How to claim the EV tax credit in 2024 is a question on many minds as the government continues to incentivize the adoption of electric vehicles. This year, the rules have changed, making it crucial to understand the new eligibility requirements, credit amounts, and claiming process.

The third quarter of 2024 is a crucial period for businesses to assess their financial performance. Investors and analysts are eagerly awaiting the release of financial reports to gain insights into company performance and future prospects. For a comprehensive overview of third-quarter 2024 financial performance reports, visit: Third Quarter 2024 Financial Performance Reports.

This guide will break down everything you need to know to maximize your potential tax savings when purchasing an EV.

Are you thinking about buying an electric vehicle? If so, you’ll want to check out the latest EV tax credit eligibility requirements for 2024. The rules have changed, so it’s important to stay informed. You can find all the details on this page: EV tax credit eligibility requirements in 2024.

The EV tax credit is a significant financial incentive for individuals and families looking to make the switch to electric vehicles. It can offset a substantial portion of the purchase price, making EVs more affordable and accessible. The credit is designed to encourage the adoption of cleaner transportation technologies, reducing greenhouse gas emissions and promoting energy independence.

Eligibility Requirements for the EV Tax Credit in 2024

The EV tax credit in 2024 has undergone significant changes, impacting both the eligibility requirements and the credit amount. This section will delve into the key aspects of eligibility, ensuring you understand whether you qualify for the credit.

First responders play a vital role in our communities, and their contributions deserve recognition. In October 2024, there might be a tax rebate specifically for first responders. To find out more about the eligibility requirements and details of this potential rebate, visit: October 2024 Tax Rebate for First Responders.

Modified Income Limits for the EV Tax Credit in 2024

The EV tax credit in 2024 is subject to income limits, meaning that individuals with higher incomes may not be eligible for the full credit amount or may not be eligible at all. These income limits vary depending on your filing status:

- Single filers: $150,000 or less

- Married filing jointly: $300,000 or less

- Head of household: $225,000 or less

If your adjusted gross income exceeds these limits, you may not be eligible for the full credit amount, or you may not be eligible at all. It’s crucial to check your tax return for the adjusted gross income (AGI) to determine your eligibility.

Vehicle Types Eligible for the Credit in 2024

The EV tax credit in 2024 applies to a specific category of vehicles. Here’s a breakdown of the eligible vehicle types:

- Electric vehicles (EVs) with a manufacturer’s suggested retail price (MSRP) of $55,000 or less for cars and $80,000 or less for SUVs and trucks.

- Plug-in hybrid electric vehicles (PHEVs) with a battery capacity of at least 7 kilowatt-hours (kWh).

- Electric motorcycles and scooters.

It’s important to note that the credit is not available for vehicles exceeding these price limits, even if they meet other eligibility criteria. The MSRP should be considered for the base model and does not include options or dealer markups.

Changes to the Manufacturing Sourcing Requirements for the EV Tax Credit in 2024

In 2024, the EV tax credit has introduced new requirements regarding the sourcing of critical minerals and battery components. These requirements aim to incentivize domestic manufacturing and reduce reliance on foreign suppliers.

Layoffs are a challenging reality for many workers, and it’s important to understand your legal rights during this process. If you’re facing a layoff in October 2024, it’s essential to be informed about your legal protections. Learn more about the legal rights of employees during layoffs in October 2024 by visiting: What are the legal rights of employees during layoffs in October 2024?

.

- At least 40% of the critical minerals used in the battery must be extracted or processed in the United States or a country with a free trade agreement with the United States.

- At least 50% of the battery components must be manufactured or assembled in North America.

Vehicles that do not meet these sourcing requirements may not be eligible for the full credit amount, or they may not be eligible at all. These requirements are expected to evolve over time, so it’s important to stay informed about any updates or changes.

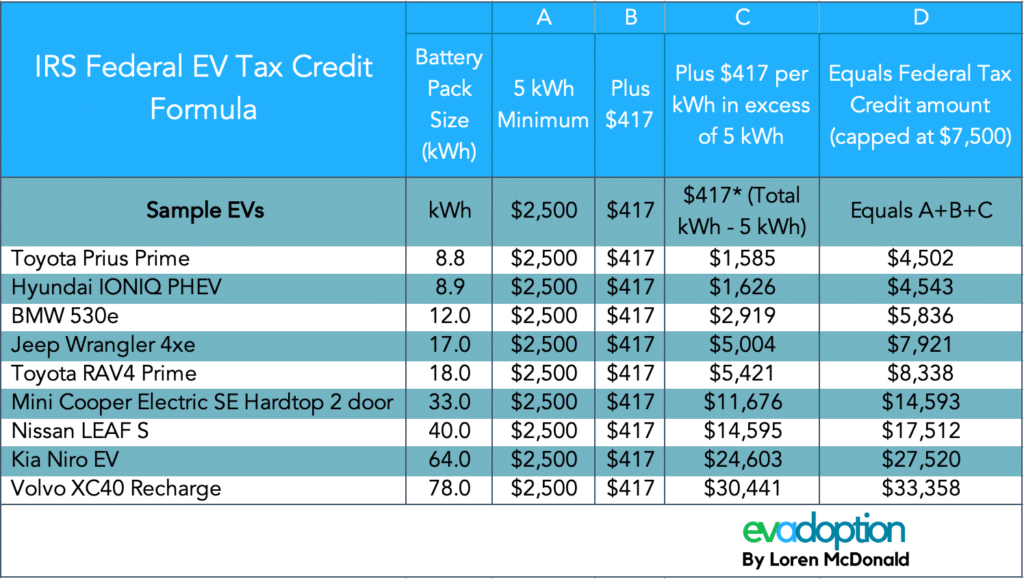

Understanding the 2024 EV Tax Credit Amount

The EV tax credit amount in 2024 varies depending on the vehicle type and purchase date. This section will break down the credit amount and explain its potential impact on the overall cost of an EV.

Recessions can have a significant impact on the political landscape, influencing policy decisions and public sentiment. If a recession occurs in October 2024, it’s likely to have political implications. To understand these potential implications, visit: What are the political implications of a recession in October 2024?

.

Breakdown of the EV Tax Credit Amount

The EV tax credit amount in 2024 is based on the following factors:

- Vehicle type:The credit amount differs based on the type of electric vehicle you purchase. For example, the credit for a battery electric vehicle (BEV) is higher than the credit for a plug-in hybrid electric vehicle (PHEV).

- Purchase date:The credit amount may be subject to phase-out based on the purchase date of the vehicle. For example, the credit amount for a vehicle purchased in 2023 may be different from the credit amount for a vehicle purchased in 2024.

Here’s a general breakdown of the EV tax credit amount in 2024:

| Vehicle Type | Credit Amount |

|---|---|

| Battery Electric Vehicle (BEV) | Up to $7,500 |

| Plug-in Hybrid Electric Vehicle (PHEV) | Up to $4,500 |

| Electric Motorcycle | Up to $3,000 |

The exact credit amount you’re eligible for will depend on the specific vehicle you purchase and its features. It’s essential to consult with a qualified tax professional to determine your specific credit amount.

Impact of the New Tax Credit on the Overall Cost of an EV

The EV tax credit can significantly reduce the overall cost of an electric vehicle. The credit amount can offset a portion of the purchase price, making EVs more affordable for consumers. This can encourage greater adoption of EVs, contributing to the transition towards cleaner transportation.

With the possibility of stimulus checks on the horizon, many are eager for updates. To stay informed about the latest developments and potential stimulus check plans, visit: Is there a stimulus check update for October 2024?.

For example, if you purchase a BEV with an MSRP of $40,000 and qualify for the full $7,500 credit, your net cost for the vehicle would be $32,500. This represents a substantial savings, making EVs more accessible to a wider range of consumers.

As we age, our financial needs may change, and there might be government assistance programs available. In October 2024, there might be a tax rebate specifically for seniors. To find out more about the eligibility requirements and details of this potential rebate, visit: October 2024 Tax Rebate for Seniors.

Implications of the Credit’s Phase-Out for Certain Manufacturers

The EV tax credit is subject to a phase-out for certain manufacturers once they reach a certain threshold of vehicle sales. This means that the credit amount may decrease or become unavailable for vehicles produced by these manufacturers after a specific point.

Veterans deserve our gratitude for their service, and Virginia may offer a tax rebate specifically for veterans in October 2024. To find out more about the eligibility requirements and details of this potential rebate, visit: Virginia tax rebate for veterans in October 2024.

The phase-out is designed to ensure that the credit remains available for a wider range of EV manufacturers and models.

Taylor Swift’s success in the music industry is undeniable, and her net worth is a testament to her talent and hard work. Curious about how much she’s earned from her record label? Find out more about Taylor Swift’s net worth from her record label by visiting: Taylor Swift’s net worth from her record label.

For example, if a manufacturer exceeds the sales threshold, the credit amount may be reduced to $3,750 for vehicles purchased after a certain date. This phase-out mechanism aims to promote competition and innovation in the EV market, ensuring that the credit benefits a diverse range of manufacturers.

With economic uncertainty looming, many people are wondering if another stimulus check is on the horizon. While there’s no official confirmation, you can stay up-to-date on the latest developments regarding potential stimulus checks in October 2024 by checking out: October 2024 stimulus check eligibility requirements.

The Process of Claiming the EV Tax Credit in 2024

Claiming the EV tax credit in 2024 involves specific steps and requires certain documentation. This section will guide you through the process of claiming the credit when filing your taxes.

With economic uncertainty, many are looking for potential relief in the form of stimulus checks. While there’s no guarantee of another stimulus check in October 2024, it’s a topic that’s generating a lot of discussion. To stay informed about the latest developments and potential stimulus check plans, visit: Will there be another stimulus check in October 2024?

.

Steps Involved in Claiming the EV Tax Credit

Here are the steps involved in claiming the EV tax credit when filing your taxes in 2024:

- Purchase an eligible EV:Make sure the vehicle you purchase meets the eligibility requirements for the EV tax credit, including the vehicle type, MSRP, and sourcing requirements.

- Obtain the necessary documentation:Collect all the required documentation, including the vehicle purchase agreement, the vehicle identification number (VIN), and any relevant information about the vehicle’s sourcing of critical minerals and battery components.

- File your tax return:When filing your tax return for the year in which you purchased the EV, use Form 8936, “Credit for Qualified Electric Vehicles.” This form allows you to claim the EV tax credit.

- Attach supporting documentation:Attach all the necessary documentation to your tax return to support your claim for the EV tax credit. This includes the vehicle purchase agreement, VIN, and any relevant information about the vehicle’s sourcing.

- Review and submit your return:Carefully review your tax return and supporting documentation before submitting it to the IRS. Ensure that all information is accurate and complete.

Documentation Required to Support the Claim

The following documentation is typically required to support your claim for the EV tax credit:

- Vehicle purchase agreement:This document should include the date of purchase, the vehicle identification number (VIN), and the purchase price.

- Vehicle identification number (VIN):This unique identifier is essential for verifying the vehicle’s eligibility for the credit.

- Manufacturer’s statement:This document may be required to verify the vehicle’s compliance with the sourcing requirements for critical minerals and battery components.

- Any other relevant documentation:Depending on your specific situation, you may need to provide additional documentation, such as a lease agreement or a statement from your lender.

Potential Pitfalls or Challenges

While claiming the EV tax credit is generally straightforward, there are some potential pitfalls or challenges that individuals may encounter:

- Meeting the eligibility requirements:Ensure your vehicle meets all the eligibility requirements, including the MSRP, sourcing requirements, and income limits. Failure to meet these requirements could result in ineligibility for the credit.

- Obtaining the necessary documentation:Collecting all the required documentation can be time-consuming. It’s crucial to gather all the necessary documents before filing your tax return.

- Tax return preparation:Preparing your tax return correctly, including Form 8936, is essential. It’s advisable to seek assistance from a qualified tax professional to ensure accuracy and avoid potential errors.

Resources and Support for Claiming the EV Tax Credit

Several reputable websites and government agencies provide information about the EV tax credit in 2024. This section will provide a list of these resources to help you navigate the process of claiming the credit.

The economic landscape is constantly shifting, and it’s natural to wonder about the possibility of a recession. While no one can predict the future with certainty, there are certain economic indicators to watch. Learn more about the signs of a recession in October 2024 by visiting: What are the signs of a recession in October 2024?

.

Reputable Websites and Government Agencies

| Website Name | Description | Contact Information | Website URL |

|---|---|---|---|

| Internal Revenue Service (IRS) | The IRS website provides comprehensive information about the EV tax credit, including eligibility requirements, documentation needs, and filing instructions. | 1-800-829-1040 | https://www.irs.gov/ |

| U.S. Department of Energy (DOE) | The DOE website offers information about electric vehicles, including resources for consumers, manufacturers, and policymakers. | 1-800-368-5555 | https://www.energy.gov/ |

| National Renewable Energy Laboratory (NREL) | NREL provides technical expertise and resources related to renewable energy and transportation technologies, including electric vehicles. | 303-275-3000 | https://www.nrel.gov/ |

| Alliance for Automotive Innovation (Auto Innovators) | Auto Innovators is a trade association representing major automotive manufacturers. Their website provides information about EV policy and incentives. | 202-775-1600 | https://www.autoinnovators.org/ |

Future Considerations for the EV Tax Credit

The EV tax credit is a dynamic policy that may evolve in the future. This section will explore potential changes or extensions to the credit beyond 2024, as well as its long-term impact on the adoption of electric vehicles.

Potential Changes or Extensions, How to claim the EV tax credit in 2024

The EV tax credit is likely to be subject to further changes or extensions in the future. The current credit is set to expire in 2032, but there is a possibility of renewal or modification before then. The future of the credit will depend on factors such as the rate of EV adoption, the availability of charging infrastructure, and the overall policy landscape.

The EV tax credit landscape is constantly evolving, with new rules and regulations being implemented. If you’re considering purchasing an electric vehicle, it’s essential to stay informed about the latest changes. You can find the latest information on EV tax credit changes in October 2024 at: EV tax credit changes in October 2024.

Potential changes to the credit could include:

- Increased credit amount:The credit amount could be increased to further incentivize EV adoption and accelerate the transition to cleaner transportation.

- Extended eligibility:The eligibility requirements could be expanded to include a wider range of vehicles, such as commercial EVs or used EVs.

- New incentives:Additional incentives could be introduced to support the development and deployment of charging infrastructure, battery technology, and other EV-related technologies.

Long-Term Impact on EV Adoption

The EV tax credit has played a significant role in accelerating the adoption of electric vehicles in the United States. The credit has made EVs more affordable for consumers, leading to increased demand and market penetration. The long-term impact of the credit on EV adoption will depend on its future trajectory and the availability of other supporting policies.

The third quarter of 2024 is shaping up to be a dynamic period in the social media landscape. From emerging trends to platform updates, there’s a lot to keep up with. To stay informed on the latest developments, check out: Third Quarter 2024 Social Media Trends.

If the credit is extended or enhanced, it is likely to continue driving EV adoption and contribute to a more sustainable transportation sector. However, if the credit is reduced or eliminated, it could slow down EV adoption and hinder the transition to a cleaner energy future.

Challenges and Opportunities

The EV tax credit faces several challenges and opportunities in the future. One challenge is ensuring that the credit remains effective in incentivizing EV adoption while also being fiscally responsible. Another challenge is ensuring that the credit is equitable and accessible to all consumers, regardless of their income level or geographic location.

Opportunities for the EV tax credit include leveraging it to support the development of innovative EV technologies, promoting the growth of the domestic EV supply chain, and creating jobs in the clean energy sector. The future of the EV tax credit will be shaped by the interplay of these challenges and opportunities.

End of Discussion: How To Claim The EV Tax Credit In 2024

Navigating the EV tax credit landscape can be complex, but with a thorough understanding of the eligibility criteria, claiming process, and potential pitfalls, you can maximize your savings. Remember to consult with a tax professional or utilize the resources provided to ensure you meet all the requirements and claim the credit successfully.

As the automotive industry continues to embrace electrification, the EV tax credit will likely play a significant role in shaping the future of transportation. By staying informed and taking advantage of this valuable incentive, you can contribute to a greener and more sustainable future.

Key Questions Answered

What is the maximum EV tax credit amount in 2024?

The maximum EV tax credit amount in 2024 varies based on the vehicle type and purchase date. It can be up to $7,500 for eligible vehicles.

Can I claim the EV tax credit if I lease an EV?

No, the EV tax credit is generally only available for the purchase of a new EV, not for leases.

If you’re a Virginia resident, you might be wondering about the eligibility requirements for the state’s tax rebate in October 2024. You can find all the details you need on the official website: Virginia tax rebate eligibility requirements for October 2024.

This information will help you determine if you qualify for the rebate and how to apply.

What happens if I sell my EV before the required holding period?

If you sell your EV before the required holding period, you may have to repay a portion of the tax credit you claimed.

Where can I find more information about the EV tax credit?

You can find detailed information on the IRS website and the Department of Energy website. Tax professionals can also provide guidance.