rates and the factors that have driven them.

Historical Rate Fluctuations

Here’s a brief overview of historical interest rate trends:

- 2012-2016:Interest rates were historically low following the 2008 financial crisis. This period saw rates for 30-year fixed-rate mortgages hovering around 3.5% to 4.5%.

- 2017-2019:Interest rates gradually increased as the economy recovered. Rates for 30-year fixed-rate mortgages climbed to around 4.5% to 5.5%.

- 2020-2022:The COVID-19 pandemic initially led to a sharp decline in interest rates as the Fed implemented accommodative monetary policies to stimulate the economy. Rates for 30-year fixed-rate mortgages dropped to record lows below 3%.

- 2023-Present:Interest rates have been rising again, driven by factors such as inflation, Fed rate hikes, and economic uncertainty. Rates for 30-year fixed-rate mortgages have climbed back above 7%.

These historical trends highlight the cyclical nature of mortgage rates. Interest rates tend to move in response to economic conditions, monetary policies, and global events. Understanding these historical trends can help homebuyers anticipate potential future rate fluctuations.

If you’re planning to buy a home in 2024, it’s important to stay informed about Home Loan Rates 2024. These rates can fluctuate based on economic conditions and market trends. You may also want to explore 2nd Mortgage Rates 2024 if you need additional funds for renovations or other purposes.

Key Events Impacting Historical Rate Fluctuations

Several key events have significantly impacted historical mortgage rate trends:

- The 2008 Financial Crisis:The financial crisis led to a severe recession and a decline in housing prices. The Fed responded by lowering interest rates to stimulate the economy, resulting in historically low mortgage rates.

- The COVID-19 Pandemic:The pandemic caused significant economic disruption, leading to a sharp decline in interest rates as the Fed implemented accommodative monetary policies to support the economy.

- The Ukraine War:The ongoing war in Ukraine has created global economic uncertainty, contributing to rising inflation and higher interest rates.

Factors Affecting Housing Interest Rates: Housing Interest Rates 2023 2024

Housing interest rates are influenced by a complex interplay of economic factors, government policies, and global events. Understanding these factors can help homebuyers make informed decisions in a changing rate environment.

Economic Factors

Several economic factors play a crucial role in shaping mortgage interest rates:

- Inflation:As mentioned earlier, rising inflation typically leads to higher interest rates. The Fed aims to control inflation by increasing borrowing costs, which can slow down economic growth and reduce demand.

- Unemployment:Low unemployment rates can indicate a strong economy, which may lead to higher interest rates as investors demand higher returns on their investments. Conversely, high unemployment rates can signal a weak economy, potentially leading to lower interest rates.

- Consumer Spending:Strong consumer spending can drive economic growth, potentially leading to higher interest rates. Conversely, weak consumer spending can signal a slowing economy, potentially leading to lower interest rates.

Government Policies and Regulations

Government policies and regulations can also impact mortgage rates. For example:

- Federal Reserve Policies:The Fed’s monetary policy decisions, such as adjusting the federal funds rate, directly influence mortgage rates. The Fed aims to control inflation and stimulate economic growth through these policies.

- Housing Regulations:Government regulations related to housing finance, such as those governing mortgage lending standards and loan programs, can impact the availability and cost of mortgages.

- Tax Policies:Tax policies, such as deductions for mortgage interest, can influence the affordability of homeownership and indirectly impact mortgage demand.

Global Economic Events and Geopolitical Factors

Global economic events and geopolitical factors can also influence interest rates. These events can create uncertainty in the market, leading to fluctuations in borrowing costs.

- International Trade Disputes:Trade disputes between countries can create economic uncertainty and potentially impact interest rates. For example, the US-China trade war in recent years has contributed to market volatility.

- Geopolitical Tensions:Geopolitical tensions, such as wars or political instability, can also create economic uncertainty and impact interest rates. For instance, the ongoing war in Ukraine has contributed to rising inflation and higher interest rates.

Impact of Interest Rates on Housing Market

Interest rates have a significant impact on the housing market, influencing affordability, demand, and overall market stability. Understanding this relationship can help homebuyers make informed decisions.

Impact on Affordability and Demand

Rising interest rates make borrowing more expensive, reducing affordability for potential homebuyers. As interest rates increase, monthly mortgage payments rise, making it challenging for some buyers to qualify for a loan or afford the desired property. This can lead to a decrease in demand, potentially slowing down sales activity.

Impact on Home Prices, Inventory Levels, and Sales Activity

Rising interest rates can have a mixed impact on home prices. In some cases, higher rates may slow down price growth or even lead to price declines as demand weakens. However, in markets with limited inventory, strong buyer demand, and limited new construction, home prices may remain relatively stable or even continue to rise despite higher interest rates.

Higher interest rates can also impact inventory levels. As demand decreases, some sellers may be reluctant to list their homes, potentially leading to lower inventory levels. This can further contribute to price stability or even price increases in markets with limited supply.

Overall, rising interest rates can lead to a slowdown in sales activity as demand decreases and affordability becomes more challenging. However, the specific impact on the housing market can vary depending on factors such as local market conditions, inventory levels, and buyer demand.

Potential Consequences of Interest Rate Changes on Housing Market Stability

Significant changes in interest rates can have potential consequences for the housing market’s stability. Rapidly rising interest rates can lead to a sharp decline in demand, potentially triggering a correction in home prices. Conversely, prolonged periods of low interest rates can create a bubble in the housing market, making it vulnerable to a crash if rates rise quickly.

Comparing Bank Of America Mortgage Rates 2024 with other lenders is essential to find the best deal. Understanding the Average Home Interest Rate 2024 can help you gauge the market and identify potential savings.

The impact of interest rate changes on housing market stability is a complex issue. It’s essential to consider various factors, including economic conditions, monetary policies, and market dynamics, to assess the potential risks and opportunities.

For those seeking a flexible mortgage option, consider Arm Rates 2024. These rates can be attractive initially, but remember to carefully consider the potential for adjustments in the future. To get a clear picture of current rates, you can check out Current 30 Year Mortgage Rates 2024.

Predictions for Future Interest Rates

Predicting future interest rate trends is challenging, but experts and market analysts offer insights based on economic projections and current market conditions. Here are some potential scenarios for housing interest rates in 2023 and 2024:

Potential Future Trends

- Continued Rate Hikes:Many economists anticipate that the Fed will continue to raise interest rates in 2023 and 2024 to combat inflation. This could lead to further increases in mortgage rates, potentially reaching levels not seen in recent years.

- Rate Stabilization:Some experts predict that the Fed may pause or slow down rate hikes in 2024 if inflation shows signs of cooling down. This could lead to a period of rate stabilization or even a slight decline in mortgage rates.

- Unpredictable Events:Unforeseen events, such as global economic shocks or geopolitical crises, could significantly impact interest rate trends. These events can create uncertainty and volatility in the market, making it difficult to predict the direction of rates.

Expert Opinions and Market Forecasts

Experts and market analysts have diverse opinions on future interest rate trends. Some predict that rates will continue to rise, while others believe that they will stabilize or even decline. It’s essential to consult with financial professionals and stay informed about market forecasts to make informed decisions.

Impact of Economic Projections and Geopolitical Events

Economic projections and geopolitical events can influence future interest rate trends. For example, if the economy experiences a recession, the Fed may lower interest rates to stimulate growth. Conversely, if inflation remains high, the Fed may continue to raise rates to control prices.

When it comes to securing a home loan, understanding the details of Home Mortgage Loan 2024 options is crucial. Specific lenders like Capital One Mortgage 2024 and Citibank Home Loan 2024 can offer competitive rates and terms.

Geopolitical events, such as wars or trade disputes, can also create uncertainty and volatility in the market, impacting interest rate movements.

Strategies for Homebuyers in a Changing Rate Environment

Navigating a changing interest rate environment can be challenging for homebuyers. Here are some strategies to help you secure the best mortgage rates and terms:

Securing the Best Mortgage Rates and Terms

- Shop Around:Compare rates and terms from multiple lenders to find the best options. Online mortgage calculators and comparison websites can help you streamline this process.

- Improve Your Credit Score:A higher credit score typically qualifies you for lower interest rates. Take steps to improve your credit score before applying for a mortgage.

- Consider a Shorter Loan Term:A 15-year mortgage typically has a lower interest rate than a 30-year mortgage. While the monthly payments may be higher, you’ll pay less interest over the life of the loan.

- Explore Government-Backed Loan Programs:Government-backed loan programs, such as FHA and VA loans, can offer lower interest rates and more flexible qualifying criteria for eligible borrowers.

- Negotiate with Lenders:Don’t be afraid to negotiate with lenders for a better rate or terms. Be prepared to shop around and present competitive offers from other lenders.

Managing the Financial Implications of Rising Interest Rates

- Save for a Larger Down Payment:A larger down payment can reduce your loan amount, lowering your monthly payments and making your mortgage more affordable, even with higher interest rates.

- Consider a Fixed-Rate Mortgage:A fixed-rate mortgage locks in your interest rate for the life of the loan, protecting you from future rate increases. While rates may be higher than adjustable-rate mortgages initially, you’ll have predictable payments.

- Budget for Higher Payments:If interest rates rise, be prepared for higher monthly payments. Factor in the potential impact of rate increases when budgeting for your mortgage.

- Refinance When Rates Drop:If interest rates fall significantly, consider refinancing your mortgage to a lower rate. This can save you money on interest payments over the long term.

Epilogue

In conclusion, housing interest rates are a key driver in the real estate market, impacting affordability, demand, and overall stability. Understanding the factors influencing these rates, analyzing historical trends, and exploring potential future predictions can empower homebuyers and sellers to make informed decisions.

By staying informed and utilizing the strategies Artikeld in this guide, individuals can navigate the changing rate environment and achieve their real estate goals.

FAQ Resource

What are the current mortgage interest rates?

Current mortgage interest rates fluctuate daily. It’s best to check with a mortgage lender or reputable financial website for the most up-to-date information.

How do interest rates affect home affordability?

Higher interest rates increase the cost of borrowing, making homeownership less affordable. This can lead to decreased demand and potentially lower home prices.

If you’re considering a Home Refinance 2024 , especially with the recent fluctuations in interest rates, it’s essential to compare rates and terms carefully. FHA loans can be a good option for borrowers with lower credit scores, so you might want to look into Fha Refinance 2024 options.

What are the main factors influencing interest rates?

Factors like inflation, unemployment, Federal Reserve policies, and global economic events all play a role in shaping interest rate trends.

Should I wait for interest rates to drop before buying a home?

Predicting interest rate movements is difficult. Consider your individual financial situation, housing market conditions, and long-term goals when making a decision.