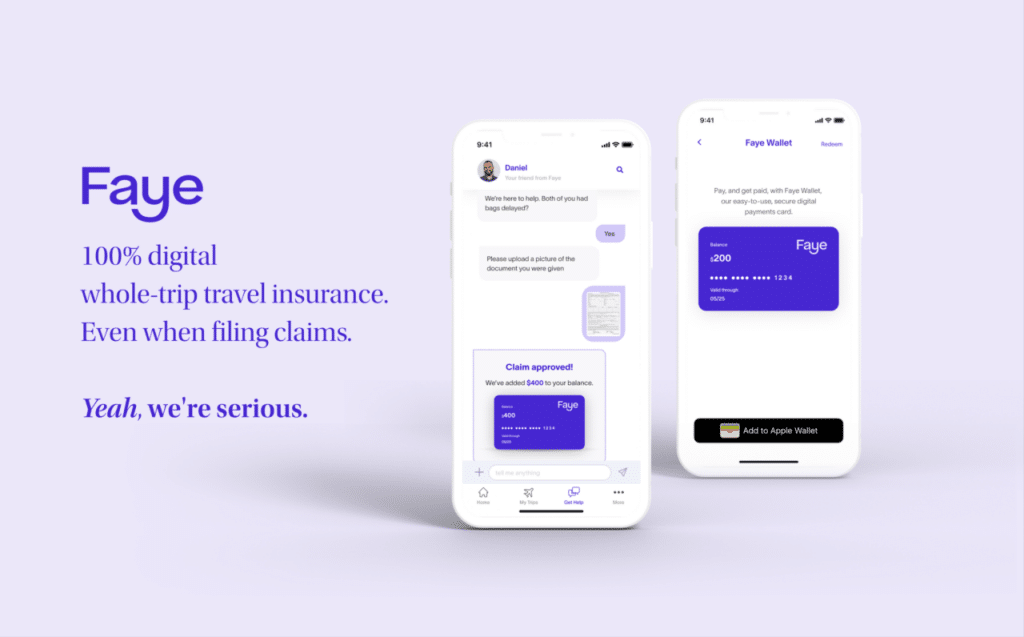

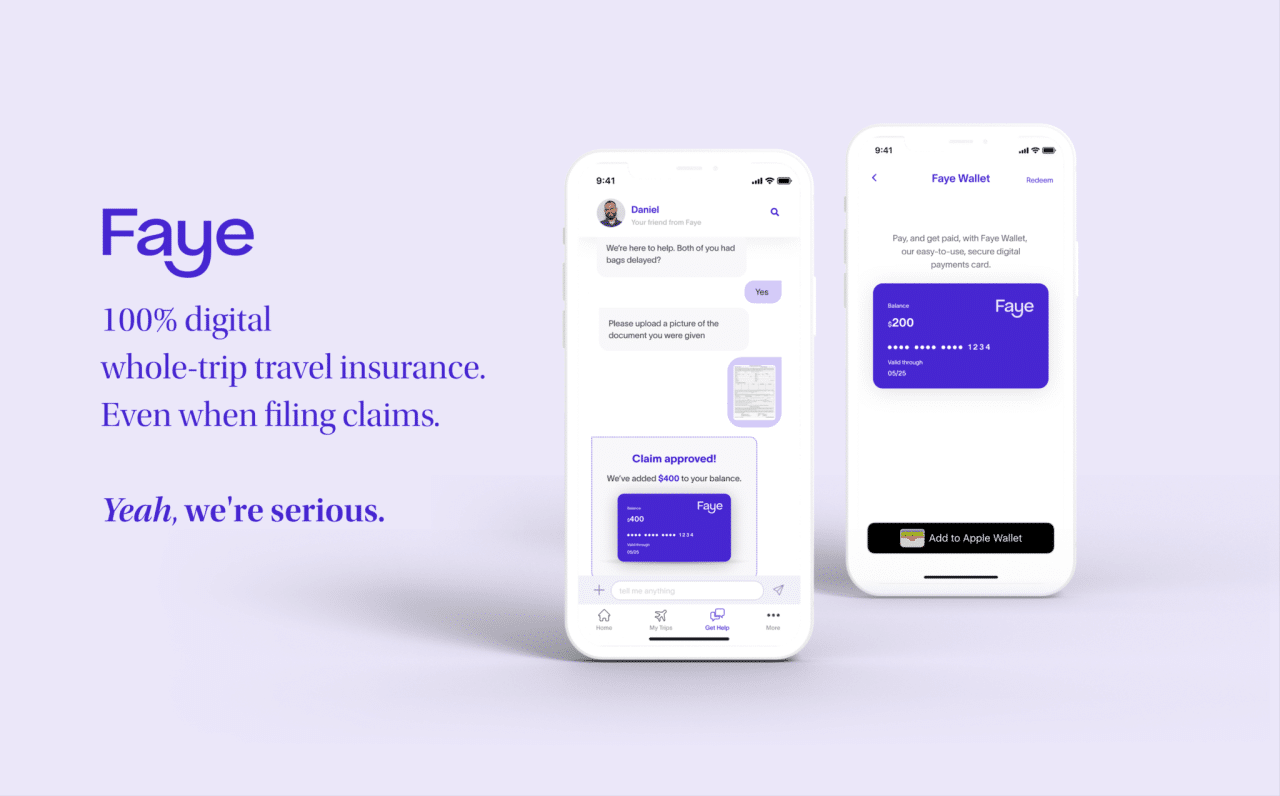

Faye Travel Insurance 2024 offers a comprehensive range of travel insurance plans designed to provide peace of mind and protection for travelers of all types. Whether you’re a seasoned adventurer exploring remote destinations or a family embarking on a relaxing vacation, Faye’s policies can help mitigate the financial and logistical burdens associated with unexpected events during your journey.

Faye Travel Insurance stands out with its commitment to providing comprehensive coverage, competitive pricing, and exceptional customer service. Their plans cater to a diverse range of travelers, offering tailored options for solo adventurers, families, and seniors. With a focus on transparency and ease of use, Faye aims to make the travel insurance process simple and stress-free.

Travel Insurance for Specific Needs

While standard travel insurance plans provide basic protection, they may not adequately address the unique requirements of all travelers. Faye Travel Insurance recognizes this and offers specialized plans tailored to meet the specific needs of adventure enthusiasts, individuals seeking comprehensive medical coverage, and senior travelers.

Exploring new countries and cultures is an amazing experience, but it’s wise to have the right safety net. International travel insurance can protect you from unforeseen events like medical emergencies, lost luggage, and trip cancellations, allowing you to enjoy your travels without worry.

Adventure Travel

For those who crave adrenaline-pumping adventures, Faye Travel Insurance offers specialized coverage for activities like hiking, skiing, scuba diving, and rock climbing. These plans go beyond standard travel insurance by providing additional protection for the unique risks associated with these activities.

For businesses that send employees on international trips, Travelers Insurance Business offers comprehensive plans designed to protect your employees and your company. These plans can cover medical expenses, trip cancellations, and other risks associated with business travel.

- Equipment Damage:Coverage for damage or loss of equipment used during adventure activities, such as ski gear, scuba diving equipment, or hiking gear.

- Rescue Expenses:Reimbursement for expenses incurred during rescue operations, such as helicopter evacuations or search and rescue efforts, in case of accidents or emergencies while engaging in adventure activities.

- Medical Care in Remote Locations:Coverage for medical expenses incurred in remote areas where access to medical facilities is limited, including transportation costs to the nearest hospital or medical center.

Medical Emergencies

Faye Travel Insurance provides comprehensive medical coverage to ensure peace of mind during your travels. Their plans include extensive benefits to cover unexpected medical emergencies, including evacuation and repatriation services.

Before you embark on your next adventure, make sure you’re properly protected. Buying international travel insurance can provide peace of mind, ensuring you have financial support in case of unexpected situations.

- Medical Expenses:Coverage for medical expenses incurred due to illness or injury while traveling, including hospitalization, surgery, and medication costs.

- Evacuation and Repatriation:Coverage for the costs of medical evacuation or repatriation to your home country in case of a serious medical emergency, ensuring you receive the necessary care in a familiar environment.

Faye Travel Insurance’s medical plans typically have maximum coverage limits for medical expenses. It’s essential to review the policy details and ensure the coverage limits are sufficient for your needs. Claims for medical expenses must be submitted with appropriate documentation, such as medical bills and receipts, within the specified timeframe Artikeld in the policy.

When choosing travel insurance, consider the reputation and experience of the provider. Allianz Travel Insurance is a well-known and trusted provider, offering a range of plans to suit different needs and budgets.

Senior Travelers

Faye Travel Insurance understands the unique needs of senior travelers and offers tailored plans designed to provide peace of mind for those over 65. These plans offer comprehensive coverage and support services specifically designed for the needs of senior travelers.

Planning a spontaneous getaway? Don’t let the lack of insurance stop you. Instant travel insurance can be purchased quickly and easily, giving you peace of mind even when you’re on a tight schedule.

- Pre-existing Conditions Coverage:Some plans offer coverage for pre-existing medical conditions, subject to certain limitations and exclusions. It’s crucial to review the policy details to understand the extent of coverage for pre-existing conditions.

- Extended Medical Benefits:Enhanced medical coverage, including higher limits for medical expenses and broader coverage for medical services, to address the potential for increased healthcare needs among senior travelers.

- Emergency Assistance Services:24/7 access to emergency assistance services, including medical advice, translation services, and support for finding medical facilities or arranging medical transportation.

It’s important to note that some Faye Travel Insurance plans may have age-related restrictions or limitations. For example, there may be a maximum age limit for coverage or certain activities may be excluded for travelers over a specific age. It’s essential to review the policy details carefully and ensure that the plan meets your specific needs and circumstances.

The world is opening up again, and with it, the need for comprehensive travel insurance. Travel insurance with COVID-19 coverage is a must-have for those who want to be prepared for any eventuality, ensuring you’re protected even if you test positive for the virus while traveling.

Comparison of Faye Travel Insurance Plans

| Plan Name | Coverage Highlights | Benefits | Exclusions | Premium Range |

|---|---|---|---|---|

| Adventure Plus | Specialized coverage for adventure activities | Equipment damage, rescue expenses, medical care in remote locations | Certain high-risk activities, pre-existing conditions (unless covered by specific add-on) | $50

Flight delays can be frustrating, but you can be prepared with the right coverage. Chase trip delay insurance can help cover expenses related to unexpected delays, ensuring you have some financial support during those stressful times.

|

| Medical Secure | Comprehensive medical coverage | Medical expenses, evacuation and repatriation, 24/7 emergency assistance | Pre-existing conditions (unless covered by specific add-on), certain risky activities | $40

Cruising the open seas is a dream for many, but it’s important to have the right protection in case of unexpected events. Cruise-specific travel insurance can provide peace of mind by covering medical expenses, trip cancellations, and even lost luggage.

|

| Senior Secure | Tailored coverage for senior travelers | Pre-existing conditions coverage (subject to limitations), extended medical benefits, emergency assistance services | Certain activities, pre-existing conditions (coverage may vary), age-related restrictions | $60

Don’t leave your health to chance when traveling abroad. Comparing medical travel insurance plans is crucial to find the best coverage for your needs and budget. You can compare different options and ensure you have the right level of protection for your international adventures.

|

Choosing the Right Faye Travel Insurance Plan, Faye Travel Insurance 2024

- Assess Your Travel Needs:Determine the specific activities you plan to engage in, the duration of your trip, and your medical history.

- Review Faye Travel Insurance Plan Options:Compare the different plans offered by Faye Travel Insurance, focusing on the coverage features and benefits that align with your travel needs and budget.

- Consider Add-ons and Optional Coverage:Explore available add-ons or optional coverage, such as coverage for pre-existing conditions, cancellation protection, or baggage loss, to customize your policy for greater peace of mind.

- Seek Expert Advice:If you have any questions or need help selecting the right plan, consult with a Faye Travel Insurance representative or a travel insurance specialist for personalized guidance.

Tips for Maximizing Coverage and Minimizing Costs

- Purchase Travel Insurance Early:Purchasing travel insurance early often allows you to secure the most comprehensive coverage and potentially lower premiums.

- Compare Quotes:Get quotes from multiple travel insurance providers to compare coverage options and prices before making a decision.

- Read the Policy Carefully:Thoroughly review the policy details, including coverage limits, exclusions, and claim procedures, to ensure you understand the terms and conditions.

- Consider a Multi-Trip Policy:If you travel frequently, a multi-trip policy can offer cost savings compared to purchasing individual trip insurance for each journey.

Closure

In conclusion, Faye Travel Insurance 2024 presents a compelling solution for travelers seeking reliable and comprehensive protection. Their commitment to providing a diverse range of plans, competitive pricing, and excellent customer service makes them a strong contender in the travel insurance market.

Whether you’re planning a short getaway or an extended adventure, Faye Travel Insurance can help you travel with confidence, knowing you have a safety net in place.

FAQ Section: Faye Travel Insurance 2024

What are the main types of coverage offered by Faye Travel Insurance?

Faye Travel Insurance offers a variety of coverage options, including medical expenses, trip cancellation, baggage loss, and emergency assistance. Specific coverage details may vary depending on the chosen plan.

How do I file a claim with Faye Travel Insurance?

To file a claim, you’ll need to contact Faye Travel Insurance directly. They will provide you with the necessary forms and instructions. You will need to provide documentation, such as medical bills or receipts for lost or damaged luggage.

What are the factors that influence the cost of Faye Travel Insurance?

The cost of Faye Travel Insurance is determined by several factors, including your destination, trip duration, age, and the level of coverage you choose. Optional add-ons, such as rental car insurance or travel assistance services, can also impact the final price.

For comprehensive travel insurance in India, Aditya Birla Travel Insurance offers a variety of plans with flexible coverage options, including medical expenses, trip cancellations, and baggage loss.

Traveling the world doesn’t have to break the bank. Cheap worldwide travel insurance is available, allowing you to find affordable protection without compromising on essential coverage.

Finding the perfect place to call home can be a challenge, especially when looking for a spacious apartment. 3 bedroom apartments for rent near me can provide the space and comfort you need, making your search for a new home a little easier.

If you’re searching for a new place to live in the 33186 area, you’re in luck. Apartments for rent in 33186 offer a variety of options to choose from, whether you’re looking for a cozy studio or a spacious family home.

Finding the perfect 3-bedroom apartment in Brooklyn can feel like a mission impossible, but it doesn’t have to be. 3 bedroom apartments for rent in Brooklyn offer a range of options, from trendy lofts to charming brownstones, making your search for a new home exciting and rewarding.

Planning for retirement is an important part of life. Annuity estimator tools can help you understand how an annuity can fit into your retirement plan and estimate how much income you can expect to receive.