Pre Approved Personal Loan sets the stage for this exploration, offering readers a glimpse into a world of convenient and potentially quick financing options. Pre-approved personal loans, as the name suggests, are loan offers extended to individuals based on their creditworthiness before they even apply.

This pre-approval process can be a boon for those seeking fast access to funds, often eliminating the need for lengthy application procedures and credit checks.

Finding the right mortgage lender can be a daunting task. Fortunately, mortgage lenders near me tools allow you to search for lenders in your local area, making it easier to compare rates and options.

Pre-approved personal loans are designed to cater to a range of needs, from consolidating existing debt to funding home renovations or unexpected expenses. Understanding the intricacies of these loans, including their eligibility criteria, interest rates, and repayment options, is crucial for making informed financial decisions.

If you’re looking for a personal loan with competitive rates and flexible terms, a Sofi Personal Loan might be a good option. They offer a range of loan amounts and repayment periods to fit your needs.

What is a Pre-Approved Personal Loan?

A pre-approved personal loan is an offer of credit extended to you by a lender, based on a preliminary assessment of your creditworthiness. This means the lender has already reviewed your credit history, income, and other relevant factors and determined that you are likely to qualify for a loan.

A second mortgage can be a useful tool for homeowners seeking additional funds. However, it’s crucial to consider the added debt and potential risks associated with this type of loan.

Key Features of Pre-Approved Personal Loans

Pre-approved personal loans typically have several key features, including:

- Pre-determined Loan Amount:The lender pre-approves you for a specific loan amount based on your creditworthiness and financial situation.

- Pre-set Interest Rate:The interest rate for the loan is usually fixed at the time of pre-approval, offering you certainty about the cost of borrowing.

- Simplified Application Process:The application process for pre-approved loans is often streamlined, as the lender already has your basic information.

- Faster Approval Times:Since your creditworthiness has already been assessed, pre-approved loans tend to have faster approval times compared to traditional loans.

Advantages and Disadvantages of Pre-Approved Personal Loans

Pre-approved personal loans offer several advantages, but they also have some potential drawbacks.

For borrowers seeking financial security, guaranteed loans offer peace of mind. These loans often come with specific eligibility requirements and may be backed by government programs, ensuring a higher likelihood of approval.

Advantages

- Convenience:Pre-approved loans offer a convenient way to access funds quickly, as you already know you are eligible.

- Faster Approval:The pre-approval process often leads to faster loan approvals, allowing you to get the funds you need more quickly.

- Pre-set Interest Rate:A pre-set interest rate provides certainty about the cost of borrowing, allowing you to plan your finances more effectively.

Disadvantages

- Limited Flexibility:Pre-approved loans often have a pre-determined loan amount and interest rate, which may not be the best fit for your specific needs.

- Potential for Higher Interest Rates:While pre-approved loans can be convenient, they may sometimes come with higher interest rates compared to traditional loans.

- May Not Be the Best Option for All:Pre-approved loans may not be suitable for everyone, especially those with poor credit history or who need a flexible loan structure.

Comparison with Traditional Personal Loans

Pre-approved personal loans differ from traditional personal loans in several ways.

If you’re planning to purchase a new vehicle, understanding auto loan rates is essential. Comparing rates from different lenders can help you secure the best possible deal.

- Pre-approval:Pre-approved loans involve a pre-approval process where the lender assesses your creditworthiness beforehand, while traditional loans require a full application and credit check.

- Application Process:Pre-approved loans often have a simplified application process, while traditional loans typically involve more paperwork and documentation.

- Interest Rates:Pre-approved loans may have pre-set interest rates, while traditional loans often have variable interest rates that can fluctuate based on market conditions.

- Flexibility:Pre-approved loans may offer less flexibility in terms of loan amount and interest rates compared to traditional loans.

Eligibility Criteria for Pre-Approved Personal Loans

To be eligible for a pre-approved personal loan, you generally need to meet certain criteria set by the lender.

Homeowners can tap into their home’s equity with an equity loan. This type of loan allows you to borrow against the equity you’ve built, providing access to funds for various purposes.

Common Eligibility Criteria

The common eligibility criteria for pre-approved personal loans typically include:

- Good Credit Score:Lenders typically prefer applicants with a good credit score, indicating a history of responsible borrowing.

- Stable Income:A steady income source is crucial to demonstrate your ability to repay the loan.

- Low Debt-to-Income Ratio:Lenders prefer applicants with a low debt-to-income ratio, meaning your debt payments are a small proportion of your income.

- Positive Loan History:A history of on-time loan payments and responsible credit management is essential.

- Age:Most lenders require applicants to be at least 18 years old.

- Citizenship:You may need to be a citizen or permanent resident of the country where you are applying for the loan.

Role of Credit Score and Income

Your credit score and income play a significant role in determining your pre-approval eligibility. A good credit score demonstrates your creditworthiness and increases your chances of getting pre-approved. Similarly, a stable income source reassures the lender that you can afford to repay the loan.

Impact of Existing Debt and Loan History

Your existing debt and loan history can significantly influence your pre-approval eligibility. Lenders prefer applicants with a low debt-to-income ratio, indicating a responsible borrowing pattern. A history of late payments or defaults can negatively impact your pre-approval chances.

How to Apply for a Pre-Approved Personal Loan: Pre Approved Personal Loan

Applying for a pre-approved personal loan is generally a straightforward process.

An equity line of credit allows homeowners to borrow against the equity they’ve built in their home. This can be a useful option for home improvement projects or other major expenses.

Steps Involved

The steps involved in applying for a pre-approved personal loan typically include:

- Check Your Eligibility:Before applying, check your eligibility criteria for pre-approved loans by visiting the lender’s website or contacting them directly.

- Submit a Pre-Approval Application:Once you determine your eligibility, you can submit a pre-approval application online, over the phone, or in person.

- Provide Required Documents:You may need to provide supporting documents, such as proof of income, address, and identity.

- Receive Pre-Approval Decision:The lender will review your application and provide a pre-approval decision, usually within a few days.

- Accept or Decline the Offer:If you are pre-approved, you can accept or decline the offer. If you accept, you will need to complete the full loan application process.

Documents Required

The documents required for a pre-approval application may vary depending on the lender, but they typically include:

- Proof of Identity:A government-issued photo ID, such as a driver’s license or passport.

- Proof of Address:A utility bill or bank statement with your current address.

- Proof of Income:Pay stubs, tax returns, or bank statements demonstrating your income.

- Credit Report:A copy of your credit report, which can be obtained from credit bureaus.

- Other Documents:Depending on the lender, you may need to provide additional documents, such as a recent bank statement or a letter of employment.

Tips for Increasing Your Chances of Pre-Approval

To increase your chances of getting pre-approved for a personal loan, consider these tips:

- Improve Your Credit Score:A higher credit score improves your chances of pre-approval and potentially lower interest rates.

- Maintain a Low Debt-to-Income Ratio:Keeping your debt payments manageable and minimizing your debt-to-income ratio can enhance your pre-approval likelihood.

- Review Your Loan History:Ensure your loan history is positive, with no late payments or defaults.

Interest Rates and Fees for Pre-Approved Personal Loans

The interest rates and fees associated with pre-approved personal loans can vary depending on several factors.

First-time homebuyers often turn to FHA home loans , which require lower down payments and have more flexible credit score requirements compared to conventional loans.

Interest Rate Determination

Interest rates for pre-approved personal loans are typically determined based on:

- Credit Score:Applicants with higher credit scores generally qualify for lower interest rates.

- Loan Amount:Larger loan amounts may come with higher interest rates.

- Loan Tenure:Longer loan terms may have higher interest rates.

- Lender’s Policies:Different lenders have their own interest rate policies, which can influence the rate you receive.

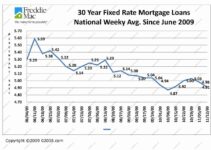

Comparison of Interest Rates

Interest rates for pre-approved personal loans can vary significantly between lenders. It is crucial to compare offers from multiple lenders to find the best rate.

Homebuyers interested in potentially lower initial monthly payments might consider variable home loan rates. However, it’s important to understand that these rates can fluctuate over time, impacting your monthly payments.

Common Fees

Pre-approved personal loans may come with various fees, including:

- Origination Fee:A fee charged by the lender for processing the loan application.

- Prepayment Penalty:A fee charged if you repay the loan early.

- Late Payment Fee:A penalty for making payments after the due date.

- Annual Percentage Rate (APR):The APR represents the total cost of borrowing, including interest rates and fees.

Repayment Options for Pre-Approved Personal Loans

Pre-approved personal loans typically offer various repayment options to suit your financial needs.

For borrowers seeking alternative lending options, Prosper Loans offer a peer-to-peer lending platform where investors provide funding. This can be a viable option for those with less-than-perfect credit.

Repayment Options

Common repayment options for pre-approved personal loans include:

- Fixed Monthly Payments:This option involves making equal monthly payments for the entire loan term.

- Variable Monthly Payments:This option allows for adjustments to your monthly payments based on your financial situation.

- Accelerated Repayment:This option involves making larger payments than required, reducing the overall loan term and interest costs.

Impact of Loan Tenure

The loan tenure, or the duration of the loan, significantly impacts your monthly payments. A longer loan term will result in lower monthly payments but will also lead to higher overall interest costs. Conversely, a shorter loan term will have higher monthly payments but lower overall interest costs.

For immediate financial needs, instant payday loans provide quick access to cash. However, it’s important to be aware of the high interest rates and potential for debt traps associated with these loans.

Examples of Repayment Schedules

Here are some examples of repayment schedules for a pre-approved personal loan of $10,000 with an interest rate of 10%:

| Loan Tenure | Monthly Payment | Total Interest Paid |

|---|---|---|

| 1 Year | $879.17 | $453.38 |

| 2 Years | $461.27 | $906.76 |

| 3 Years | $321.45 | $1,360.14 |

Pros and Cons of Pre-Approved Personal Loans

Pre-approved personal loans offer advantages and disadvantages that you should consider before deciding if they are right for you.

When seeking a loan, it’s important to understand the differences between money lenders. Some offer traditional loans, while others specialize in specific loan types, such as payday loans or personal loans.

Pros and Cons Table, Pre Approved Personal Loan

| Pros | Cons |

|---|---|

| Convenience and quick access to funds | Limited flexibility in loan amount and interest rates |

| Faster approval times | Potential for higher interest rates compared to traditional loans |

| Pre-set interest rate for certainty | May not be suitable for everyone, especially those with poor credit |

Benefits and Risks

Pre-approved personal loans can be beneficial for those who need quick access to funds and are confident about their creditworthiness. However, they also carry risks, such as potentially higher interest rates and limited flexibility.

Need a quick cash injection? A $500 loan can provide immediate financial relief. However, be sure to compare interest rates and terms before committing to a loan.

Suitability

Pre-approved personal loans can be suitable for:

- Individuals with good credit:Those with a good credit history are more likely to qualify for pre-approved loans with favorable terms.

- Those needing funds quickly:Pre-approved loans can provide quick access to funds, which can be helpful in emergencies or for time-sensitive needs.

- Individuals who prefer certainty:A pre-set interest rate offers certainty about the cost of borrowing.

Pre-approved personal loans may not be suitable for:

- Individuals with poor credit:Those with poor credit may not qualify for pre-approved loans or may face higher interest rates.

- Those needing flexibility:Pre-approved loans offer limited flexibility in terms of loan amount and interest rates.

- Individuals who want to compare multiple options:Pre-approved loans may not allow for extensive comparison of different loan offers.

Alternatives to Pre-Approved Personal Loans

If pre-approved personal loans are not suitable for your needs, several alternatives can provide financing.

Looking for a quick and convenient loan solution? Loan Express might be a good option. They offer a streamlined application process and fast funding, making it a popular choice for borrowers in a hurry.

Alternative Financing Options

Alternative financing options to pre-approved personal loans include:

- Traditional Personal Loans:These loans involve a full application and credit check, offering more flexibility in terms of loan amount and interest rates.

- Credit Cards:Credit cards can provide short-term financing, but they typically have higher interest rates than personal loans.

- Home Equity Loans:These loans use your home’s equity as collateral, offering lower interest rates but carrying a risk of foreclosure if you default.

- Peer-to-Peer Lending:This option involves borrowing money from individuals through online platforms, potentially offering lower interest rates.

- Family and Friends:Borrowing money from family or friends can be an option, but it’s important to have a clear agreement in place.

Comparison of Features and Benefits

Each alternative financing option has its own features and benefits:

- Traditional Personal Loans:Offer more flexibility in loan amount and interest rates, but may take longer to approve.

- Credit Cards:Provide quick access to funds but have higher interest rates and can lead to debt accumulation.

- Home Equity Loans:Offer lower interest rates but carry the risk of foreclosure if you default.

- Peer-to-Peer Lending:Potentially offer lower interest rates but may involve more risk and a less established lending process.

- Family and Friends:Can be a convenient option but can strain relationships if not handled properly.

Suitability for Different Situations

The suitability of each alternative financing option depends on your specific situation and needs:

- Traditional Personal Loans:Suitable for those needing a flexible loan structure and willing to wait for approval.

- Credit Cards:Suitable for short-term financing needs but should be used responsibly to avoid debt accumulation.

- Home Equity Loans:Suitable for those with significant home equity and seeking a low-interest loan.

- Peer-to-Peer Lending:Suitable for those willing to take on more risk and seeking potentially lower interest rates.

- Family and Friends:Suitable for those with strong relationships and a clear understanding of the loan terms.

Tips for Choosing the Right Pre-Approved Personal Loan

Selecting the right pre-approved personal loan involves careful consideration of several factors.

Advice on Choosing the Best Loan

When choosing a pre-approved personal loan, consider these tips:

- Compare Interest Rates:Obtain quotes from multiple lenders to compare interest rates and fees.

- Review Loan Terms:Carefully read the loan agreement to understand the loan terms, including the repayment schedule, fees, and penalties.

- Consider Your Needs:Choose a loan that meets your specific needs in terms of loan amount and repayment options.

- Assess Your Creditworthiness:Be realistic about your credit score and the likelihood of getting approved for a pre-approved loan with favorable terms.

- Check for Hidden Fees:Be aware of any hidden fees or charges that may be associated with the loan.

Factors to Consider

When comparing pre-approved loan offers, consider these factors:

- Interest Rate:Aim for the lowest possible interest rate to minimize the overall cost of borrowing.

- Loan Fees:Compare origination fees, prepayment penalties, and other associated fees.

- Loan Tenure:Choose a loan term that fits your budget and repayment capabilities.

- Repayment Options:Ensure the repayment options align with your financial situation and preferences.

- Lender Reputation:Choose a reputable lender with a history of fair and transparent lending practices.

Checklist for Evaluating Pre-Approved Loan Options

Use this checklist to evaluate pre-approved loan options:

- Interest rate:Is the interest rate competitive compared to other lenders?

- Loan fees:Are there any hidden fees or charges?

- Loan tenure:Does the loan term fit your budget and repayment capabilities?

- Repayment options:Are the repayment options flexible and convenient?

- Lender reputation:Is the lender reputable and trustworthy?

- Customer service:Does the lender offer good customer service and support?

Epilogue

Navigating the world of pre-approved personal loans requires a careful assessment of your financial needs, credit history, and the terms offered by various lenders. By understanding the pros and cons, exploring alternative options, and seeking professional advice when needed, you can make an informed decision that aligns with your financial goals.

Remember, pre-approved personal loans can be a valuable tool for achieving your financial aspirations, but it’s essential to approach them with a clear understanding of their intricacies.

Question & Answer Hub

What is the difference between a pre-approved personal loan and a traditional personal loan?

A pre-approved personal loan is offered to you based on your credit history before you apply, while a traditional personal loan requires a formal application and credit check.

Can I get pre-approved for a personal loan without a good credit score?

Understanding current loan rates is crucial when considering a loan. Whether you need a personal loan, a mortgage, or an auto loan, knowing the current rates can help you make informed financial decisions.

It is generally more difficult to get pre-approved for a personal loan with a poor credit score. Lenders typically offer pre-approvals to individuals with good credit history.

What are the common fees associated with pre-approved personal loans?

Common fees include origination fees, processing fees, and late payment fees. It’s important to review the loan agreement carefully to understand all associated fees.