Financial impact of PNC Bank layoffs in October 2024 reverberated throughout the industry, prompting questions about the bank’s future and the broader economic landscape. The move, which saw a significant number of employees let go, was a response to a challenging market environment and a need to streamline operations.

Finding a new job after layoffs can be challenging, but there are resources available to help you through the process. For information on the best resources for job seekers in October 2024, you can check out this link.

While the immediate impact focused on cost-cutting measures, the long-term implications remain uncertain, affecting stakeholders across the board.

For residents of Virginia, the deadline for claiming your tax rebate in October 2024 is fast approaching. To ensure you don’t miss out, make sure to check the deadline here.

The layoffs were announced amid a backdrop of economic uncertainty, with rising inflation and interest rates impacting the banking sector. PNC Bank, like many financial institutions, faced pressure to adapt to these changing conditions, leading to a strategic decision to reduce its workforce.

The possibility of a recession in October 2024 is a concern for many. You can find more information on the likelihood of a recession in October 2024 here.

The decision was met with mixed reactions, with some praising the bank’s proactive approach to cost management, while others expressed concern about the potential impact on employee morale and customer service.

Financial Impact of PNC Bank Layoffs in October 2024

The announcement of layoffs at PNC Bank in October 2024 sent shockwaves through the financial industry, prompting questions about the bank’s financial health and the broader economic climate. This article will delve into the financial implications of these layoffs, examining their impact on PNC Bank’s operations, profitability, and stakeholders.

If a recession hits in October 2024, some industries will be affected more than others. To see which industries are most likely to be impacted, you can read this article.

Background and Context

PNC Financial Services Group, Inc., commonly known as PNC Bank, is a major American financial services corporation with a wide range of offerings, including commercial and retail banking, investment services, and asset management. The bank operates in 27 states and the District of Columbia, serving a diverse customer base.

The possibility of a recession in October 2024 has many people wondering about its impact on the housing market. To learn more about how a recession might affect the housing market, you can visit this article.

In October 2024, the banking industry was facing a challenging economic environment characterized by rising interest rates, inflation, and potential recessionary pressures. These factors were impacting loan demand, profitability, and overall bank performance.

A recession in October 2024 could have a significant impact on the job market. For more information on how a recession might affect the job market, you can visit this article.

PNC Bank announced layoffs affecting a significant number of employees across various departments, signaling a strategic shift in response to the changing economic landscape. The scale of the layoffs and their impact on PNC Bank’s financial performance will be discussed in detail.

The Great ShakeOut 2024 is a great opportunity to prepare for emergencies. Creating an emergency kit is essential, and you can find helpful tips and resources here.

Direct Financial Impact

The immediate financial impact of the layoffs on PNC Bank can be analyzed by examining the bank’s expenses and revenue streams.

Taylor Swift’s net worth is a topic of much curiosity, and you can find a breakdown of her earnings and investments here.

- Reduced Salary Costs:Layoffs directly reduce PNC Bank’s salary expenses, contributing to a decrease in overall operating costs.

- Severance Packages:PNC Bank will likely incur significant expenses related to severance packages for laid-off employees. The cost of these packages will vary depending on factors like seniority and years of service.

- Potential Revenue Impact:While layoffs can reduce expenses, they can also have a negative impact on revenue. Customer churn, reduced lending activity, and changes in investment banking operations are all potential consequences of layoffs.

The short-term impact on PNC Bank’s profitability will depend on the balance between reduced expenses and potential revenue loss. If the cost savings from layoffs outweigh the revenue decline, PNC Bank’s profitability could improve in the short term. However, if the revenue impact is significant, the bank’s financial performance may suffer.

Tesla’s Q3 2024 net income is a key indicator of the company’s performance. You can find more information on Tesla’s Q3 2024 net income here.

Long-Term Financial Implications, Financial impact of PNC Bank layoffs in October 2024

The long-term implications of the layoffs are more complex and multifaceted. The impact on PNC Bank’s operational efficiency, employee morale, and reputation will influence its future financial performance.

The EV tax credit in 2024 is a topic of interest for many. To find out if there’s a limit on the EV tax credit, you can check out this article.

- Operational Efficiency:Layoffs can potentially enhance operational efficiency by streamlining processes and reducing redundancy. However, if the layoffs lead to a loss of critical skills and expertise, it could negatively impact the bank’s long-term performance.

- Employee Morale and Customer Satisfaction:Layoffs can have a significant impact on employee morale, leading to decreased productivity and a decline in customer service quality. This, in turn, can negatively impact customer satisfaction and loyalty.

- Reputation and Brand Image:The public perception of PNC Bank’s response to the economic downturn and the handling of layoffs can affect its reputation and brand image. Negative publicity can lead to customer churn and reduced investor confidence.

Impact on Stakeholders

The layoffs will have a direct impact on PNC Bank’s employees, shareholders, and customers.

Virginia residents are set to receive a tax rebate in October 2024, and many are wondering about the amount. You can find information on the amount of the rebate here.

- Employees:Laid-off employees will face job losses, severance packages, and potential career disruptions. The impact on their financial well-being and future career prospects will be significant.

- Shareholders:Shareholders may experience fluctuations in PNC Bank’s stock price as the market reacts to the layoffs and their impact on the bank’s financial performance. Potential dividend adjustments could also affect shareholder returns.

- Customers:Customers may experience changes in service quality, branch closures, or reduced accessibility as a result of the layoffs. This could lead to dissatisfaction and potentially drive customers to other banks.

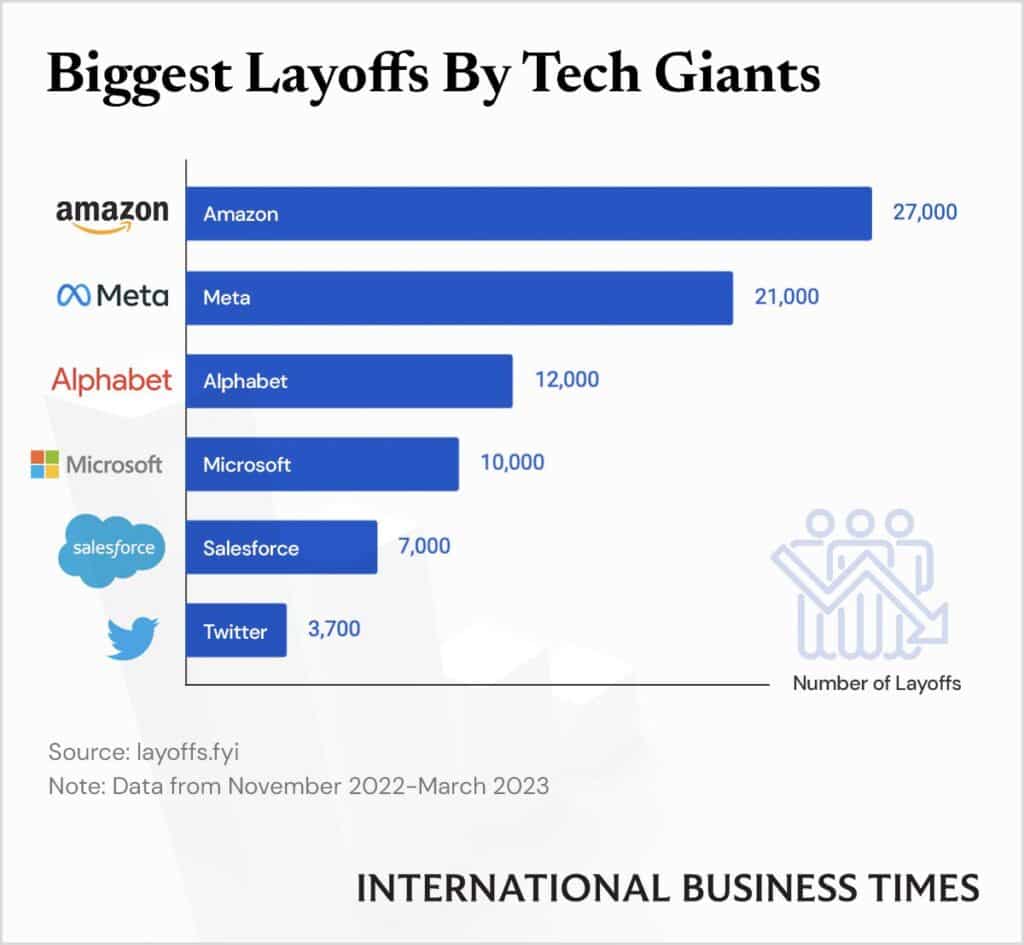

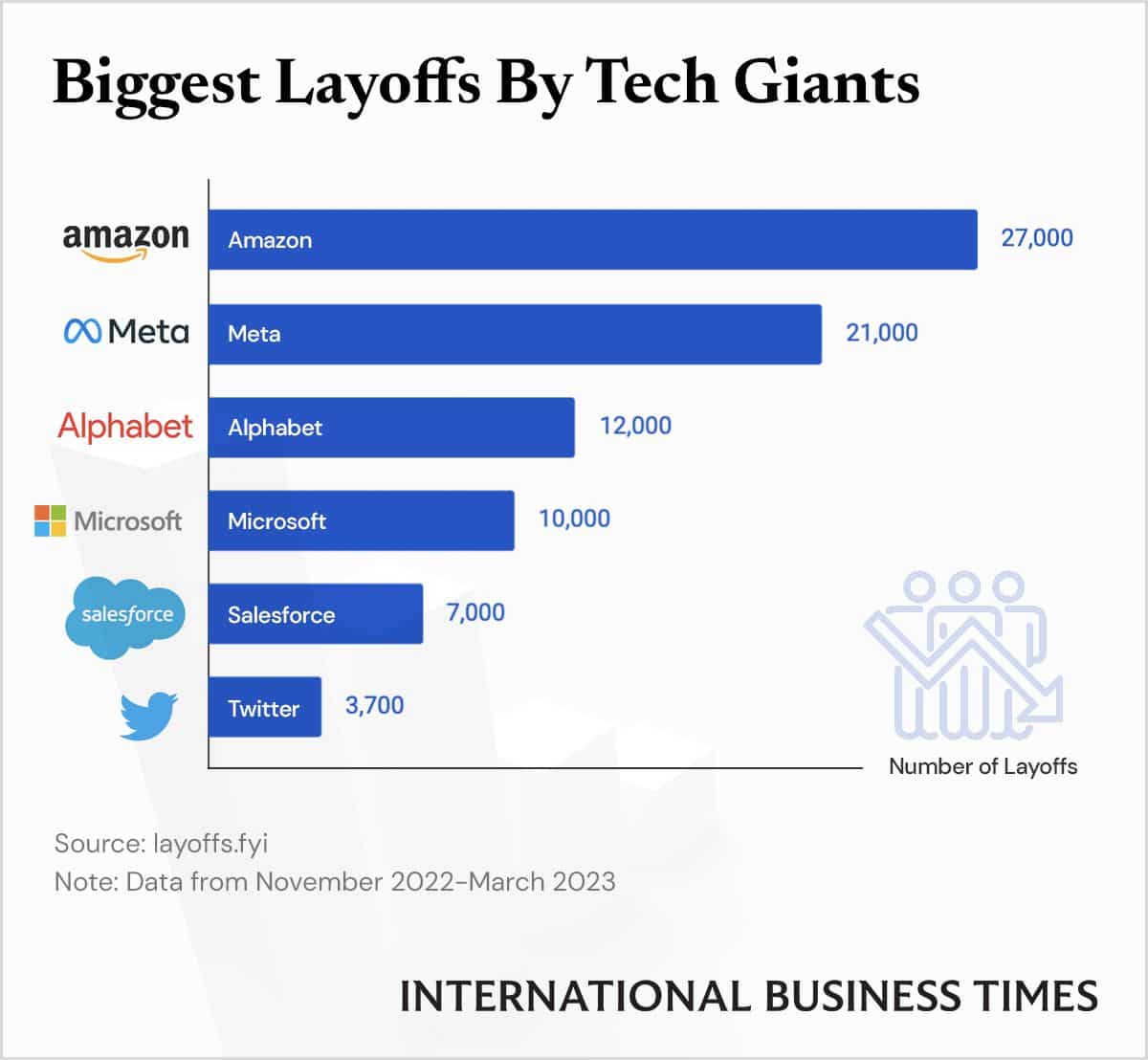

Comparative Analysis

The financial impact of the PNC Bank layoffs can be compared to similar events in the banking industry. Other financial institutions have also implemented cost-cutting measures, including layoffs, in response to economic challenges. Comparing PNC Bank’s actions to those of its competitors will provide insights into the effectiveness of its cost-cutting strategy and its position within the industry.

The Great ShakeOut 2024 is a nationwide earthquake drill that takes place every year. If you’re wondering what it is and how to participate, you can find all the information you need here.

Future Outlook

The layoffs at PNC Bank have significant implications for the bank’s future growth and expansion plans. The impact on operational efficiency, employee morale, and customer satisfaction will determine the bank’s ability to navigate future economic challenges and compete effectively in the market.

The layoffs could also lead to strategic shifts in PNC Bank’s operations and business model. The bank may focus on specific areas of growth while reducing its presence in others. The long-term implications of the layoffs on PNC Bank’s financial performance and market position will depend on the effectiveness of its strategic adjustments and its ability to adapt to the evolving economic landscape.

Ultimate Conclusion: Financial Impact Of PNC Bank Layoffs In October 2024

The financial impact of PNC Bank layoffs in October 2024 will undoubtedly shape the bank’s future trajectory. While the immediate impact focused on cost reduction and operational efficiency, the long-term implications remain to be seen. The bank’s ability to navigate this challenging period will depend on its ability to maintain employee morale, customer satisfaction, and a strong brand image.

Amazon is set to release its earnings report in October 2024, and the date for this announcement is eagerly awaited by investors. To stay updated on this, you can visit this link.

The future success of PNC Bank will be a testament to its strategic agility and commitment to navigating the evolving financial landscape.

Expert Answers

Will the layoffs impact PNC Bank’s customer service?

The impact on customer service is a key concern. While the bank aims to maintain service quality, branch closures or reduced staff could potentially lead to longer wait times or reduced accessibility.

What are the potential implications for PNC Bank’s stock price?

The layoffs could initially have a positive impact on PNC Bank’s stock price, reflecting cost savings and improved efficiency. However, long-term effects depend on how the bank navigates the market and manages its operations.

The Great ShakeOut 2024 is a crucial reminder of the importance of earthquake preparedness. It’s vital to know what to do in case of an earthquake, and you can learn more about the significance of preparedness here.

Are there any plans for further layoffs in the future?

PNC Bank has not publicly announced any plans for additional layoffs beyond the October 2024 announcement. However, the economic climate remains volatile, and further adjustments may be considered depending on future market conditions.

Amazon’s profit margin outlook for October 2024 is a topic of much discussion, with analysts weighing in on various factors. You can find more information on this topic here.