Immediate Annuity Orders set the stage for a comprehensive exploration of a financial planning tool that provides guaranteed income streams. This article delves into the intricacies of Immediate Annuity Orders, examining their definition, key features, legal framework, tax implications, benefits, drawbacks, and real-world applications.

By understanding the nuances of Immediate Annuity Orders, individuals can make informed decisions about incorporating them into their financial strategies.

An Immediate Annuity Order is a type of annuity contract that provides regular payments to the annuitant immediately upon purchase. This type of annuity is often used by individuals who are seeking a steady stream of income in retirement or who need to supplement their existing income.

If you’re looking for a guaranteed stream of income, a Genworth Immediate Annuity might be a good option. This type of annuity provides you with regular payments for life, but it’s important to understand the terms of the policy before investing.

Immediate Annuity Orders can be purchased with a lump sum payment or through a series of installments. The amount of the annuity payments is determined by factors such as the age of the annuitant, the amount of the initial investment, and the interest rate that is applied to the investment.

Annuity payments can be a valuable source of income in retirement. Understanding how an Annuity Is Given By 2024 can help you make informed decisions about your financial future.

Immediate Annuity Order

An Immediate Annuity Order, also known as an Immediate Annuity, is a financial instrument that provides a guaranteed stream of income payments for life. It’s a type of annuity that starts paying out immediately after the purchase, offering a steady source of income for individuals seeking financial security.

A Variable Annuity Definition 2024 can be a complex topic, but it’s important to understand the basics before investing. This type of annuity offers potential for growth, but it also comes with risks.

Definition of Immediate Annuity Order

An Immediate Annuity Order is a legal and financial instrument that compels a party to make regular payments to another party, starting immediately. These payments are typically structured as a fixed amount for a set period, or for the lifetime of the recipient.

It’s important to be aware of the potential for an Annuity 10 Penalty 2024 if you withdraw your funds before the age of 59 1/2. Make sure to consult with a financial advisor to determine if this type of annuity is right for you.

The payments are often made in exchange for a lump sum payment or a specific asset.

Variable annuities offer a range of investment options, but it’s important to choose carefully. Understanding the Variable Annuity Investment Options 2024 can help you make informed decisions about your financial future.

In a legal context, an Immediate Annuity Order can be issued by a court as part of a settlement agreement, divorce decree, or other legal proceedings. This order ensures that a specific party receives ongoing financial support from the other party.

If you’re looking for a variable annuity that offers a range of investment options, you might want to consider the The Director 6 Variable Annuity Hartford 2024. This annuity is offered by Hartford Life Insurance Company and offers a variety of sub-accounts to choose from.

In a financial context, an Immediate Annuity Order is often used as a way to convert a lump sum of money into a guaranteed stream of income. This can be beneficial for individuals who are retired or nearing retirement, or who are seeking a reliable source of income.

There are many resources available online that can help you understand the basics of annuities. You can find helpful videos on YouTube, such as the Annuity Formula Youtube 2024 , that can explain the concepts in a clear and concise way.

Here are some scenarios where an Immediate Annuity Order might be used:

- Divorce settlements:A court might order a spouse to pay an Immediate Annuity to the other spouse as part of a divorce settlement. This can ensure that the spouse who is receiving the payments has a consistent source of income for the rest of their life.

- Personal injury settlements:In a personal injury case, a court might order the defendant to pay an Immediate Annuity to the plaintiff. This can provide the plaintiff with ongoing financial support for their medical expenses, lost wages, and other damages.

- Retirement planning:Individuals can purchase an Immediate Annuity Order from an insurance company to provide themselves with a guaranteed stream of income during their retirement years. This can be a way to ensure that they have enough money to cover their living expenses.

Getting a Immediate Needs Annuity Quote can help you understand the potential costs and benefits of this type of annuity. This can help you make informed decisions about your financial future.

Key Features of Immediate Annuity Orders

Immediate Annuity Orders are characterized by their immediate payout structure and the guaranteed stream of income they provide. Here are some of their key features:

- Immediate payments:The payments from an Immediate Annuity Order begin immediately after the purchase or issuance of the order.

- Guaranteed income:The amount of the payments is typically fixed and guaranteed for a specified period or for the lifetime of the recipient.

- Regular payments:Payments are usually made on a regular basis, such as monthly, quarterly, or annually.

- Lump sum purchase:Immediate Annuity Orders are typically purchased with a lump sum payment, which is then used to fund the annuity payments.

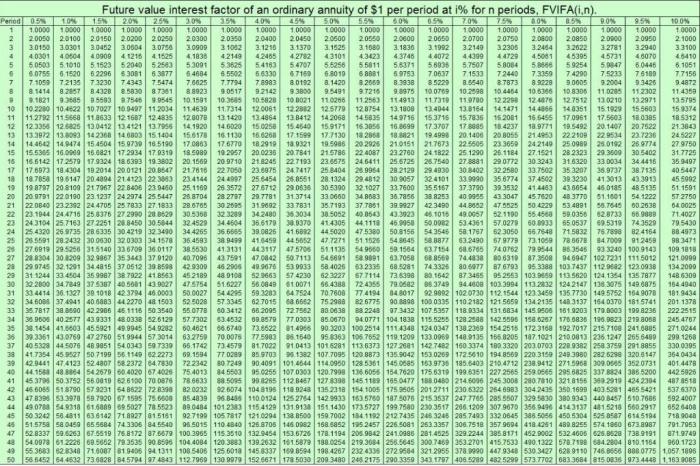

- Interest rate:The amount of the annuity payments is determined by factors such as the purchase price, the interest rate, and the age of the recipient. Higher interest rates generally result in higher annuity payments.

Legal and Regulatory Framework

Immediate Annuity Orders are subject to various laws and regulations depending on the jurisdiction. Courts and regulatory bodies play a crucial role in overseeing these orders, ensuring fairness and compliance. Here’s a brief overview:

- Legal framework:Laws governing Immediate Annuity Orders typically address aspects such as contract formation, payment obligations, and dispute resolution.

- Regulatory oversight:Regulatory bodies, such as insurance commissions or financial authorities, often set standards for the issuance and administration of Immediate Annuity Orders, ensuring financial stability and consumer protection.

- Legal implications:An Immediate Annuity Order can have significant legal implications for individuals and entities involved. These implications can include contractual obligations, potential disputes, and tax liabilities.

Tax Implications of Immediate Annuity Orders

The tax treatment of Immediate Annuity Orders varies depending on the jurisdiction and the specific circumstances. Understanding these implications is crucial for financial planning and tax compliance.

The Kotak Immediate Annuity Plan Calculator is a helpful tool for those who are looking to purchase an immediate annuity. This calculator can help you estimate your monthly payments and determine if this type of annuity is right for you.

- Taxable income:Annuity payments are generally considered taxable income, and the recipient may be required to pay income tax on the payments they receive.

- Tax deductions:In some cases, there may be tax deductions available for expenses related to the purchase or issuance of an Immediate Annuity Order.

- Tax planning strategies:Individuals and entities can employ various strategies to minimize their tax burden related to Immediate Annuity Orders, such as using tax-advantaged accounts or structuring the order to optimize tax efficiency.

Benefits and Drawbacks of Immediate Annuity Orders

Immediate Annuity Orders can offer a range of benefits as a financial planning tool, but it’s important to consider potential drawbacks and risks before making a decision.

It’s important to remember that a A Variable Annuity Does Not Provide 2024 a guaranteed return on your investment. The value of your investment can fluctuate, and you may lose money.

- Benefits:

- Guaranteed income:Provides a reliable and predictable source of income for life.

- Financial security:Offers peace of mind by ensuring a consistent income stream, especially during retirement.

- Longevity protection:Payments continue for the lifetime of the recipient, regardless of how long they live.

- Flexibility:Immediate Annuity Orders can be customized to meet individual needs and financial goals.

- Drawbacks:

- Lower returns:The returns on Immediate Annuity Orders are typically lower than other investment options, such as stocks or bonds.

- Inflation risk:The fixed payments may not keep pace with inflation, reducing the purchasing power of the income over time.

- Limited flexibility:Once an Immediate Annuity Order is purchased, it can be difficult to change the payment terms or withdraw the funds.

- Interest rate risk:Interest rates can fluctuate, which can affect the amount of the annuity payments.

Case Studies and Examples

Real-world examples demonstrate how Immediate Annuity Orders have been implemented and the outcomes they have achieved. These case studies provide insights into the practical applications and potential implications of using this financial instrument.

An annuity is a financial product that can provide you with a stream of income in retirement. Understanding how an Annuity Is A Series Of 2024 payments work can help you make informed decisions about your financial future.

- Case Study 1: Divorce Settlement

In a divorce settlement, a court ordered the husband to pay his ex-wife an Immediate Annuity of $5,000 per month for the rest of her life. This ensured that the wife had a consistent source of income after the divorce, helping her maintain her financial stability.

A Roth Variable Annuity 2024 can be a great option for those who are looking for tax-free income in retirement. It’s important to consider the tax implications of this type of annuity before investing.

This case illustrates how Immediate Annuity Orders can be used to ensure fairness and provide ongoing financial support in divorce proceedings.

- Case Study 2: Retirement Planning

A retired teacher purchased an Immediate Annuity Order with a lump sum payment of $200,000. The annuity provided her with a guaranteed monthly income of $1,500 for life, ensuring she had a reliable source of income during her retirement years.

This example demonstrates how Immediate Annuity Orders can be a valuable tool for retirement planning, providing a steady stream of income for individuals who are no longer working.

Final Wrap-Up

In conclusion, Immediate Annuity Orders offer a compelling solution for individuals seeking a reliable and predictable income stream. By carefully considering the various factors, such as legal regulations, tax implications, and potential risks, individuals can determine whether an Immediate Annuity Order aligns with their financial objectives.

As with any financial decision, thorough research and consultation with a qualified financial advisor are essential to ensure informed and successful implementation of Immediate Annuity Orders.

Essential FAQs

What are the different types of Immediate Annuity Orders?

It’s crucial to understand your financial situation and how it’s affected by your annuity. A Annuity Statement Is 2024 is a document that will provide you with all the details you need to make informed decisions about your financial future.

Immediate Annuities can be categorized as fixed, variable, or indexed, each offering distinct features and risk profiles. Fixed annuities provide a guaranteed rate of return, while variable annuities link returns to the performance of underlying investments. Indexed annuities offer a potential for growth tied to a specific market index.

How do I choose the right Immediate Annuity Order for my needs?

If you’re looking for information about retirement planning, you might want to consider a 457 B Variable Annuity. These plans offer tax advantages and potential for growth, but it’s important to understand the details. You can learn more about the specifics of a 457 B Variable Annuity 2024 to see if it’s right for your financial goals.

Selecting the appropriate Immediate Annuity Order depends on individual circumstances, risk tolerance, and financial goals. Factors to consider include desired income levels, investment horizon, and tax implications. Consulting a financial advisor can help assess suitability and tailor the annuity to specific requirements.

Many people find that a Variable Annuity With Living Benefit Rider 2024 offers a great deal of security. It’s essentially an insurance policy that can protect your assets from market downturns, but it’s important to research the details of the policy before committing.

What are the risks associated with Immediate Annuity Orders?

Risks associated with Immediate Annuity Orders include potential for lower returns compared to other investments, potential for inflation eroding purchasing power, and limited flexibility in accessing funds.