5 Mortgages 2024: Navigating the Housing Market delves into the intricacies of the mortgage landscape in the current year, providing a comprehensive guide for both prospective homebuyers and seasoned investors. This year presents a unique set of challenges and opportunities, as interest rates fluctuate, affordability remains a concern, and the housing market continues to evolve.

For military personnel, Navy Federal Home Loan 2024 might be a good option. They offer competitive rates and specialized programs designed for those who serve our country.

From understanding the various mortgage types available to identifying key factors influencing mortgage decisions, this guide provides valuable insights and practical strategies for navigating the mortgage process successfully. Whether you’re looking to purchase your first home, refinance an existing loan, or simply stay informed about the latest trends in the mortgage industry, this resource offers the knowledge you need to make informed decisions.

The Mortgage Landscape in 2024

The mortgage market in 2024 is a dynamic environment shaped by a complex interplay of economic factors, interest rate fluctuations, and evolving borrower needs. Understanding the current landscape is crucial for anyone considering a mortgage, as it can significantly impact affordability, loan options, and overall financial planning.

A Home Line Of Credit 2024 can be a flexible financing option for home improvements or unexpected expenses. It’s essentially a revolving line of credit secured by your home’s equity.

Current State of the Mortgage Market

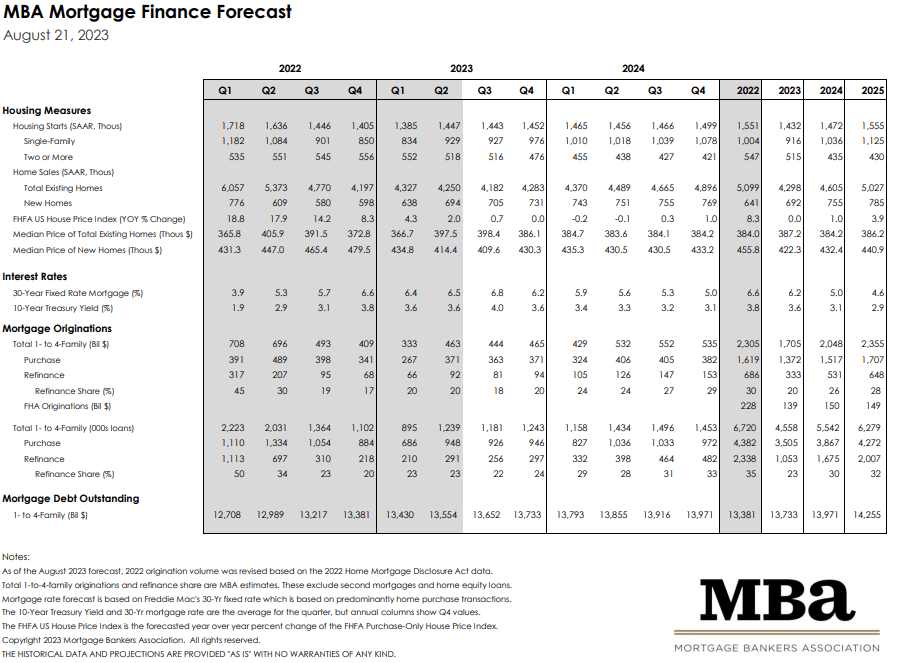

The mortgage market in 2024 is characterized by a combination of factors that influence both borrowers and lenders. Interest rates have been on an upward trajectory, driven by inflation and the Federal Reserve’s efforts to curb it. This has led to higher borrowing costs for homebuyers, making affordability a significant concern.

Stay informed about current home loan interest rates by checking Current Home Loan Interest Rates 2024. This website provides up-to-date information on prevailing rates.

Inventory levels remain relatively tight, contributing to competition among buyers and potentially pushing prices higher.

Impact of Economic Factors

Economic factors play a crucial role in shaping the mortgage market. Inflation, driven by rising prices for goods and services, has a direct impact on interest rates. As inflation rises, the Federal Reserve often raises interest rates to control it, which in turn increases borrowing costs for mortgages.

Additionally, recessionary fears can create uncertainty in the market, leading to increased risk aversion among lenders and potentially impacting mortgage availability and terms.

Comparison with Previous Years

Compared to previous years, the mortgage market in 2024 presents a different landscape. Interest rates are significantly higher than they were in the recent past, making homeownership more expensive. This has resulted in a slowdown in the housing market, with fewer transactions and a more cautious approach from buyers.

If you’re looking to purchase a high-value home, Jumbo Loan Rates 2024 can provide insights into jumbo loan rates and eligibility requirements.

The availability of mortgage products may also differ, with lenders adjusting their offerings based on market conditions and risk appetite.

Types of Mortgages Available in 2024

Navigating the mortgage landscape requires understanding the different types of loans available. Each mortgage type comes with its own set of features, benefits, and drawbacks, making it essential to choose the option that best aligns with your individual financial circumstances and goals.

For those buying their first home, First Time Buyer Mortgage 2024 offers a helpful resource for navigating the process and finding suitable loan options.

Fixed-Rate Mortgages

Fixed-rate mortgages offer predictable monthly payments throughout the loan term. The interest rate remains constant, providing stability and protection against rate fluctuations. This type of mortgage is generally preferred by borrowers seeking a predictable budget and a sense of security.

However, fixed-rate mortgages may have slightly higher initial interest rates compared to adjustable-rate mortgages.

If you’re a veteran, you’re likely eligible for a VA loan. To get a sense of current rates, visit Va Rates Today 2024 for an overview.

Adjustable-Rate Mortgages (ARMs)

Adjustable-rate mortgages (ARMs) feature interest rates that can change periodically, typically based on an index like the LIBOR. ARMs often start with lower initial interest rates compared to fixed-rate mortgages, making them attractive to borrowers seeking lower monthly payments in the early years.

A Guarantor Mortgage 2024 can be a good option for first-time homebuyers who may lack the necessary credit history. This type of mortgage involves a guarantor who agrees to cover the loan if you default.

However, the risk lies in potential rate increases later in the loan term, which can lead to higher monthly payments.

FHA Loans, 5 Mortgages 2024

FHA loans are insured by the Federal Housing Administration (FHA), making them more accessible to borrowers with lower credit scores or smaller down payments. FHA loans offer more flexible qualification requirements compared to conventional loans, making them a popular option for first-time homebuyers or those with limited credit history.

If you prefer to work with a local lender, Local Mortgage Lenders 2024 can help you find lenders in your area.

However, FHA loans typically come with mortgage insurance premiums, which are added to the monthly payments.

Considering refinancing your current mortgage? Refinance House 2024 can help you understand the process and compare current refinance rates.

Mortgage Types Comparison Table

| Mortgage Type | Interest Rate | Term | Eligibility Requirements | Benefits | Drawbacks |

|---|---|---|---|---|---|

| Fixed-Rate Mortgage | Fixed for the loan term | Typically 15 or 30 years | Good credit score, sufficient income, and down payment | Predictable payments, protection against rate fluctuations | Higher initial interest rates compared to ARMs |

| Adjustable-Rate Mortgage (ARM) | Variable, adjusts periodically | Typically 15 or 30 years | Good credit score, sufficient income, and down payment | Lower initial interest rates compared to fixed-rate mortgages | Potential for rate increases, leading to higher monthly payments |

| FHA Loan | Fixed or adjustable | Typically 15 or 30 years | Lower credit score requirements, smaller down payment | More accessible for borrowers with lower credit scores or smaller down payments | Mortgage insurance premiums, potentially higher interest rates |

Factors Influencing Mortgage Decisions in 2024

Choosing the right mortgage is a significant financial decision that requires careful consideration of various factors. Understanding your individual circumstances, financial goals, and the current market conditions is essential to making an informed choice.

Financial Situation and Credit Score

Your financial situation plays a crucial role in determining your mortgage options. Factors like income, debt levels, and savings all impact your ability to qualify for a loan and the terms you can secure. A good credit score is essential for obtaining favorable interest rates and loan terms.

It’s advisable to review your credit report and address any negative items before applying for a mortgage.

For a quick snapshot of today’s mortgage rates, visit Mortgage Rates Today 2024. Understanding current rates can help you make informed decisions about your mortgage options.

Long-Term Goals

Your long-term financial goals should also guide your mortgage decision. Consider factors like your expected income growth, potential changes in your living situation, and your overall financial aspirations. For instance, if you anticipate moving in the near future, an adjustable-rate mortgage with a shorter initial term might be a better option than a fixed-rate mortgage with a longer term.

For veterans looking for VA loan rates, Va Interest Rates Today 2024 offers current information on rates and program details.

Researching Lenders and Comparing Offers

It’s essential to research different lenders and compare their loan offers before making a decision. Lenders have varying rates, fees, and terms, so it’s crucial to find the best fit for your needs. Online mortgage calculators and comparison websites can be helpful tools for this process.

Securing the Best Possible Terms

To secure the best possible mortgage terms, consider the following strategies:

- Negotiate interest rates and fees: While lenders may have set rates, there’s often room for negotiation. Be prepared to discuss your credit score, debt-to-income ratio, and other factors that demonstrate your financial strength.

- Shop around for the best rates: Compare offers from multiple lenders to ensure you’re getting the most competitive terms.

- Consider pre-approval: Getting pre-approved for a mortgage can strengthen your negotiating position and give you a clear understanding of your borrowing capacity.

Trends in the Mortgage Industry in 2024

The mortgage industry is constantly evolving, driven by technological advancements, changing consumer preferences, and evolving regulatory landscapes. Understanding these trends is essential for staying informed about the latest mortgage options and navigating the process effectively.

Increasing Popularity of Online Mortgage Applications

The increasing popularity of online mortgage applications has streamlined the process, making it more convenient for borrowers. Online platforms offer quick pre-approvals, real-time rate updates, and digital document submission, reducing the need for in-person interactions. This trend is likely to continue, with lenders further investing in technology to enhance the borrower experience.

Rocket Mortgage is a popular online lender. Rocket Mortgage Com 2024 provides information about their services and mortgage options.

Rise of Fintech Lenders

Fintech lenders are disrupting the traditional mortgage landscape by leveraging technology to offer innovative lending solutions. These companies often have more flexible underwriting guidelines and faster approval processes, appealing to borrowers who may not qualify for traditional loans. The rise of fintech lenders is expected to continue, increasing competition in the market and potentially driving down interest rates.

Impact of Technology on the Mortgage Process

Technology is transforming the mortgage process in numerous ways. Artificial intelligence (AI) is being used to automate tasks like document verification and risk assessment, while big data analysis helps lenders to make more informed lending decisions. These advancements are streamlining the process, reducing errors, and potentially making mortgages more accessible.

Home mortgage interest rates can fluctuate daily. Home Mortgage Interest Rates 2024 offers a platform to track these fluctuations and find competitive rates.

Potential Future of the Mortgage Industry

The future of the mortgage industry is likely to be shaped by continued technological innovation, evolving regulations, and changing consumer expectations. Predictions suggest that interest rates may remain volatile in the short term, but long-term trends indicate a gradual decline.

Loan terms are expected to become more flexible, with options like shorter-term mortgages and interest-only payments gaining popularity.

Strategies for Obtaining a Mortgage in 2024: 5 Mortgages 2024

Securing a mortgage in the current market requires a proactive approach and a clear understanding of the process. By taking the necessary steps, borrowers can increase their chances of getting approved for a loan with favorable terms.

Finding a low-interest home loan can be a challenge, but it’s definitely possible. Check out Low Interest Home Loans 2024 for a comprehensive guide on available options and how to qualify.

Improving Credit Scores

A good credit score is essential for obtaining a mortgage with competitive interest rates. To improve your credit score, consider the following:

- Pay bills on time: Timely payments make up a significant portion of your credit score. Set up reminders or use automatic payments to ensure bills are paid promptly.

- Reduce credit utilization: Aim to keep your credit utilization ratio (the amount of credit you’re using compared to your available credit) below 30%. This demonstrates responsible credit management.

- Avoid opening new credit accounts: Opening multiple new accounts can temporarily lower your score. Focus on managing existing accounts responsibly.

Saving for a Down Payment

A substantial down payment can strengthen your mortgage application and potentially qualify you for better loan terms. Start saving early and consider strategies like increasing your income, reducing expenses, or investing to grow your savings.

Preparing for the Mortgage Application Process

Before applying for a mortgage, take the following steps to prepare:

- Gather financial documents: This includes pay stubs, bank statements, tax returns, and other documents that demonstrate your financial stability.

- Review your credit report: Ensure your credit report is accurate and address any errors or negative items that could impact your application.

- Shop around for lenders: Compare offers from multiple lenders to find the best rates and terms.

Resources and Tools

Numerous resources and tools can help you navigate the mortgage process:

- Online mortgage calculators: These tools help you estimate monthly payments and compare different loan options.

- Mortgage comparison websites: These websites allow you to compare rates and terms from multiple lenders.

- Financial advisors: A financial advisor can provide personalized guidance and support throughout the mortgage process.

Epilogue

As we conclude our exploration of 5 Mortgages 2024, it’s clear that the mortgage landscape is dynamic and ever-changing. By understanding the current market conditions, exploring available mortgage options, and implementing strategic planning, borrowers can position themselves for success in this evolving environment.

Whether you’re a first-time buyer or a seasoned investor, staying informed about mortgage trends and best practices is essential for achieving your financial goals in the housing market.

FAQ Explained

What is the current average interest rate for a 30-year fixed-rate mortgage?

The average interest rate for a 30-year fixed-rate mortgage fluctuates daily. It’s best to check with multiple lenders for the most up-to-date information.

If you’re looking for a mortgage lender that doesn’t require traditional credit score requirements, you might want to explore Non Qm Mortgage Lenders 2024. These lenders offer alternative options for borrowers who may not meet the typical criteria.

What are the key factors to consider when choosing a mortgage lender?

Consider factors like interest rates, fees, customer service, loan terms, and the lender’s reputation. It’s crucial to compare offers from multiple lenders.

How can I improve my credit score to qualify for a better mortgage rate?

Pay bills on time, keep credit utilization low, and avoid opening too many new credit accounts. You can also dispute any errors on your credit report.